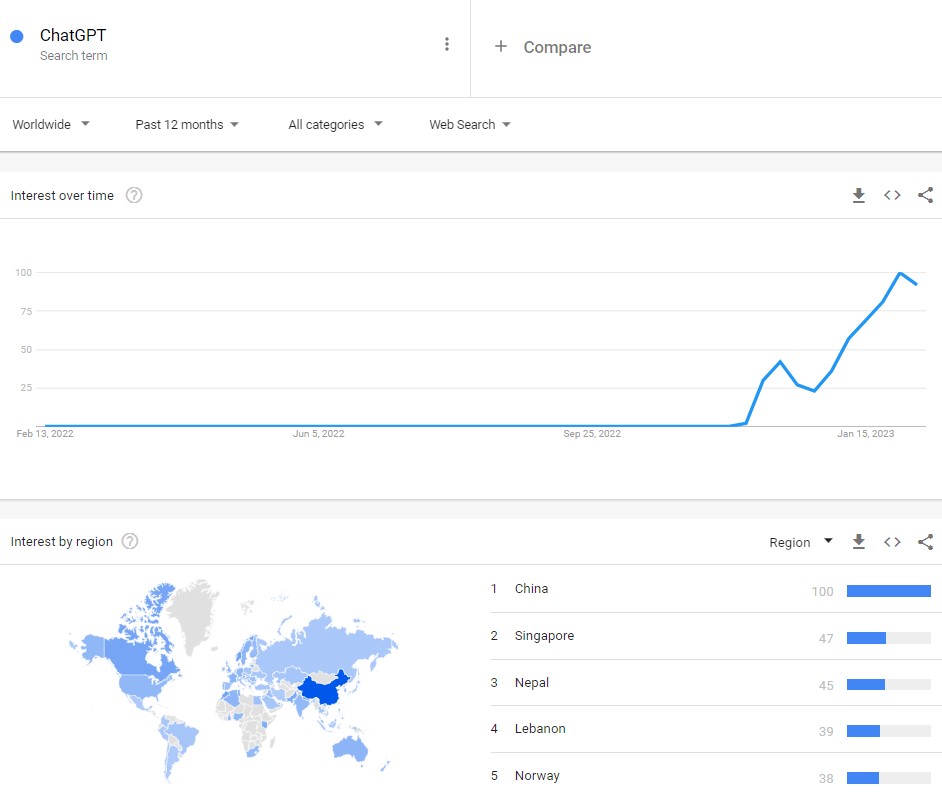

The race is on in generative AI (artificial intelligence). Chat GPT introduced this natural language algorithm to a mass audience in November, 2022, and we love it so far. With a market proof at hand, companies are rolling out commercialization efforts. These conversational knowledge engines will find their way into more and more products and platforms and in turn feed more and more popularity.

The highest profile commercialization features a duel between two of the biggest tech companies on the planet: Microsoft Corporation (MSFT) and Alphabet (GOOG).

Microsoft AI

Microsoft (MSFT) has mindshare thanks to its partnership with ChatGPT. The company rolled out a well-oiled and well-prepared marketing campaign starting with an excited and animated CEO Satya Nadella. Nadella and crew made Bing look like the search engine of the future. They made the Edge browser look like it already owns the internet. Together, Microsoft calls the combination a “copilot for the web”, a very catchy phrase.

The trial period is already over, but users can hop on a waitlist to get their hands on the new Bing. Quite telling, Microsoft will expedite a user’s request if that user accepts Windows defaults on the PC (most likely things like accepting Edge as the default browser) and also installs the Bing app. The most telling quote of the entire show came when Yusef Mehdi, Corporate Vice President and Consumer Chief Marketing Officer, noted “it’s cumbersome to click on links” to unlock the joy of discovery. That soundbite alone feels like a shot across the bow for Search Engine Optimization (SEO). The key search experience focuses on a conversation with the AI. Search results and AI results share the same screen until a user switches to a pure chat mode to further explore the search results with the AI.

MSFT responded to the news with a 4.2% surge that confirmed support at the 200-day moving average (DMA) (the blue line below). Sellers sharply faded the next day’s attempt to follow-through. MSFT gained as much as 3.4% before succumbing to a 0.3% loss.

Google AI

The day after Microsoft’s splash, Prabhakar Raghavan, a Google Senior Vice President, talked about his company’s generative AI offering, Bard. The branding was an interesting contrast to Microsoft. Microsoft did not introduce a new brand name and instead chose to feature Bing as the AI itself. The Bard presentation was embedded in a larger discussion about new Google search features. This lack of a spotlight dulled the moment. Google’s presentation lacked the sizzle and newness of Microsoft’s. While Microsoft had enough AI content to fill up an hour, Google spent under 7 minutes focused on Bard (the total Search presentation lasted 38 minutes).

Like the Bing integration, Bard integrates a conversation with generative AI in the search experience. BARD is behind Microsoft’s offering. Unlike Microsoft, Google did not have tangible details on an integration of BARD into Google search. As a result, Google’s demo looked flat compared to Microsoft’s. BARD’s release is only going to a limited number of testers while Microsoft is ready for mass release after a waitlist period.

Unfortunately for Google, a lackluster presentation followed a failed demonstration of BARD in a Twitter ad. Panicked traders sent GOOG reeling. The day before GOOG benefited from Microsoft-motivated anticipation with a 4.4% gain and fresh 200DMA breakout. The subsequent sell-off immediately wiped out those gains and then some. I think this sell-off was an over-reaction assuming Google has a real product that will just take more time to rollout. This discount triggered my trade idea.

The Sprint Pairs Trade

The trade on the big boys battling over AI is a relatively low risk, good reward setup. I am using call options on both Microsoft Corporation (MSFT) and Alphabet (GOOG). This position plays the potential for at least one of these stocks to continue to rally in the coming months. I backstop the trade with a put spread on the Invesco QQQ Trust (QQQ). Macroeconomic headwinds could overwhelm the AI hype in the short-term. QQQ is a decent hedge for this pairs trade because GOOG is 8% of the value of QQQ and MSFT has a whopping 12% share (according to SwingTradeBot).

June expirations assume 4 months is a sufficient sprint for the dynamics of this trade to work out. The ranges are out-of-the money with the ends of the ranges targeted around key resistance levels for the call spread and key support for the put spread. Maximum value and profit is measured at expiration starting with prices as of February 8, 2023.

- MSFT call spread 280/295 (approximate cost $5, maximum value of $15)

- GOOG call spread 105/120 (approximate cost $3.5, maximum value of $15)

- QQQ put spread 280/260 (approximate cost $3.6, maximum value $20)

Totals across all three positions: maximum loss and approximate cost $12.10, maximum upside profit $17.90, maximum downside profit $7.90. I will fold if losses reach 40-50% of the maximum potential loss; such a loss is possible if all three positions get trapped in tight trading ranges and just chop around. I may also chose to close out the position before MSFT and GOOG report Q1 earnings in April/May. Profits are more likely thanks to the starting discount on GOOG.

The ideal ratio for an options trade is 1:3 risk/reward ratio. However, such a ratio is typically not possible with a hedged spread as the setup limits risk at the cost of capping reward. Note the GOOG call spread meets the 1:3 hurdle. It prices in deeper pessimism. This setup is designed to allow me to wait patiently.

Once the dust settles on the hype, I will consider making longer-term AI bets.

Be careful out there!

Full disclosure: long QQQ put spread