Stock Market Commentary

I earlier wrote about a forlorn stock market writing a love note to the Federal Reserve. This love note comes in the form of a basket of sell-offs. The selling is so broad and so deep that traders could throw a dart and find descriptive stock charts. The examples below are some of the more striking and representative in my universe. The forlorn stocks in particular say a LOT about how far and how quickly sentiment soured in the stock market.

Stock Chart Reviews – Below the 50-day moving average (DMA)

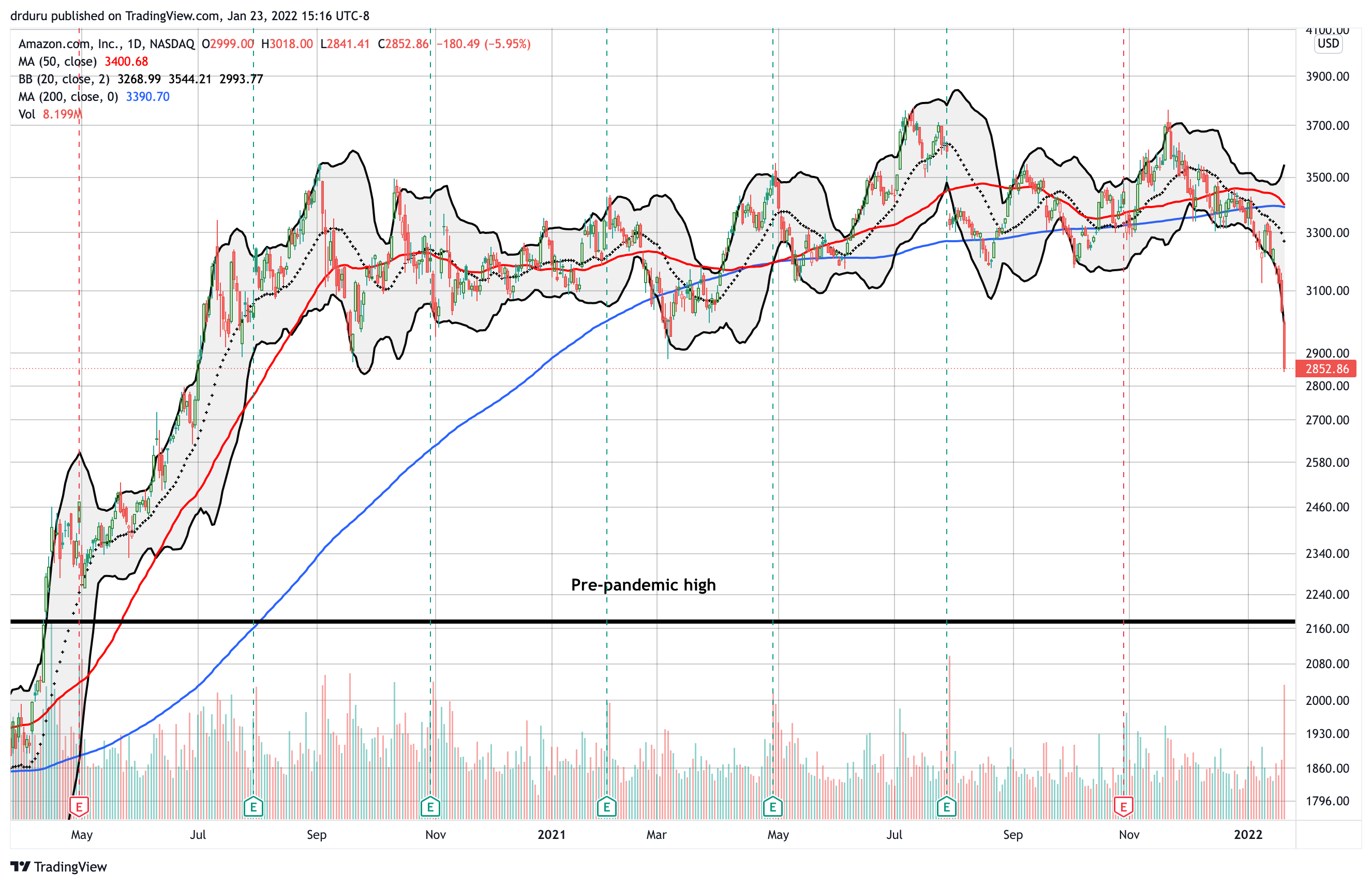

Amazon.com (AMZN)

In Friday’s 6.0% decline, Amazon.com (AMZN) broke down below its 19-month trading range and went into bear market territory. AMZN is 23.5% below its all-time high. A bear market technically begins with a 20%+ decline.

Of all the shocking charts I reviewed for the week, AMZN topped the list. For whatever reason, I assumed AMZN was stuck in its trading range, just growing into its valuation. Accordingly, I thought the trading range would hold firm through the sell-off. Now that I am thinking of the extreme of extreme scenarios, I wonder whether AMZN could eventually join the growing list of forlorn stocks giving up their pandemic era gains.

Twilio Inc (TWLO)

Cloud communications platform company Twilio Inc (TWLO) characterizes the list of forlorn stocks. The selling remains relentless. TWLO topped out almost a year ago. The stock sits at a 20-month low with a 56.7% loss from its peak. Things do not get much worse than this…unless 13 times sales is still not enough of a valuation compression for investors.

Goldman Sachs Group, Inc (GS)

Goldman Sachs Group, Inc (GS) started last week’s cascade of forlorn stocks. GS lost 7.0% post-earnings and ended the week with a 9-month low. In an instant, GS went from a financial stock that looked to benefit from higher rates to a stock barely skirting a bear market. GS is down 18.9% from the all-time high set just in early November.

SPDR Select Sector Fund – Financial (XLF)

SPDR Select Sector Fund – Financial (XLF) shows how selling came suddenly to the financials. XLF reached a fresh 52-week high in the previous week. XLF has mainly gone downhill from there. The ETF of financial stocks closed the week right on top of its 200DMA for a very important pre-Fed technical test.

Materials Select Sector SPDR Fund (XLB)

In the previous week I drew a sharp contrast between the digital lows and material highs. The distinction in treatment narrowed with last week’s selling. Materials Select Sector SPDR Fund (XLB) lost 5.4% for the week. While small compared to expensive growth stocks, the selling was enough to punch XLB through 200DMA support. I am watching for an entry point on XLB. I like buying on a confirmed 200DMA breakout. A discount on a successful test of the September and October lows would be an easier buy.

SPDR S&P Retail ETF (XRT)

The SPDR S&P Retail ETF (XRT) experienced a major fakeout on the November breakout above an extended trading range. In just two months, XRT reversed off its all-time high to an 11-month low.

Dillards, Inc (DDS)

With XRT sinking fast, a retail stock like Dillards, Inc (DDS) really sticks out. Despite being a department store – a category that is supposed to be fading in the age of e-commerce and AI-generated clothing sales – DDS has managed to hold steady and stabilize over the last two months. DDS is even clinging to lingering gains from its October/November breakout. I am now watching DDS for a breakout above its 50DMA (bullish) or a 200DMA breakdown (bearish). Otherwise, the stock trades in limbo. Note that DDS gained 288% last year.

Macys Inc (M)

Department store Macys Inc (M) has a similar chart to DDS. I know Macys has succeeded in going omni-channel, but I am still surprised by this performance. Note that M gained 133% last year and is down 12.4% for this year. I am doing the same watching on Macys as I am on Dillards.

The Sherwin-Williams Company (SHW)

Paint company The Sherwin-Williams Company (SHW) survived several bad news earnings reports last year. SHW was not so fortunate in the previous week with sentiment souring across the stock market. SHW dropped 2.8% and buyers largely stepped aside this time around. The stock ended the week with a confirmed 200DMA breakdown.

Adobe Inc (ADBE)

I earlier described a potential bottoming in Adobe Inc (ADBE). ADBE ended the week clinging to that bottom. With a close on the intraday lows and the lower Bollinger Band (BB) opening up, ADBE now carries significant risk of invalidating the bullish engulfing pattern.

Block, Inc (SQ)

After another week of relentless selling, suddenly Block, Inc (SQ) looks in danger of eventually reversing its pandemic era gains. The stock chart shares characteristics with the forlorn stocks. SQ lost 7.4% just on Friday.

Draft Kings (DKNG)

Draft Kings (DKNG) could be a king of forlorn stocks now. Friday’s 5.9% loss effectively reversed all of DKNG’s pandemic era gains. If that breakout line fails to hold as support, DKNG will put its pandemic lows into play.

Netflix (NFLX)

I have written skeptically about the value of Netflix (NFLX) in the past. However, the stay-at-home trends of the pandemic compelled me to acquiesce. Fast-forward to Friday’s 21.8% post-earnings plunge and suddenly those pandemic era tailwinds disappeared in a flash. NFLX created a massive fake-out with September’s breakout. Now NFLX is a member of the forlorn stocka. Still, I could not resist buying into this massive wipeout. I think of this purchase as the one I should have made in March or April of 2020.

Analysts rushed out with fresh opinions and ratings, yet the average rating remains a buy on NFLX. NFLX could churn for a while given the massive surprise the company delivered on Q1 subscriber guidance. The company and the stock have a hill to climb to regain the market’s trust and confidence.

Applied Materials (AMAT)

My attempt at patience on Applied Materials (AMAT) completely failed. The 6.3% rebound that gave me hope to extend profits on my call spread quickly turned sour. AMAT opened last week with an 8.8% loss. Perhaps stubbornly, I refreshed the call spread as AMAT tested 200DMA support. I am off to a poor start with AMAT closing the week with a 200DMA breakdown on a 2.9% loss. Whatever happens going forward, AMAT will remain on my shopping list. If AMAT comes down low enough, I will start accumulating shares.

NVIDIA Corporation (NVDA)

Even NVIDIA Corporation (NVDA) cannot maintain its footing in this market of forlorn stocks. NVDA looked impressive with a strong rally into November earnings that was followed by fresh buying. Unfortunately, NVDA topped out soon after. With the October breakout almost crushed to dust, NVDA put a test of 200DMA support into play.

Alphabet Inc (GOOG)

Even Alphabet Inc (GOOG) joined the crew of stocks breaking below key supports. GOOG confirmed a 200DMA breakdown and punched through support from the September/October lows.

Intuitive Surgical, Inc (ISRG)

Robotic surgery company Intuitive Surgical, Inc (ISRG) confirmed a triple top with a 200DMA breakdown. Friday’s 7.9% post-earnings loss wiped out the rest of ISRG’s gains from 2021. ISRG is 1.2% down from its 2020 close.

Chipotle Mexican Grill, Inc (CMG)

I know the market is full of forlorn stocks when Chipotle Mexican Grill, Inc (CMG) is in free fall. CMG peaked in August after a strong, albeit brief, post-earnings run-up. Relentless selling all year has taken CMG down 21.2% for the year. Like ISRG above, CMG wiped out all its gains for 2021. CMG is 0.6% below where it closed at the end of 2020. I am watching to see how CMG behaves at the 2021 lows.

Stock Chart Reviews – Above the 50DMA

BHP Group Limited (BHP)

The materials trade took a hit after Canadian steel company Stelco warned of shrinking demand. I have a hard time believing the implied broad-based global economic slowdown. However, since the market sold down steel-related names, I have to take the implications seriously. Diversified commodities company BHP Group Limited (BHP) fell 4.5% in sympathy.

Caterpillar (CAT)

Caterpillar (CAT) is no longer benefitting from material highs. The stock fell three straight days and closed the week right at 200DMA support. Earnings on January 28th should mark a major turning point for the stock and related industrials…positively or negatively. I am going into the week with long call options from a calendar call spread.

Be careful out there!

Footnotes

Source for charts unless otherwise noted: TradingView.com

Full disclosure: long AMAT call spread, long CAT calls, long NFLX

FOLLOW Dr. Duru’s commentary on financial markets via StockTwits, Twitter, and even Instagram!

*Charting notes: Stock prices are not adjusted for dividends. Candlestick charts use hollow bodies: open candles indicate a close higher than the open, filled candles indicate an open higher than the close.

Grammar checked by Grammar Coach from Thesaurus.com