U.S. Dollar Breakdown

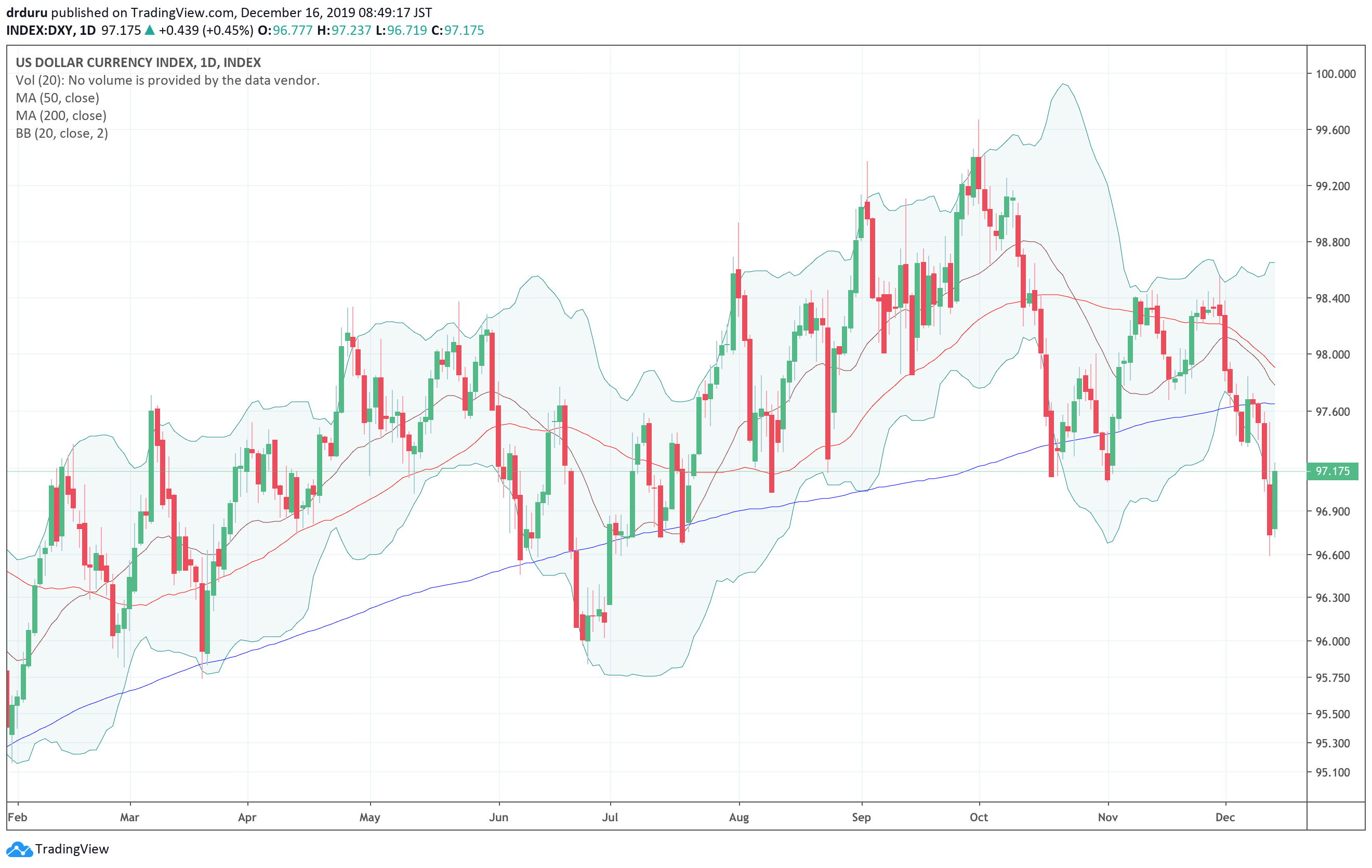

In the wake of the Federal Reserve’s last pronouncements on monetary policy, the U.S. dollar index (DXY) sold off and confirmed its latest breakdown below its 200-day moving average (DMA).

Source: TradingView.com

This latest 200DMA breakdown looks more damaging than other episodes. For example, the U.S. dollar index extended further below its 200DMA than in other episodes. The U.S. dollar index also failed to make a new high after the last breakdown. A close below the June low would confirm a new bearish turn for the dollar.

In Search of Inflation

I read through the transcript of the Fed’s press conference for clues to help me understand the dollar’s dive. One statement in particular caught my interest as it suggested the Fed will not even consider increasing interest rates for the foreseeable future:

“…in order to move rates up, I would want to see inflation that’s persistent and that’s significant, a significant move up in inflation that’s also persistent before raising rates to address inflation concerns. That’s my view…We haven’t tried to turn it into some sort of, you know, official forward guidance. It happens to be my view that that’s what it would take to want to move interest rates up in order to deal with inflation.”

Jerome Powell, Federal Reserve Chair, Transcript of Chair Powell’s Press Conference December 11, 2019

Depending on your perspective, inflation has not moved up significantly nor persistently since before the Financial Crisis, maybe the 1980s. With such a history, inflation is not likely then increase significantly or persistently anytime soon. Powell’s claim implies that the Fed funds rate will not go higher for a very long time to come.

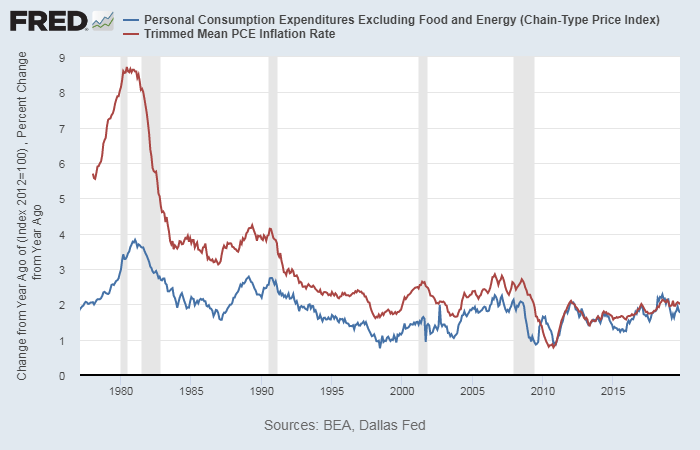

The Federal Reserve uses the Personal Consumption Expenditures (PCE) index as its measure of inflation. The Fed has a 2% target for inflation. The chart below shows that PCE has stayed below 2% for the vast majority of the time since 1992. I included the trimmed mean PCE as the Fed sometimes refers to this alternate but complementary measure of inflation.

Sources: U.S. Bureau of Economic Analysis, Personal Consumption Expenditures Excluding Food and Energy (Chain-Type Price Index) [PCEPILFE], retrieved from FRED, Federal Reserve Bank of St. Louis, December 14, 2019; and Federal Reserve Bank of Dallas, Trimmed Mean PCE Inflation Rate [PCETRIM12M159SFRBDAL], retrieved from FRED, Federal Reserve Bank of St. Louis, December 14, 2019.

During the press conference Powell acknowledged difficulties in producing inflationary pressures.

“It’s been very challenging to get inflation to be at target. If you look around the world, the United States, of all major economies, has been closest to it but still hasn’t quite been able to achieve it. And I would also point out that this year which has been a good year for the economy inflation– core inflation is actually running at 1.6 percent, whereas it ran close to 2 percent most of last year. So, it’s a real challenge.”

The financial markets apparently got the message. Despite the economy’s strength, financial markets are still expecting monetary policy to get more dovish over time. The next change in rates is projected for November, 2020 with a 55.7% chance of at least a 25 basis points rate cut. Those odds jump to 61.3% for December. These projections imply that the financial markets do not expect incremental strength in the economy for the next year. Not only are inflationary pressures nowhere on the horizon, but financial markets are expecting a bias toward softness.

A Healthy, Disinflationary Economy?

The Fed’s dovishness is not coupled with pessimism for the state of the economy. Indeed, the Fed remains “favorable.”

“Our economic outlook remains a favorable one despite global developments and ongoing risks…

Household spending has been strong—supported by a healthy job market, rising incomes, and solid consumer confidence. In contrast, business investment and exports remain weak, and manufacturing output has declined over the past year. As has been the case for some time, sluggish growth abroad and trade developments have been weighing on those sectors. Even so, the overall economy has been growing moderately. And with a strong household sector and supportive monetary and financial conditions, we expect moderate growth to continue. As seen from FOMC participants’ most recent projections, the median expectation for real GDP growth slows slightly over the next few years but remains near 2 percent.”

Economic gains are even reaching people who have long failed to participate in general prosperity:

“People who live and work in low- and middle-income communities tell us that many who have struggled to find work are now finding new opportunities. Employment gains have been broad-based across all racial and ethnic groups and all levels of education. These developments underscore for us the importance of sustaining the expansion so that the strong job market reaches more of those left behind. We expect the job market to remain strong…

…there are a lot of things going on that suggest that people at the margins of the labor force are being pulled in and being given chances, which is a great thing.”

This is good news. However, if the economy actually will need more rate cuts, then I have to guess that progress for those left behind will continue to be excruciatingly anemic.

The Trade

The current outlook suggests to me that the U.S. dollar’s rally should soon come to an end…if the dollar has not already topped out. Still, until some other major economy develops stronger economic fundamentals than the U.S. (Canada used to be a prime candidate), I do not expect the U.S. dollar to experience a strong sell-off. The stage looks set for an extended trading range until some fresh catalyst comes along. For now, I am trading for a rebound in the U.S. dollar index back to or through its 200DMA before gravity takes over again. At that point, I plan to short currency pairs like USD/CAD and go long AUD/USD (I have a standing short on EUR/USD that I remain very reluctant to close out).

Be careful out there!

Full disclosure: long and short various currency pairs including the U.S. dollar