AT40 = 52.8% of stocks are trading above their respective 40-day moving averages (DMAs)

AT200 = 56.3% of stocks are trading above their respective 200DMAs

VIX = 10.9 (volatility index)

Short-term Trading Call: cautiously bullish

Commentary

The Fed hikes short-term rates, and long-term rates go down. This relationship is not the expected one but is the consistent one. Last year, the iShares 20+ Year Treasury Bond (TLT) reached an all-time high after the Fed started its tightening cycle in December, 2015. Tuesday’s gap up confirmed TLT’s 200DMA breakout and could well be a fresh warm-up for a 2016-like run-up. It is time for me to get long again.

Of course, when TLT began its run-up in early 2016, it accompanied a steep plunge in the stock market as worries ran rampant that the bond ghouls were correctly anticipating some kind of economic calamity. While the underpinnings of the market still look good, I think it is wise to put the S&P 500 (SPY) “on notice.”

During Monday’s rally I took profits up on a few long positions, including my Apple (AAPL) call options. I decided to hold onto my QQQ call options. While I of course regretted that decision, I held the course and doubled down. Yet, with long-term rates tumbling and the Japanese yen (FXY) strengthening all over again (with a particular eye on a sell-off in AUD/JPY), I married that purchase with a double down on my call options on ProShares Ultra VIX Short-Term Futures (UVXY). I am basically banking on QQQ or UVXY soaring at least one more time this week.

AT40 (T2108), the percentage of stocks trading above their respective 40-day moving averages (DMAs), lost enough to go negative for the week and close at a near 2-week low. This pullback indicated some strong undertow in trading. Retail and energy were certainly two sectors whose broad-based losses likely contributed to the heaviness.

With Tuesday’s loss. crude oil completed a 20% loss from its last high. This move technically pushed oil into a bear market. The last time crude oil cross this bearish threshold, it promptly rallied. I have my finger on the trigger in preparation for a relief rally.

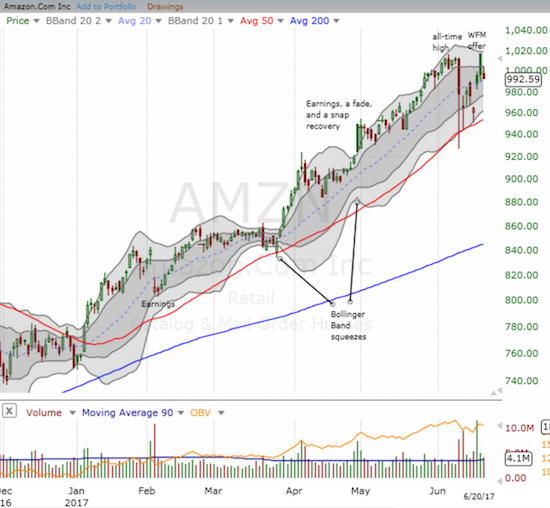

Retail was hit by fresh headlines from Amazon.com (AMZN). The company’s plan to offer more innovations in the process of buying clothes spooked investors across the sector. Unlike Friday’s moves, AMZN’s giant sucking sound did produce gains although the stock did initially gap up.

If the market resumes its sprint this week, I expect AMZN to benefit. So I took advantage of this pullback to finally speculate on a call option.

In early May, I took fresh note of Chipotle Mexican Grill (CMG) as the market’s reaction to earnings seemed to confirm an on-going rally in the shares. Fast forward to today: CMG has confirmed a 50DMA breakdown with a severe gap down that finished a reversal of late March’s breakout and tested 200DMA support. The catalyst was an update on guidance that I would have interpreted as a small “tweak” if I had not seen the market’s severe reaction and CMG’s subsequent 7.3% loss. Although the entire market is likely staring at that 200DMA support line, I decided to trigger my “buy the dip” trade on CMG one more time with a short-term call option. Note that CMG is well over-extended below its lower-Bollinger Band (BB).

Finally, iShares MSCI Brazil Capped (EWZ) is back on my radar. The plunge in EWZ a month ago inspired me to trigger my buying rule for the ETF. EWZ’s sharp rally the following trading day contributed to what I called at the time the “Nut Job Stock Market.” EWZ lost 4.3% and looks ready to re-challenge the lows from May. With EWZ closing below its lower-BB, I am preparing to take another swing at the ETF.

Be careful out there!

— – —

FOLLOW Dr. Duru’s commentary on financial markets via email, StockTwits, Twitter, and even Instagram!

“Above the 40” uses the percentage of stocks trading above their respective 40-day moving averages (DMAs) to assess the technical health of the stock market and to identify extremes in market sentiment that are likely to reverse. Abbreviated as AT40, Above the 40 is an alternative label for “T2108” which was created by Worden. Learn more about T2108 on my T2108 Resource Page. AT200, or T2107, measures the percentage of stocks trading above their respective 200DMAs.

Active AT40 (T2108) periods: Day #339 over 20%, Day #153 over 30%, Day #20 over 40%, Day #7 over 50% (overperiod), Day #2 under 60% (underperiod), Day #99 under 70% (corrected from June 9, 2017 post by doing complete recount!)

Daily AT40 (T2108)

Black line: AT40 (T2108) (% measured on the right)

Red line: Overbought threshold (70%); Blue line: Oversold threshold (20%)

Weekly AT40 (T2108)

*All charts created using freestockcharts.com unless otherwise stated

The charts above are my LATEST updates independent of the date of this given AT40 post. For my latest AT40 post click here.

Related links:

The T2108 Resource Page

You can follow real-time T2108 commentary on twitter using the #T2108 or #AT40 hashtags. T2108-related trades and other trades are occasionally posted on twitter using the #120trade hashtag.

Be careful out there!

Full disclosure: long QQQ call options, short USO put options, long AMZN and XLE call options

*Charting notes: FreeStockCharts.com uses midnight U.S. Eastern time as the close for currencies.