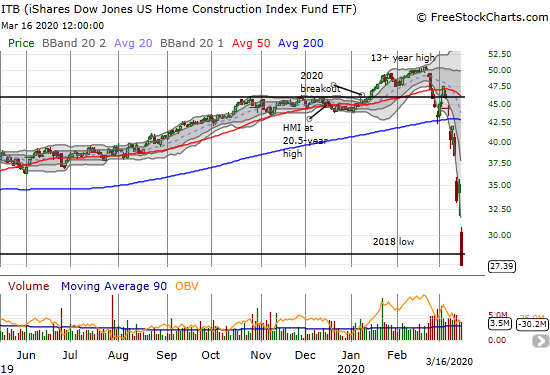

It seems every week I need to generate new superlatives to describe the epic collapse in the stock market. For the housing-related stocks, forget animal spirits getting trampled. This time around the walls have all caved in on the sector. Today’s third crash during this sell-off in the stock market featured a complete collapse in housing and construction related stocks that signals/confirms an investor scramble to price in the likelihood of a recession and a calamitous slowdown in the housing market.

Source: FreeStockCharts

The list of the carnage is absolutely mind-boggling and the swiftness of the collapse is breathtaking. The table below is a large sample from the list of housing-related stocks I follow. I list the name of the stock, today’s change (loss), the total change (loss) from the last high, and the relative level (low) of the stock. The stocks are listed in reverse order of their loss today.

| COMPANY NAME (STOCK SYMBOL) | TODAY’S CHANGE | CHANGE FROM HIGHS | RELATIVE LEVEL |

| Taylor Morrison Home (TMHC) | -35.6% | -66.8% | All-time |

| Century Communities (CCS) | -33.5% | -58.9% | 4-year |

| KB Home (KBH) | -30.2% | -59.9% | 3-year |

| M/I Homes (MHO) | -29.2% | -64.5% | 4-year |

| LGI Homes (LGIH) | -29.8% | -55.8% | 15-month |

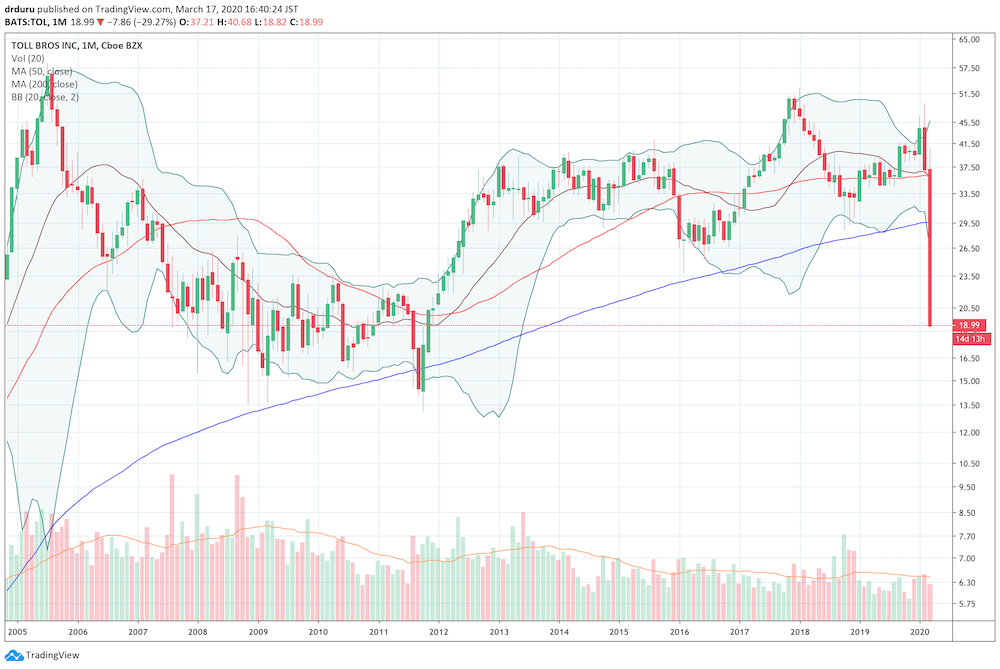

| Toll Brothers (TOL) | -29.3% | -61.4% | 8 1/2 – year |

| M.D.C Holdings (MDC) | -29.1% | -56.4% | 4-year |

| Realogy Holdings (RLGY) | -28.1% | -69.6% | All-time |

| U.S. Concrete (USCR) | -24.9% | -79.2% | 7-year |

| Tri Pointe Group (TPH) | -24.8% | -51.1% | All-time |

| Lowe’s Companies (LOW) | -24.8% | -42.6% | 2 1/2 – year |

| Meritage Homes (MTH) | -24.5% | -53.7% | 15-month |

| Beazer Homes (BZH) | -24.0% | -65.0% | 11-year |

| Zillow Group (ZG) | -23.1% | -57.4% | 15-month |

| Five Point Holdings (FPH) | -22.0% | -49.3% | All-time |

| Pulte Homes (PHM) | -21.1% | -48.6% | 16-month |

| D.R. Horton (DHI) | -20.2% | -49.5% | 3-year |

| Redfin Corporation (RDFN) | -19.8% | -57.6% | All-time |

| Home Depot (HD) | -19.8% | -33.2% | 15-month |

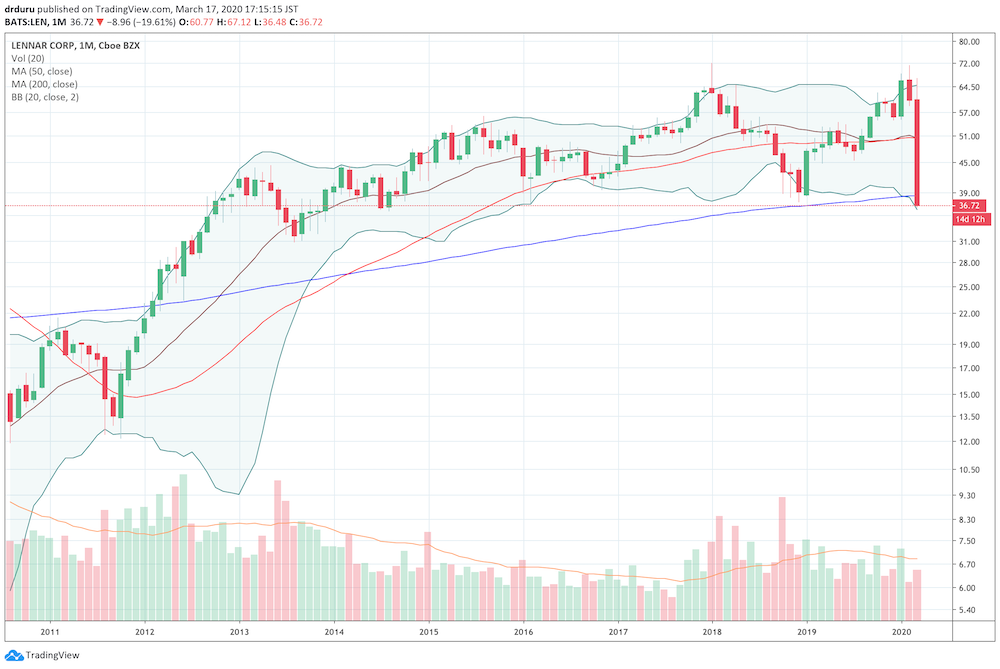

| Lennar (LEN) | -19.6% | -48.4% | 5-year and 7-month |

| Sherwin-Williams Co (SHW) | -18.7% | -31.9% | 13-month |

| Owens Corning (OC) | -18.5% | -50.3% | 5-year and 3-month |

| Acuity Brands (AYI) | -11.9% | -41.1% | 7-year |

For most stocks, the change from highs measures just 3 to 4 weeks of selling. Along the way, I rebuilt a small portfolio of these stocks as part of the seasonal trade on home builders. The stock market crash completely blew away that strategy for the rest of the season (ending in April/May). Still, the on-going declines have created a swath of what I think are irresistible bargains for more normal times. Home builders are considered priced for an economic calamity when they trade below book value. Home builder stocks like KBH, CCS, TOL, LEN, and TMHC have book values around 0.7, 0.5, 0.5, 0.7, and 0.5 (calculated from Yahoo Finance) respectively. These are rock bottom valuations last seen around the time of the big post-recession trough in housing in 2011/2012.

Speaking of trough, of the stocks that did not hit all-time lows, Toll Brothers (TOL) sticks out as a stock which completely reversed its gains from the big 2012 breakout. The weekly chart below speaks volumes.

Source: TradingView.com

I made the mistake of focusing on accumulating TOL because I read through the transcript of the last earnings report and concluded that investors over-reacted. On that basis, I looked forward to a reversal in sentiment by the next earnings report. The coronavirus-related implosion essentially makes past earnings statements nearly irrelevant. Instead, Toll Brothers now suffers from a highly levered balance sheet with debt/equity at 88. Builders plumbing all-time lows are also getting hit by debt-related penalties, like Taylor Morrison Home (TMHC) which made a major acquisition at exactly the wrong time.

Source: TradingView.com

Spec Homes Will Weigh Heavily

The timing of this implosion catches the housing industry at a particularly vulnerable time because it is gearing up for a major Spring selling season. Starting last year, encouraged by declining mortgage rates thanks to Fed rate cuts, buyers rushed back into the market. Buyers have focused on affordable, lower-priced homes (so much so that even Toll Brothers was forced to start pivoting its strategy to lower-priced luxury homes!). To meet the demand builders were significantly ramped up starts. A lot of builders stocked up on “spec homes” which are speculative homes built in advance of anticipated demand. That demand is likely evaporating as I type, and it will leave these builders in tight capital positions. Average selling prices are already suppressed thanks to the pivot to lower-priced homes. Now, builders with spec inventory will be competing with each other to increase incentives and lower price just to liquidate inventories.

I am guessing these builders who spent years very carefully managing their businesses based on the hard lessons of the housing bubble and subsequent crash will emerge from this virus crisis even more reluctant to help increase housing supply (as the National Association of Realtors so eagerly wants them to do). Once buyers finally deplete existing supplies of homes, the industry will likely re-pivot to building to demand.

Nervously Awaiting Earnings Season

So while the U.S. housing market is being sold for a major discount and firesale, I am stepping aside for a moment out of an abundance of caution. I am sitting on what I already own. If the panic keeps intensifying, many home builder stocks could go a lot lower just from a technical standpoint. I am sure there will be large bounces from oversold levels, but those rallies will likely be short-lived. Investors will be on edge awaiting news on the depth of problems in the sector. The first big post-collapse earnings report comes from KB Home on March 26th. I plan to listen to that conference call if possible so I can report on key take-aways as soon as possible.

Be careful out there!

Full disclosure: long ITB shares and call options, short MTH put, long TOL shares and calls, long KBH calls, long LEN calls, long LOW shares and calls, long RDFN, long USCR, long CCS, long FPH

If you are not already familiar with it … hit up the paper published yesterday by a U.K. group headed by Neil Ferguson. Search on his name via twitter, find tweets with links to his paper. He is a world renowned expert of infectious disease, and the modeling of their spread. It is his work that is now determining the actions that the Trump is taking. And, it is Neil’s work that has caused this sell off. He started going public with cursory info just about the time the markets tanked. Those who paid attention to him rushed the exists, The key points …. Surge in US cases begin in May, peak in June, tail off in July. Then, it revisits us again with peak cases in November. Provided we follow draconian measures of social distancing, cancel schools and all events where more than 10 people meet, and a few other major steps he outlines and Trumps team recommended yesterday, we MIGHT be able to keep US deaths to the 1 to 1.2 million range. Worse though, the need for ICU beds will still be 8x over what we now have available. So, three major issues here … 1. this is going to last much longer than Trump and his team are willing to announce right now. 2. There will be significantly more economic damage then most now have on their radar, and 3. Death rates will shock and depress the economic psyche of consumers, continuing and deepening the economic slump. It is now apparent to me that the hedge fund and institutional sellers who have been keyed in to the work of Neil have caused this selling. And, given that if Neil is correct, we are in an infant stage of true economic debacle. Dr. DuRu, I greatly respect your work. I would ask that you not publish this info far and wide right now via your website or email. Just having the understanding that deaths will possibly exceed 1 Million will certainly cause yet another round of panic. Trump and his team know this. They want to delay the panic as long as possible. But, use this info wisely in planning your trading. Like you, I just wish I had this knowledge much sooner. It has cost me greatly.

Thanks for reading and posting! I was not clear though at the end there – sounds like you don’t want me to publish your comment? Regardless, The market is behaving as if it fears exactly the scenarios you are describing. I don’t think there are any “secrets!”

I do not have issue with you leaving my comment posted here. Just didn’t think it wise to circulate the death estimate number exceeding 1 million in an email or as a main post, right now. Neil Ferguson could wind up being wrong. But, it does appear that many governments are now aligning their game plans up with Neil’s proposals to flatten the curve. And again, even if all those proposals are 100% effective, at the peak we will need 8x more ventilators and ICU beds than are currently available. Without following these steps though, Neil is projecting that as many as 2.2 million Americans die. So, closing schools, limiting gatherings to less than 10 people, social isolation of anyone older than 70, and quarantine of entire families if any one member is sick … should save at least 1 to 1.1 million lives. The problem though is that we will

be doing these things for the remainder of 2020 and into 2021… far longer than Trump is now willing to admit. And lives lost are far higher than he is willing to admit to the American public right now. These things will cause an economic shock much greater than most currently understand. Let’s hope that Ferguson is wrong. But in adopting the Neil Ferguson playbook, it is clear that Trump’s team has finally convinced Trump that if does not get on board, then we’ll be looking at 2.2 million bodies stackIng up in a few months. The alternative of 1 to 1.1 million is still shocking enough, and an economy that will all but be closed down for much of the coming year. That’s why we now have this equity market debacle … large investors who know of Neil Ferguson’s projections are massive sellers. And it is likely that they are not near done selling. Again, let’s hope Neil Ferguson is blowing smoke.

The interesting thing happening behind the scenes is the effort to greatly expand ICU and ventilator capacity. There are several huge industrial companies who are stepping up to the challenge. For example, I saw a few posts on Twitter of GE employees who are literally working 24 hours a day in an effort to crank out 100,000 ventilators over the next 30 days. This is an historic effort harking back to the days of World War II. We will hear about many heroic efforts like this after this crises has come and gone. And too, our military is on red alert and prepping to flow field hospital capability to hotspots as needed, or transport patients back to VA and/or active military hospitals near airports, throughout America. In preparation of this need, VA hospital beds near airports are being cleared out and made ready to accept anyone and everyone in need of a ventilator. VA patients who were in these hospital beds are being moved to more rural locations and doubling and tripling up to clear space for the crunch to come. We will be short of medical skills for people who can intubate patients and monitor ventilator performance. Medical school students are getting crash courses now and will fill in on the front lines. Doctors of more sleepy specialities are also getting crash course training to be ready to walk into the war zone of an ER. There is a ton of out of the box thinking and action taking place now to try our best to ramp up ICU beds and ventilators, and manpower to monitor them. If everyone saw and understood this stuff happening behind the scenes right now, understood the breath of the prep to handle the disaster to come, the S&P would likely be down 60,70,80%. If Neil Ferguson’s model is right, it’s going to get really bad. June headlines in the press will be absolutely horrendous, depressing … Death everywhere. And, with yet another virus peak to hit us again in November. So, we are in early stages. Yet, I still see numerous talking heads on both CNBC and Bloomberg saying this thing peaks in the next 30 to 45 days …. Not according to Neil Ferguson’s model. Prepare yourself for times you never expected to happen in our country.

Man – I sure hope that is the absolute worse case scenario. I tend to avoid fear and stress, so I am definitely leaning more toward the “better case” scenario!

I don’t think Neil is blowing smoke. He is just piecing together what could be the absolute worst possibilities. I think China and South Korea are already demonstrating that things don’t nearly have to get as bad as that scenario.

Well all I can do is gulp hard on all of that potential bad news!