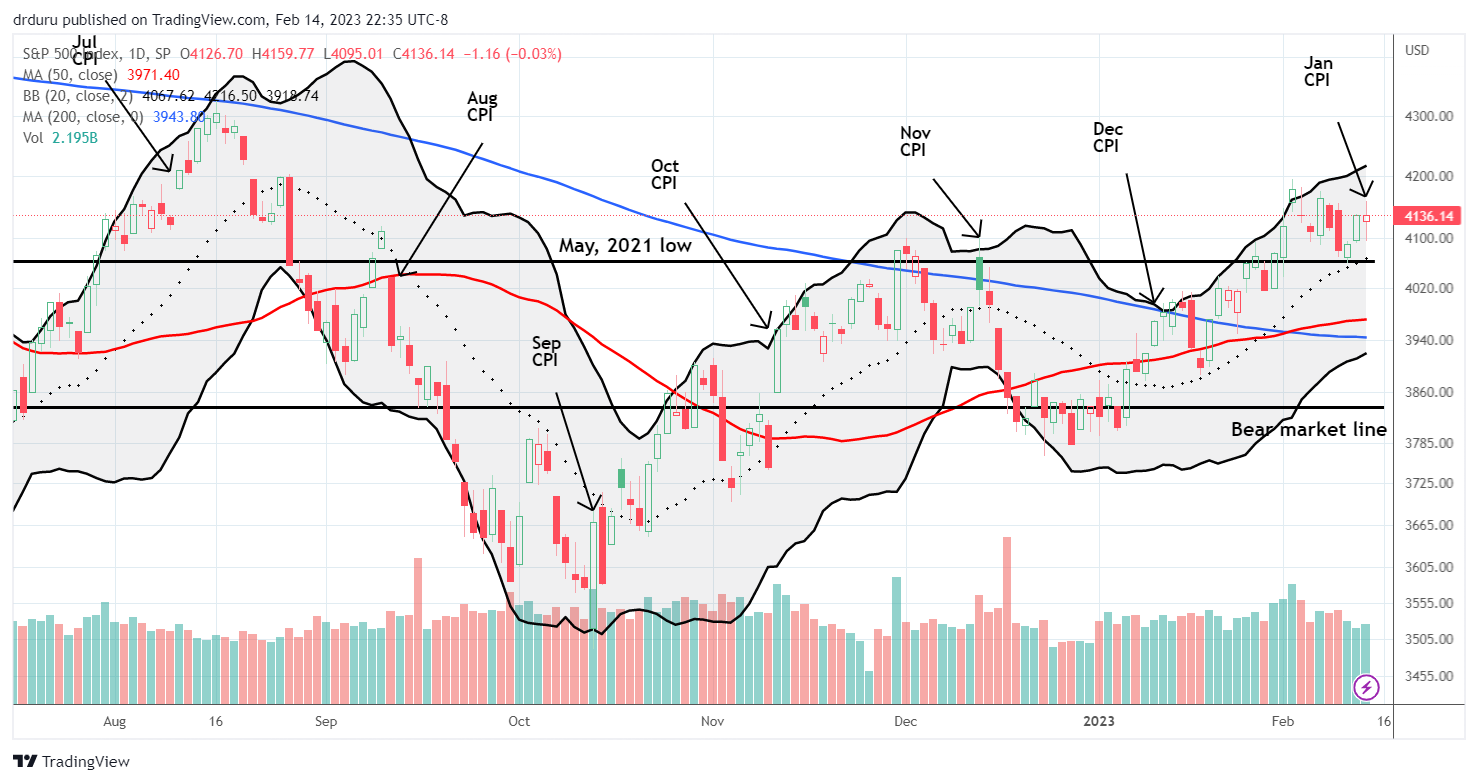

My idea for a trade on the U.S. CPI (Consumer Price Index) report seemed like a great idea last month. Up to that point, the market experienced sharp swings based on the directional gap between the actual inflation readings and expected inflation. I used the Cleveland Federal Reserve’s “nowcasting” to generate an approximate trading model. I used this model to predict an upside CPI surprise for January. Core CPI instead came in slightly under expectations, and the S&P 500 (SPY) ended the day up 0.3%. Based on the trading model, I once again predicted a higher-than-expected inflation reading for January. This time, my prediction held true, but the market’s reaction prevented me from profiting. The intraday swings made me realize the time had already come to put a quick end the inflation trade.

The U.S. Dollar (Eventually) Settled On Hot Inflation

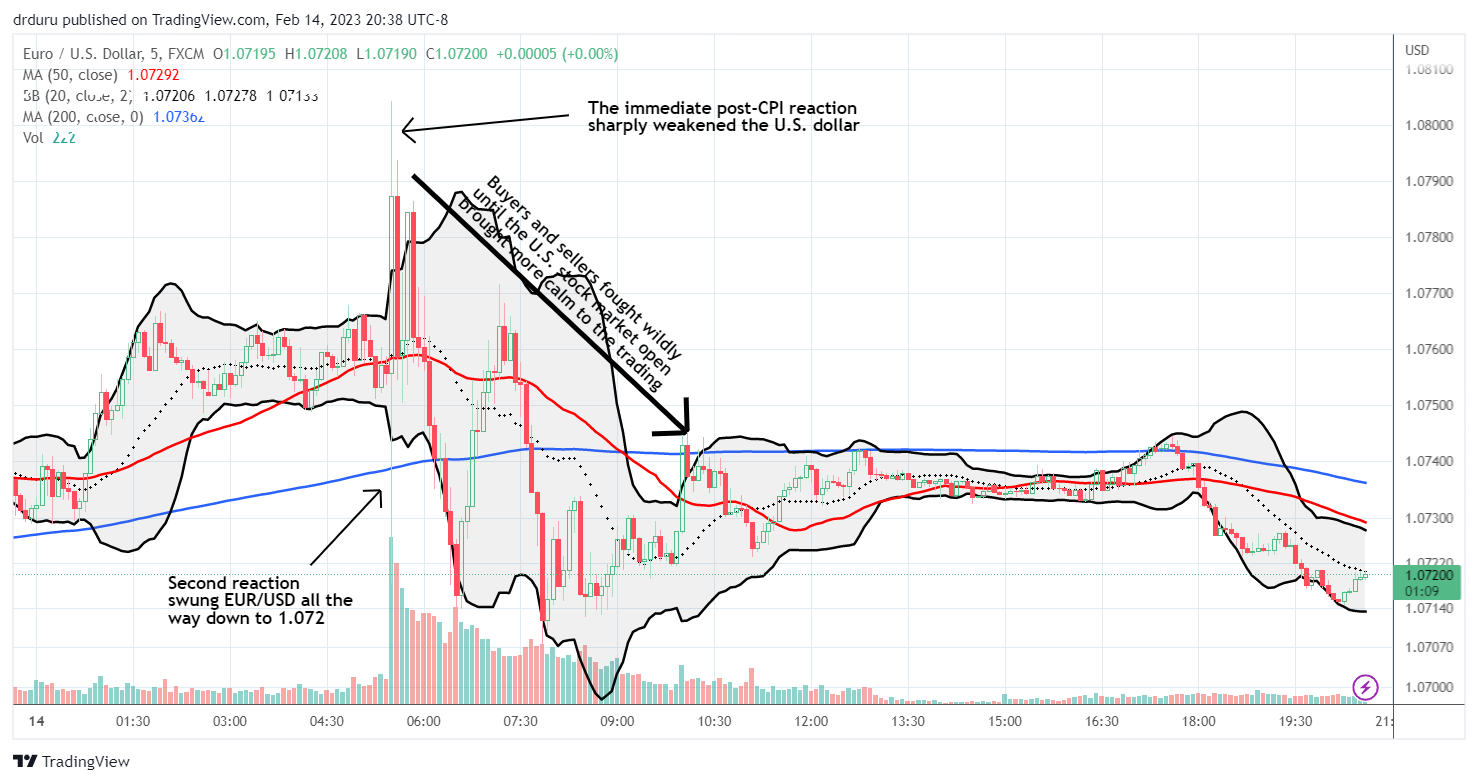

The immediate reaction in the currency markets featured wild trading with the U.S. dollar swinging from weakness to strength in rapid fashion. In the hour between the release of the CPI report and the market open for U.S. stocks, dollar currency pairs swung sharply up and down and back. The open for trading in the U.S. stock market seemed to bring more calm, perhaps from post-open, incrementally higher liquidity. The 15-minute chart of the euro versus the U.S. dollar (EUR/USD) shows the wild swings while the overall intraday trend was for U.S. strength. The daily chart of EUR/USD shows the net result of the trading: a continuation of recent U.S. dollar strength with traders fighting to defend support at the 50-day moving average (DMA) (red line).

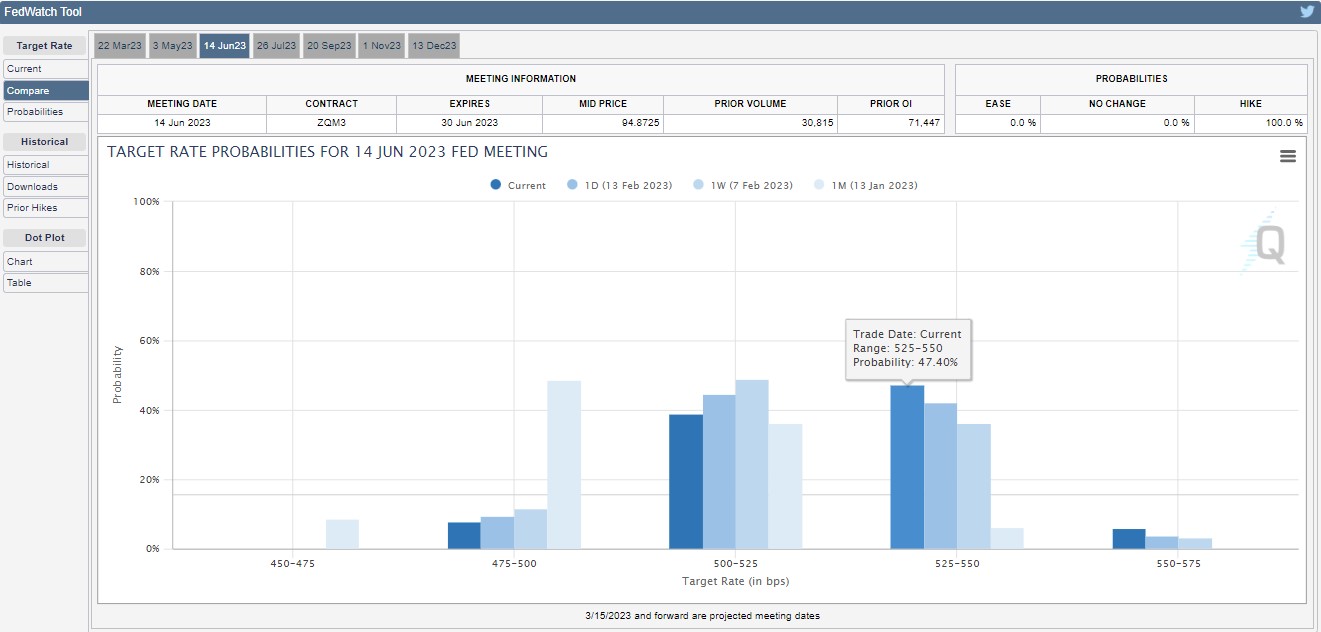

The overall strength in the U.S. dollar came from a rerating of the landscape for the Fed Fund futures. The market increased the odds of a 25 basis point rate hike in June from 42 to 47%. Suddenly, the “higher for longer” that the Fed has messaged for months looks a little more real.

The Indecisive Bond Market

As the currency moves calmed down, the wild swings in stocks and bonds got going. The iShares 20+ Year Treasury Bond ETF (TLT) first rallied at the open (lower bond yields). TLT next sank to last week’s low. Bond yields went no higher and TLT settled somewhat higher than the midpoint of the day’s range.

The Indecisive Stock Market

The day’s lack of decisiveness sent the S&P 500 (SPY) swinging wildly as well. The index followed TLT. The S&P 500 opened slightly down and then rallied to a gain. Just as the market seemed to settle on a positive spin on the inflation print, sellers took over. Suddenly, traders seemed to understand the hawkish implications of the CPI report. At that point my SPY put spread acquired a small profit. Just as I started anticipating follow-through selling to make the put spread a solid success, buyers regained control of the narrative. The S&P 500 ended the day flat.

My put spread ended the day in the red. I could have only secured a profit if I somehow anticipated the lows of the day. This kind of intraday behavior gives a poor risk/reward ratio for my inflation trade. Together, my results from the last two CPI prints make me realize I need to bring the inflation trade to a quick end.

A Bias for Positive Inflation Spins Helps Bring the Quick End

CNBC’s Kelly Evans broke down the inflation components in a piece titled “What is the CPI report telling us?” The potential to see hot and cooling inflation in the same report reflected the day’s gyrations. However, Evans’s conclusion is what told me that the inflation trade holds too much risk for the potential reward: not only do I need to predict the direction of the CPI surprise, but also I need to anticipate how the market will interpret the gap and the components of inflation.

- The headline (core and total) numbers were higher than expected: “A lot of frustration over the fact that the Fed has been hiking for a year now, and inflation is still this high”

- “The ‘super-core’ number cooled substantially last month” (Super-core is a new term for me. Evans used it to refer to services ex-housing. This measure kept Powell cautious in the last statement on monetary policy).

- “‘Real’ earnings still aren’t keeping up.”

Evan concluded in agreement with a pundit: “All told, ‘a lot of the inflation we see is in the rear view mirror, and the road ahead looks better,’ as Chris Rupkey of FWDBONDS told clients this morning.” In other words, going forward, the market is likely to interpret every inflation print with a positive spin. The recent trading on the CPI reports seems consistent with a bias for optimism. Only an extreme surprise could force a real change; even then I suspect the hit to stock prices would be quite temporary until extreme surprises happened over subsequent months. Accordingly, I bring the inflation trade to a quick end. Time to go back to responding to the market’s response instead of trying to anticipate the market’s reaction function.

Be careful out there!

Full disclosure: long SPY puts, short EUR/USD

No one should be surprised that a year of rate hikes – even extremely aggressive ones – did not quell inflation. Rate hikes are the wrong tool for this situation.

The high demand in the economy is a symptom of re-balancing after Covid disruption, funded by Covid-response fiscal stimulus that’s still flowing. Tens of millions of people left full-time jobs never to return. Add to that the changes in energy costs and supplies caused by Russia’s war on Ukraine and Europe’s responses.

Interest rate rises don’t do much to fix the situation. They do create angst in currency markets and for people and businesses dependent on variable-rate financing.