Back in October and November, Bitcoin (BTC/USD) created renewed excitement when the cryptocurrency challenged its all-time high and then set three new all-time highs. Unfortunately, the breakout turned into a fakeout. Bitcoin peaked with the NASDAQ (QQQ) in November as financial markets moved away from aggressively priced risk assets. However, a more sustainable bottom may have arrived. Two plunges on the way down could have cashed out enough motivated sellers to clear a path for healthy rallies in 2022.

The selling started in earnest as the NASDAQ (COMPQX) dropped 1.9% and closed below support at its 50-day moving average (DMA) on December 3rd. The selling was strong enough to carry into Saturday. I did not see any credible explanations for the drop. The episode just looked like on of those sporadic hiccups that are a feature of cryptocurrencies like Bitcoin.

Fast Money’s Brian Kelly implied that the sell-off was related to institutional investors deciding to take off inflation hedges. Kelly called the drop a buying opportunity. I definitely agreed with that assessment as my long-standing strategy for Bitcoin remains to buy into price collapses. Bitcoin did indeed reverse sharply off the lows, but the price action never reversed the losses. That failure turned out to be a sign of further selling to come. December was just the first of two plunges.

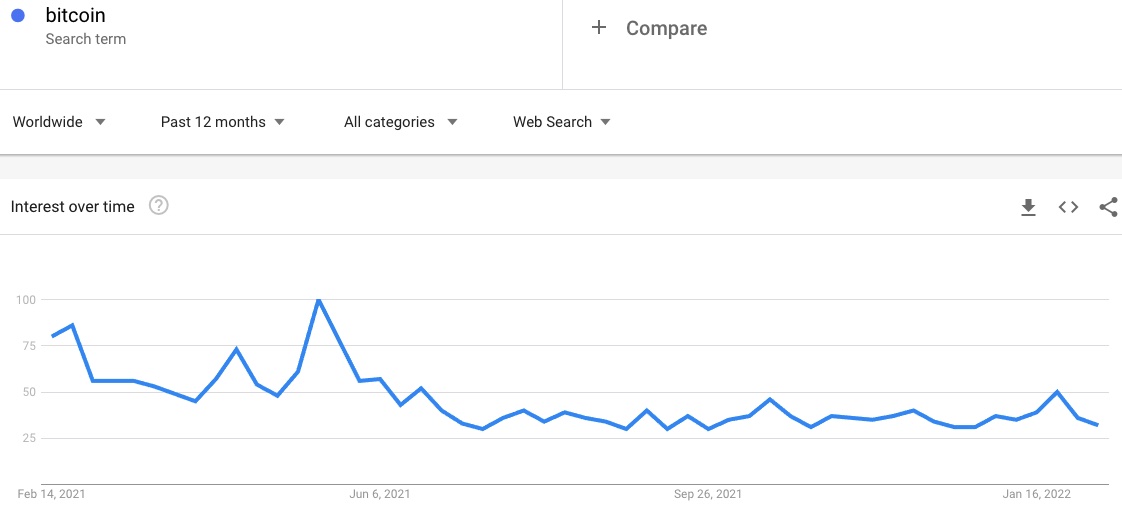

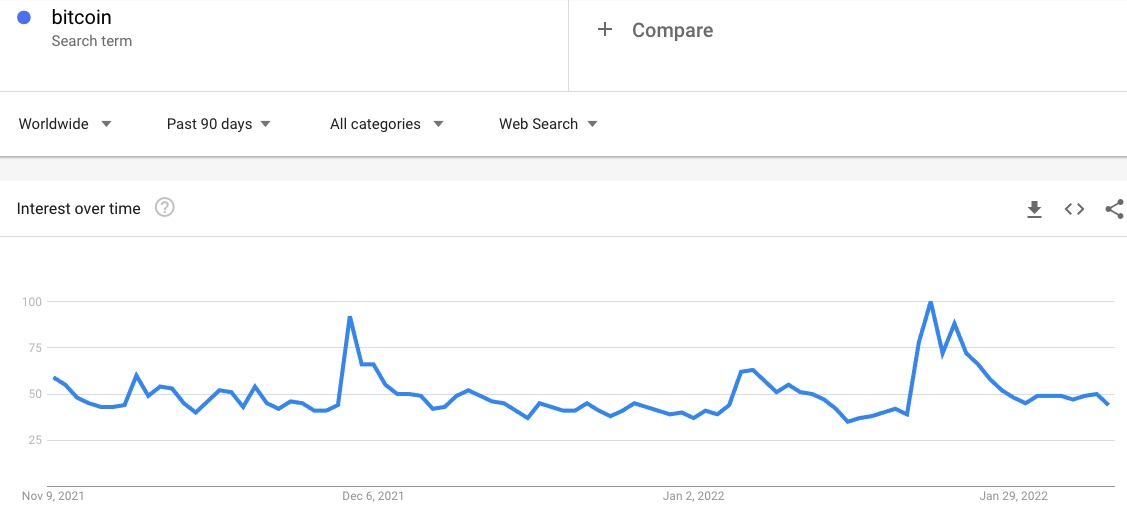

The Wisdom of Google Trends

Bitcoin took a month to return to the lows of the December plunge. It held its ground there until crypto markets shuddered upon news that Russia’s central bank proposed banning cryptocurrencies. (It turns out authoritarian governments still do not like decentralized money). The subsequent 2-day plunge was roughly equivalent to December’s however a key difference emerged. Google trends for the search “bitcoin” surged to a higher peak than at the time of December’s sell-off. While both Google trends responses were small compared to earlier surges, the relative increase for January appeared to flag a difference. Bitcoin soon bottomed and began a rally. The buying hit a kind of crescendo on February 4th and soon after generated a confirmed 50DMA breakout. It was the Google Trend Momentum Check (GTMC) doing its work again.

More importantly, the rally erased all the losses from the Russian news. That reversal is an important bullish and bottoming signal. Combined with the GTMC signal, this second of two plunges likely cleared the pathway for 2022 rallies. A break below the recent lows would invalidate the bullish signal.

The Trade with Two Plunges

I dutifully accumulated Bitcoin (and Ethereum (ETH/USD)) on the way down. I focused my buying on big down days. While I did not use GMTC to guide my decisions this time around, I am still gratified to see the trading model working.

I took profits on my BTC/USD on the current breakout. However, I am still holding the Bitcoin products Grayscale Bitcoin Trust (GBTC) and ProShares Bitcoin Strategy ETF (BITO) at small losses. These positions stay put until at least a fresh challenge on the Bitcoin $50-$60K range.

Meanwhile, I have become more interested in Ethereum than Bitcoin. Each cryptocurrency benefits from dedicated fan bases and staunch adherents, but I am more interested in the growing applications for Ethereum (for example, NFTs – non-fungible tokens). If Bitcoin is like a “store of value,” then Ethereum is a “store of use cases.” In other words, I remain comfortable trading either crypto since they continue to enjoy (eventual) floors after steep sell-offs. I am just accumulating larger ETH positions on the dips.

The chart below shows ETH/USD has not yet reversed the Russia losses. Moreover, ETH still needs to clear its 50DMA hurdle.

Be careful out there!

Full disclosure: long ETH/USD, long GBTC, BITO

Thanks for updated crypto article. Agree with your ETH assessment of “use value” which is why I have become interested in crypto.

Wish I would have paid more attention to your previous GTMC theory and to crypto in general….Pretty Clear spike on Jan 21/22 in the midst of a downtrend! I usually have the RSI/Stoch/Stoch RSI up on my charts and BTC was Oversold on the daily/weekly (except for weekly RSI so 5 out of 6). I guess now still ok time to buy….as long as you keep an eye on those google searches….ha…

As far as future prospects, unlike a company in which your investing in future profits, if crypto fulfills its stated purpose (that is to be a currency), then stability not volatility would be the norm. Obviously there would still be traders out there who could make money off of it, but it seems to me the dreams of many of today’s retail investors are pipe dreams (ie they missed the boat). I have a hard time seeing ETH or BTC as long term store of value until price is more stable and fees for transfer go down even more.

Know of any way to short ‘alt coins’. Seems like there is a fortune to be made there. Ha

If I didn’t already own some bitcoin and ethereum, I would definitely use the latest mini-dip to start some small purchases.

I agree that a good currency is stable. So these are still the early days of figuring out what crypto will actually deliver. Stable coins are supposed to be part of the currency solution, but I haven’t spent anytime on them…partially because “stable” is not good for trading. lol.

I don’t know how to short alt-coins. Seems VERY dangerous since the price moves for alt-coins make even less sense than the main cryptos.