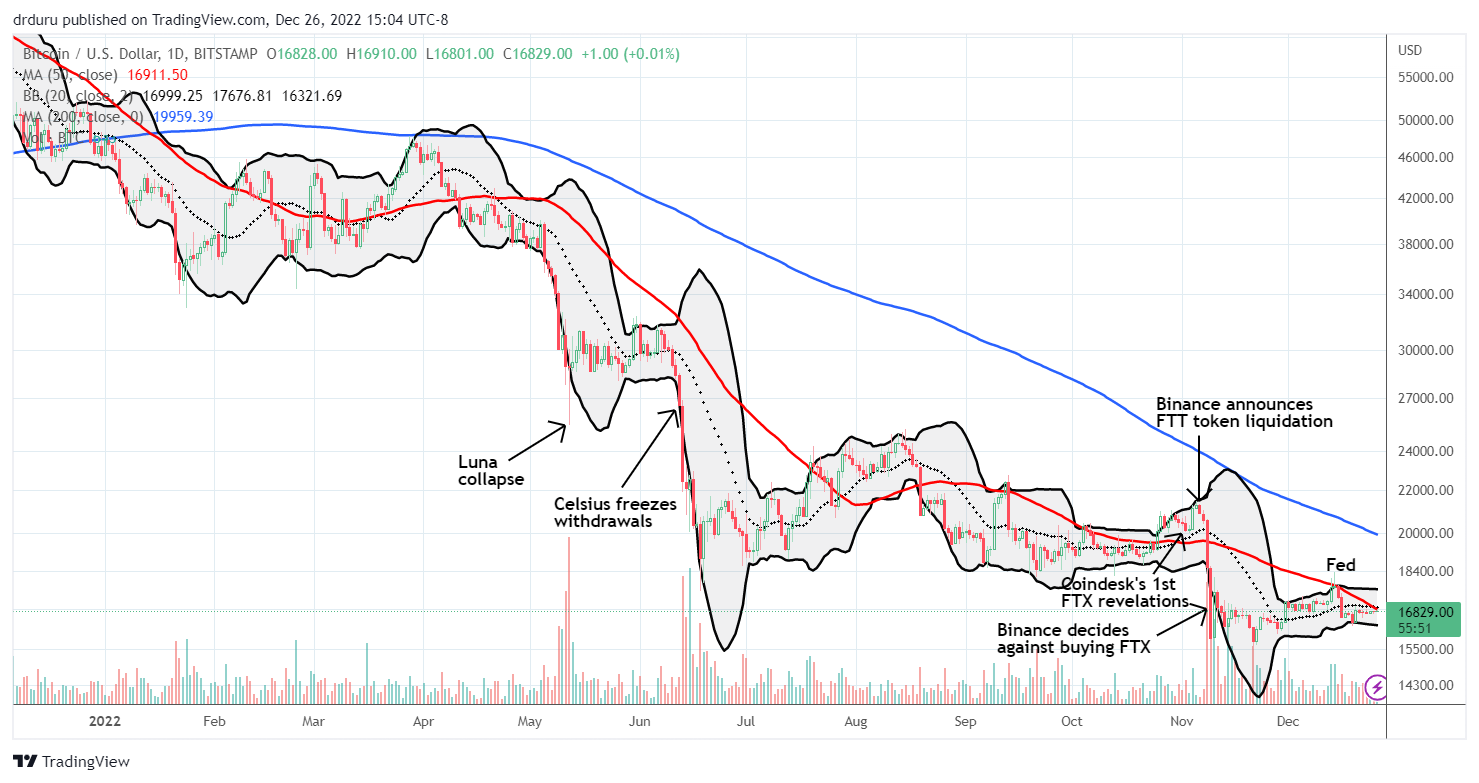

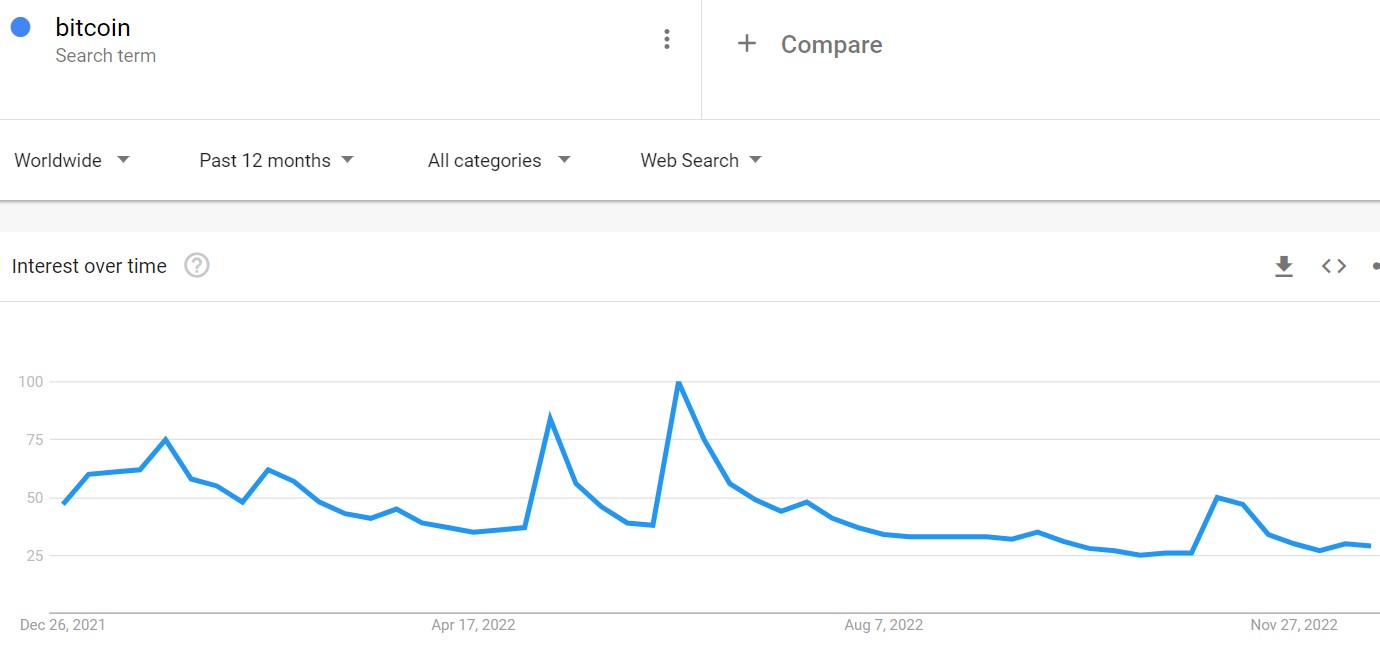

I will remember 2022 as the year of rolling crypto crises. One disaster after another undermined confidence in the ecosystem and forced changes in the bullish narratives for crypto. Through it all, the Google Trends Momentum Check (GTMC) stepped up to the test as a technical signal for short-term bottoms in Bitcoin. These crises did not directly involve Bitcoin (BTC/USD), but correlations can go to one in crypto in times of extremes. The three big crises of the year – Luna’s collapse, the related demise of Celsius Network, and then the implosion of FTX – each caused significant sell-offs in Bitcoin. Spikes in Google searches for “Bitcoin” coincided with short-term bottoms for Bitcoin in each case.

The Google Momentum Check (GTMC)

As a reminder, the GTMC uses extremes in Google search trends data to assess the potential for an end to extreme price action in financial markets. Bitcoin has provided fertile ground for this technical indicator given the technical nature of crypto trading and its ability to deliver a multitude of extreme moves. In December, 2020, I created an addendum to the GTMC for Bitcoin to accommodate extreme price trends. Basically, the lack of a top (or bottom) resets the GTMC. At some point, even extreme trends come to an end.

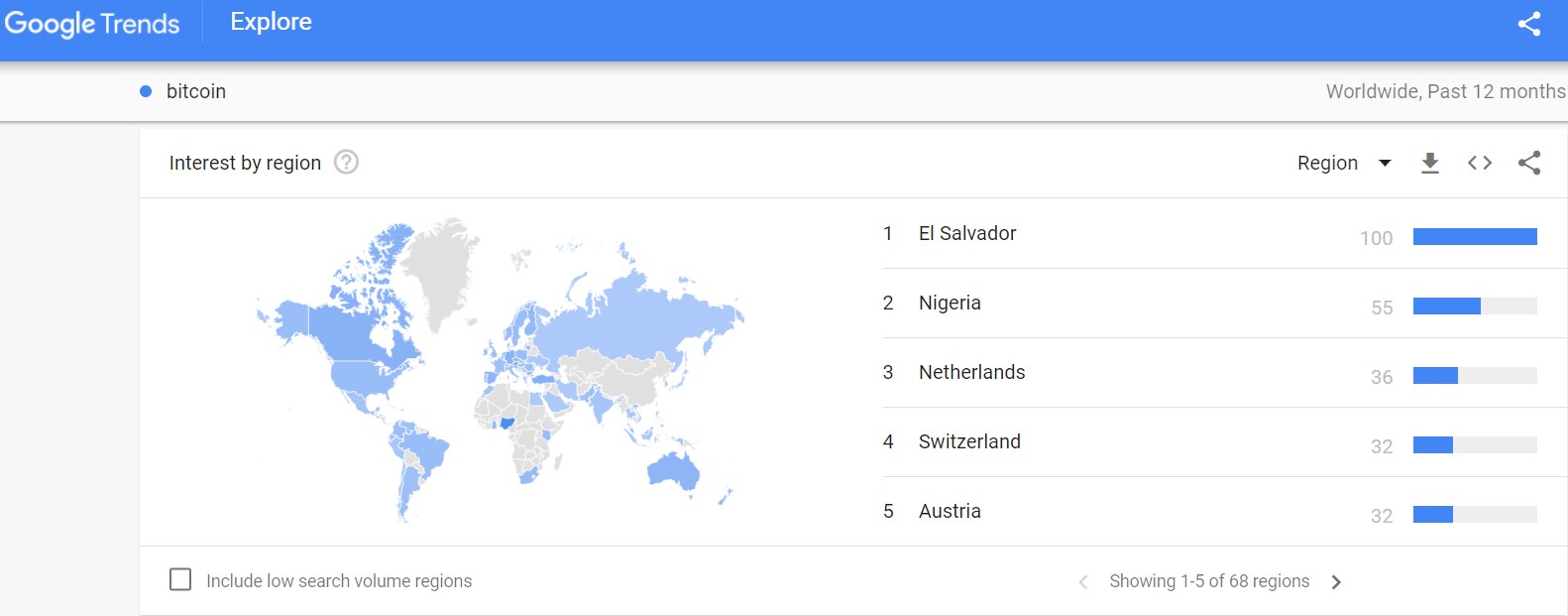

For Bitcoin, I focus on the worldwide Google search trends. The U.S. is not a top country for Bitcoin searches, so American searches are not representative by themselves. Over the last 30 days and 12 months, El Salvador is the topped all countries for searches on Bitcoin. Nigeria was the top country last year. It is now number 2. Ghana and South Africa have been supplanted by the likes of the Netherlands, Switzerland, and Austria. Each country is important for different reasons, so the worldwide search trends seem adequately representative of the worldwide sentiment for Bitcoin.

Bitcoin’s Hard Year

At the time of writing, Bitcoin is down 64% year-to-date, a loss similar to a wide range of speculative technology stocks and SPACs. The Federal Reserve’s normalization of monetary policy slammed a hard ceiling over Bitcoin and most other crypto given currency debasement is (was?) a key tenant of the Bitcoin bull case. Even the last Federal Reserve meeting sent Bitcoin reeling (see the chart below) along with the rest of the stock market.

The U.S. dollar rode the wave of Federal Reserve support this year to a 9.2% gain year-to-date. Unfortunately for Bitcoin, the dollar’s November peak and subsequent pullback did not revive Bitcoin interest. I strongly suspect the rolling crypto crises continue to dampen crypto enthusiasm.

The lack of significant lift in Bitcoin has limited trading opportunities using the GMTC. Thus, I have flipped positions faster than usual and sat on core holdings longer than usual. I even flipped ProShares Short Bitcoin Strategy ETF (BITI) this month. I should have kept BITI on the radar after the Luna collapse.

Bitcoin and the GMTC

The last three peaks in Google searches for “Bitcoin” coincided with this year’s three crypto crises.

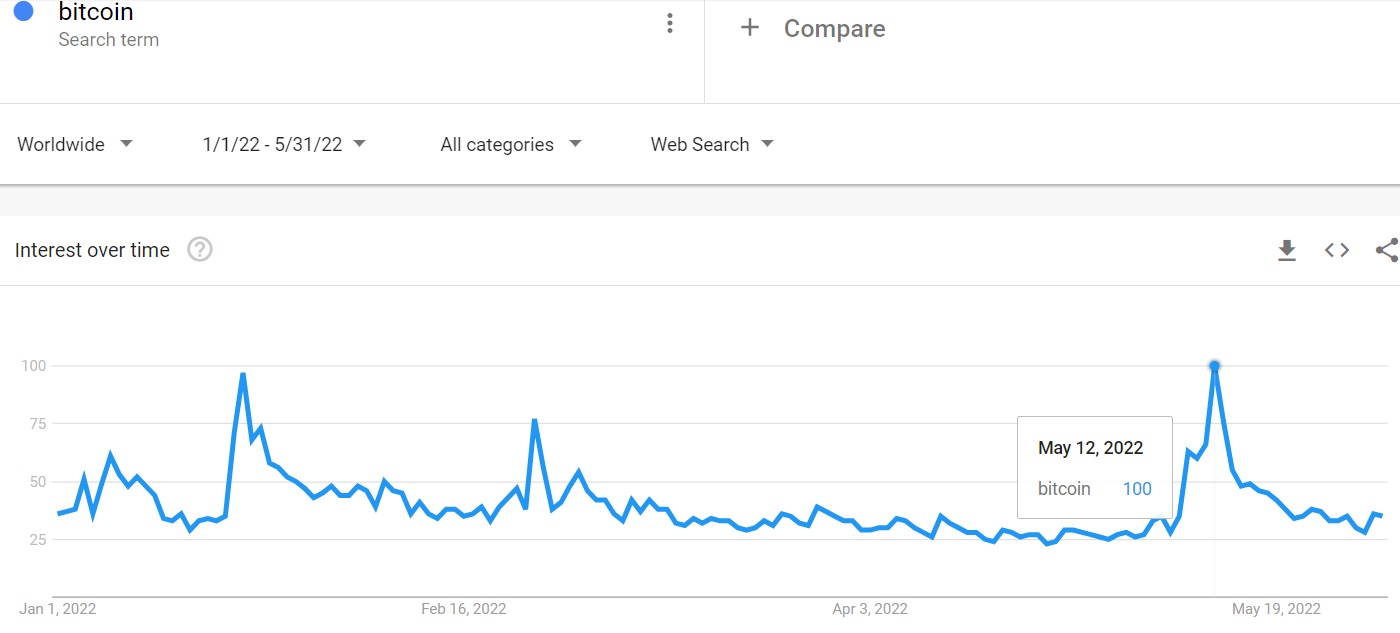

Luna and the GTMC

Luna collapsed 96% on May 12th. Bitcoin suffered an extreme sell-off going into that collapse – a 27% loss in a week. On the day of the collapse, BTC/USD lost as much as 12% before rebounding to flat on the day. The additional lift from there was minimal.

Google searches for bitcoin surged that day as well. The surge generated the largest spike of the year at that time. Interestingly, the zoomed-in view makes the January 22, 2022 jump look almost as big as the May 12th spike. I covered the January drop and GMTC’s timely signal when I was much more optimistic about a sustained rally. Note well how the news of a Russian ban on crypto led to a bottom that lasted longer than the bottoms created by the crypto crises. The other spike occurred on February 24th when Russia invaded Ukraine. While the GMTC delivered again, I did not act to trade on that signal. (This drop also undermined crypto’s use case as a stable source of value in the face of economic shocks).

The Luna bottom held until the related Celsius crisis.

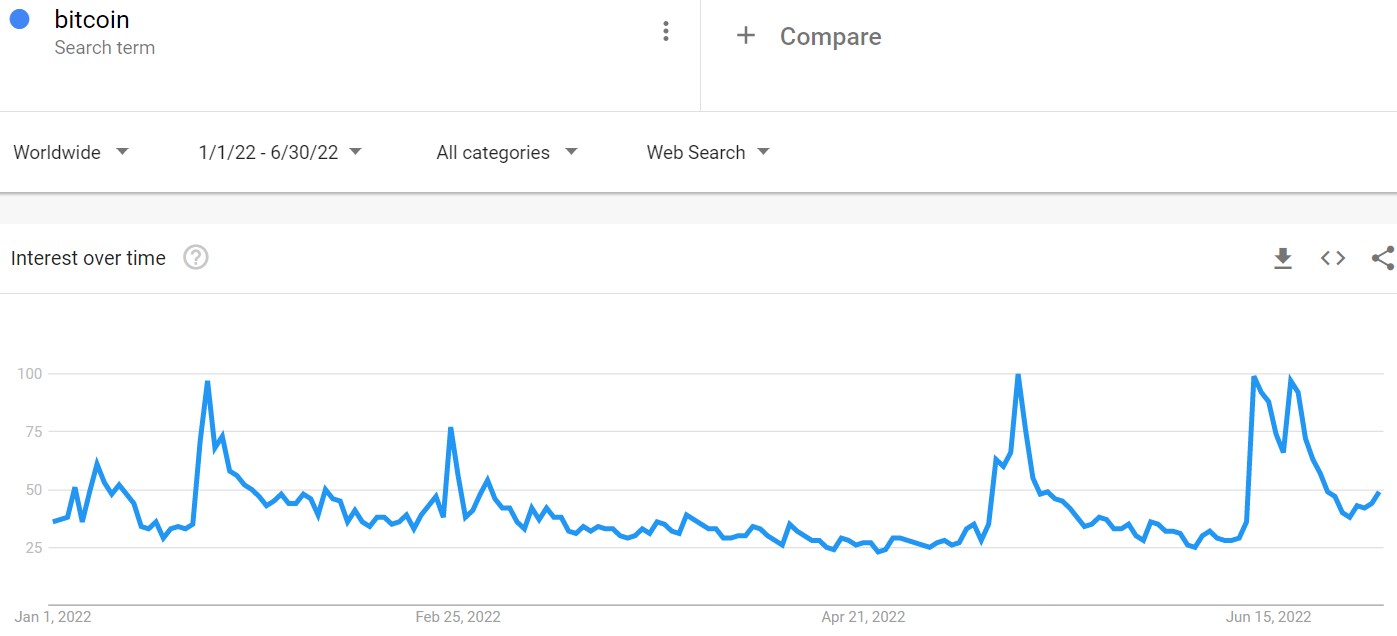

Celsius and the GMTC

The Celsius episode was the most challenging for the GMTC. When Celsius froze withdrawals on June 12th, Bitcoin broke the Luna bottom and continued an extended slide. Google search trends spiked on June 13th as Bitcoin lost 15.5%. The selling continued until June 18th when Google search trends spiked one more time. Bitcoin has to yet to rebound to the June 12th intraday low. A very hawkish Federal Reserve press conference on June 15th helped to grease the skids for crypto at that time.

Celsius Network filed for bankruptcy on July 13th.

That last surge in Google searches on Bitcoin marked a bottom that lasted until, you guessed it, the FTX implosion.

FTX and the GMTC

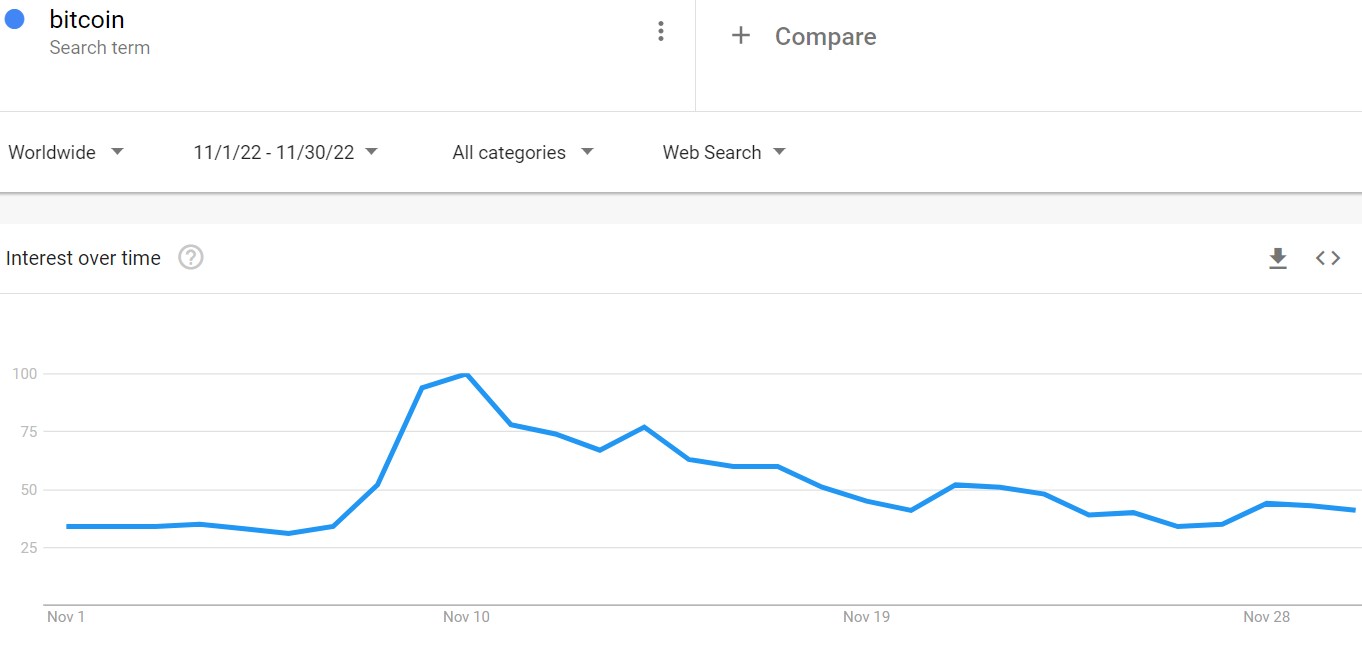

The collapse of FTX caused a lot of collateral damage in the world of cryptocurrencies. Over two days, BTC/USD lost 9.9% and then 14.1% before sellers exhausted themselves. A week and a half later, Bitcoin made a fresh low before carving out a final bottom. Despite the historic significance of FTX’s implosion and subsequent bankruptcy, the Google search surge for Bitcoin was not nearly as large as previous crypto crises. This relatively tepid response marks a key red flag that makes me wary of fresh Bitcoin lows in coming months.

The graph below zooms in on the one month surrounding the initial FTX drama. The final peak in Google searches happened on November 10th. Searches slowly faded downward from there.

The Trade

As I mentioned earlier, I think Bitcoin’s upside will be tightly capped as long as the Federal Reserve is in its cycle of monetary tightening. This cycle creates risk aversion and eliminates free or “easy” money, both pillars are ripe and fertile conditions for sustaining Bitcoin rallies. If the next fresh upside catalyst does not happen soon (Cathie Wood’s reiteration of her $1M target for Bitcoin failed to create a spark), I fully expect the next crypto crisis to take out the FTX lows. At that point, I will look again to GMTC to provide guidance on timing a quick trade through the price extremes.

Be careful out there!

Long BTC/USD, BITO, and GBTC