Stock Market Commentary

What a week to start the year’s trading. It started with a definitively bearish end to extended overbought conditions. Overbought conditions bullishly resumed in the middle of the week despite an insurrection in Washington D.C. The week ended with a confirmation of the freshly bullish sentiment in the market. The trading action showed off the best and the worst effects of a financial market awash in liquidity. The money smooths over the pain of truly bad news. The money accentuates the power of good news.

The Stock Market Indices

The S&P 500 (SPY) gained another 0.6% on the day and set an all-time high. The index is over-extended with the second straight close above the upper Bollinger Band (BB). However, this reach demonstrates the freshly bullish sentiment in the stock market.

The NASDAQ (COMPQX) got back to out-performing with a 1.0% gain and its own close above its upper-BB. The tech-laden index sits at an all-time high and joined the confirmation of freshly bullish sentiment.

Small caps once again traded inversely to the S&P 500 and the NASDAQ. The iShares Trust Russell 2000 Index ETF (IWM) faded to a 0.2% loss despite its third straight day closing above its upper-BB. IWM provided a tiny nick in the market’s freshly bullish sentiment.

The Financial Select Sector SPDR Fund (XLF) also betrayed the freshly bullish sentiment ever so slightly. At the lows of the day, XLF closed the gap up from Thursday. A rebound got XLF back to a 0.1% loss and a close above the upper-BB.

Stock Market Volatility

The pressure continued on the volatility index (VIX). The VIX lost 3.6% and is now right back to the recent lows. The previous week, I correctly anticipated that this support would provide a launch pad for a fresh surge in volatility. That surge lasted a day. As a result, I think this time around the 20 level will have to provide the next launchpad.

The Short-Term Trading Call: The Challenge from Freshly Bullish Sentiment

- AT40 = 73.8% of stocks are trading above their respective 40-day moving averages (first day of overbought period)

- AT200 = 88.0% of stocks are trading above their respective 200-day moving averages (TradingView’s calculation).

- Short-term Trading Call: bearish

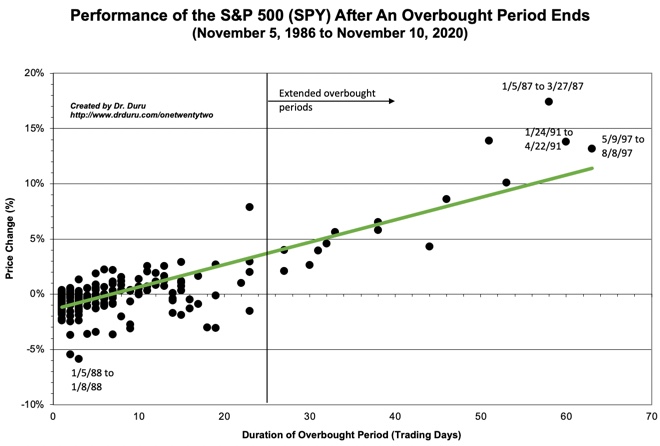

AT40 (T2108), the percentage of stocks trading above their respective 40DMAs, closed at 73.8%. While my favorite technical indicator did not close at its highs for the week, AT200 did. In fact, the percentage of stocks trading above their respective 200DMAs hit a new 11+ year high. Accordingly, the freshly bullish sentiment is clear. Still, I am maintaining a bearish short-term trading call. This decision is a small bit of stubborn sprinkled with a dash of caution. I continue to look back at the trading action going into this refresher period for the bulls, and I see a weakening foundation. Yet, my trading has to defer to the momentum, so I still cannot endorse making aggressively bearish trades. I will even make very selective bullish trades. As a reminder, I will back off to a neutral rating if the overbought extends past 5 days.

Stock Chart Reviews – Below the 50DMA

Best Buy (BBY)

The market delivered many rallies that countered the negative headlines of an American insurrection with the positive hopes for more liquidity for the stock market. Electronics retailer Best Buy (BBY) surged 4.9% on Wednesday. Buyers followed through the next day. BBY ended the week with a 0.1% loss and a mild rejection from overhead 50DMA resistance. So if the stock breaks Friday’s intraday low, I will short BBY with an initial target of a reversal of Wednesday’s gain. A 50DMA breakout would of course move consistently with freshly bullish sentiment.

FedEx Corp (FDX)

The post-earnings selling has yet to subside in FedEx Corp (FDX). The stock is riding a straight line downward. I think it is late to hop on the downward momentum. However, FDX would sit near the top of a bearish list after the end of this overbought period. Bulls can buy a break of the downtrend.

Stock Chart Reviews – Above the 50DMA

Chipotle Mexican Grill (CMG)

I used Chipotle Mexican Grill (CMG) as an example of how to protect profits after a market sell-off. I for one was relieved that buying in the prior and historic oversold period worked out as well as it did. CMG went on to marginally violate its uptrend before resuming its ascent. A fresh breach occurred in October but it too was short-lived. CMG is now just a meandering stock riding a bias for higher prices!

CyberArk Software (CYBR)

Most of the cyber-security stocks I wrote about in late December managed one or two more days of gains before stalling out. A small correction followed the stall. That correction could be ending. CyberArk Software (CYBR) sold off the first 3 days of the year. CYBR managed to plunge 5.1% on a day of security chaos. CYBR came close to uptrending 20DMA support before rebounding. The stock is a buy with a stop below the 20DMA.

Palo Alto Networks (PANW)

Palo Alto Networks (PANW) also sold off to its 20DMA. PANW rebounded 5.2% on Thursday. The stock looks ready to continue the rally. I bought a calendar call spread as PANW rallied on Thursday. The spread hit the initial price target on Friday, so I need to look for a new position this week.

Carvana (CVNA)

Carvana (CVNA) is another stock that bounced perfectly off support this week. The digital used car seller just goes up and up with a few buyable hiccups. However, I am sitting out this latest round.

First Solar (FSLR)

Solar stocks, especially First Solar (FSLR), had a tumultuous week. A Goldman Sachs downgrade took FSLR down 9.0% on Tuesday. The Democratic win in the U.S. Senate on Wednesday helped to send FSLR right back up 8.2%. On Thursday, FSLR made a new 9 1/2 year all-time high. A downgrade for the solar sector on Friday sent FSLR down 1.3%. FSLR faded from an intraday all-time high.

fuboTV Inc (FUBO)

A lot of surprising buzz is swirling around streaming service fuboTV Inc (FUBO). SPAC financing seems to be a key driver. The last moonshot in FUBO reversed as fast as it launched. A breach of 50DMA support seemed to wake up just enough buying interest. FUBO closed the week flat with its last consolidation period. I have zero interest in buying these kinds of stocks (I am a former and now think of YouTube TV as a much better deal for my needs). However, I can see from this Fast Money CNBC segment, FUBO has been a compelling short.

Micron Technology Inc (MU)

A post-earnings fade may signal a top for semiconductor chip maker Micron Technology (MU). The opening gap higher took MU to prices last seen in August, 2000, but the move left the stock over-stretched well above the upper-BB.

Okta (OKTA)

Another perfect bounce off support – Okta (OKTA) dropped right to 50DMA support on Wednesday. The rebound confirms an entry point for a buy in the stock of this internet/computer security company. I do not want to sit out this round as I consider this setup to be one of those “select” buying opportunities.

VanEck Vectors Rare Earth/Strategic Metals ETF (REMX)

The latest run in rare earths completely zipped by me. VanEck Vectors Rare Earth/Strategic Metals ETF (REMX) resolved a BB-squeeze to the long side on November 3rd. REMX is up 76.3% ever since. Friday’s 2.9% loss has the look of a (short-term) top. Still, the fundamentals of liquidity and economic recovery are strong tailwinds. Many years ago, I had an ill-fated run in the space with a now bankrupt company called Molycorp. As a result I took rare earths off my radar.

iShares Silver Trust (SLV)

I guess the options traders piling into iShares Silver Trust (SLV) call options, especially the March 28/34 call spread, got caught off-guard by Friday’s pullback. I accumulated straight January $25 calls and was quite happy until this 6.9% plunge swept my profits away. SLV bounced off 50DMA support, so I am interested in going right back in for a fresh bet against the U.S. dollar (DXY). I will target a March expiration.

Select Sector SPDR Trust Energy (XLE)

The temptation was high to take profits on my March $44 calls in Select Sector SPDR Trust Energy (XLE). I already watched slightly higher profits nearly evaporate after the pullback from the December highs. However, oil looks undervalued relative to an on-going global economic recovery and a weak U.S. dollar, so I want to hang on for longer. Follow-through on Friday’s selling will motivate me to preserve my remaining profits.

Be careful out there!

Footnotes

“Above the 40” (AT40) uses the percentage of stocks trading above their respective 40-day moving averages (DMAs) to measure breadth in he stock market. Breadth indicates the distribution of participation in a rally or sell-off. As a result, AT40 can identify extremes in market sentiment that are likely to reverse. Above the 40 is my alternative name for “T2108” which was created by Worden. Learn more about T2108 on my T2108 Resource Page. AT200, or T2107, measures the percentage of stocks trading above their respective 200DMAs.

Active AT40 (T2108) periods: Day #61 over 20%, Day #45 above 30%, Day #44 over 40%, Day #43 over 50%, Day #42 over 60%, Day #3 over 70% (day #3 overbought)

Red line: Overbought threshold (70%); Blue line: Oversold threshold (20%). Source: FreestockCharts

Source for charts unless otherwise noted: TradingView.com

Full disclosure: long UVXY shares, long SPY put spread, long XLE calls, long SLV calls

FOLLOW Dr. Duru’s commentary on financial markets via StockTwits, Twitter, and even Instagram!

*Charting notes: FreeStockCharts stock prices are not adjusted for dividends. TradingView.com charts for currencies use Tokyo time as the start of the forex trading day.