Stock Market Commentary

The stock market rebounded out of oversold trading conditions but ended the week in ugly fashion. The combination produced fascinating snapshots of an ugly oversold bounce. Expensive growth stocks are rapidly falling out of favor while a convergence of negative headlines and uncertainties is painting plenty of ugly all over the stock charts. Even the shrinking percentage of stocks trading above their 50-day moving averages (DMAs) often look ugly. Still, I am bullish given my oversold trading rules. The case for chasing shorts downward is precarious given the prospects for sharp bounces and rebounds on the slightest positives.

Stock Chart Reviews – Below the 50DMA

DoorDash (DASH)

DoorDash (DASH) confirmed its topping pattern by slicing right through support at its 200-day moving average (DMA) (the blue line below). The ugly oversold bounce has not benefited DASH. However, given the near oversold conditions in the stock market, DASH is now mainly a short on fades.

KraneShares CSI China Internet ETF (KWEB)

In my last Stock Chart Review, I claimed “…given on-going Chinese government restrictions and poor earnings results, KWEB’s risks favor a breakdown below the trading range.” The trading range broke last week. The trading action weighed particularly heavy from news that China will force Didi Global (DIDI) to delist just 5 months after going IPO. DIDI crashed through its own trading range with a 22.2% plunge.

United States Oil Fund (USO)

After the United States Oil Fund (USO) gapped down to 200DMA support, I opened up a strangle options play assuming that oil would continue to make major price moves….either up or down. So far, the technicals are keeping USO magnetized to this critical long-term support line. I opened a small position with the intent to add in the direction of the next big move. The $50 call expires this month. The put spread expires next month.

Chipotle Mexican Grill, Inc (CMG)

Suddenly, burritos are falling out of favor in the stock market. Chipotle Mexican Grill, Inc (CMG) started trading poorly ever since a breakdown below support at the 50DMA (the red line below) on September 28th. On October 19th, Chipotle took a PR hit after Tennessee Titans wide receiver A.J. Brown claimed he got food poisoning at a Chipotle location. Three days later CMG suffered a 2.8% post-earnings loss. A false 50DMA breakout last month delivered the final topping blow for CMG. The stock has had just ONE up day ever since. The current 200DMA breakdown has essentially reversed all the gains from July earnings and the subsequent breakout. These breakdowns are part of the ugly oversold bounce. Needless to say CMG is at best a “no touch” until it can at least confirm a 200DMA breakout.

Affirm Holdings, Inc (AFRM)

Buy now, pay later plans are all the rage in retail now. These plans offer a way for consumers to buy goods they can only afford with payments spread out over a given amount of time. They also typically offer consumers much better interest rates than a credit card. I do not understand how the proliferation of these plans and related companies is sustainable. For now, the stock market seems to be on board with the presumption that the industry carries minimal risk. Affirm Holdings, Inc (AFRM) enjoyed such boundless optimism after announcing a payments partnership with Amazon.com (AMZN) on August 30th. AFRM gained a stunning 46.7% on that day.

A -15.4% rush for the exits ahead of November earnings flashed the first warning sign. The second warning sign came from a strong post-earnings fade after the stock almost reached back to its all-time high. Since then, AFRM has broken 50DMA support, confirmed 50DMA resistance and is nearing the closing price after the Amazon.com news. AFRM is in a bit of limbo here. I am watching to see whether it will trade down to its 200DMA.

Meta Platforms, Inc (FB)

In late October, I made the case for shorting Meta Platforms, Inc (FB), formerly Facebook. The stock proceeded to rally and even breakout above 50DMA resistance. Without a confirmation of the breakout, I kept holding the short. I took small profits on the position at the end of Wednesday’s steep selling given my rules on covering shorts in oversold periods. FB ended the week at a 7-month low.

Best Buy (BBY)

Support for Best Buy (BBY) completely collapsed after earnings. The selling finally took a break on a near test of the 2021 low. BBY managed to gain 1.9% despite the selling in the rest of the stock market.

Etsy, Inc (ETSY)

I was watching Etsy, Inc (ETSY) after a picture-perfect test of 50DMA support on Thursday. That test turned into a critical failure after ETSY lost 7.3% the next day on a 50DMA breakdown. Given the simultaneous end of October’s big breakout, ETSY becomes a fade at 50DMA resistance with a profit target at 200DMA support.

iShares Expanded Tech Software Sector ETF (IGV)

The iShares Expanded Tech Software Sector ETF (IGV) is suddenly down 12.7% since hitting an all-time high a month ago. The expensive growth stocks that constitute IGV are exactly the kinds of stocks that fall out of favor when expectations for tighter monetary policy reduce the amount of forward earnings investors are willing to discount (and investors have happily discounted years into the future with rates essentially zero). The higher the valuation premium, the further the downside risk. I covered my IGV short too quickly – it was ahead of the worst of the selling. Now I am watching to see whether 200DMA support will hold.

Splunk Inc (SPLK)

Splunk Inc (SPLK) is clinging to its status as an expensive growth stock. Growth is stalling, profitability remains elusive after years and years of operations, and a CEO transition has further dampened sentiment. SPLK now trades at levels where I earlier indicated I would get interested in buying. A test of 2021 support is underway. I need a second higher close to pull the trigger. SPLK now trades at “just” 7.9 times sales. Compare this valuation to the 127 times sales for Snowflake (SNOW).

Robinhood Markets Inc (HOOD)

The sellers remain unrelenting in Robinhood Markets (HOOD). Not only is the $38 IPO price a distant memory, but also HOOD has effectively enjoyed precious few days of favor from traders and investors. HOOD is in falling knife mode, but it could rebound at a moment’s notice given the stock market’s near oversold status. I continue to watch for even a faint sign of stabilization.

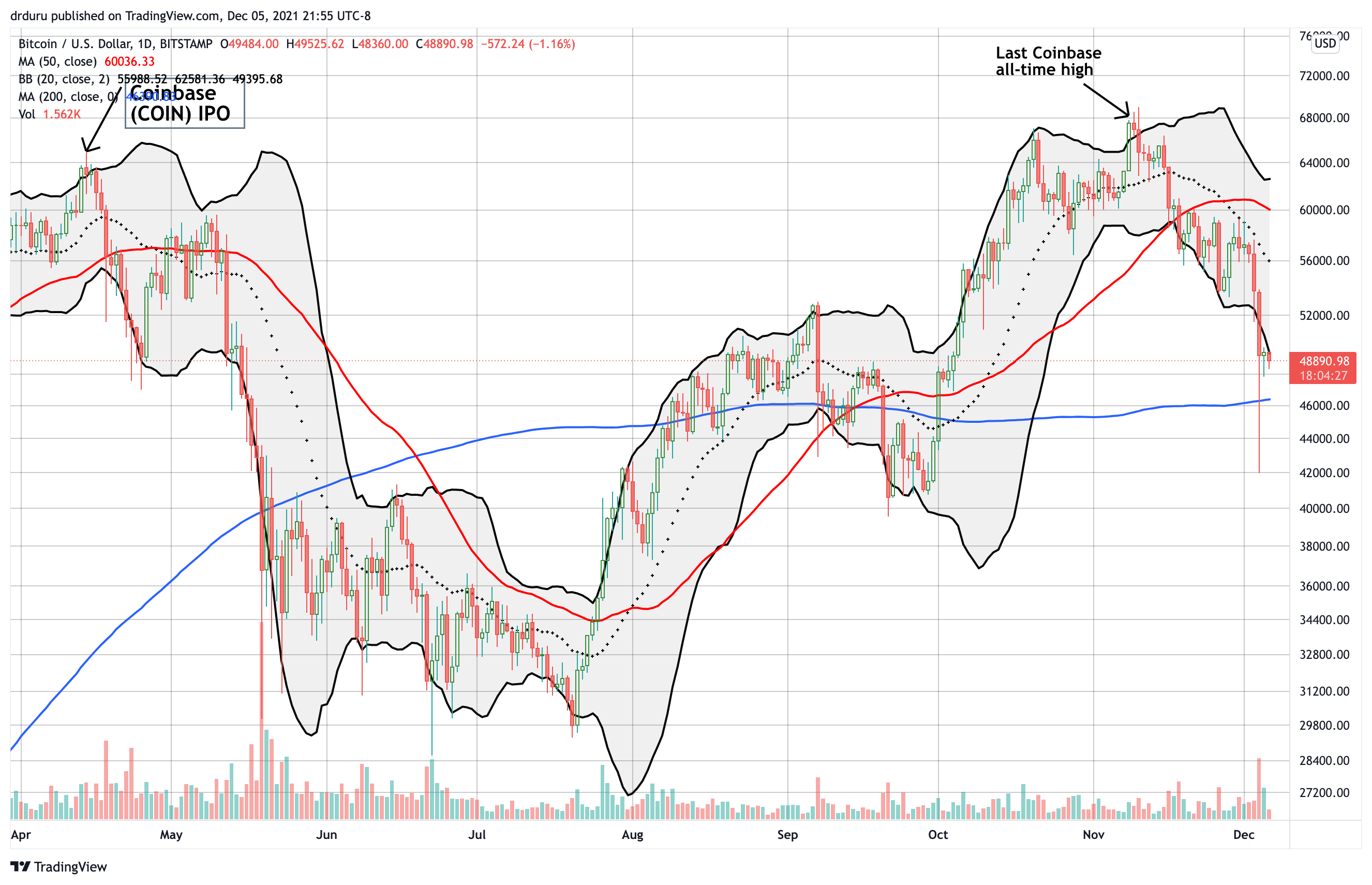

Coinbase Global, Inc (COIN)

For about a month, Coinbase Global, Inc (COIN) looked like it finally obtained sustained favor from traders and investors. On November 8th, COIN closed at an all-time in unison with a new all-time high in Bitcoin (BTC/USD). COIN rallied one more day into earnings. An 8.1% post-earnings loss brought the momentum to an end. A month later, COIN has confirmed a fresh 50DMA breakdown on the heels of three days of strong selling pressure. The $250 reference price from the direct listing is once again in view.

Unity Software Inc (U)

Last week, Unity Software Inc (U) lost its 50DMA support. I was earlier eyeing it for a buy off 20DMA support (the dotted line below). Now, Unity is “no touch” until it can confirm a 50DMA breakout. While U falls into the bucket of expensive growth stocks that are falling out of favor, I would NOT short such a stock with a strong and concentrated narrative behind it (the future of the metaverse).

Stock Chart Reviews – Above the 50DMA

Apple (AAPL)

Apple (AAPL) looked like it confirmed a blow-off top with a 3.2% loss back to its former all-time high. I stuck by the Apple Trading Model (ATM), but I did not participate in the 3.2% surge that invalidated the blow-off top. Just when AAPL was receiving accolades as a safety trade, it flared out with a fresh topping pattern. Now AAPL looks stuck between the last topping fade and support from the former all-time high.

Tesla, Inc (TSLA)

Tesla (TSLA) may be the “tell all” stock of them all. While TSLA remains above 50DMA support, the stock looks “uncomfortable.” Friday’s 6.4% drop tested the lows from November and effectively confirmed the topping pattern created by two failures to breach the all-time high. TSLA is now a 50DMA breakdown away from risking a reversal of the October breakout. I am staying on the sidelines for now as trading TSLA here looks more tricky and precarious than usual. Note well how TSLA did not benefit at all from the oversold bounce.

Snowflake Inc (SNOW)

As intimated above, Snowflake Inc (SNOW) is a member of the expensive growth stocks falling quickly out of favor. However, SNOW did well to stave off an 8.5% pre-earnings plunge with a 15.9% post-earnings surge. A subsequent 4.2% loss failed to close SNOW below its 50DMA. Count this stock as a fighter even with a likely double-top hanging in the balance.

Be careful out there!

Footnotes

Source for charts unless otherwise noted: TradingView.com

Grammar checked by Grammar Coach from Thesaurus.com

Full disclosure: long AAPL calls, long BBY call spread and shares, long USO put spread and call options, long BTC/USD, long BITO, long GBTC

FOLLOW Dr. Duru’s commentary on financial markets via StockTwits, Twitter, and even Instagram!

*Charting notes: Stock prices are not adjusted for dividends. Candlestick charts use hollow bodies: open candles indicate a close higher than the open, filled candles indicate an open higher than the close.