(This is an excerpt from an article I originally published on Seeking Alpha on September 3, 2012. Click here to read the entire piece.)

“…the private sector’s revised outlook for the policy rate also appears to reflect a growing appreciation of how forceful the FOMC intends to be in supporting a sustainable recovery.” (Ben Bernanke at Jackson Hole, Wyoming in speech titled “Monetary Policy since the Onset of the Crisis“)

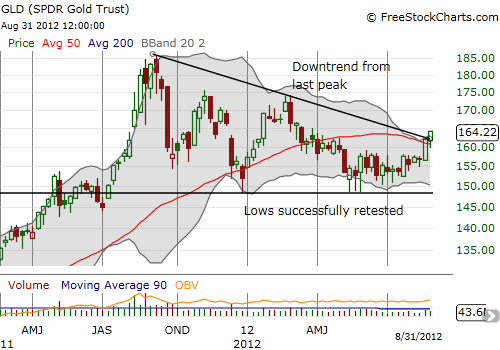

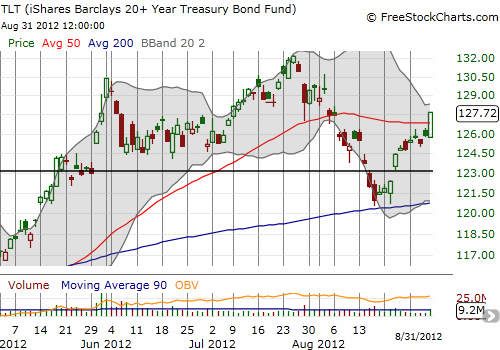

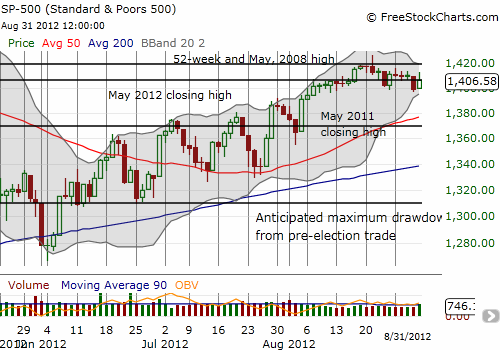

This statement was just about the only new news I could discern from Ben Bernanke’s speech at Jackson Hole on August 31. It serves as a reminder that the Federal Reserve will continue to take strong measures to address persistent economic weakness. In a more subtle sense, it communicates to any who will listen that if you did not believe the Federal Reserve is ready to act again when it sees the need, then you need to hop on the train of “growing appreciation” before you get left behind. I am guessing in that spirit, silver (SLV) and gold (GLD) rallied forcefully and long-term Treasury yields dropped. Gold broke out from its downtrend, silver looks ready to do so, and TLT jumped over final resistance. This trading suggests the market is getting ready for action although the S&P 500 (SPY) ended in a stalemate.

{snip}

The rest of the speech was an accumulation and/or compilation of opinions, projections, and policy pronouncements that have been made in the past…{snip}

So, overall, Jackson Hole appeared to provide a summary and confirmation of the Federal Reserve’s readiness to act if deemed necessary. {snip}

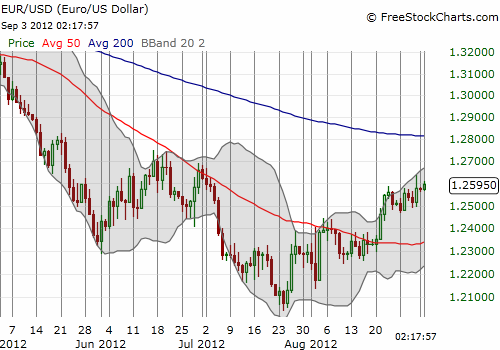

The currency markets took the dollar index down on the heels of Jackson Hole, but it was not a large move relative to the slow decline already underway. {snip}

Source for charts: FreeStockCharts.com

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on September 3, 2012. Click here to read the entire piece.)

Full disclosure: long SSO puts, long GLD and SLV, net short the euro (all at the time of original writing)