I have finally jumped into the crypto-era. Bitcoin broke out into the first “convincing” and buyable technical pattern I have seen since the bubble burst over a year ago.

Breakout

Anyone who follows cryptocurrencies knows by now that Bitcoin (BTC/USD) broke out last week. The move was a powerful one that launched the cryptocurrency out of a months-long consolidation period and above resistance at its 200-day moving average (DMA). The cryptocurrency is currently trading back to November, 2018 levels. If this were a stock, I would buy it…so I bought it. I started with a small “no regret” position, and I am hoping for a chance to super-size the position on a test of what should be support at the 200DMA and/or the top of the previous consolidation range.

Source for charts: TradingView.com

Google Search Trends

The pattern in Google Trends sealed the deal for me. Bitcoin not only awakened from its price slumber, but also search interest reignited. The broad-based jump in search interest in “Bitcoin” confirmed the price action.

In previous posts, I have written about how a spike in search interest can signal the end of an extreme move in prices. Indeed, last November I claimed a small spike in Google search interest suggested a bottom could finally be in the works. That bottom is confirmed with last week’s breakout.

This latest case is different as the price action is not an extreme extension of an existing price move (trend). Instead, the price action is a distinct and abrupt change in price behavior. My hypothesis for this new case is that a spike in search interest confirms a strong change in price behavior.

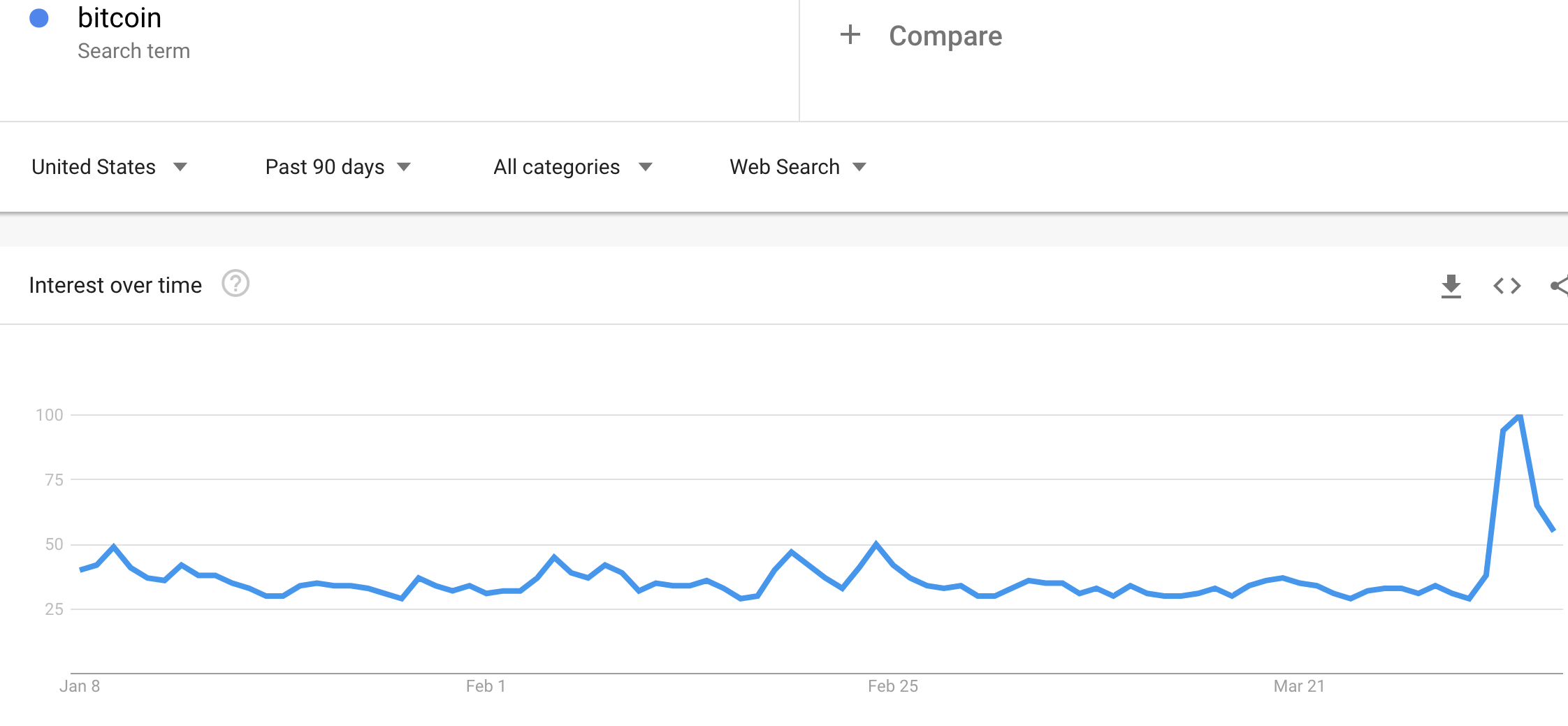

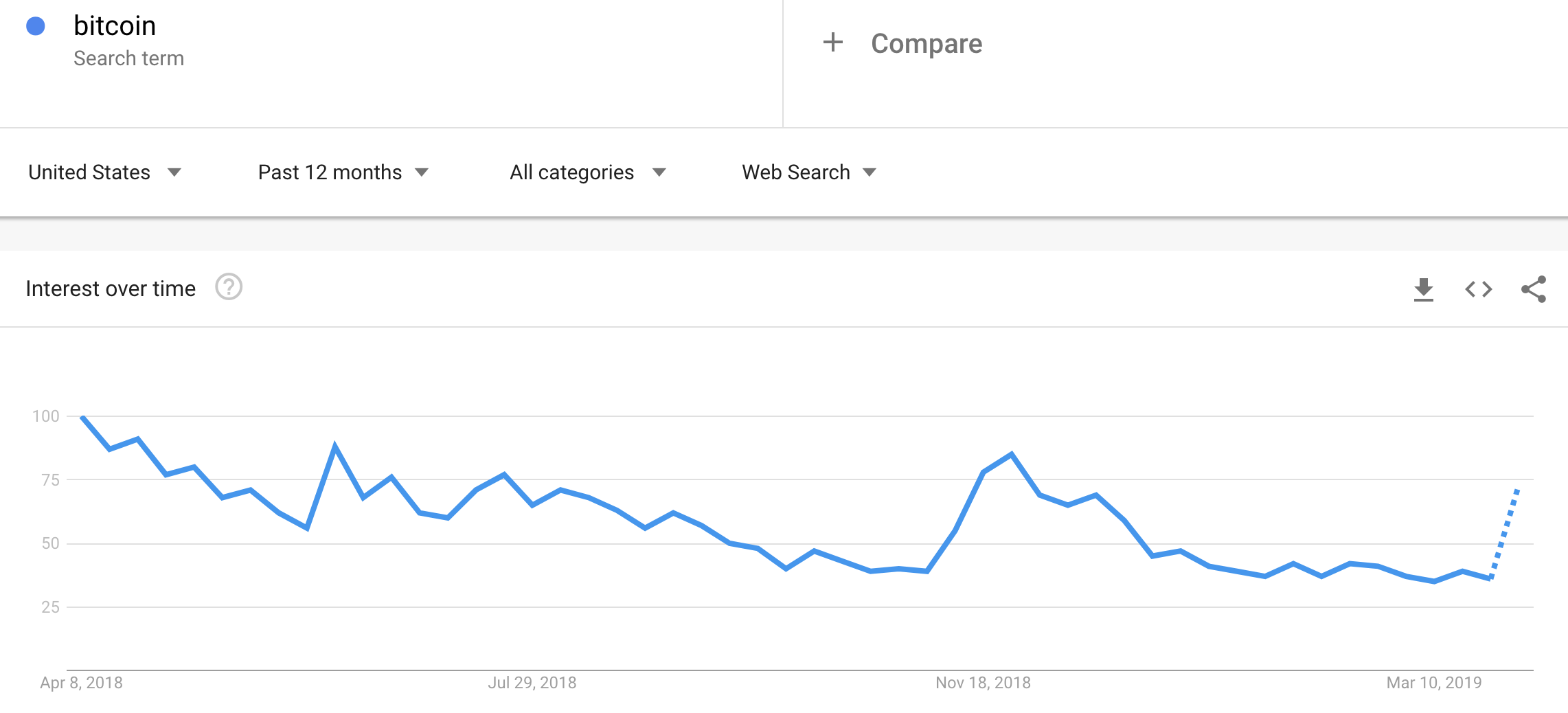

As a reminder, Google Trends provides an index of search activity relative to the chosen timeframe. The daily chart covering the past 90 days shows the spike is the largest amount of search interest in the term “Bitcoin” over the last 90 days. The 12-month chart shows Google’s estimate for the coming week based on the underlying daily data. Just like Bitcoin’s price, the estimated search interest returned to November, 2018 levels.

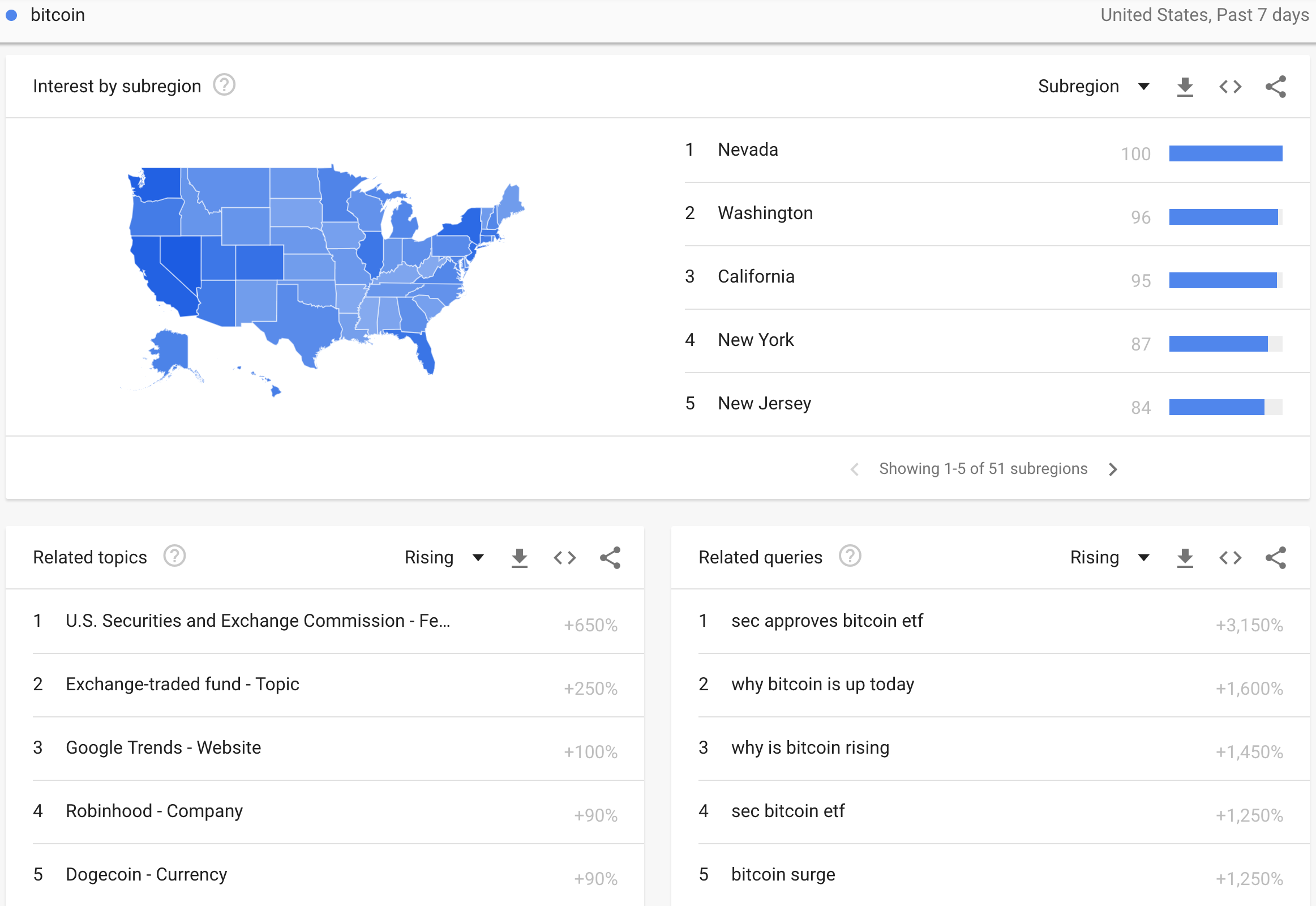

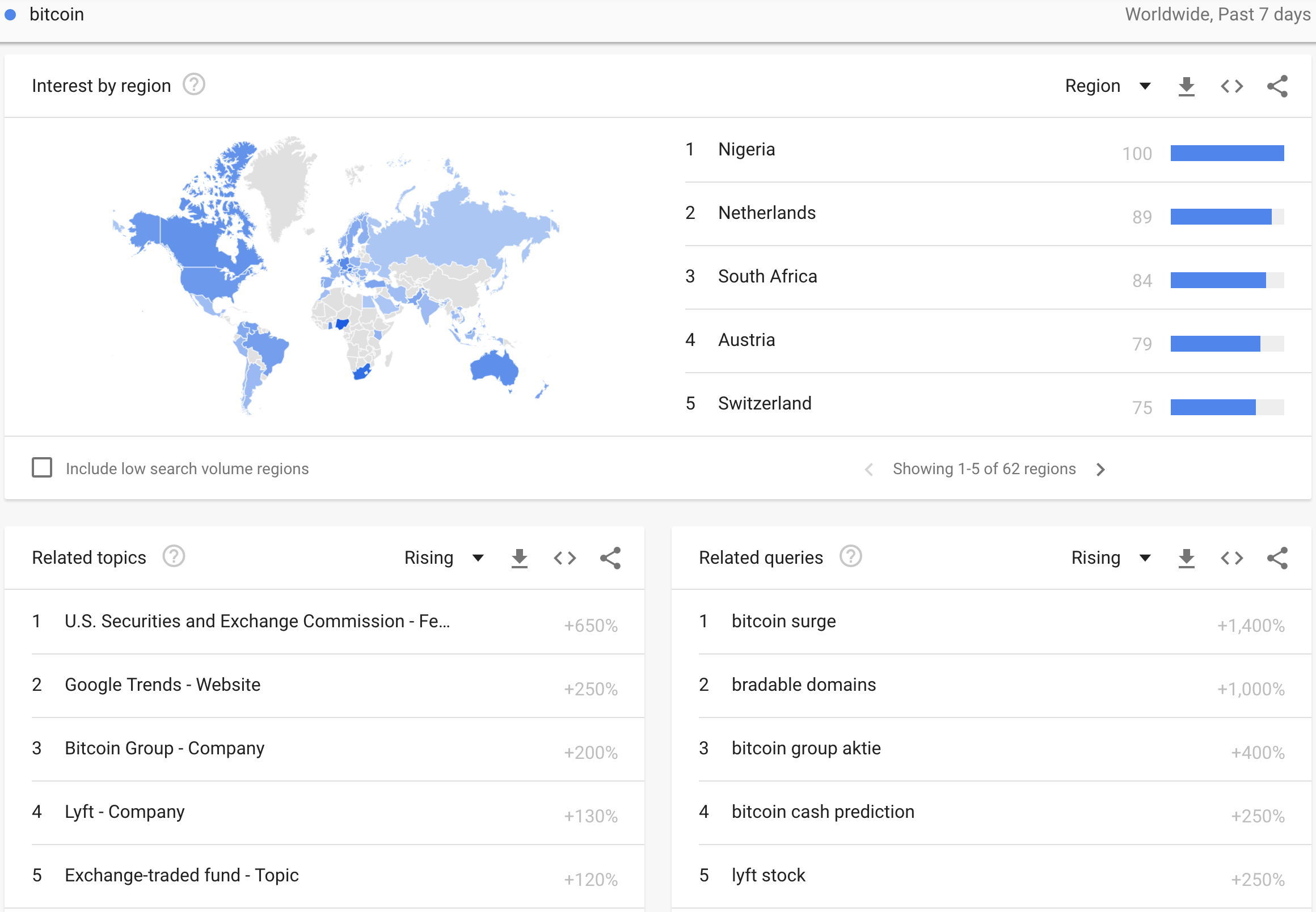

The following charts provide additional confirmation of search interest by zooming to the last 7 days. The highly populated states of California and New York are in the top 5 states ranked according to relative search interest. While the U.S. does not show up in the 5 countries (it is ranked #14 behind other English-speaking countries like Ghana, Australia, Canada, and even Singapore), Nigeria is top-ranked and has the world’s seventh highest population.

Source for trend charts: Google Trends

Searching for Drivers

With these kinds of technical evidence, the reason for the price move hardly matters to me in terms of justifying a speculative position in Bitcoin. Still, I turned to CNBC’s Fast Money to check on what might be considered the conventional wisdom explaining the price action. Much to my surprise, there was no specific event that CNBC’s Brian Kelly provided to explain the move. He even threw cold water on the rumor that the SEC was about to approve a Bitcoin ETF. Instead, he drew on the “usual suspects” of improving sentiment, increased institutional interest, and major brokerages with custody solutions. He once again declared the bottom for Bitcoin, but this time I agree with him!

Kelly also drew up a very modest price target of $6000 for this move. This subdued enthusiasm is a marked contrast to earlier episodes of excitement over squiggles in the price of Bitcoin. I hope the modesty is another sign that the froth in the market has largely evaporated. Kelly claimed that Bitcoin would be “overvalued” at $6500 or $6800 (no details provided).

CNBC also posted Kelly’s interviewon its website….

Bitcoin bull says digital currency’s surge above $5,000 could just be the beginning from CNBC.

CNBC’s Fast Money even trotted out the Bitcoin “bug” again. Fast Money has largely avoided cryptocurrency topics this year (thank goodness). Going forward, I think the amount of fresh Fast Money interest in cryptocurrency, Bitcoin in particular, will be highly correlated to the amount of fresh froth in the market.

Be careful out there!

Full disclosure: long BTC/USD

Fascinating!