Last week was full of important news for forex trading. As a dollar bull, euro bear, and yen bear, the week presented particular challenges that hedging could only soothe a little bit. I had a good run with these positions in recent weeks. As forex goes, a setback was due – just too bad the setbacks piled into the same week!

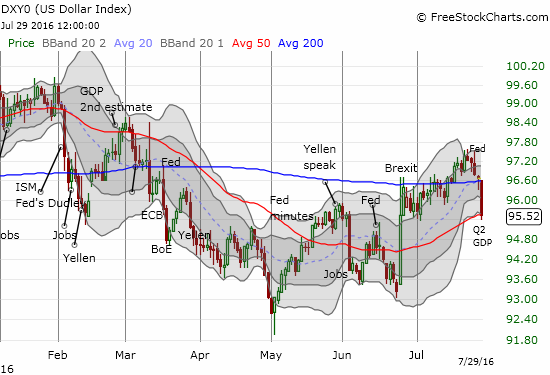

I start with the Federal Reserve. I assumed no new news would come out of the latest decision on monetary policy and that markets would manage to remain relatively calm in the wake of the news. I was right for a spell. The market interpreted the July 27th Fed statement much more dovishly than I thought it should. In fact, the Fed seemed more resolute than usual. In particular, the Fed made absolutely no mention of Brexit or economic troubles in China. The Fed even dipped its toe a bit into the realm of confidence when it claimed that “near-term risks to the economic outlook have diminished” – a clear, albeit indirect, blanket dismissal of the risks of Brexit, China, and others. Yet, with the U.S. dollar experiencing recent strength, it was setup for selling and profit-taking. The dollar’s subsequent decline really accelerated with another “disappointment” from the Bank of Japan (BoJ) on Thursday night and then a notably weak U.S. Q2 GDP report of 1.2% (market “expectations” were for 2.5%) on Friday morning. The bullish breakout for the U.S. dollar index is over before it could generate much follow-through momentum.

Source: FreeStockCharts.com

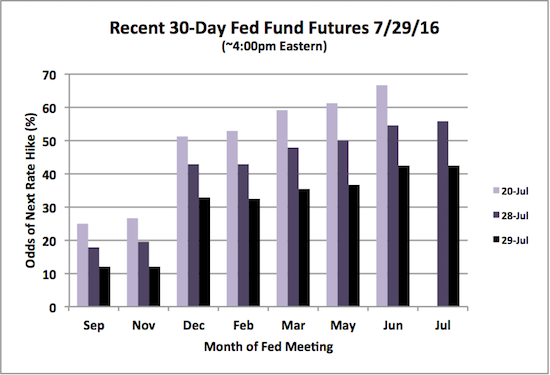

The dollar is roughly following the trends in expectations for the next rate hike from the Fed. These odds have become volatile again. Market bettors are once again in full retreat on expectations for the next rate hike. For a brief moment just a week and a half ago, expectations had moved back into 2016. Now, they are pushed far into 2017 again.

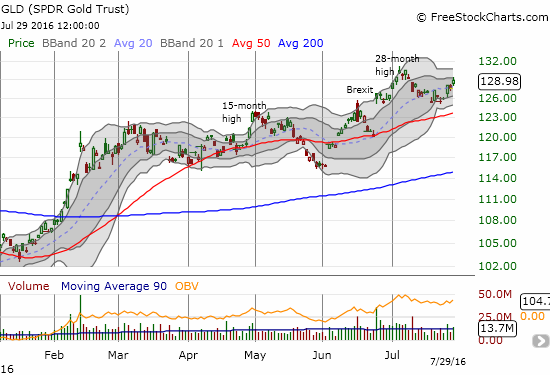

This week’s (dollar dovish) action had a notable impact on the SPDR Gold Shares (GLD). Once again, GLD escaped a confirmation of a top with the Fed coming to the rescue. Going into the Fed, GLD was wobbly having just erased all its incremental post-Brexit gains. Now, it looks like that level is providing support for the next leg up!

Source for charts: FreeStockCharts.com

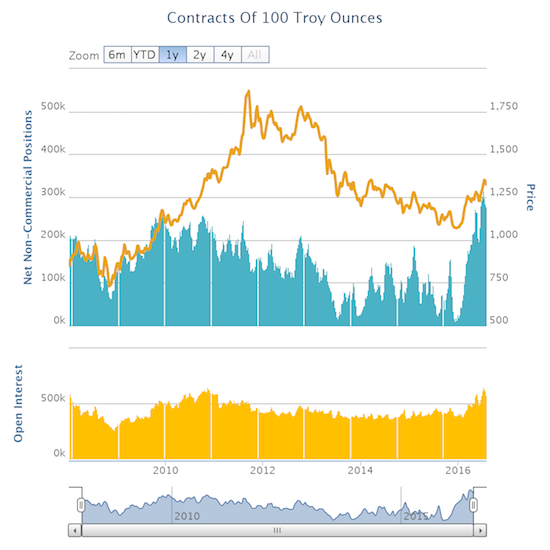

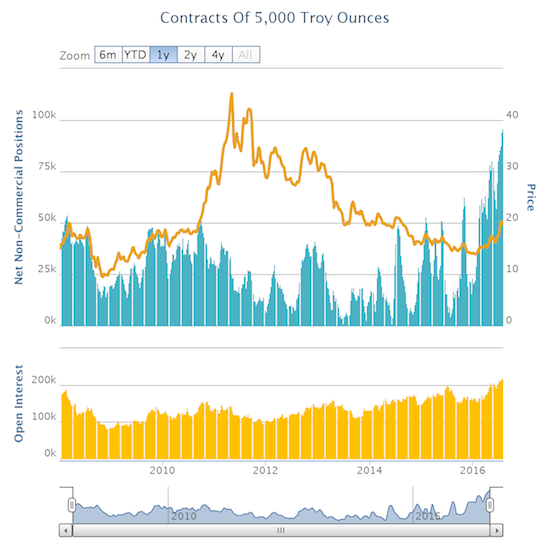

Speculators have finally gotten a little more cautious on gold even as bullishness on silver continues higher. It is quite the mixed message, but the mix is quite consistent with the contrasts that are roiling forex trading. (Note that I finally sold my position in Pan American Silver Corp. (PAAS) but still hold a core iShares Silver Trust (SLV) position).

Source: Oanda’s CFTC Commitments of Traders

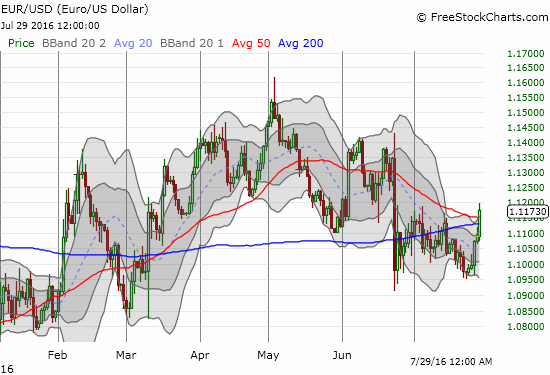

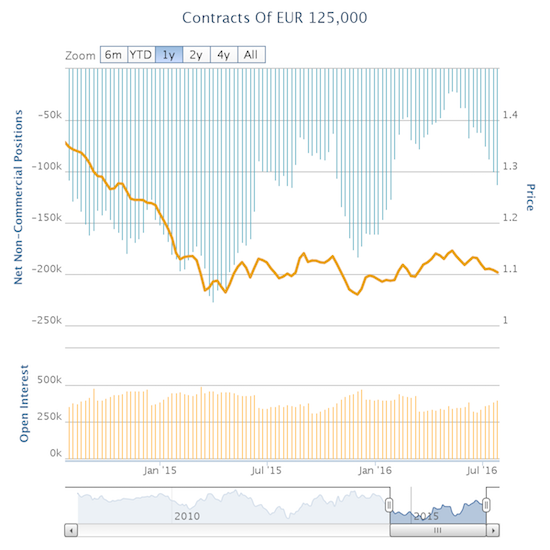

The forex market seems to always be on the hunt for an excuse to buy the euro (FXE), and the Fed apparently gave them one. The U.S.’s disappointingly weak GDP contrasted sharply with a eurozone GDP that beat “expectations” of 1.5% with a 1.6% print. I am sure this contrast added to the upward pressure on EUR/USD. Moreover, speculators had just finished pushing bearish euro bets to their highest level since late January. Speculators are clearly anticipating weakness, not strength, in the eurozone outlook as last week marked the fourth consecutive week of gains on net shorts.

Source: FreeStockCharts.com

Source: Oanda’s CFTC Commitments of Traders

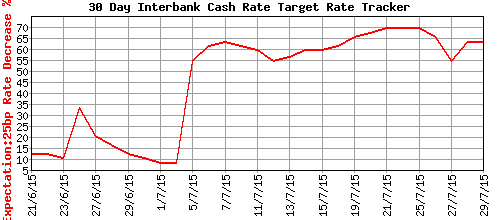

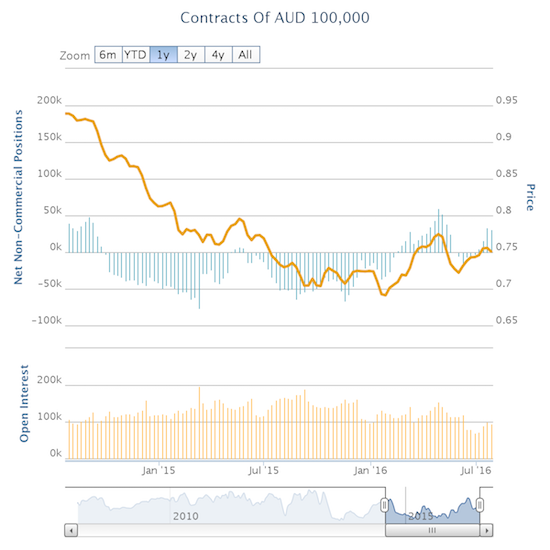

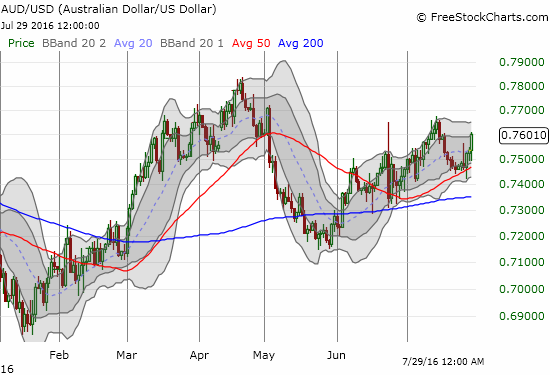

The Australian dollar (FXA) continues to add to the contrasting forex messages. The currency has shown resilience even as the market expects another rate cut from the Reserve Bank of Australia (RBA) at its August meeting. The odds for a rate cut at the August meeting are now at 64%. They were as high as 70% in the previous week. In the last week, speculators maintained net bullish positions which got more bold in the prior week. I was unfortunate enough to set a stop sell upon AUD/USD breaking support at the 50DMA. That lasted for all of a few minutes (if that) – I guess too many other traders either had the same idea or too many AUD/USD longs had stops set that market markers and algos successfully busted before taking AUD/USD higher again. I am sticking with a short bias going into the RBA meeting as long as the currency remains so strong. Contrary is the name of the game right now.

Source: ASX RBA Rate Indicator

Source: Oanda’s CFTC Commitments of Traders

Source: FreeStockCharts.com

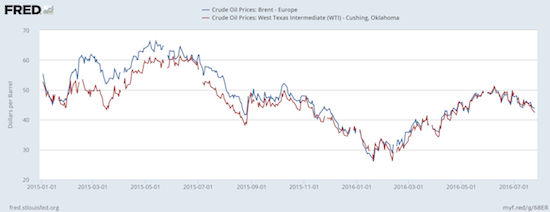

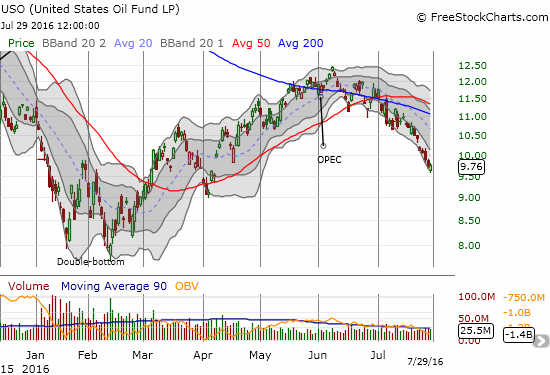

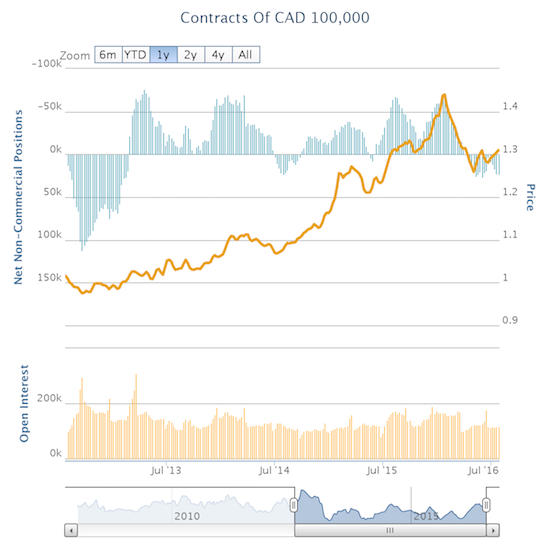

The Canadian dollar (FXC) is another currency of surprising contrasts. Oil prices have noticeably weakened over recent weeks. At the same time, speculators have increased net longs back to levels at their highest of the year and levels last seen in early January. Perhaps speculators are anticipating an imminent end to this modest slide in oil. However a small miss in May GDP suggests oil’s decline could presage worse results for June, the month oil prices last peaked.

Sources: US. Energy Information Administration, Crude Oil Prices: West Texas Intermediate (WTI) – Cushing, Oklahoma [DCOILWTICO], retrieved from FRED, Federal Reserve Bank of St. Louis, July 31, 2016.

US. Energy Information Administration, Crude Oil Prices: Brent – Europe [DCOILBRENTEU], retrieved from FRED, Federal Reserve Bank of St. Louis, July 31, 2016.

Source: FreeStockCharts.com

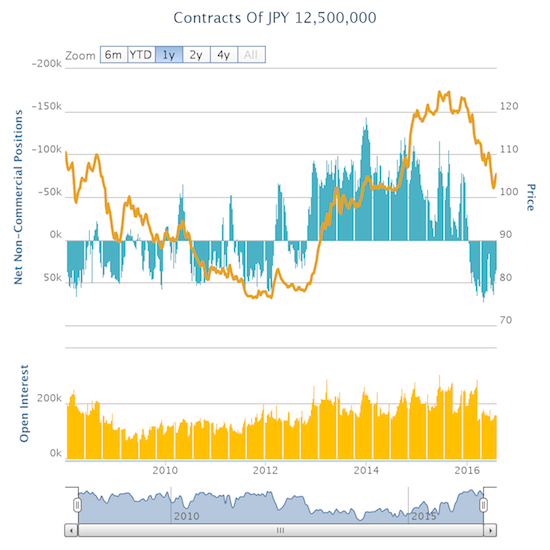

Currency traders have the Japanese trapped in a box at this point. There was a lot of hype and anticipation about “helicopter money” going into the Bank of Japan’s (BoJ) latest decision on monetary policy. The helicopters failed to get off the ground as the BoJ instead chose “just” to increase the piles of yen being spent to buy ETFs: “The Bank will purchase ETFs so that their amount outstanding will increase at an annual

pace of about 6 trillion yen (almost double the previous pace of about 3.3 trillion yen).” Also contrast the BoJ’s assessment of global economic risks to the Fed’s:

“Against the backdrop of the United Kingdom’s vote to leave the European Union and the slowdown in emerging economies, uncertainties surrounding overseas economies have increased and volatile developments have continued in the global financial markets. In order to prevent these uncertainties from leading to a deterioration in business confidence and consumer sentiment as well as to ensure smooth funding in foreign currencies by Japanese firms and financial institutions, thereby supporting their proactive economic activities, at the Monetary Policy Meeting (MPM) held today, the Policy Board of the Bank of Japan decided upon the following…”

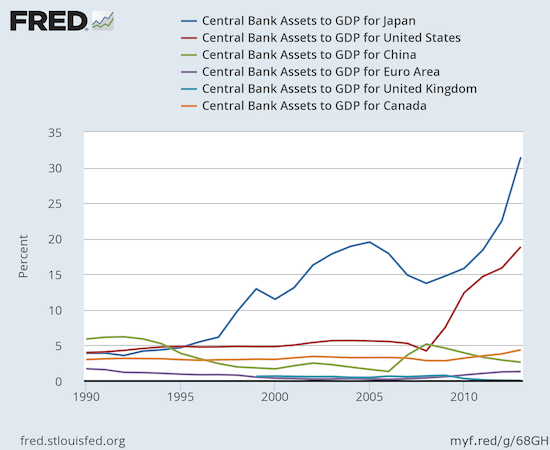

So while the BoJ continues along a path of historic monetary easing and a massive run-up in its balance sheet, the market finds itself so disappointed that the yen surged in value once again. For this cycle, the worse the outlook for Japan, the more loved the yen. What is down is really up…

Source: FreeStockCharts.com

Source: World Bank, Central Bank Assets to GDP for Japan [DDDI06JPA156NWDB], retrieved from FRED, Federal Reserve Bank of St. Louis, July 31, 2016.

Note that on Friday, I reloaded monthly $FXY put options expiring in August. I had such phenomenal success betting on the late June/early July top on CurrencyShares Japanese Yen ETF (FXY), I could not resist fading this latest FXY rally. If the rally continues, I will try again around 100 for USD/JPY. USD/JPY is currently at 102.

The forex market, including gold and silver, contains a hot cauldron of contrasts with sometimes confounding cause and effect. Crowded trades are showing a surprising capacity to get ever more crowded. Traders continue to show a high capacity for confounding and flouting central banks. Economic data are volatile and cause quick changes in short-term opinions. In this environment, traders need to be flexible, be willing to think contrary, and think along multiple timeframes. Risk management is also paramount. I am always trying to improve on all counts!

Be careful out there!

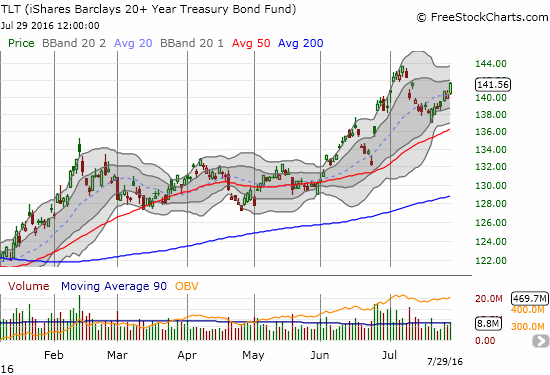

Full disclosure: long and short various currency positions that are subject to immediate change, have a hedged position on USO, long TLT call spread, long GLD, long SLV