The race to zero interest rate policies (ZIRPs) is reaching a climax.

Australia: Reserve Bank of Australia

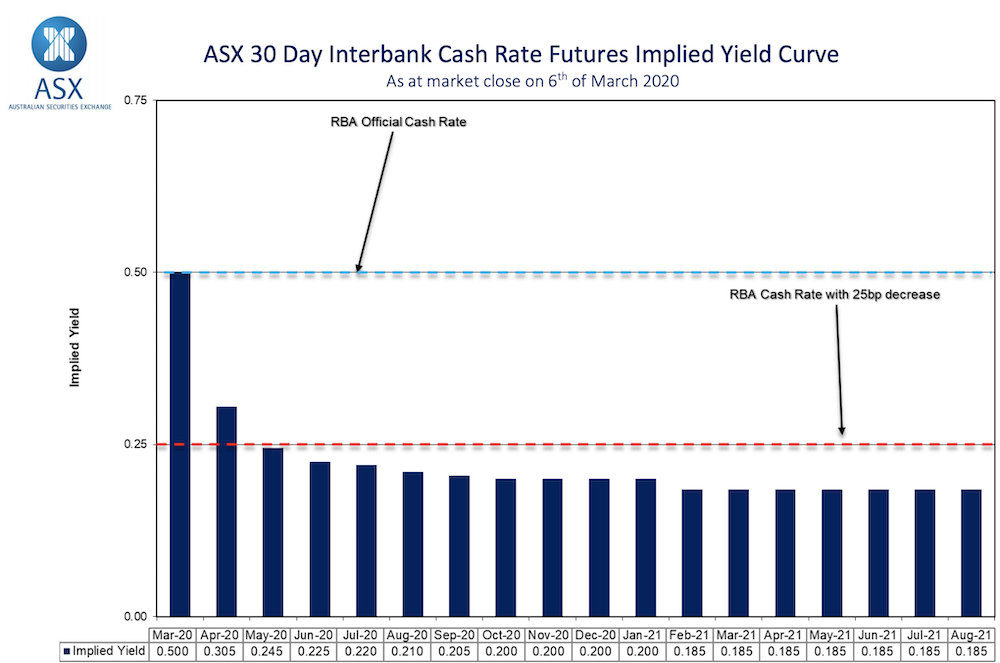

On March 3, 2020, The Reserve Bank of Australia dropped its key interest rate 25 basis points (bps) from 0.75% to 0.5%, an all-time low for Australia. In doing so the RBA proclaimed the following in its statement:

“The coronavirus has clouded the near-term outlook for the global economy and means that global growth in the first half of 2020 will be lower than earlier expected. Prior to the outbreak, there were signs that the slowdown in the global economy that started in 2018 was coming to an end.”

The notion that a slowdown in the global economy was already underway caught my attention. As the U.S. stock market ripped higher from October, 2019 to February, 2020 there were a lot of reasons offered to make the rally seem to make sense. in retrospect, one would have to believe that the stock market was looking forward to the global economic recovery. Now that the prospects for that recovery are almost completely gone, it makes sense that the U.S. stock market has effectively wiped out that entire breakout.

According to bond markets and the pricing for odds that the central banks will cut rates, the trouble seems far from over. In Australia, the futures markets are anticipating more rate cuts from the RBA.

Source: ASX

United Kingdom: Bank of England

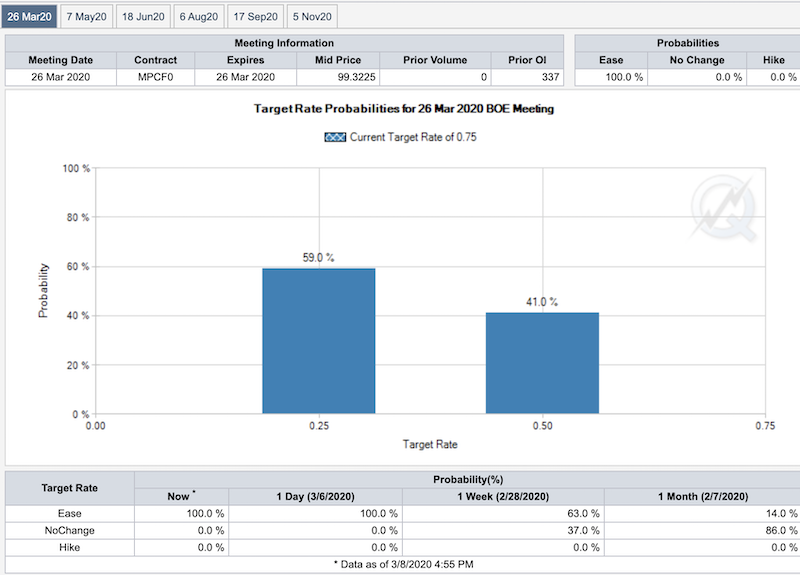

I have not seen or heard much from the major headlines about the Bank of England (BoE). Brexit is on the books and fading into the rearview mirror as economic issues and trade deals take greater hold. Futures markets are expecting the BoE to cut rates later this month as much as 50 basis points all the way down to 0.25%. Just a month ago, the odds of easing at all were only 14%.

Source: CME BoE Watch

United States: Federal Reserve

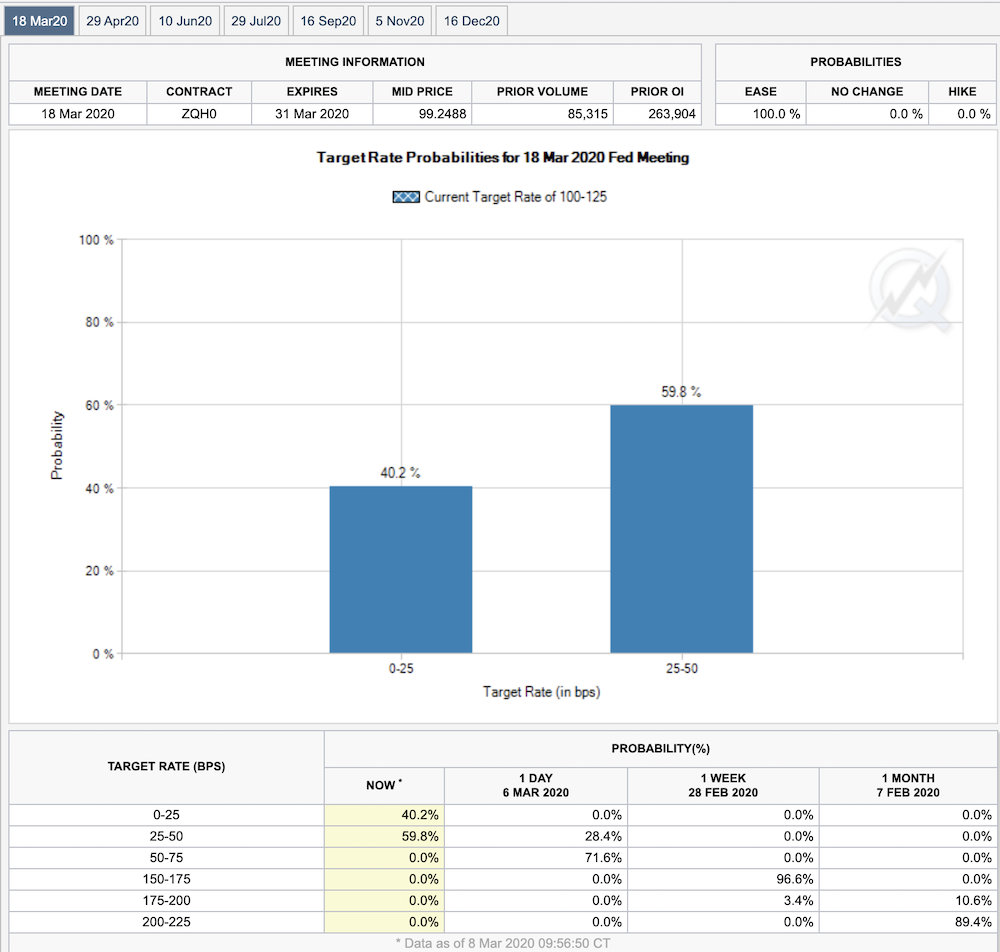

Last week, the Federal Reserve slashed rates by 50 basis points in an emergency cut meant to stabilize financial markets. From the terse statement:

“The fundamentals of the U.S. economy remain strong. However, the coronavirus poses evolving risks to economic activity. In light of these risks and in support of achieving its maximum employment and price stability goals, the Federal Open Market Committee decided today to lower the target range for the federal funds rate by 1/2 percentage point, to 1 to 1‑1/4 percent. The Committee is closely monitoring developments and their implications for the economic outlook and will use its tools and act as appropriate to support the economy.”

At the time of writing, that effort looks like it completely failed as financial markets are crashing. Bond yields continued to plummet after the Fed’s emergency rate cut and futures are demanding yet more rate cuts from the Fed. Amazingly, the market wants another 75 basis points at the currently scheduled March meeting. At the current rate of implosion, the Fed may be forced to go into emergency mode again this week! Note that the market is close to pricing in a 50/50 shot at going all the way to zero (lower bound) at the Fed meeting.

Source: CME FedWatch

This race to ZIRPs demonstrates that the global financial system is trapped by easy and accommodative monetary policies. Despite years of economic recovery since the 2008/2009 financial crisis, rates never increased much across the major central banks. Now, rates are racing to zero ahead of what could be some kind of global recession. If that recession deepens, who knows what other tools central banks will have available to bring to bear when fiscal policies will be burdened by divisive politics and tremendous debt loads from increased deficit spending?

For traders and investors, it will be important to keep in mind a very broad range of possibilities…but never, never panic and do not forget to buy at the huge discounts the market is offering up. The oversold conditions of the U.S. stock market are going to get “ridiculously” extreme ahead of desperate actions by financial authorities.

Finally, note that the bond market went parabolic last week; iShares Barclays 20+ Year Treasury Bond Fund (TLT) soared 5.2% alone on Friday. Parabolic run-ups are built NOT to last. The ironic next move will be for bond yields to soar on inflationary expectations from super-easy monetary policies and super-stimulative, turbo boosted fiscal policies with debts piling up in astronomical amounts.

Source: FreeStockCharts

Be careful out there!

Full disclosure: no positions