Fed to the Rescue

If you are sitting at home wringing your hands about catching a virus from the outside world, I am guessing you are not exactly relieved to hear that the U.S. Federal Reserve may try to come to your rescue with more rate cuts. Yet, easy money is what central banks know well in the wake of the financial crisis. Easy money is the easy solution to each and every source of angst for financial markets. At 2:30pm Eastern, the Federal Reserve warmed the engines of its ambulance in the form of the following statement as a hint of rate cuts to come:

The fundamentals of the U.S. economy remain strong. However, the coronavirus poses evolving risks to economic activity. The Federal Reserve is closely monitoring developments and their implications for the economic outlook. We will use our tools and act as appropriate to support the economy.

Statement from Federal Reserve Chair Jerome H. Powell, February 27, 2020

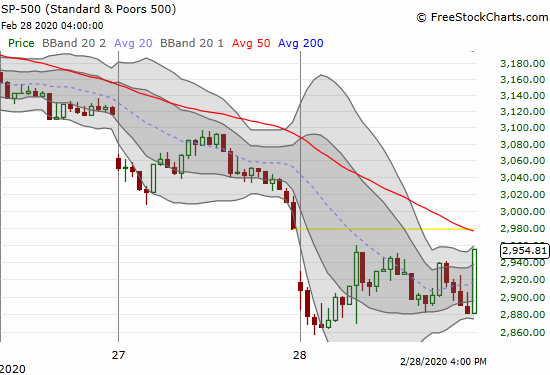

The stock market took the hint and ran with it for about 30 minutes. Sellers rushed in to get out the market at slightly better prices. Buyers won the battle with a surge in the final 15 minutes of trading. The S&P 500 (SPY) closed the day at its intraday high.

Source: FreeStockCharts

I will write more about the stock market’s epic oversold levels in a coming post. For those interested in getting a sense now, see my description of Thursday’s epic trading: “Second Derivative Selling Reverses More Stock Market Breakouts.” The market’s angst and eagerness for any good news is evident in the rapid repricing of the odds for rate cuts. I am frankly startled that the market went straight for projecting a 50 basis point (bps) rate cut instead of the standard fare of 25bps! It looks like an ambulance full of rate cuts will be careening around the corner at any moment.

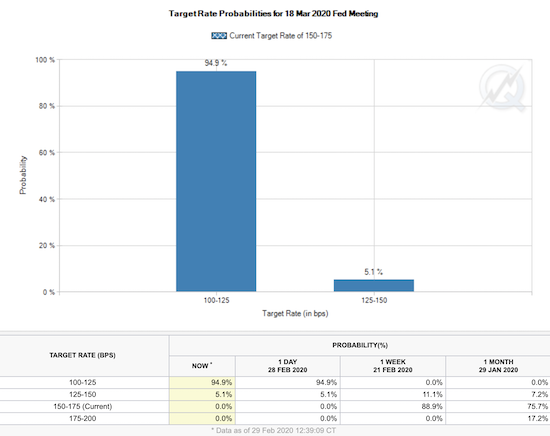

The chart below shows that the current target rate is 150-175 basis points (bps) (1.50% to 1.75%). For the March 18th Fed meeting, financial markets are pricing in a 94.9% chance of a cut down to 100-125 bps and a 5.1% chance of a more standard 25 bps cut. The market thinks there is ZERO CHANCE of the Fed leaving rates where they are now. Remember, the Fed tries hard not to follow markets given the disruptions disappointments can cause.

Source: CME Fedwatch

A Rapid and Abrupt Shift In Expectations

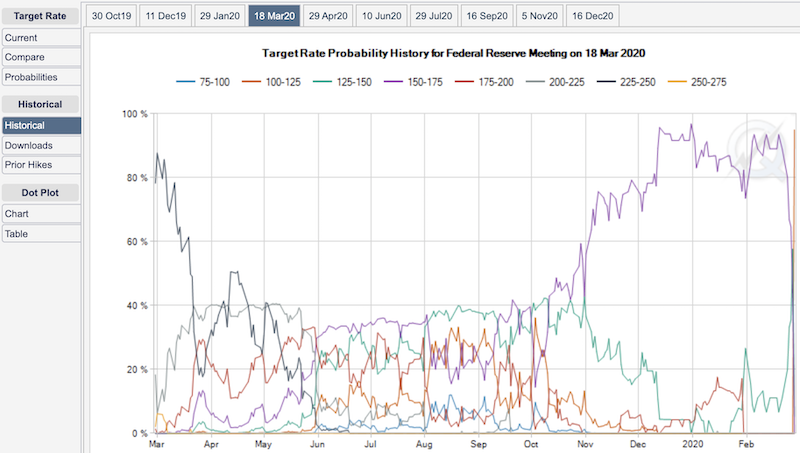

So just a week ago, the market was essentially expecting the Fed to stay put on rates. Now, the market expects a half a percent rate cut (and whispers in the financial press are relaying the prospects of an “emergency” rate cut ahead of the March 18th meeting!). Previously, the market was not expecting the dovish Fed to cut rates again until April and just by the standard 25 bps. A month ago, the odds favored July for the next 25 bps cut. The chart below shows how fast the market’s rate expectations shifted for March…all in the last few days.

Source: CME Fedwatch

The chart below is a timeline from March, 2019 to February, 2020 for the market’s expectations for rates for the March, 2020 Fed meeting. The y-axis shows the market’s odds for rates at the conclusion of that meeting. The high purplish line represents current rates. From December to early February, the market pried in 80-100% odds for rates to stay where they are. The mess of lines at the far right edge represent those odds falling to zero while odds of rate cuts soared.

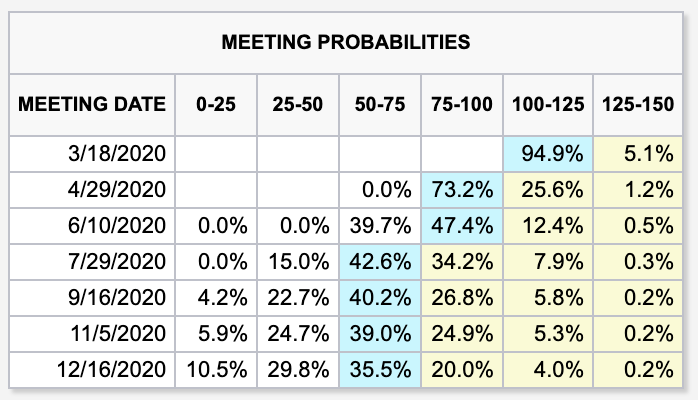

The table below shows the pressure on rates goes out until July. The market will not be satisfied with 50 bps in March. The market is looking for another 25 bps in April (or by June). The market will want yet more in July where rate expectations finally stabilize.

Source: CME FedWatch

New pressure on the U.S. Dollar

The surge in dovishness has helped push the U.S. dollar index (DXY) off its recent 3-year high and toward another test of converged support at its 50 and 200-day moving averages (DMAs). Pressure has largely come from a surging euro (FXE) which is apparently being targeted by short-covering; traders are shifting to “risk-off” and closing out carry trades using the euro with its negative rates as the short side.

This latest pullback in the U.S. dollar is my opportunity to go long and in particular I have been accumulating a short EUR/USD position per my on-going bearishness on the euro. I am assuming the European Central Bank (ECB) will have to follow suit with more monetary stimulus after the Fed goes all-in. That easing should weaken the euro a lot more than the current weakening in the U.S. dollar.

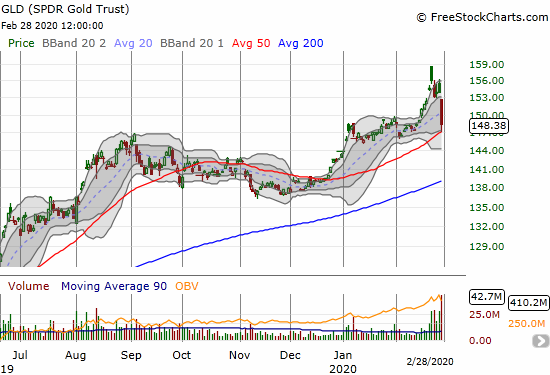

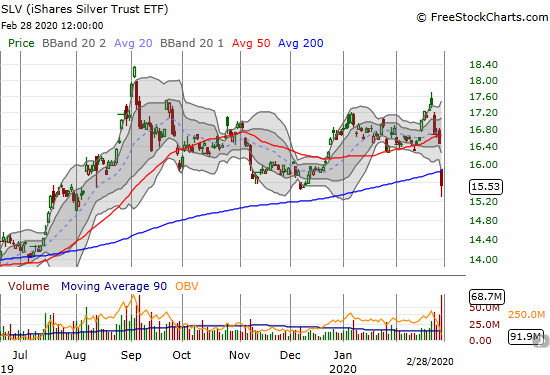

No Shelter In Unprecious Metals

The weaker dollar is not helping gold or silver. Both precious metals sold off sharply in the past two days. I read a Marketwatch article guessing that investors are taking profits in order to raise cash. Silver of course generally gets pressured along with commodities. I am still treating these pullbacks as excellent buying opportunities to supplement my long-term holds of shares in SPDR Gold Trust (GLD) and iShares Silver Trust (SLV). I already started accumulating March call options on SLV. I have GLD up next for this week. I will also look at longer-dated call options (likely spreads).

Source for above charts: FreeStockCharts

Flashbacks to 1999

This monetary episode gives me flashbacks to 1999. At that time, the global panic was about the potential disruptions from computer clocks changing centuries, aka Y2K. It seems quaint now, but 20th century computer clocks were not built to handle a change in century. While IT and software shops across the globe rushed in their fixes, the Federal Reserve increased liquidity in financial markets as insurance. The stock market, especially for tech stocks, was already rushing ever higher. The U.S. economy was already strong and unemployment was extremely low. The Fed’s extra boost was just the kindling to send the stock market over the top in 2000.

“While the evidence of precautionary inventory hedging to date is mixed, in the financial sphere, borrowers and lenders are clearly taking steps to build liquid assets and reduce their reliance on credit markets around the end of the year. This is reflected in a noticeable rise in deposit and commercial paper rates for funding that would be outstanding over year’s end. Many corporate treasurers have moved forward their debt offerings to avoid any chance of a dearth of credit availability in the fourth quarter or difficulties funding short-term liabilities. The Century Date Change Special Liquidity Facility of the discount window that was approved by the Federal Reserve Board in July and the contingency actions of the Federal Open Market Committee announced by the Federal Reserve Bank of New York on September 8 should help to ensure an ample supply of liquidity and relieve funding pressures.”

Remarks by Chairman Alan Greenspan Before the President’s Council on Year 2000 Conversion, Financial Sector Group, Year 2000 Summit, Washington, D.C., September 17, 1999

Be careful out there!

Full disclosure: long SSO, short EUR/USD, long GLD, long SLV shares and calls