The Good

When Lennar (LEN) reported earnings on June 25th, the stock market responded with the kind of hesitation and whiplash symbolic of the seasonal topping pattern in place for home builders. The first reaction was celebratory as LEN gapped upward and rallied as high 3.6%. The initial reporting on LEN earnings focused on all the positive parts of the Q2 earnings report. While revenues, deliveries, and new orders for the quarter were up slightly, margin gains really stood out. Some highlights from the earnings report compared to Q2 2018.:

- Net earnings +38%

- Deliveries +5%

- New orders +1% (although the value of new orders fell 4%)

- Revenues +2%

- Homebuilding operating margins +42.2%

- Gross margin up 3.3% points

- Operating margin on home sales up 3.4% points

The Bad

Things took a dramatic reversal in the middle of the conference call after LEN discussed some negatives. The new reporting on LEN’s earnings turned from the positives and focused on the negatives. Suddenly the market seemed to panic over a simple statement about average sales price. From the Seeking Alpha transcript of the conference call: “Our average sales price will continue to move lower going forward as many new entry-level communities come online. This is particularly the case in Texas, as all of our Texas markets in the last 18 months we bought over 75% of the land that’s targeted to entry-level product.” The increased share of lower-priced homes does not surprise me given the general housing market data. Moreover, LEN noted an impact from selling a lower share of higher-priced CalAtlantic homes.

An analyst question from the conference call laid bare the underlying wariness of investors (emphasis mine):

“So I’m going to go for the bigger picture question given the fact that your stock is selling off and I think there’s a big elephant in the room that no one’s addressing, which is the fear of recession and the yield curve is certainly telling us that. So people say to me, why in the world would I want to own a homebuilding stock late in the cycle with the risk of recession around the corner after 10 years of economic recovery.”

The analyst went on to claim that Lennar’s scale and size would be a tremendous disadvantage in a recession. The company has to take more and more risks to sustain existing performance and those risks will hurt in an economic downturn. LEN responded with the well-worn script describing an inventory-constrained housing market: “… there’s a need that is driving the housing market. And in our view and I’ve said this for some time, it presents somewhat of a floor for a downward limit on how constrained the market can get.”

Lennar management also expressed its confidence in the health of the economy and housing market. LEN also reassured the analyst that being the low-cost producer provides operational advantages. Moreover, Lennar is confident it could scale down its “machine” as needed to fit the economic environment.

LEN’s reassurances have yet to provide solace to the market…

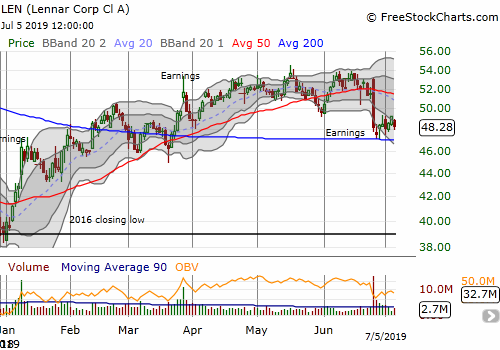

Source: FreeStockCharts

Fortunately for Lennar, its 200-day moving average (DMA) currently serves as price support. This critical trend line sits as the technical opportunity in the stock.

Guidance

LEN provided guidance during the conference call. Here are some key numbers compared to the third quarter 2018 results:

- New orders 12,500 to 12,800: +1.5% to +5.4%

- Deliveries 13,000 to 13,250 homes: +3.1% to +5.1%

- Average sales price $385,000 to $390,000: -7.2% to -6.0%

- Gross margin 20.25% to 20.5%: flat

- EPS $1.25 to $1.35: -8.8% to -1.5%

The drop in EPS sticks out more than the drop in average sales price.

Here are some key points from the annual guidance compared to full year 2018 (without removing results influenced by the Cal-Atlantic acquisition):

- Deliveries 50,500 and 51,000 homes: +10.7% to +11.8%

- Average sales price $400,000: -3.1%

- Gross margin: 20.5% to 21%: +0.9% to +1.4%

Guidance on full-year EPS growth was notably absent. If the third quarter is any indication, the full-year EPS growth will be small. Still, overall, neither the third quarter nor the full-year guidance concern me; the subsequent selling in LEN looks overdone.

Incentives

Given the increased importance of entry-level homes, incentives loom as a potentially larger issue. Several analysts asked about incentives. LEN noted the hit to gross margins in the second quarter as a part of their push to maintain their full-year home delivery guidance in the wake of the brief housing slowdown. The company expects incentives to decline going forward. LEN mentioned incentives on new orders went from 6.1% in Q4 to 5.7% in Q2 and 5.6% in Q2. The floor for incentives is about 3% given normal discounts on closing costs and other related costs.

Housing Demand

Lennar also provided interesting data points on housing demand:

- Housing markets continue to trend toward strengthening supported by lower mortgage rates and more affordable pricing: “…the market is generally continuing to improve, and we believe, will continue to improve for the foreseeable future.”

- The high end coastal markets, especially the San Francisco Bay Area and Orange County, are an exception partially because of reduced Chinese demand.

- Homes priced in the $400,000 to $600,000 range are selling well in Californian markets.

Costs

Margins look strong but underneath the covers Lennar provided some important points on costs, some encouraging, some concerning:

- Lower material costs: “This is the first time in years that the cost of materials has dropped as lower-cost lumber and synergies flow through our closings.”

- Lumber is about 13% of Lennar’s direct cost.

- Peak pricing was about $600 per thousand board feet in June, 2018.

- Lumber plunged to about $330 per thousand board feet in December, 2018 and hit $300 per thousand board feet in June, 2019 after a rally to $400 per thousand board feet.

- Tariffs on Chinese imports: “…average the impact to us is about $500 per home” (no, the Chinese are not paying all the tariffs!).

- Labor shortages: “The severity of the labor shortage in the construction industry is the strongest headwind that we face. Labor cost represent 43% of our direct spend and were up 2.8% sequentially in the second quarter and 7.7% year-over-year.”

- Land cost as a share of sales is going up. (This trend will squeeze affordability).

A New Strategy

Lennar introduced an interesting strategic twist which likely speaks volumes about the ceiling for home sales in the not so-distant future. Lennar is experimenting in Florida with a strategy to build homes for a third-party land owner who will in turn rent out the dwellings.

Conclusions: The Opportunity

After reviewing Lennar’s results, I think the post-earnings selling was overdone. The Q3 EPS guidance is definitely a sore point, but I think expectations were too high going into the quarter. According to Yahoo Finance, analysts going into earnings maintained ratings of 6 strong buys, 10 buys, and 3 holds. In July, analysts crowded into the hold category with 7 strong buys, 6 buys, and 9 holds. Ratings were last this bad in April, 2018 on the heels of the first big pullback in home builders in 2018 and in the wake of Lennar’s April earnings.

Valuation also supports some kind of floor on the stock. At just 1.0 price/book, LEN is already priced for a recession. Trailing price/earnings is 8.2 and the forward P/E is 8.3. Price/sales is only 0.7. The only thing missing from a picture of low expectations is that short interest is only 4.4% of the float!

I want to buy the stock if LEN remains at or around current prices going into its Q3 earnings report. By extension, home builders which sold off in sympathy with LEN’s earnings also represent a potential trading and/or investing opportunity.

I am also entertaining the use of LEN options for a short-term bet that 200DMA support will soon transition to a run at 50DMA resistance and a reversal of the post-earnings loss (a 6.4% gain from Friday’s close). My seasonal trading rules on home builders stand as my obstacles.

Be careful out there!

Full disclosure: no positions