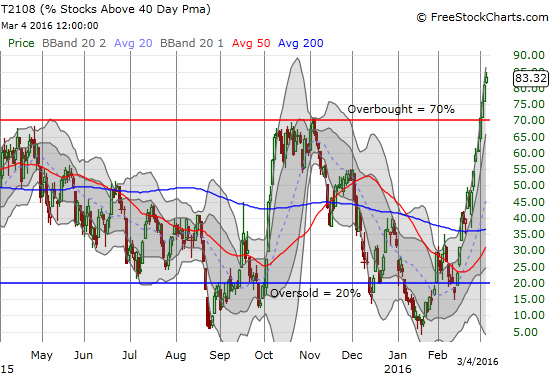

(T2108 measures the percentage of stocks trading above their respective 40-day moving averages [DMAs]. It helps to identify extremes in market sentiment that are likely to reverse. To learn more about it, see my T2108 Resource Page. You can follow real-time T2108 commentary on twitter using the #T2108 hashtag. T2108-related trades and other trades are occasionally posted on twitter using the #120trade hashtag. T2107 measures the percentage of stocks trading above their respective 200DMAs)

T2108 Status: 83.3% (March 3rd marked the first time above 80% since 2013!) – 6th overbought day

T2107 Status: 34.0% (matches highs from December, 2015)

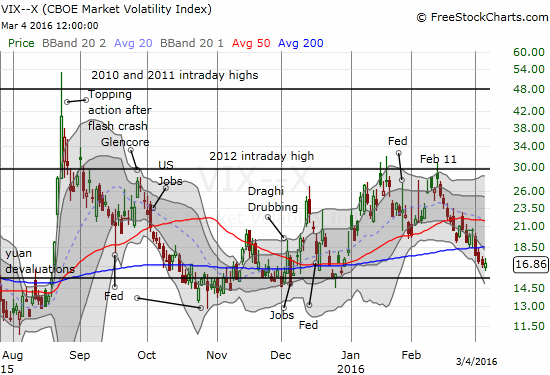

VIX Status: 16.9

General (Short-term) Trading Call: cautiously bullish

Active T2108 periods: Day #16 over 20%, Day #15 over 30%, Day #12 over 40%, Day #9 over 50%, Day #5 over 60%, Day #4 over 70%, Day #2 over 80% (overbought)

Commentary

$X great example of the current melt-up. Up 62% this week alone. $SLX up 23%.

— Dr. Duru (@DrDuru) March 4, 2016

This week was remarkable, but you may not realize it by simply reviewing the major indices.

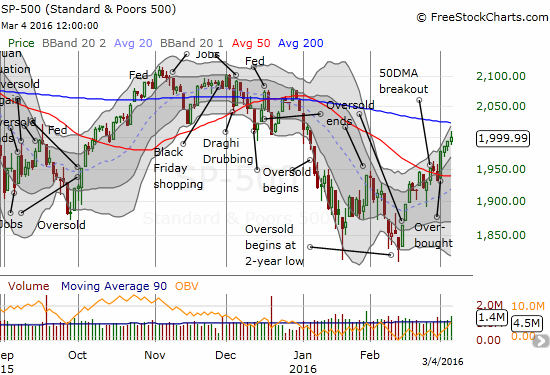

The S&P 500 (SPY) closed up 2.7% for the week, dominated by a 2.4% rally to start the month of March. This move was a convincing confirmation of a 50DMA breakout that ushered in the first overbought period in 414 trading days.

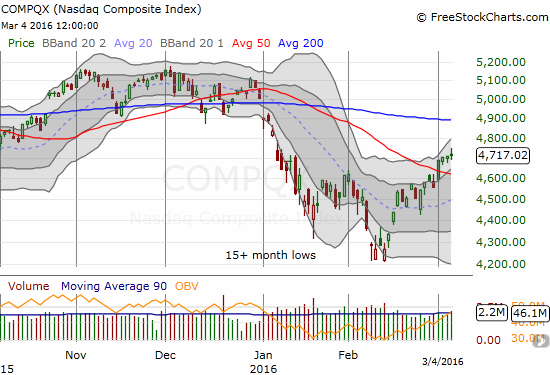

At 1999.99, the S&P 500 is still below declining 200DMA resistance. As the chart above shows, even the NASDAQ experienced a very moderate follow-through to its own 50DMA breakout. Traders have to turn to T2108, the percentage of stocks trading above their respective 40DMAs, and T2107, the percentage of stocks trading above their respective 200DMAs, to see the remarkable (relative) strength in the market.

T2108 and T2107 provide evidence of a rapidly healing market. This healing is not readily evident from the major indices. T2108 was last this high in January, 2013. T2108 is back to the highs seen after the recovery from the August angst. T2108 is so high that I am not expecting a lot further progress. I have only recorded THREE periods since 1986 where more than 90% of stocks traded above their respective 40DMAs: February to March, 1991, May to June, 2003, and April to May, 2009. Stock market historians will notice that these were the sharp recovery months following major market sell-offs. The last few stocks that have yet to recover above their 40DMAs are mainly the worst of the lot. I will give examples below of speculative stocks that have ripped higher for big gains. The stocks who could not gain on a week like this last one are simply not likely to gain much support later without a direct stock-specific catalyst.

I now move from T2108 to T2107. As long as T2107 can continue its advance, I will assume the market is still getting stronger. I have downgraded my trading call from bullish to cautiously bullish to reflect the dependence on a new dynamic. Moreover, the S&P 500 is now “close enough” to its 200DMA resistance to warrant even more caution than what I expressed when the index first began testing its 50DMA resistance; the index also finally showed more tentativeness by fading off Friday’s intraday high.

Overall, the trading rules I introduced in the last T2108 Update remain. I will stay bullish until/if the S&P 500 closes below its 50DMA support AND follows through. Even a failure to break through 200DMA resistance will not cause me immediate alarm, especially if T2107 is advancing. Since there is little room between the 50 and 200DMAs, I do not feel an urgency to switch back to a bearish bias. The bearish alarms will go off if/once T2108 tumbles out of overbought status (below 70%).

The volatility index, the VIX, managed to print a marginal gain, but it remains in a definite downtrend. The VIX is on a path to return to the old 15.35 pivot.

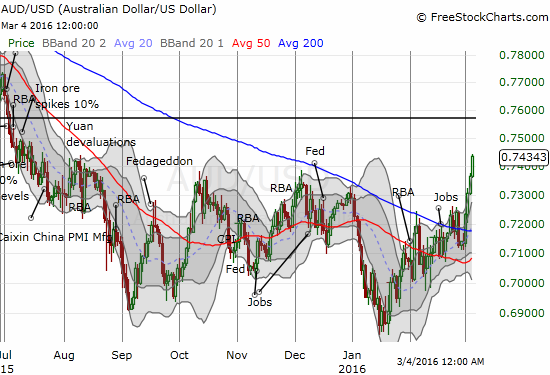

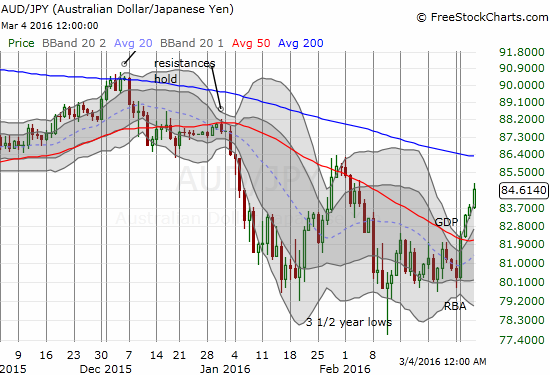

The Australian dollar (FXA) is fully supporting the bullish market sentiment. However, against the Japanese yen (FXY), the Aussie is getting very stretched. It has closed above its upper-Bollinger Band (BB) for four days straight and Friday’s close was well above the region that defines two standard deviations from the 20DMA. Resistance also looms overhead from the 200DMA.

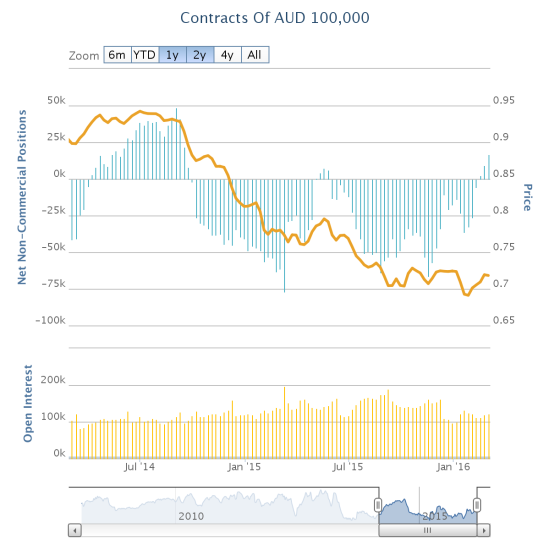

Currency speculators are further confirming a bullish change in sentiment with increasing net long positions on the Australian dollar.

Source: Oanda’s CFTC’s Commitments of Traders

The signs of bullishness are actually everywhere and easy to find. I present a a stream of charts showing different flavors and aspects of the current bullishness; yet they are just a small sample. I also discuss the key trades I have made in the past three days.

First the trades with no charts…

I decided to finally sell all my shares of ProShares Ultra S&P500 (SSO) and ProShares Short VIX Short-Term Futures (SVXY). This closes out my T2108 oversold trades. From here, I will primarily focus on the trades of individual stocks. I will get interested in SSO and SVXY on the next big dip in the market. I sold my shares in Tableau (DATA) just in time. The stock is sliding along its 20DMA. A critical Bollinger Band squeeze is developing. I added a few hedges with shares in Direxion Daily Energy Bear 3X ETF (ERY) and Direxion Daily Russia Bear 3X ETF (RUSS). I also sold the bulk of my shares in FXCM (FXCM).

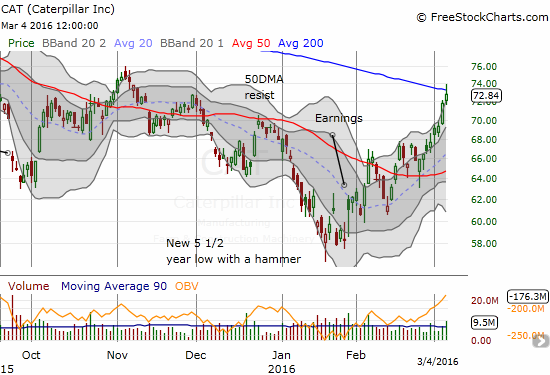

What better way to start a chart-fest than with Caterpillar (CAT) and Apple (AAPL)?

CAT is following along with the run-up in commodities. CAT has ripped off a 26% gain from the January lows. When it tested 200DMA resistance I purchased a new round of hedges with put options. CAT promptly faded from this resistance. Needless to say, my overall bullishness will be tainted if CAT turns south from here.

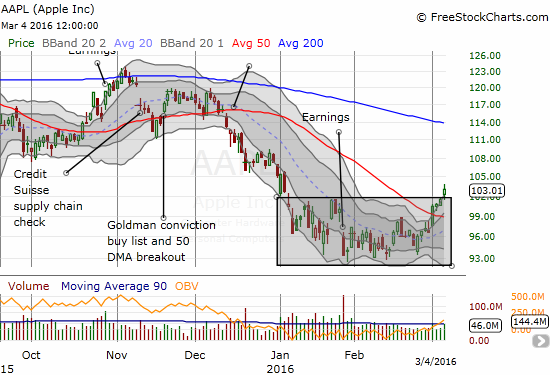

Apple (AAPL) finally woke up this week. It not only broke out above 50DMA resistance, but also it broke through a region of consolidation. I am rubbing my eyes as I contemplate a LONG overdue AAPL bottom. I could not pull the trigger on AAPL calls this past week because the stock traded along the upper-BB. Going long at such an out-stretched point carries too much risk for a short-term trade. Buyers are showing off by maintaining the upward pressure here.

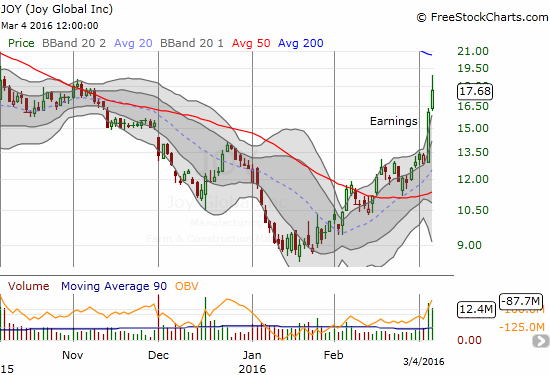

Joy Global (JOY) ripped higher in post-earnings trade. No doubt, this burst added a little more confidence to CAT buyers. I last talked about JOY on October 9, 2015 as a “catch-up” stock for buyers late to the bounce from oversold conditions. I have traded in and out of JOY since then with mixed results. The April call options I bought shortly after my post are now back to even with the stock returning to those October levels. With hindsight, I should have “backed up the truck” when JOY confirmed 50DMA support on February 24th.

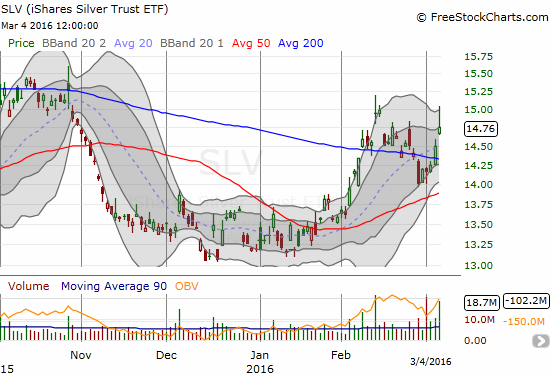

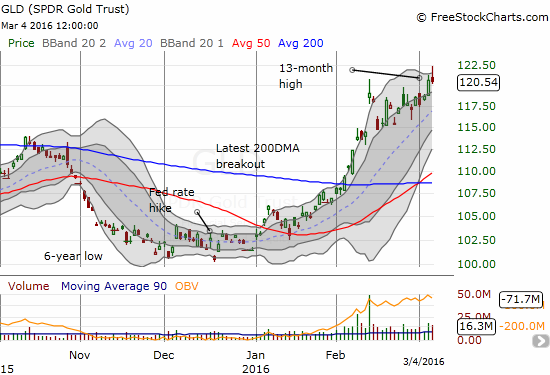

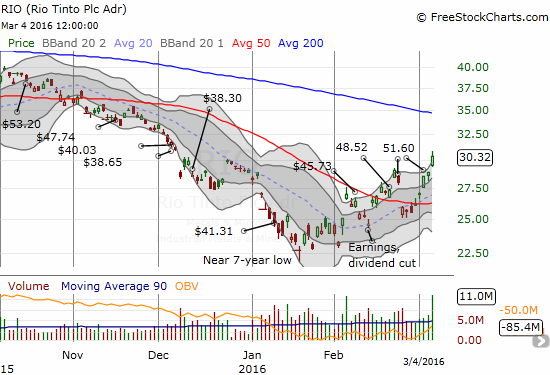

The commodity space has been absolutely fascinating. There is nothing like a run-up in this space to scream bullishness. In the previous week, I decided to double-down on iShares Silver Trust (SLV) despite its big pullback. I assumed the 50DMA support would hold, and it did. I locked in my profits with SLV touching its upper-BB. I did not open a fresh short-term trade on SPDR Gold Shares (GLD) because it did not dip enough; it has proved out once again the power of my method of analyzing short-term gold moves (for example, see “Gold Still Has Room to Run“). I was very fortunate to let go of my raging bearishness on iron ore long enough to pair my standing put options on BHP Billiton Limited (BHP) with a fistful of call options on Rio Tinto plc (RIO). The BHP put options are nearly worthless, but I almost paid for them with the profits I took on my RIO call options. Going forward, I will be trading this space a lot more actively. (Stay tuned for my trading calls).

Steel stocks have ripped higher along with commodities. Nevermind that higher commodities are adding to costs. Hopefully, demand is ripping even higher!

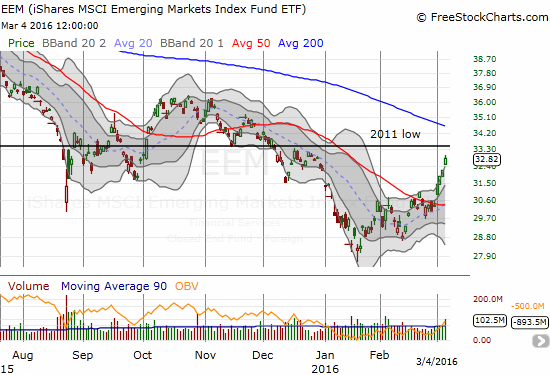

The Australian dollar has of course benefited from the sharp recovery in commodities. Emerging markets have as well (or have perhaps helped drive commodities higher). The iShares MSCI Emerging Markets (EEM) soared 9.4% on the week with a confirmation of a 50DMA breakout. With EEM stretched well above its upper-BB, I took this moment to re-establish one of my favorite hedge trades: long out-of-the money call and put options.

The market is so bullish that even broken down GoPro (GPRO) is filing a petition for a breakout. Friday’s big fade put that request in jeopardy.

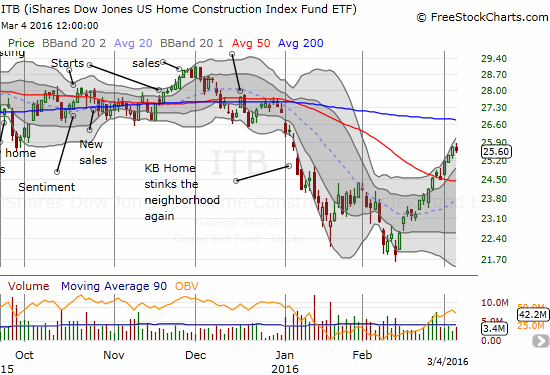

Some of my biggest successes from this rally have come from the shares of home builders. I will cover some of my latest opinions in future posts. Here is iShares US Home Construction (ITB) with a 17% gain from February lows with a near relentless march upward.

Red Robin Gourmet Burgers Inc. (RRGB) is making a steady surge higher. The rise is nearly in stealth mode as the stock makes very incremental gains in a curved form through the upper-BB channel.

Like AAPL, Shopify Inc. (SHOP) is breaking out of a tight period of consolidation. Buyers have made a convincing comeback from February’s false 50DMA breakout.

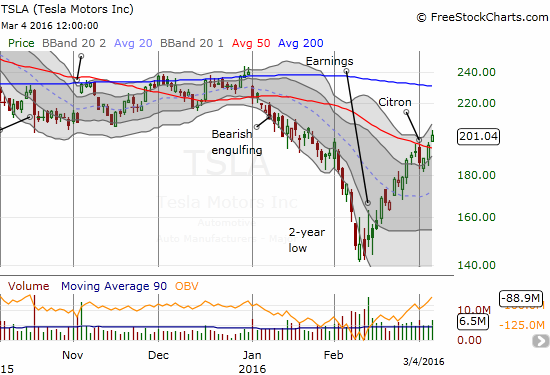

Tesla Motors (TSLA) followed through on my earlier claim that the stock would bounce back quickly from the Citron-related selling. I locked in my profits on Thursday thinking that buyers would only be able to reverse the selling before resuming a press downward. Buyers did not stop there. They decided instead to continue the previous momentum with what is now a bullish 50DMA breakout. Notice the increase in volume and increasing on-balance volume (OBV).

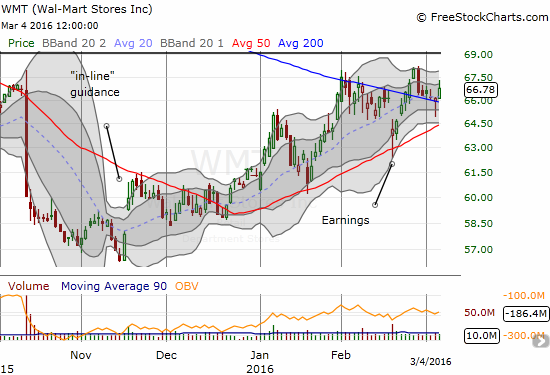

Wal-Mart Stores (WMT) has stalled with a 200DMA pivot. At these levels, the stock is neatly holding onto a reversal of October’s big sell-off. This is a critical juncture. Buy on the breakout, buy on the next big dip to 50DMA support.

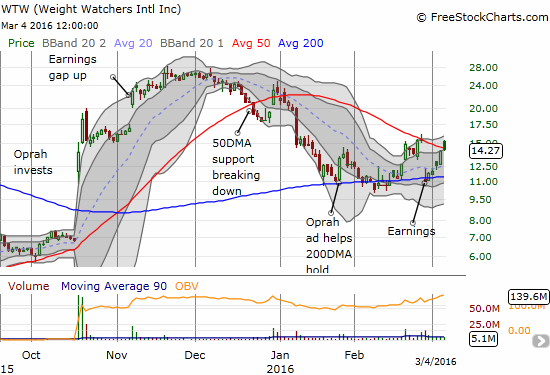

Controversial Weight Watchers International, Inc. (WTW) was walloped after earnings, but the 200DMA held true as support. Getting over the immediate pre-earnings price could launch the next big run-up. Otherwise, a lot more churn may be ahead.

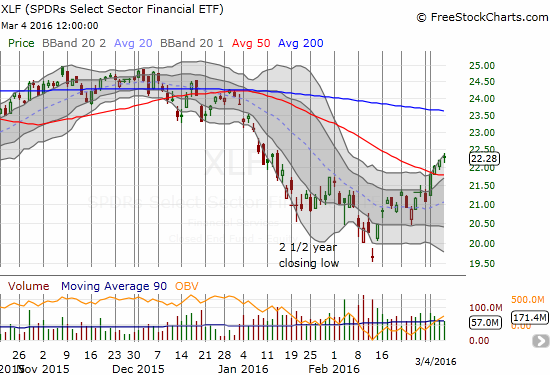

Finally, financials are also strong participants in the rally. The 50DMA breakout pretty much confirms February’s abandoned baby bottom and 2 1/2 year closing low as a sustainable bottom.

— – —

For readers interested in reviewing my trading rules for T2108, please see my post in the wake of the August Angst, “How To Profit From An EPIC Oversold Period“, and/or review my T2108 Resource Page.

Reference Charts (click for view of last 6 months from Stockcharts.com):

S&P 500 or SPY

U.S. Dollar Index (U.S. dollar)

EEM (iShares MSCI Emerging Markets)

VIX (volatility index)

VXX (iPath S&P 500 VIX Short-Term Futures ETN)

EWG (iShares MSCI Germany Index Fund)

CAT (Caterpillar).

IBB (iShares Nasdaq Biotechnology).

Daily T2108 vs the S&P 500

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Red line: T2108 Overbought (70%); Blue line: T2108 Oversold (20%)

Weekly T2108

*All charts created using freestockcharts.com unless otherwise stated

The charts above are the my LATEST updates independent of the date of this given T2108 post. For my latest T2108 post click here.

Related links:

The T2108 Resource Page

Expanded daily chart of T2108 versus the S&P 500

Expanded weekly chart of T2108

Be careful out there!

Full disclosure: short AUD/JPY, long ITB call options, long GLD, long SLV call options, long RRGB call options, long CAT put options, long EEM call and put options