AT40 Status: 60.3% of stocks are trading above their respective 40-day moving averages (DMAs)

AT200 Status: 68.4% of stocks are trading above their respective 200DMAs

VIX Status: 11.0 (volatility index)

Short-term Trading Call: neutral

Commentary

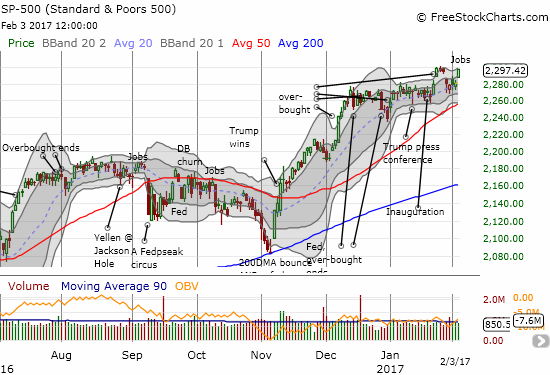

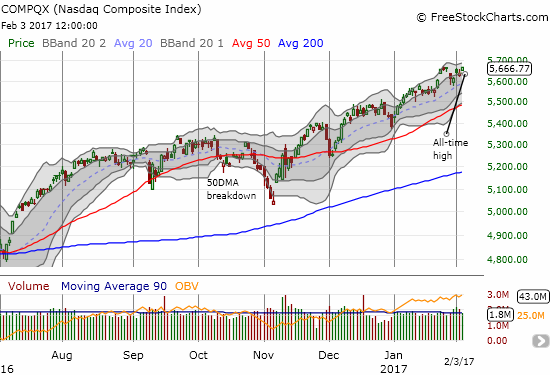

Nothing says “strong sentiment” like a stock market that actually rallies on a strong U.S. jobs report: the fear of the implications for hawkish monetary policy has seemingly disappeared. The S&P 500 (SPY) jumped 0.7% in the wake of the report on January jobs. The index closed within a point of its all-time high. The NASDAQ (QQQ) pushed to a new all-time high by 6 points.

The current rally has been one of the more stealthy (and halting) ones in a long time.

After the NASDAQ bounced off its pre-election low on November 4th, it made a statement after December 1st when it bounced off support at its 50-day moving average (DMA) with a 20DMA newly trending upward. The S&P 500 on the other hand came to a screeching halt after its December high on the 13th. Its breakout on January 25th should have heralded a confirmation of a new bullish turn but instead the index came to another complete halt. THAT pause turned toppy when the index gapped down and formed a 3-day abandoned baby top. Amazingly, the S&P 500 failed to close cleanly below my line in the sand at 2,280 marking off bearish territory. Now, the index has come back to attempt an invalidation of the bearish topping pattern.

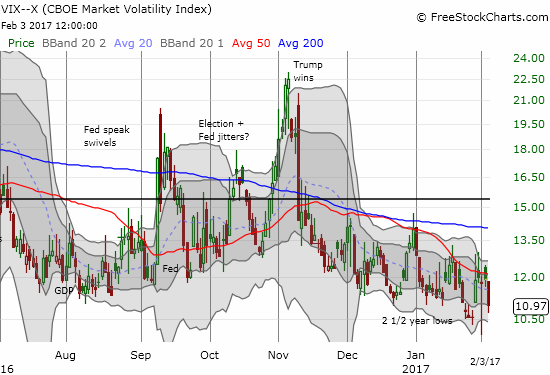

My short-term trading call stays at neutral despite the bullish prospects. The bearish divergence between the S&P 500 and AT40 remained in place despite AT40’s hop from 53.3% to 60.3%. AT40 closed just below a downtrending 20DMA; only a move back into overbought territory will end the bearish divergence. Moreover, as I have stated in earlier posts, I will not flip the trading call to bullish on a fresh breakout simply because the volatility index, the VIX, is so dangerously low.

The bounce in the VIX on January 30th when the S&P 500 gapped down made sense because the VIX historically has spent little time plumbing these depths. Yet, the bears and sellers continue to prove incapable of sealing the deal. This trading situation is sub-optimal as I would prefer to be definitive about the trading call when there are so many individual stocks making definitive (up AND down) moves. But it is what it is.

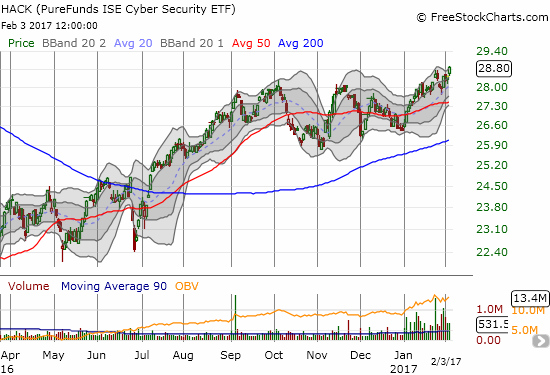

My overall strategy is to keep bullish trades tightly focused on my preferred sectors of commodities, homebuilders, and cybersecurity and be open to one-off cases. This approach allows me to avoid regret since these are areas I like over longer periods of time and have no problem accumulating (conditionally) on sell-offs. Outside of that, I am looking for reasons to short. Again, not ideal, but this is what happens with a neutral short-term trading posture.

@IBDinvestors #myIBD $RPD – basically the cyber security space.

— Dr. Duru (@DrDuru) August 26, 2016

ETF Managers Trust – PureFunds ISE Cyber Security ETF (HACK) is up 6.8% since I responded to IBD’s contest. Unfortunately, this performance lags the NASDAQ’s 8.7% since then. In the last week, HACK finally broke out to a new 17-month high.

In December, I offered up cybersecurity firm Rapid7, Inc. (RPD) as a potential beneficiary of a January relief rally. At the time, RPD was rocketing higher and the next day succeeded in reversing its post-earnings loss. RPD has not traded higher since and my position is just above flat right now. I still like RPD as an under-valued cybersecurity play and plan to keep holding just like HACK.

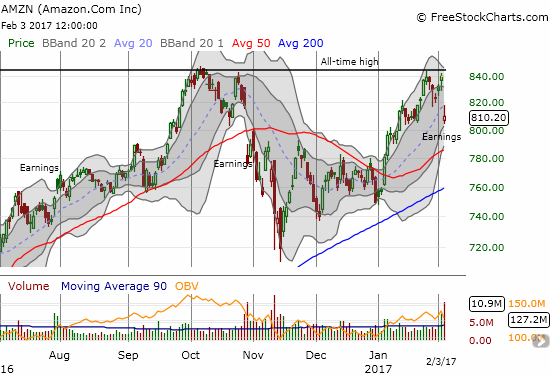

Amazon.com (AMZN) dropped 3.5% in response to its latest earnings report. I went back into the strategy archives and bought the dip for a two-week play. This time around I picked a bullish call spread (820/830). In the chart below, I drew a dark line across all-time highs to highlight AMZN’s next technical challenge: breaking out above a double-top.

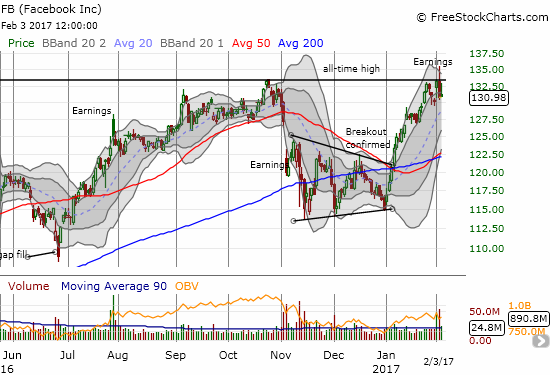

Facebook (FB) is working on its own double-top pattern at all-time highs. The post-earnings reaction created a bearish fade from an intraday all-time high. Buyers stepped back in on Friday only to get turned back again. A retest of the 20DMA uptrend is in play, and I can easily see FB retesting its 50 and 200DMAs in coming weeks.

As a reminder, a breakout from a double-top is a VERY bullish event. So I am on alert for both AMZN and FB either way the winds blow.

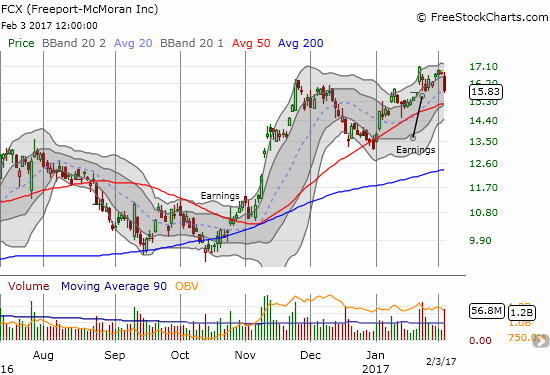

After China hiked interest rates by the smallest of fractions on Friday, commodities responded in kind by selling off. China is churning through an on-going cycle of heating and cooling its economy that can catch traders and investors off-guard. I now have to cool my own jets and watch what develops. My short-term trade on Freeport-McMoran (FCX) is likely over as FCX once again reversed its post-earnings gain. My trade on the 50DMA for Cliffs natural Resources (CLF) still has a chance with the 50DMA looming directly overhead as a pivot.

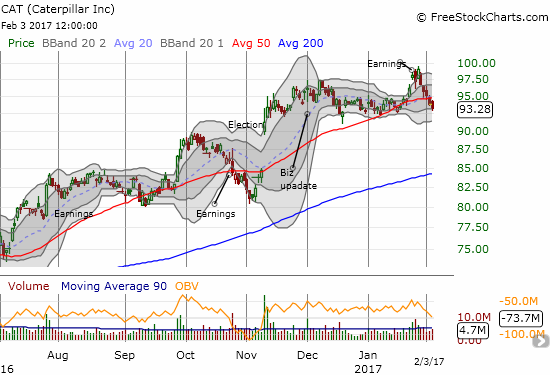

I am now bearish on Caterpillar (CAT) which is heavily dependent on commodities and China. Per my note February 1st, a close below its 50DMA is a shorting signal. A close below $91.50 will be an aggressively bearish signal. I am going to wait for the latter before acting unless I feel my bullish positions have gotten big enough to motivate me to look for a hedge.

Chipotle Mexican Grill (CMG) is back in focus after one of the nastier post-earnings fades that can happen. CMG gapped up only to sell off right from the open. After the smoke cleared, CMG lost 4.5%, cracked 200DMA support, printed a bearish engulfing pattern, and confirmed a second failure at what is now resistance at the “Ackman” ceiling.

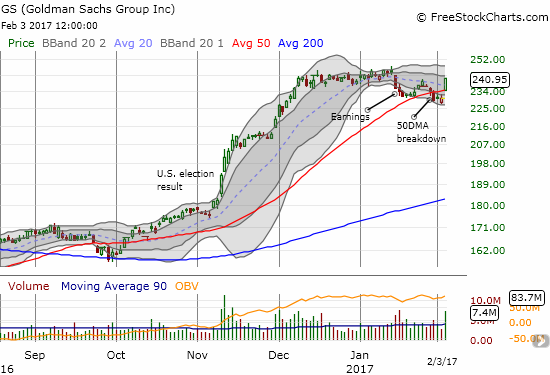

Finally, financial stocks responded exceptionally well to news of President Trump’s executive order to begin dismantling the Dodd-Frank regulation of the financial industry. The Financial Select Sector SPDR Fund (XLF) jumped 2.0% and stopped just short of a fresh 9-year high. XLF added juice to the S&P 500’s post-jobs rally. The news also catapulted Goldman Sachs (GS) out of a bearish breakdown and its highest post-earnings close.

— – —

FOLLOW Dr. Duru’s commentary on financial markets via email, StockTwits, Twitter, and even Instagram!

“Above the 40” uses the percentage of stocks trading above their respective 40-day moving averages (DMAs) to assess the technical health of the stock market and to identify extremes in market sentiment that are likely to reverse. Abbreviated as AT40, Above the 40 is an alternative label for “T2108” which was created by Worden. Learn more about T2108 on my T2108 Resource Page. AT200, or T2107, measures the percentage of stocks trading above their respective 200DMAs.

Active AT40 (T2108) periods: Day #241 over 20%, Day #61 over 30%, Day #60 over 40%, Day #58 over 50%, Day #1 over 60% (overperiod, ending 4-day underperiod), Day #7 under 70%

Daily AT40 (T2108)

Black line: AT40 (T2108) (% measured on the right)

Red line: Overbought threshold (70%); Blue line: Oversold threshold (20%)

Weekly AT40 (T2108)

*All charts created using freestockcharts.com unless otherwise stated

The charts above are my LATEST updates independent of the date of this given AT40 post. For my latest AT40 post click here.

Related links:

The T2108 Resource Page

You can follow real-time T2108 commentary on twitter using the #T2108 or #AT40 hashtags. T2108-related trades and other trades are occasionally posted on twitter using the #120trade hashtag.

Be careful out there!

Full disclosure: long AMZN call spread, long XLF call options, long FCX and CLF call options, long HACK, long RPD