“Looking for one of the 4% of stocks still trading above their respective 200DMAs? Apple (AAPL) is one of those lucky few. If sellers break AAPL, I foresee two binary possibilities: 1) buyers will finally see enough bargains to go on a buying spree, or 2) buyers give up all hope and the resulting rush to lock in remaining profits in AAPL ignites a fresh wave of selling in the stock market. Regardless of the outcome, I still see AAPL staying stuck in a trading range with its 50DMA as the cap.”

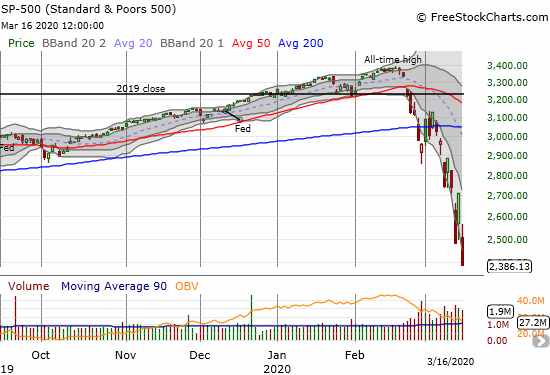

This quote was my claim as the stock market crash slammed into a bear market. There is of course no necessary connection between AAPL’s behavior and the rest of the stock market, but I am noting a potential psychological connection. Apple is a revered brand, and the stock has remained relatively resilient. AAPL is down 26.0% from its all-time high set on February 12, 2020 while the S&P 500 (SPY) is down 29.5% from its all-time high on February 19, 2020. However, today the stock market lost AAPL. The stock lost 12.9% and closed below its uptrending 200DMA.

Remember when on February 17th Apple warned that its financial results would be impacted by the coronavirus in China? the news seems like an eternity ago. The day after that news, AAPL gapped down 3.0% and buyers stepped right in to close the stock with just a 1.8% loss on the day. The very next day buyers nearly finished closing the gap. That moment perhaps symbolizes the peak of complacency in the stock market at the time; it is a complacency that is now hard to believe, much less remember. The stock market has completely flipped to an all-out panic over the coronavirus and the resulting economic calamity being caused in an effort to contain the virus.

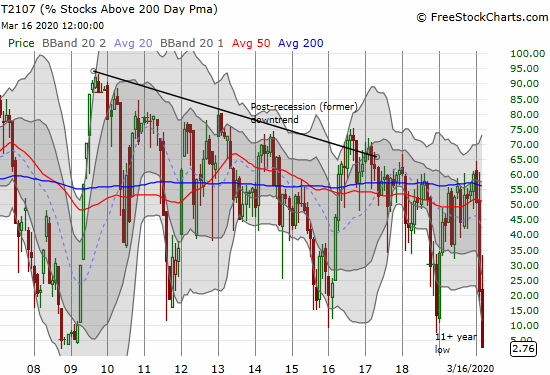

AAPL’s resilience was also notable because AT200, the percentage of stocks trading above their respective 200-day moving averages (DMAs), plunged in a straight line while AAPL slowly tipped over. Today (March 16, 2020), AT200 closed at just 2.8%, a level last seen during the front-end of the financial crisis. This is what a market collapse looks like.

Source of charts: FreeStockCharts

In my last post on trading this stock market, I eagerly noted I would buy the market down to S&P 500 (SPY) at 2600. Within hours of that post, the stock market suffered its THIRD crash in this sell-off as futures imploded after another emergency measure from the Federal Reserve. The S&P 500 opened the next day at 2508 and rallied as high as 2563 before ending the day with a 12.0% loss.

I am trying to change my rules as fast the market forces the issue. Now I have 2600 as a critical line below which I am very wary about buying and above which buyers can convince me they are ready to defend a bottom in the stock market. In the meantime, AAPL is my wildcard. If the stock can relocate 200DMA support with TWO closes above that trendline, I suddenly will get a lot more interested almost no matter what else is happening at the time.

{Trading side note, I have had some success buying AAPL calls on a down open and flipping them on the next intraday rally. In coming posts, I may discuss focusing more and more on AAPL trades instead of broadening the risk profile}

Be careful out there!

Full disclosure: long SSO, short AAPL put spread