I assumed the seasonal trade on home builders came to an end some time in May. However, the tailwinds lifting builders higher remain as strong as ever. This strength and outperformance has confused and confounded those assuming higher interest rates would mean disaster for the housing market and an eventual recession. A recent upgrade for the housing sector by Raymond James shined a spotlight on the scramble to keep up with the improving fundamentals. On July 14, Raymond James upgraded five home builders to outperform. Four of these builders were previously rated market perform and one strong buy. The upgrades came with the following humble acknowledgement:

“We are keenly aware that the optics of turning more positive on homebuilders after the group has already achieved a new all-time high is far from ideal…But we must always reassess what we missed earlier.”

The Raymond James analyst set price targets on individual home builders that imply 15-22% upside from current levels. The list below includes the previous rating before the upgrade to outperform.

- KB Home (KBH) $61 (market perform)

- Lennar Corporation (LEN) $150 (market perform)

- MDC Holdings (MDC) $55 (market perform)

- PulteGroup Inc (PHM) $93 (market perform)

- Toll Brothers (TOL) $100 (strong buy)

In my last Housing Market Review, I acknowledged that 2023 had developed into an anomaly year given a unique convergence of market forces. Still this kind of late cycle boost from analysts surprises me and surely further undermines expectations for a recession just around every corner of the economy.

More Momentum for Outperformance

The bullish message came through loud and clear on Friday’s broadcast of CNBC’s Fast Money. During the “trade it or fade it” segment, guests Bonawyn Eison and Courtney Doming agreed that DR Horton (DHI) should continue higher from here. At the 3:09 point in the video below, they together explain how the resilience of the consumer along with supply and demand imbalances combine with DHI’s concentration of entry level homes to create positive catalysts.

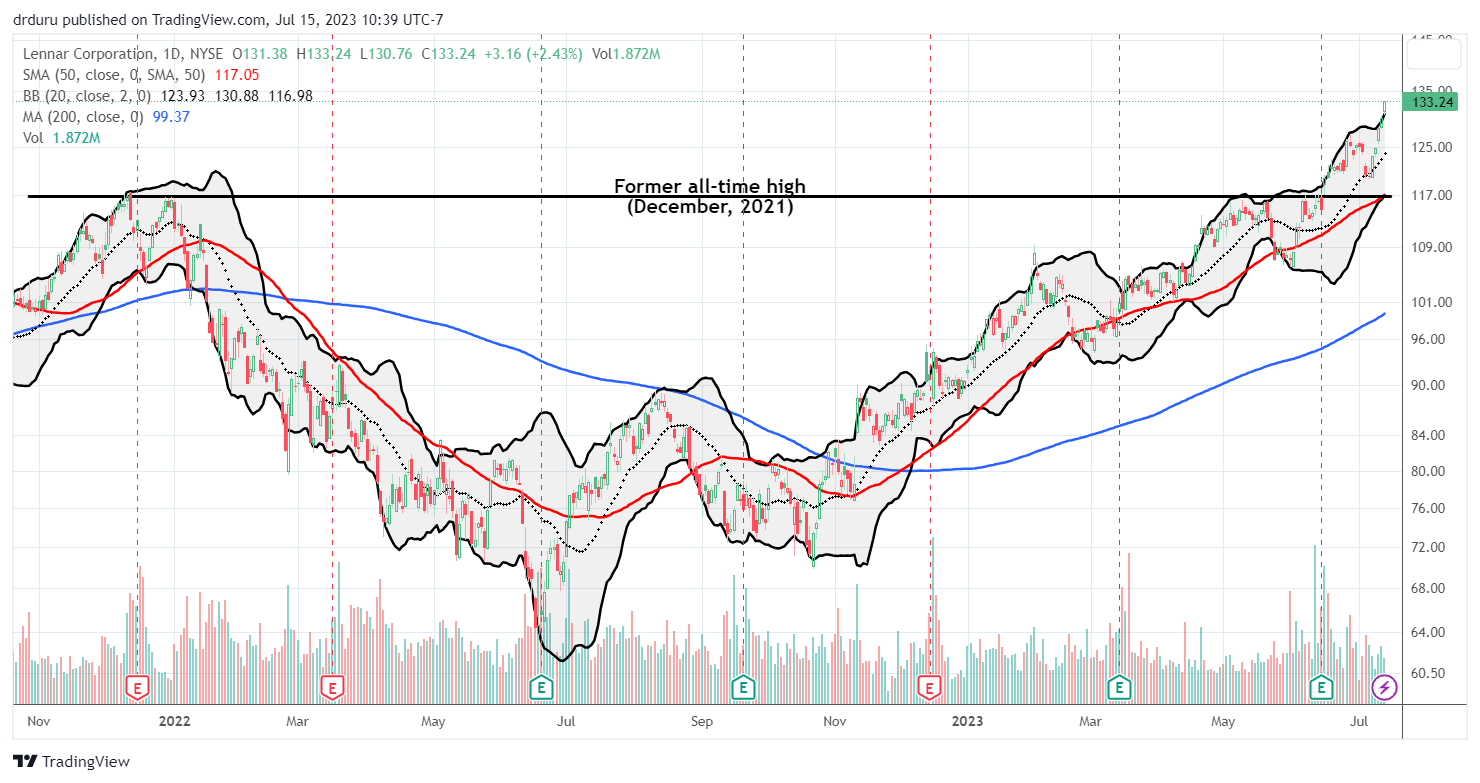

Lennar Outperformance

Raymond James’s move to get more bullish on home builders is aligned with on-going bullishness on builders among analysts. According to Seeking Alpha, there are now 8 analysts with strong buy ratings on LEN. The average rating is a buy (3.77 on a 5 scale) with 4 buys, 8 holds, 1 sell and 1 strong sell.

However, the average rating on LEN is almost at its lowest level in the last 5 years. The average rating was 3.73 in July, 2020 (the immediate wake of the pandemic and a low for housing activity) and 3.75 in March, 2021. So in a sense, analysts as a whole are falling further and further behind the LEN outperformance. The stock has been making new all-time highs for the last month.

Analysts stayed relatively positive through the 2022 sell-off, perhaps demonstrating an inertia built from the momentum of the pandemic housing mania. (That was a time when the seasonal trade on home builders had a very timely end). The first and only strong sell rating showed up in January of that year. A sell rating showed up in August just as home builders were bottoming. The strong sell disappeared the next month and showed up again in May of this year. The biggest changes have happened in the hold ratings.

Price targets have a wide range: $111 to $161. With LEN trading just under the average $135.56 price target, more analysts may soon feel the pressure to upgrade home builders like LEN. Given this potential, home builders remain buys on the dip until a material negative catalyst appears. This is a year for counter-model trading on home builders!

Be careful out there!

Full disclosure: long ITB, KBH