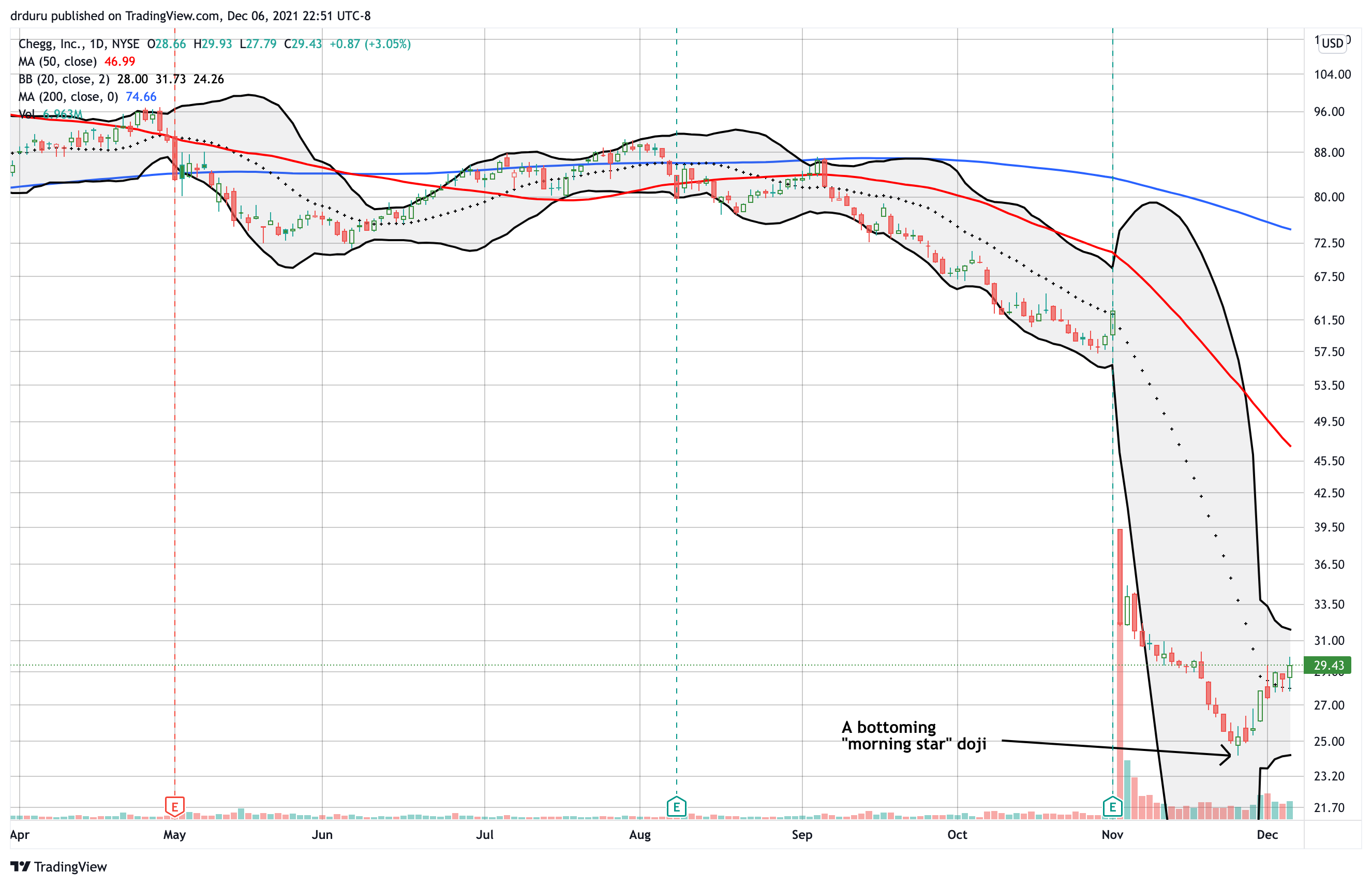

Between an accelerated share buyback program and executives using their own money to buy shares, Chegg, Inc (CHGG) finally looks ready for a price bottom.

On November 29th, Chegg made the following proclamation in concert with the $300M acceleration of share repurchases: “The accelerated share repurchase demonstrates the strength of our balance sheet, and it reaffirms our confidence in the long-term opportunity for Chegg, as well as our continued commitment to enhancing shareholder value…We are firm believers in the future growth of online education and skills services globally and in Chegg’s position to support students on their path from learning to earning.”

Chegg added $500M to its repurchase authorization during its last earnings report. However, investors and traders were clearly not mollified as the earnings results overshadowed the bullish news about the share buyback (see my piece in Seeking Alpha “Chegg Flunked But A Make-Up Test Is On The Way“). The crowd almost drowned out the latest news as well. CHGG rallied to a 7.3% gain before sellers faded the stock back to a 3.1% gain. However, buyers returned for more with an 8.3% gain the next day.

Two days later Chegg announced that its CEO and CFO loaded up on shares. While they were surely emboldened by the company’s commitment to buy shares, the additional buying made a strong point: management thinks the company is cheap and under-valued. Daniel Rosensweig, President, CEO, and co-Chairman, bought 25,000 shares costing a total of $710K. CFO Andrew J Brown bought 20,000 shares costing a total of $563.8K.

The Trade

Shortly after earnings, I shorted a put option as a first move to accumulate CHGG on the cheap. The market promptly assigned those shares to me as the stock’s weakness continued. After the accelerated repurchase news, I sold another put option with more confidence that it would expire worthless. I will not likely add more shares until CHGG closes above its post-earnings intraday high (at $39.50). Such a close should demonstrate the market’s readiness to put CHGG’s misfortunes in the past. The stock repurchases and insider buying have already indicated the company is ready to bury its earnings debacle in the past.

Be careful out there!

Full disclosure: long CHGG shares and short a put

I want to follow Chgg

I don’t have an email subscription to do that, but feel free to check this link from time-to-time: https://drduru.com/onetwentytwo/tag/chgg/