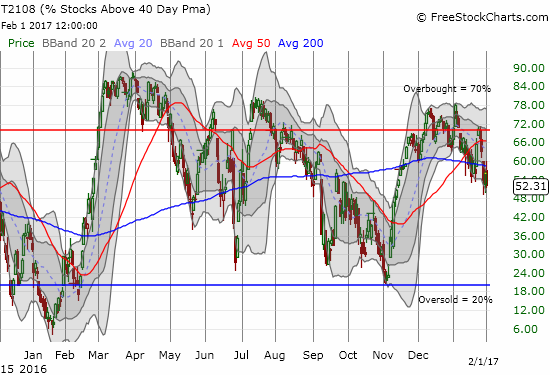

(“Above the 40” uses the percentage of stocks trading above their respective 40-day moving averages [DMAs] to assess the technical health of the stock market and to identify extremes in market sentiment that are likely to reverse. Abbreviated as AT40, Above the 40 is an alternative label for “T2108” which was created by Worden. Learn more about T2108 on my T2108 Resource Page. AT200, or T2107, measures the percentage of stocks trading above their respective 200DMAs.)

AT40 (T2108) Status: 52.3%

AT200 (T2107) Status: 65.6%

VIX Status: 11.8

Short-term Trading Call: neutral

Commentary

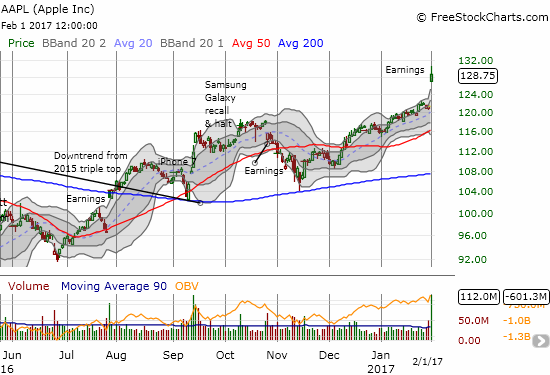

The S&P 500 (SPY) can thank its ability to stay out of negative territory to earnings from Apple (AAPL).

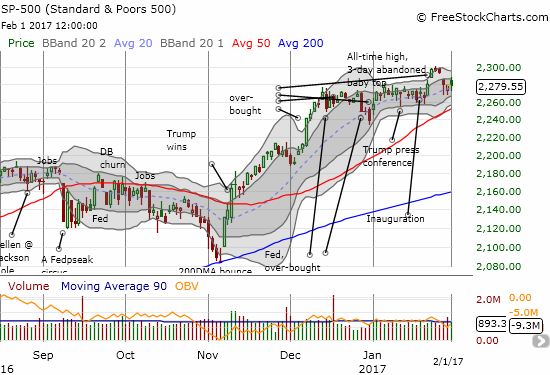

This impressive 6.1% gain was just enough to help squeeze the S&P 500 into a close flat with the previous day’s close. The flat close also means the index still sits right on my line in the sand between a bearish (below) and a neutral (above) trading call.

We know that AAPL was the main savior of the S&P 500 because AT40, the percentage of stocks trading above their respective 40DMAs, tumbled significantly on the day. AT40 hit a new 2 1/2 month low and looks ready to reverse all of its post-election gain. For the past 3 days, AT40 has returned to a downtrend that refreshed the warning sign of a bearish divergence with the S&P 500. The S&P 500 sits comfortably within the confines of its earlier trading range while stocks in general are slowly but surely declining (dropping below their 40DMAs).

The month of February started with another pronouncement on monetary policy from the U.S. Federal Reserve. The statement contained nothing new, and it looked like a copy and paste from so many similar past statements. No surprise then that the net market reaction was very muted. The market next looks forward to the U.S. employment report on Friday.

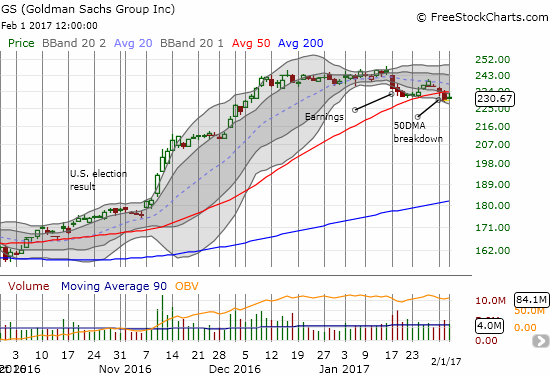

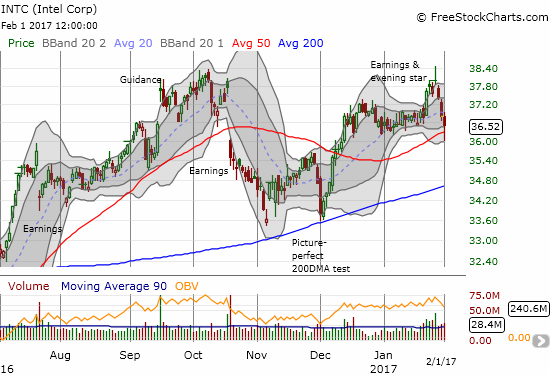

While the S&P 500 ended the day flat, some important individual stocks made important moves. I noted three meaningful tests of 50DMA support: Goldman Sachs (GS), Caterpillar (CAT), and Intel (INTC).

GS failed the test on Tuesday as it broke down on high trading volume. This kind of break would normally immediately motivate me to short GS. Yet, given its high status as a core part of the Trumpflation rally, I am waiting to see whether sellers actually generate follow-through. Today, GS managed to gap up a little bit, rally toward 50DMA resistance, and then close near where it opened.

Caterpillar (CAT) bounced off its 50DMA support for the second day in a row. Unlike GS, I would short CAT as soon as it closed below support; granted, I imagine short-term downside may be limited to the bottom of the previous trading range.

Intel (INTC) has already returned to the lower part of its previous trading range. The stock briefly cracked 50DMA support before bouncing back. Hearkening to my earlier strategy of buying INTC in between earnings, I decided to BUY some March call options on the 50DMA test. If support ultimately fails, my next buy point would be a retest of 200DMA support. Hopefully on such a scenario AT40 would be flashing oversold (below 20%).

All three of these stocks are immediate reminders that all is not well under the covers of the major indices. Yet, I must keep the short-term trading call at neutral because the bears and sellers are still failing to punch in convincing confirmation of the bearish tidings from the near month-long bearish divergence.

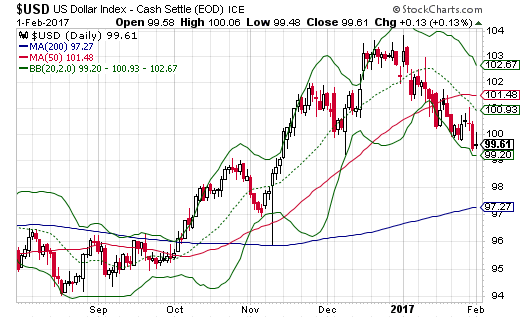

Finally, in the land of foreign exchange the U.S. dollar (DXY0) remains in focus after a horrible performance in January. The U.S. dollar index lost about 2.5% during a time in which U.S. President Donald Trump and members of his team took various opportunities to talk down the U.S. dollar and talk up the currencies of trade partners (competitors?). The dressdown made for the dollar’s worst January in 30 years. Like may forex traders, a large loss in the U.S. dollar to start 2017 was nowhere close to my radar. This surprise likely flags the start of what promises to be a year full of (complete) surprises in financial markets.

Source: StockCharts.com

— – —

FOLLOW Dr. Duru’s commentary on financial markets via email, StockTwits, Twitter, and even Instagram!

Active AT40 (T2108) periods: Day #239 over 20%, Day #59 over 30%, Day #58 over 40%, Day #56 over 50% (overperiod), Day #3 under 60% (underperiod), Day #5 under 70%

Daily AT40 (T2108) vs the S&P 500

Black line: AT40 (T2108) (measured on the right); Green line: S&P 500 (for comparative purposes)

Red line: AT40 (T2108) Overbought (70%); Blue line: AT40 (T2108) Oversold (20%)

Weekly AT40 (T2108)

*All charts created using freestockcharts.com unless otherwise stated

The charts above are my LATEST updates independent of the date of this given AT40 post. For my latest AT40 post click here.

Related links:

The T2108 Resource Page

You can follow real-time T2108 commentary on twitter using the #T2108 or #AT40 hashtags. T2108-related trades and other trades are occasionally posted on twitter using the #120trade hashtag.

Be careful out there!

Full disclosure: long and short positions versus the U.S. dollar, long INTC call options

One cannot help but be amazed at how well the market has done since the presidential election was finalized, considering that it seemingly was horrified beforehand of a possible Trump win, and sold off accordingly.

He hasn’t gotten off to a very smooth start, either. But the market hasn’t reflected that. It’s an eerie situation.

My intuition tells me that this complacency isn’t going to last forever. Regardless of what our new president does or says, this is a VERY old bull market that is in VERY bad need of a correction. We had a nasty one about a year ago, and we need another if this market is going to continue in any kind of a healthy manner.

At current prices, I see nothing within my universe of interest that begs me to buy it. And for me, that tells the story right there.

Good point that looming overhead is that this bull market is old by historical standards. From that perspective, huge tax cuts and significant regulatory rollback may prove to be the final vapors of fuel required for a last run-up. I also wonder whether there has been anytime in the stock market before this Fed-interventionist era when market sentiment so dramatically changed on a regular basis from panic and horror to glee and celebration.

Duru,

Is it ‘different this time’?

Probably not. All bull markets come to an end. But certainly it can get even more overbought, and for a longer time, before that happens. In that case, the downside risk gets magnified.

The market really needs some ‘panic and horror’ to knock it down and avoid, at least for a while, the eventual reappearance of the bear.

Unlike the last 8 or 9 years, monetary policy is no longer on the side of the market. Rates are going up. Even with stimulative fiscal policy, that’s not a good thing for stocks.

I agree. As always, the trick is what’s the catalyst and the timing.

We have had several panic and horror moments that were relatively quickly smoothed over. Even flash crashes have not had lasting impact. But, as you point out, when monetary policy no longer supports easy money, these quick healings may be more likely. I daresay monetary policy remains very accommodative and will stay so for some time even as rates inch up at a snail’s pace. Moreover, I think markets remain keenly aware of how ready the central bank is to come to the rescue even now – the Bank of England is case in point.