The economic data continue to worsen in Europe. While it is difficult to find signs of concern in U.S. markets, wariness is etched in a few key corners of financial markets.

Precious Signals

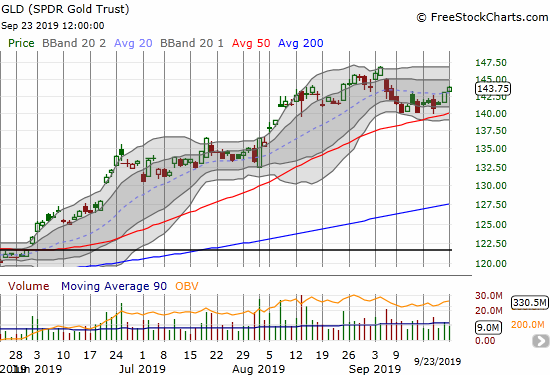

Notably, the precious metals gold and silver look ready for a fresh upward push. Gold and silver can perform well in times of worry, and both have soared in recent months. The SPDR Gold Trust (GLD) is up 18.6% year-to-date (compare to the S&P 500 (SPY) which is up 19.3% year-to-date). GLD experienced a major breakout starting in early June and barely paused until the most recent peak almost 3 weeks ago. Now GLD looks like it confirmed support for the next run-up.

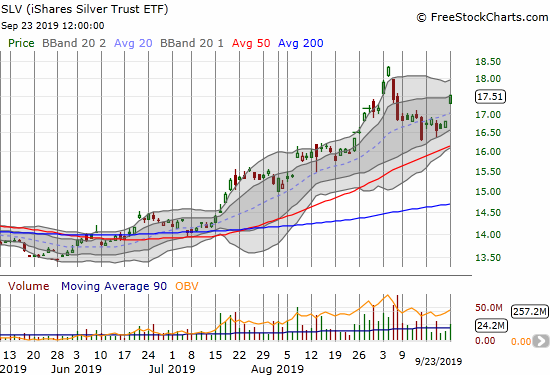

The setup for iShares Silver Trust ETF (SLV) looks even better. SLV gapped up for a 4.2% gain and suddenly looks ready to challenge its recent high. SLV is up 20.6% year-to-date.

Bond Signals

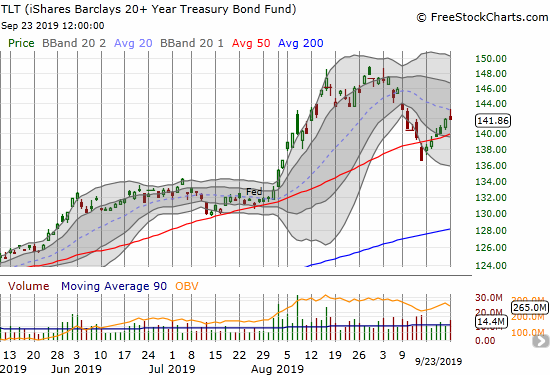

Lower bond yields can also signal investor concerns about the future. Although the iShares Barclays 20+ Year Treasury Bond Fund (TLT) pulled back on Monday to a flat close, this measure of long-term bond yields looks like it is recovering from the recent pullback and brief 50DMA breakdown.

Currency Concerns

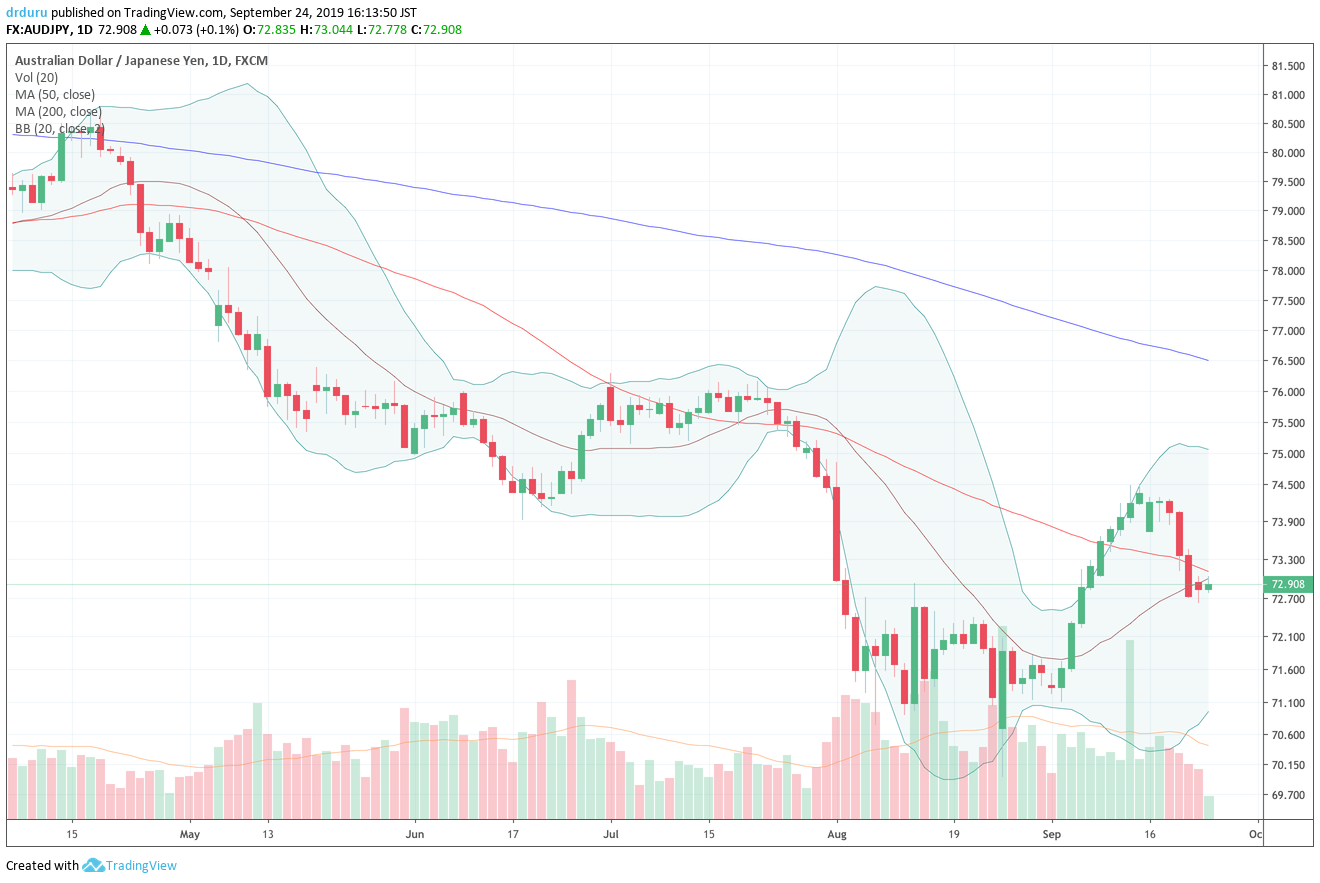

The currency market is also back to worrying in the form of a sagging Australian dollar versus the Japanese yen (AUD/JPY). After confirming the S&P 500’s recent breakout with its own overdue breakout above 50DMA resistance, AUD/JPY is sinking again. Last week, AUD/JPY fell back sharply into a fresh 50DMA breakdown. I like to watch AUD/JPY as a leading signal of risk appetites given how slow the stock market can be in responding to simmering catalysts.

Source: TradingView.com

The Trades

While none of these signals is dramatic enough to flip me bearish from my neutral short-term trading call, I am keen to trade the reviving uptrends in GLD, SLV, and TLT. I maintain core positions in GLD and SLV shares. On Monday, I belatedly started accumulating call options in SLV. I will continue buying if SLV dips up to a close of Monday’s gap up. I will also return to buying GLD call options. I bought call options in TLT on the 50DMA breakdown. I almost took profits on Monday but stayed my hand after noticing the concerning signals in AUD/JPY, GLD, and SLV.

Be careful out there!

Full disclosure: long GLD, long SLV shares and calls, long TLT calls, short AUD/JPY