I finally have to release my long-standing bullishness on the U.S. dollar index (DXY0) even as the dollar recently managed to bounce off its critical, uptrending 200-day moving average (DMA).

Source: FreeStockCharts.com

Looking at this chart, I get the feeling of something that is biding its time for a definitive catalyst that pushes it down into a true breakdown. So many financial assets have reversed their initial post U.S. election moves that the U.S. dollar seems destined to soon do the same (and then some). The growing political drama in the U.S. is increasingly coloring my assessment of the U.S. dollar. Until now, the relatively bullish environment for U.S. stocks has dulled my senses over the potential of the caustic politics in the U.S. for impacting the dollar. When I have paid attention to impacts, I looked at the other side of the ledger…like the impact on the Canadian dollar of U.S. trade actions or the Mexican peso’s impressive post-election recovery against the U.S. dollar.

However, after President Donald Trump abruptly and surprisingly fired James Comey, the director of the Federal Bureau of Investigations (FBI), I lifted my head up and looked at the U.S. from an outside-looking-in point of view. If the politics in the U.S. were erupting in another country, I would at best avoid dabbling in that country’s currency and would likely look for opportunities to short it. The grinding descent of the U.S. dollar from its 14-year high has unfolded slowly enough that my position from within the system has sufficiently clouded my trader’s perspective.

A more bearish outlook on the U.S. dollar has its benefits and self-sustaining logic. Sure the Federal Reserve is raising interest rates, but the market has presumably already priced in two rate hikes for this year. Since the Fed is definitely not going to three rate hikes, there is only downside potential on the bet on the rate environment. The growing political risks in the U.S. could make the dollar relatively unattractive when compared to other countries and regions where conditions are improving from bad situations (like the eurozone or even Turkey). Even if Trump resolves political risks, a firmer position merely gives him a stable platform for doing his occasional dressdown of the U.S. dollar in favor of cheaper U.S. exports and mercantile advantage over trading partners. This trifecta of catalysts are simply too weighty for me to stomach being a dollar bull anymore.

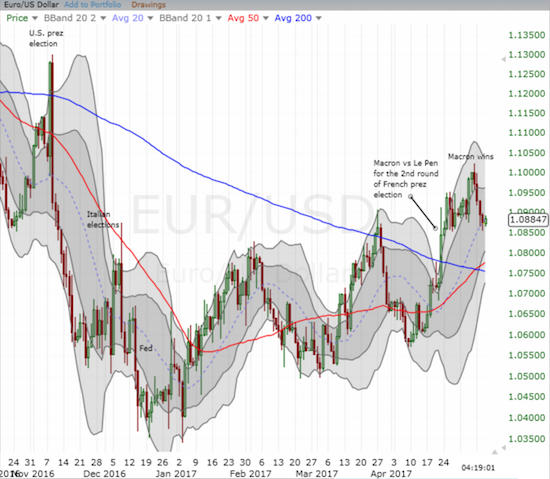

So, my top currency of preference over the U.S. dollar automatically becomes the euro. I have written several times about my growing bullishness on the euro. My freshened outlook now seals the deal. The euro has had a nice (and gentle) pullback from the favorable outcome of the French presidential election. I am gradually accumulating a new long euro position. I also just bought a fresh round of call options on CurrencyShares Euro ETF (FXE). The only major currency I still like less than the U.S. dollar is the Australian dollar (which is not included in the U.S. dollar index).

Source: FreeStockCharts.com

If the U.S. dollar index manages an upside breakout from the current, grinding descent off the 14-year high, I will reassess my position(s).

Be careful out there!

Full disclosure: net long the euro, long and short various currencies against the U.S. dollar, net short the Australian dollar

Where does this leave you vis a vis the Canadian dollar?

I am left *wanting* to be bullish the Canadian dollar as a relatively drama free play against the US dollar. Shorts have also ramped against it. But I think oil is going to keep roiling the currency around so I am only willing but dips and sell rips. I am currently short USD/CAD per my last post on the loony.

I am short term bearish USD and am still wondering which is a better expression, long euro or long CAD. If the dollar thesis is correct, euro would usually be part of that move, it is such a big part of DXY. I can’t resist long CAD though and the long spec positioning, which is even more extreme last week. That by no means makes it a sure thing but I like the odds of playing against that. CAD has held up well despite Moody’s downgrading banks last week. If this is indeed the start of a Canadian property meltdown then maybe there is more to go. However if it isn’t then there could well be a sizeable rally in cad with the short interest being a kicker. problem with long euro is that people are already onto it, net spec positioning now positive and best in a while. Hard for me to see it rally to more than to 1.12 but perhaps I need some more imagination.

My approach to eur/usd is to buy dips and sell rallies. So even with a 1.12 cap, there is money to be made. If history proves correct, net spec turning positive on the euro could be the beginning of a rally and not the end. Just watch for net specs going negative again. I agree with you on CAD although not concerned yet about a property meltdown. Property should have collapsed along with oil. So Canada seems resilient. With oil not likely to get much lower, and net specs crowding short, CAD could indeed rally big. So what’s left is maybe USD/JPY? The yen sure has been extra weak lately…..