This week’s market crash and subsequent sharp rebound revealed some key divergences among housing-related stocks. While one more home builder made it to my “do not touch” list, I see even more opportunities.

Opportunities

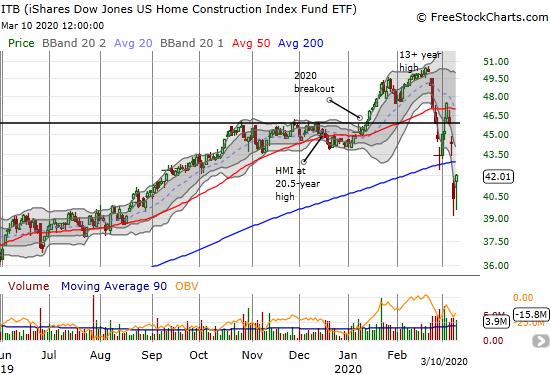

iShares Dow Jones US Home Construction Index Fund ETF (ITB)

To start the week, the iShares Dow Jones US Home Construction Index Fund ETF (ITB) broke down below its 200-day moving average (DMA) and closed below that critical trend line for the first time in a year. The incredible 9.1% loss on the day left behind what looks like a distinct topping pattern from the 2020 breakout and subsequent 13+ year high.

Still, I could not resist such a large drop during the seasonally strong period for home builders. I used the drop to buy back into shares. I have significantly dropped my upside expectations on such trades and see the 2020 breakout as offering stiff future resistance. I will next buy a fresh call spread with the short-side set at the $46 resistance level.

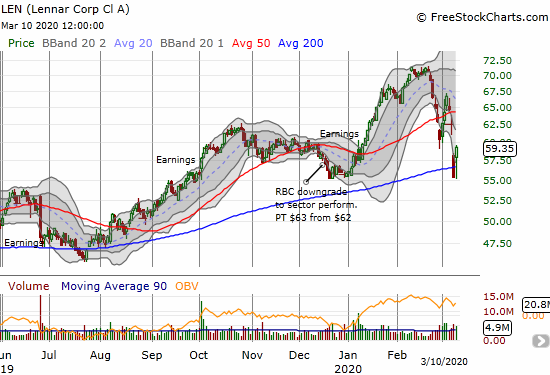

Lennar (LEN)

Lennar (LEN) successfully defended support at its 200DMA with its 7.2% gain on the day. This display of strength and relative out-performance put LEN on my buy list. The stock enters bear territory if it breaks down below this week’s closing low. My short-term upside target is capped around 50DMA resistance.

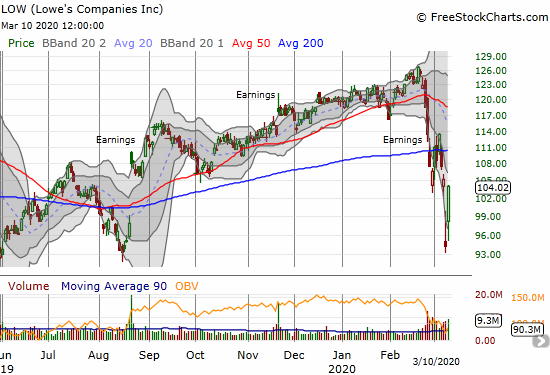

Lowe’s Companies (LOW)

I put Lowe’s Companies (LOW) on my shopping list last week after the stock made a strong move above its 200DMA. At the time I did not have a market crash on my radar. In Monday’s 10.5% plunge I bought more call options and shares. I think of LOW as a winner in an era where people are scrambling to find cleaning supplies and do-it-yourself solutions to their hygiene and anti-viral needs. I plan to continue accumulating shares if the market offers up further discounts as secular trends also favor LOW for the long-term.

Home Depot (HD)

Many people seem to prefer Home Depot (HD). As a result, Home Depot is the more expensive of the two hardware big box stores. HD did not gain as much as LOW, but the stock also did not lose as much going into the day. More importantly, the stock regained its 200DMA with the day’s 7.2% gain. HD also successfully defended support at December’s reaffirmation of guidance. I do not think of HD as offering as much upside as LOW.

The Penalty Box

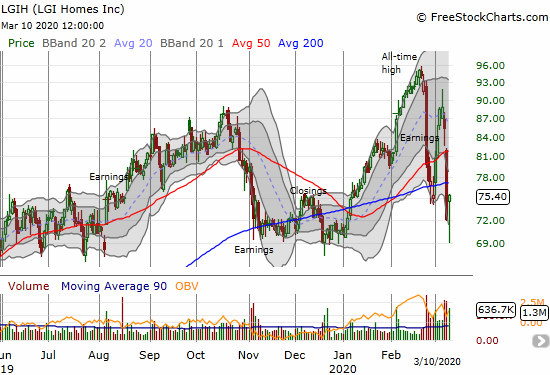

LGI Homes (LGIH)

LGI Homes (LGIH) has experienced some of the largest swings among the home builders starting with a massive post-earnings decline last month. The stock started the week with a 15.6% loss that looked like confirmation of a top in the stock. The next day’s 4.6% gain is encouraging but the stock has a lot of damage to repair. I am no longer interested in buying back into this stock especially with the potential Texan economic fall-out from the collapse in oil prices

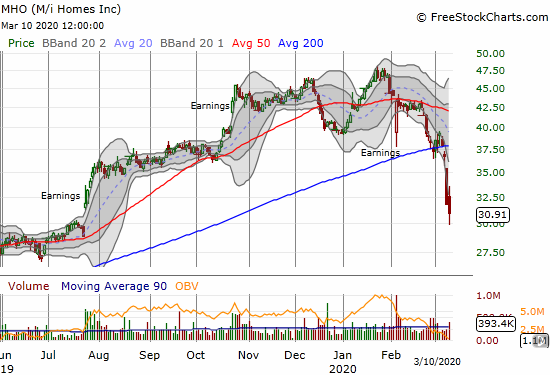

M/I Homes (MHO)

M/I Homes (MHO) made it to my list of fresh cracks in housing-related stocks. MHO quickly confirmed its 200DMA breakdown with the crash that started this week. The stock further confirmed a bearish turn by losing 2.7% on a major market rally day. This sharp and distinct divergence from the market and from ITB officially keeps MHO off my buy list. The loss essentially filled the post-earnings gap from last July.

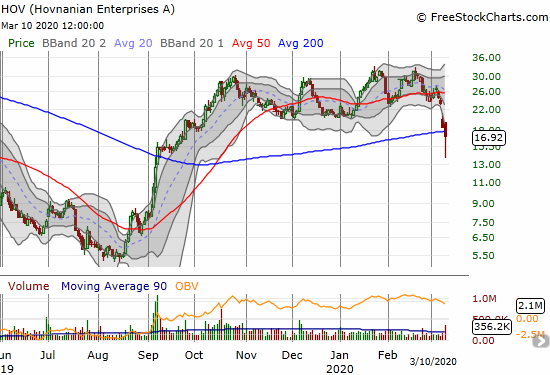

Hovnanian Enterprises (HOV)

The speculative fever in Hovnanian Enterprises (HOV) is ever so slowly seeping away. HOV is breaking down from a 5-month consolidation period that ended with pivots around the 50DMA. The 200DMA breakdown and 8.5% loss makes HOV stick out as a relative under-performer – quite a turn in events from the sharp run-up that started last August.

An Interest in Rates

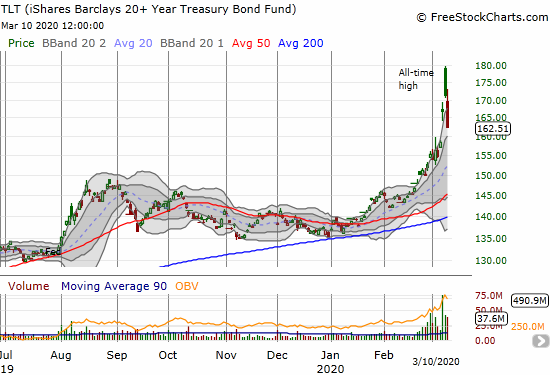

iShares Barclays 20+ Year Treasury Bond Fund (TLT)

Over the weekend I referred to the iShares Barclays 20+ Year Treasury Bond Fund (TLT) when noting that parabolic moves are built not to last. TLT put in one more parabolic move for good measure before fading from its intraday high. The move created a bearish gap and crap well above the upper Bollinger Band (BB). Sellers followed through on Tuesday to print a 5.1% loss and confirmed the topping action. TLT is important to watch for home builders as the plunging yields in Treasurys translate into lower mortgage rates.

I only participated in part of the rally in TLT, and I am torn on how to make a bear/bull call on the fund. I like TLT call options as a hedge for a bullish portfolio, but the technicals scream out a top. One option is to bet on a shallow rebound to $170 or so with a call spread.

Be careful out there!

Full disclosure: long ITB shares and calls, long LOW shares and calls