AT40 = 39.5% of stocks are trading above their respective 40-day moving averages (DMAs)

AT200 = 50.4% of stocks are trading above their respective 200DMAs

VIX = 12.0

Short-term Trading Call: bullish

Commentary

Urban Outfitters (URBN) notwithstanding with its 19.5% after hours surge, Tuesday, August 15, 2017 was a signature day for the weakness engulfing retailing stocks. Despite my short-term bullish call for the S&P 500 and general stock market, I am devoting most of this Above the 40 post to the on-going ugliness that is retail.

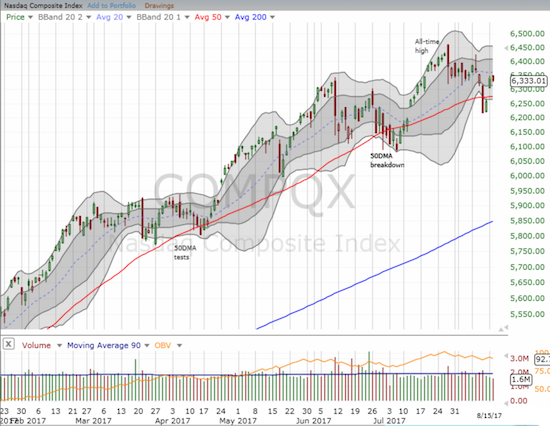

Today was a “day of rest” from Monday’s fantastic and bullish rally. The S&P 500 (SPY) tried to rally but ended the day essentially flat – ditto with the tech-laden NASDAQ. The PowerShares QQQ Trust (QQQ) managed to end up on the green side of flat largely thanks to the 1.1% rally in Apple (AAPL) (I took this opportunity to lock in profits on my AAPL call options).

The volatility index gapped down but managed to hold onto its declining 200-day moving average (DMA). Still, the implosion from last week’s spike continued.

AT40 (T2108), the percentage of stocks trading above their respective 40DMAs, confirmed the day of rest with its own pullback from 42.5% to 39.6%. AT200 (T2107), the percentage of stocks trading above their respective 200DMAs, closed at 50.4% which was below the previous 2017 low from May. So there remains a lingering longer-term concern emanting from this indicator.

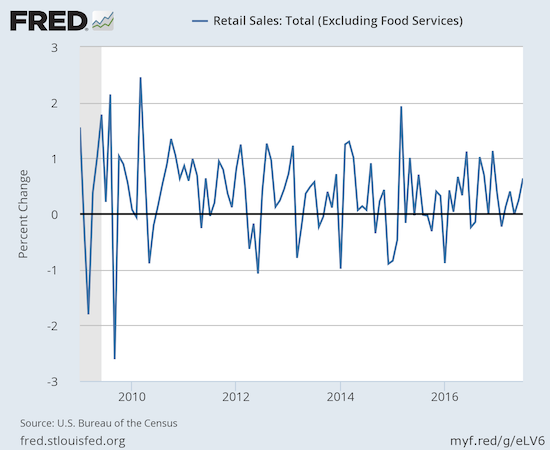

Moving on to the big story of the day (for me), the SPDR S&P Retail ETF (XRT) dropped 2.7% to set a new 18-month low. Traders can be forgiven for missing the headline that retail sales jumped in July by the largest monthly percentage since the days of Christmas cheer.

Source: U.S. Bureau of the Census, Retail Sales: Total (Excluding Food Services) [RSXFS], retrieved from FRED, Federal Reserve Bank of St. Louis; August 15, 2017.

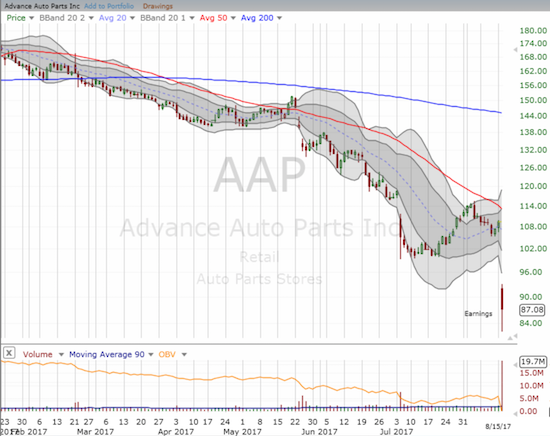

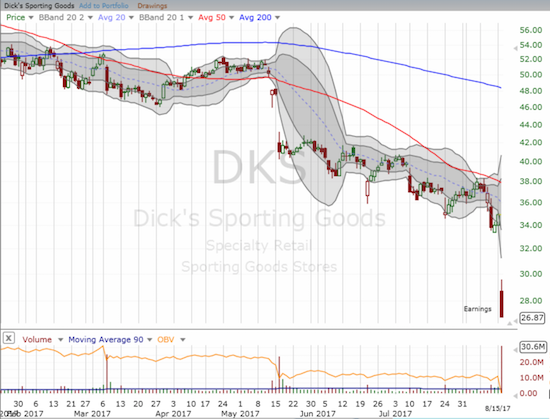

The carnage in retail was widespread, starting with key names that reported earnings: Advanced Auto Parts (AAP) with a nasty 20.3% drop and a near 4-year closing low, Coach (COH) with a 15.2% decline that punctured 200DMA support, and Dick’s Sporting Goods (DKS) rounded out the disaster trio with a whopping 23.0% plunge that ended at the low of the day and a fresh SEVEN year low. Ouch. (Note I speculated on COH by first flipping shares for a small intraday profit and then ended the day with call options to play 200DMA support).

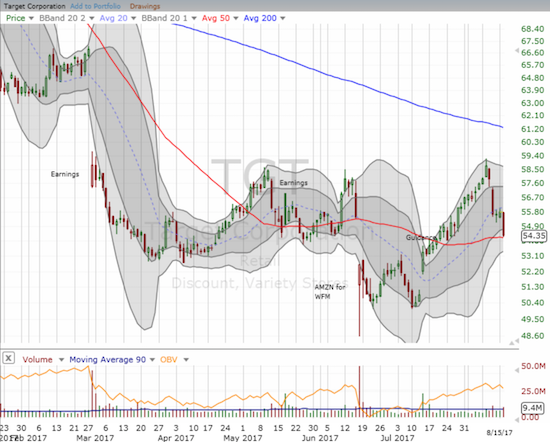

Target (TGT)

TGT took it on the chin for a 2.6% loss and a tempting test of its 50DMA. I recently bought shares for a longer-term play, but I like doing another short-term round of call options around these levels.

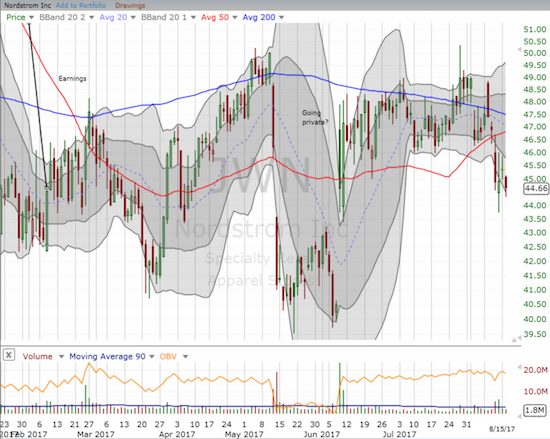

Nordstrom (JWN)

I am surprised JWN has made no progress since news about the likelihood of the company going private. In last week’s sell-off, I looked the stock up and started a new position on the dip. There should be at least 10% potential upside from current levels just measuring the current trading range.

Ulta Beauty (ULTA)

Regular readers know that I have been eyeing ULTA ever since it broke down below 200DMA support. Today’s 4.4% plunge broke the recent logjam and further confirmed the bearish turn of events for this former momentum stock. Again, ULTA has all the characteristics of a stock where big players are trying their best to abandon ship in an orderly fashion. I was positioned to keep playing the recent tight range from the bearish side and sold my latest put option on Monday for minimal profit. I clearly regret that I let Monday’s stock market rally dissuade me from continuing to hold onto the put option.

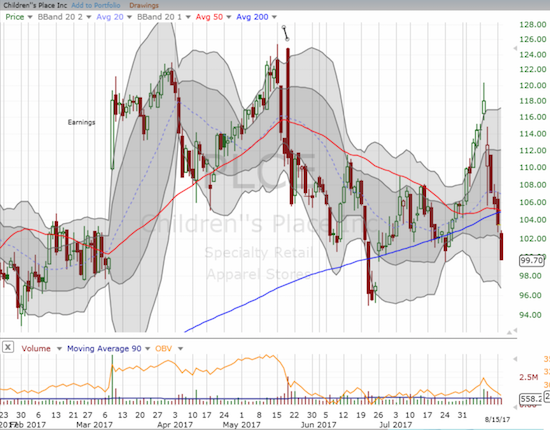

Children’s Place (PLCE)

PLCE is one of the few apparel retailers that continues to pump out strong results. The stock is doing its best to pivot around an uptrending 200DMA. However, Monday’s severe under-performance along with a combined 50/200 DMA breakdown is a big red flag. I want to buy this dip, but the technicals are waving me off. I want to see a close above the moving averages before I consider it. I do not want to short PLCE given I think the business remains quite strong…granted a short interest that is 32% of float suggests a much different conclusion!

Domino’s Pizza (DPZ)

I am glad I took profits when I did. DPZ has pulled back since I sold. The stock looks ready for another test of 200DMA support. I am ready to buy again, but I will exercise a little more patience as it is very possible now that DPZ is in the middle of a major breakdown: the stock is still in the middle of post-earnings weakness.

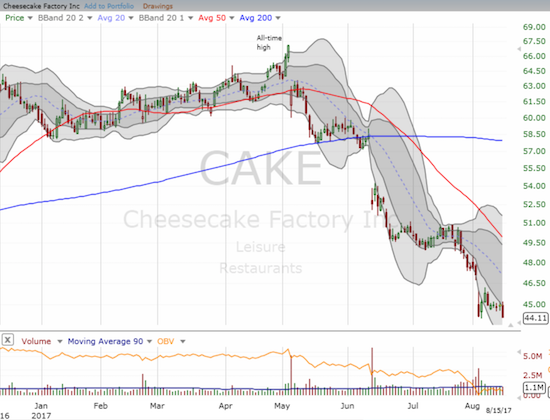

Cheesecake Factory (CAKE)

I used to love Cheesecake Factory “back in the day.” I have made it there just twice in the last year and both times I have been astounded by the sheer number of options on the menu. Clearly, the abundance of options and delicious desserts are somehow insufficient these days. CAKE the stock is down sharply from the all-time high just three months ago. Today it closed at a fresh near 3-year low. Shorts are eating their cake on this one to the tune of 18% of float.

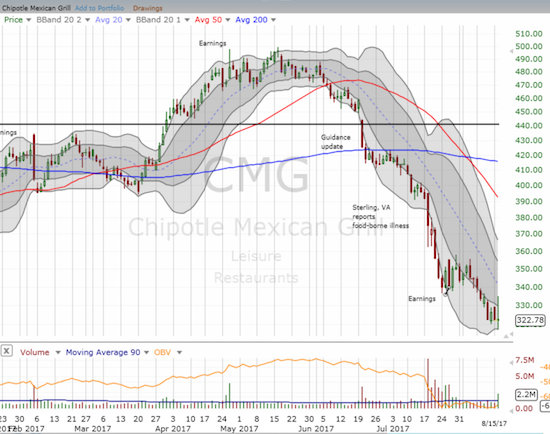

Chipotle Mexican Grill (CMG)

CMG has suffered mightily for a while now. In today’s trading, “something” dramatic happened. Sellers took early control only to be overrun starting right at 10am (Eastern). However, when buyers went to lunch, they apparently never returned. CMG ended the day flat. The 5-minute chart shows the intraday drama, and the daily chart shows the resulting stalemate in high relief. I typically think of such moves as a turning point where the last of the panicked sellers finally shake out. Yet, the buyers were not very convincing. Still, I jumped aboard soon after the dramatic turn-around. Time will soon tell whether I am next to get shaken out! Continuing the theme: shorts are 17.9% of CMG’s float.

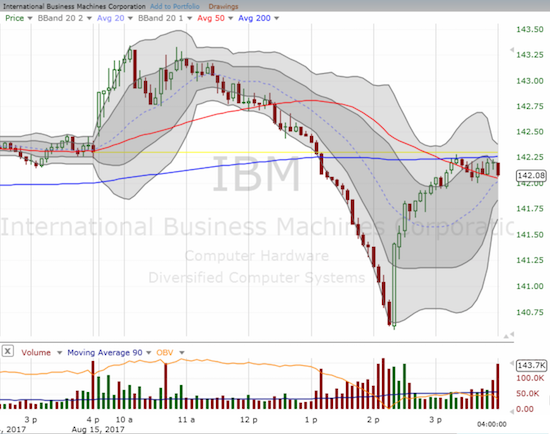

International Business Machines (IBM)

IBM also had a dramatic bear/bull intraday battle. Unlike CMG, the buyers made a lasting statement and had the last word on the day. A Bollinger Band (BB) squeeze is even developing around the stock. Unlike CMG, I was betting on a continuation of the breakdown. I became emboldened after Warren Buffet started to capitulate on his position back in May. I will quickly switch to a buyer if IBM makes more progress from here.

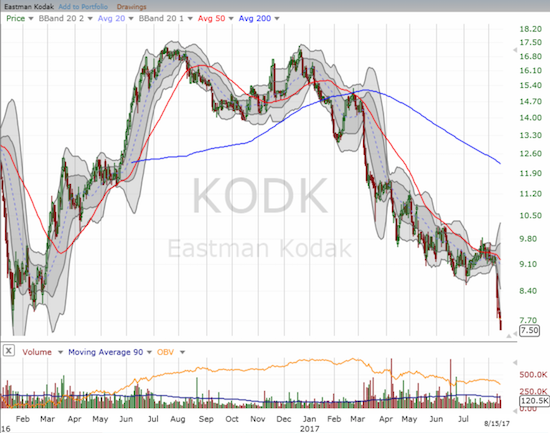

Eastman Kodak (KODK)

I was rooting for KODK after it emerged from bankruptcy and started trading again almost 4 years ago. Back in 2012, the original stock was one of my biggest “bankruptcy scare” trades ever. The celebration did not last long as the stock proceeded to go into a fresh tailspin starting in early 2014. A relief rally in 2016 broke the gloom, but KODK hit a new all-time closing low today. I want to believe there is value here, but I do not dare reach out for the falling knife at this point. I will continue watching for now.

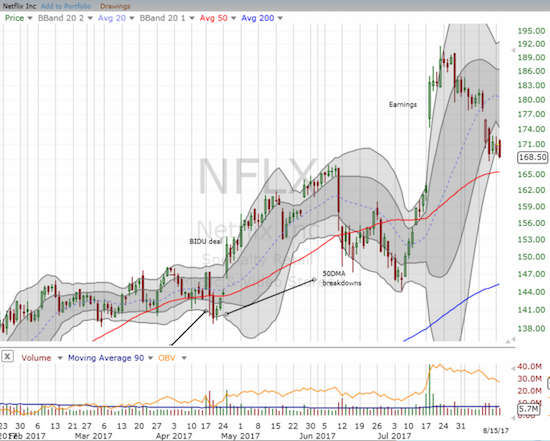

Netflix (NFLX)

The Barron’s effect is surprisingly still weighing on NFLX. I speculated further on an eventual rebound and doubled down on my call options. The 50DMA still sits there waiting to offer support. NFLX once again under-performed the usual suspects.

AMC Entertainment Holdings (AMC)

The bottom did not hold on AMC as I had hoped. The bounce only lasted three trading days. Now I will patiently wait for buyers to show interest again before acquiring a second tranche of shares. The hurdle is high given shorts have consumed 19% of AMC’s float.

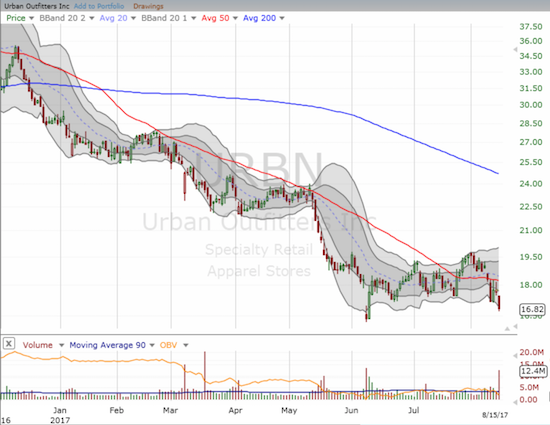

Urban Outfitters (URBN)

Finally, the next great hope for retail: URBN. URBN reported earnings that the market in after hours loved. Ahead of those earnings, URBN suffered along with the entire retail space with a high-volume 5.1% decline toward 2017’s low.

Here is silver for one last trading note. I jumped back into call options on iShares Silver Trust (SLV). My rationale remains the same for the last trade. Here, I am playing a test of converged support at the 20 and 50DMAs.

— – —

FOLLOW Dr. Duru’s commentary on financial markets via email, StockTwits, Twitter, and even Instagram!

“Above the 40” uses the percentage of stocks trading above their respective 40-day moving averages (DMAs) to assess the technical health of the stock market and to identify extremes in market sentiment that are likely to reverse. Abbreviated as AT40, Above the 40 is an alternative label for “T2108” which was created by Worden. Learn more about T2108 on my T2108 Resource Page. AT200, or T2107, measures the percentage of stocks trading above their respective 200DMAs.

Active AT40 (T2108) periods: Day #377 over 20%, Day #191 over 30%, Day #1 over 40% (overperiod ending 2 days under 40%), Day #8 under 50% (underperiod), Day #14 under 60%, Day #137 under 70%

Daily AT40 (T2108)

Black line: AT40 (T2108) (% measured on the right)

Red line: Overbought threshold (70%); Blue line: Oversold threshold (20%)

Weekly AT40 (T2108)

*All charts created using freestockcharts.com unless otherwise stated

The charts above are my LATEST updates independent of the date of this given AT40 post. For my latest AT40 post click here.

Related links:

The T2108 Resource Page

You can follow real-time T2108 commentary on twitter using the #T2108 or #AT40 hashtags. T2108-related trades and other trades are occasionally posted on twitter using the #120trade hashtag.

Be careful out there!

Full disclosure: long AMC, long CMG shares and call, long COH calls, long IBM put spread, long JWN, long SLV shares and calls, long NFLX calls

*Charting notes: FreeStockCharts.com uses midnight U.S. Eastern time as the close for currencies.

Hey DD, any thoughts on NIB/cocoa lately. It looks like a very weak bottom. Either it could form a saucer type pattern or more likely fall though to explore further lows. I am getting my powder ready though and looking to pulll the trigger, hopefully not before it dumps

I JUST happened to publish an article on SA on cocoa: https://seekingalpha.com/article/4099737-cocoa-prices-weaken-anew-early-hints-main-growing-season

Hey, that is a coincidence. Great article, it doesn’t seem to tag into NIB and Choc though so people may have trouble finding it. I might buy a little here with a starter position. It may have found a floor but price bouncing along the bottom of the floor for so long makes me wonder if it has one further puke up before a bottom. What do your think of the Ghanaian government price scheme ? What are the chances of them going broke and how long will it take ? What is causing the widespread weakness in softs ?

DD, I did some very superficial research, as I have not traded softs before. From what I can gather the weakness in softs is due mainly to weather patterns and globally, weather that has been supportive for bumper crops for 3 years in a row ?

Other than NIB, CHOC, CORN etc, basically ETF’s that trade off holdings in futures, do you know of any stocks that deal in this area. I looked up Dreer (DE), but that is nowhere near the bottom of the range in the last 10 years. I was looking for something like CHK when natural gas was at a 20 year low, 2 years ago – a stock with very asymetric optionality basically- that has a good chance of surviving if prices bottom in the next 3 years, that has been completely sold down and has reasonable prospects of increasing 300-500% in the event of a rally in the underlying of 50%. CHK was a 10 bagger from the bottoms. I can’t see anything like that with cocoa. And barring that, perhaps the best play would be to buy into the one of the ETF’s. The whole sector is due for mean reversion at some stage, but has not got any clear signs of bottoming.

The problem with the ETF’s is the futures roll and negative contango. CHOC seems very illiquid. I think I would look at NIB. DBA is actually probably more attractive as a more diversified bet and probably as much upside and similar downside as NIB from what I can see. The downside being about a further 20% drop from current in a very bad case scenario. DBA also appears to be one of the more liquid Ag ETF’s.

The technicals are not encouraging, but as you have mentioned, most of the bad news is possibly in the price of Ags, except perhaps an even more bumper season this year than projected by WADS. That being said, if there is dissapointment in crop or weather expectations, that could fire a very strong rally. I am tempted to buy here a starter position for a long term holding, say 2-3 years. But I am looking for the best vehicle I can find for that.

Any thoughts. Presumably, you had thought the same a year ago, but given up on that idea after lower lows ? I may end doing the same, so am cautious to take my time to pull the trigger. What would be nice is a clear capitulation bottom. A bumper crop might do that presumably.

The widespread weakness in softs is baffling me. I think it could more of a trading thing than a fundamental thing. A large enough number of traders have just decided to be bearish.

I still like to think of NIB/cocoa as bouncing along in a trading range. Perspective can be bouncing along the bottom or banging against the top. 🙂

Thanks for pointing out that SA did not tag the article properly. I really dislike posting there anymore as their distribution model no longer works enough for me to bother. But every now and then I post because I know a good number of people have no idea (or no interest?) in checking out these same articles on my blog. oh well!

Thanks for doing the research. I had no idea there was a global weather pattern supporting bumper crops. That has to be an oddity and climate change is not supposed to support farming worldwide.

The only other thing I can think of in the ag economy to look at is potash stocks. They have been hammered pretty good now: MOS, POT, IPI. Let me know what you think. Not 10-baggers though.

I did indeed think that cocoa and corn were bottoming last year. I gave up on CORN and changed my strategy recently to try to play a trade range. And, as you noted, I look at CORN as now an option on some kind of adverse climate/weather event that throws bumper crop projections for a loop. Can imagine the massive short-covering what would ensue?!

The ETNs are awful with the futures roll, but CORN tries its best to minimize the loss. For those of us who don’t want to dabble in futures, ETNs are really the only true choice.

DD, thanks for reminding me about POT. That is a blast from the past. The last time I looked at POT was when BHP had bought into Potash deposits in Canada at the peak of the cycle. This reminded me of their hot briquette investment which they eventually closed in 2005, just before the big climatic move in resources. I think BHP have decided to shelve the Potash mine further expansion for now. Hard to say if this is a the contrarian sign of the bottom. Maybe it is just the start of the eventual capitulation. They are still positive about Potash potential by the sounds of it.

Potash stocks and particularly MOS, I will watch but probably not at the stage of being safe to buy long term from what I am comfortable with. DBA, I do feel comfortable buying a position in that probably next week. The downside in the next 2 years in a bad case scenario is from my guess 20% further and upside probably 50%. I think I will scale in and buy 1/3 here, 1/3 on a further 20% decline and another 1/3 when the turn is clearly occurred.

Fertiliser stocks could be a good punt if a final stage of liquidation selling occurs. Thanks for pointing it out.

Let me know when you get around to buying fertilizer stocks! I like the idea of scaling into DBA.