(This is an excerpt from a LONG overdue article on commodities I originally published on Seeking Alpha on April 18, 2016. Click here to read the entire piece.)

Last week was a great week for a pairs trade in iron ore.

I love this trade => Oil, Iron Ore & Gold Correlation: A Mining Pair Trade. https://t.co/dMqugRMyCd via @barronsonline $RIO $BHP $USO

— Dr. Duru (@DrDuru) April 7, 2016

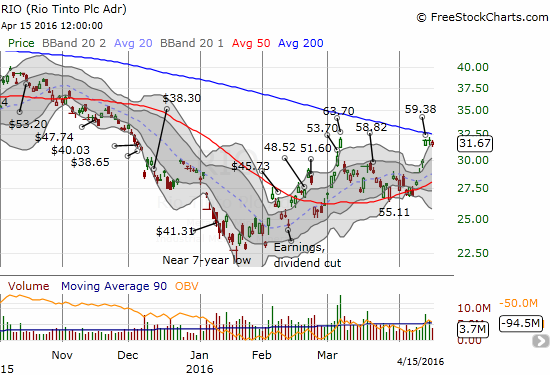

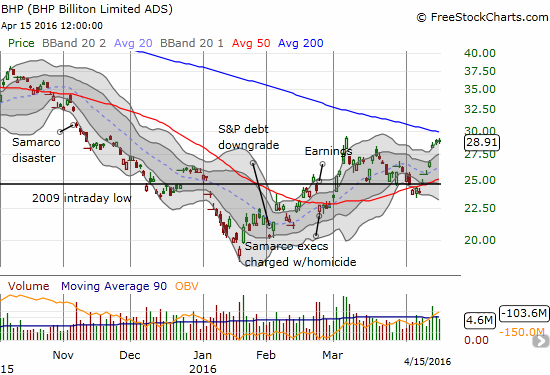

An article from Barron’s titled “Oil, Iron Ore & Gold Correlation: A Mining Pair Trade” caught my immediate attention when it was published on April 7, 2016. The article extensively quoted an analysis from Bernstein that proposed a pairs trade on iron ore versus oil using Rio Tinto (RIO) on the long side and BHP Billiton (BHP) on the short side. The analyst used a simple, but, in my opinion, brilliant concept to play a divergence in analyst commodity price projections and the historical correlation between these prices. At the time of the article, analyst consensus for oil prices and iron ore were extremely bullish in favor of oil. The expectations implied a substantial deviation from historical correlations.

{snip}

Regardless, I like the trading concept even if all the mechanical details are not readily apparent. {snip}

{snip}

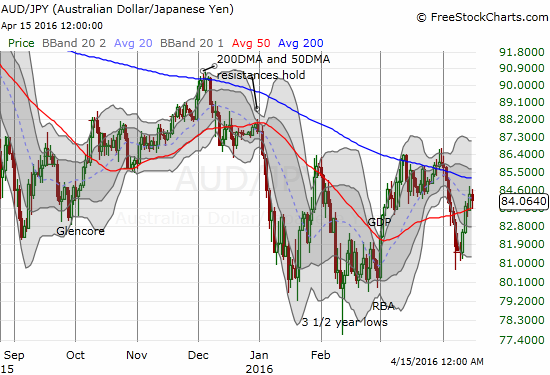

Source: FreeStockCharts.com

{snip} My biggest lesson came from positioning the pairs trade using options – my preferred method.

For my first swing at this pairs trade, I started by going long RIO call options. I scaled into a BHP short position as the rally progressed. {snip}

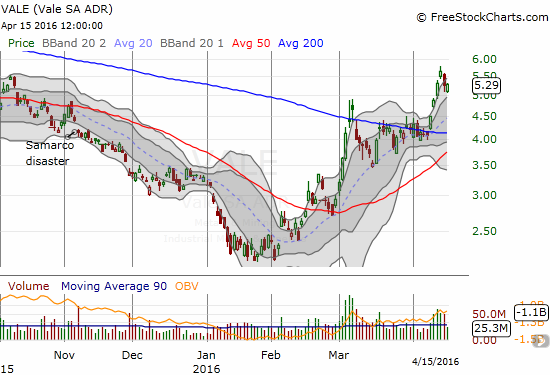

I will hold the short side of BHP until/unless the stock breaks resistance the way CLF and VALE have already accomplished. I plan to buy the dips on RIO as long as I am holding the BHP short position. {snip}

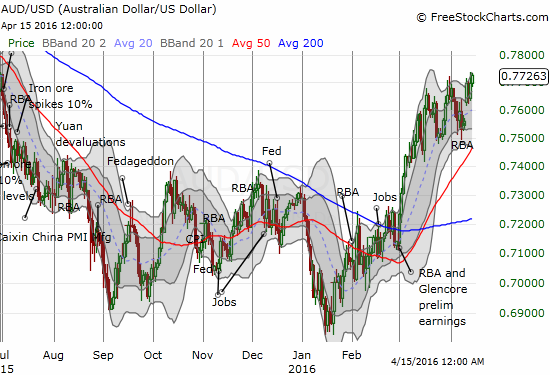

The abiding and persistent strength in the Australian dollar (FXA) motivated me to trade aggressively on the long side to this pairs trade. {snip}

Source: FreeStockCharts.com

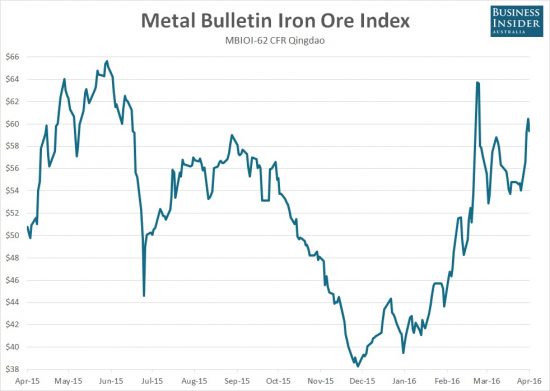

Source: Business Insider Australia

(According to Business Insider Australia, the spot price of iron ore is up 36.3% year-to-date.)

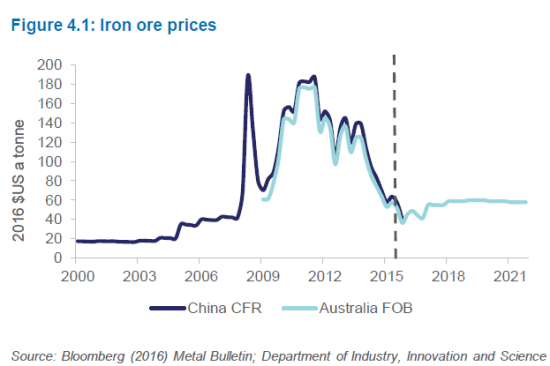

While I do not follow oil forecasts much – oil is a heavily manipulated market where everyone seems to take turns being very wrong in their forecasts, I do follow iron ore commentary very closely. Iron ore’s lasting bear market has definitely taken its toll on market participants. {snip}

Source: Australian Government, Department of Industry, Innovation and Science – Office of the Chief Economist

On April 14th, Bloomberg published comments from Rio Tinto’s CEO Sam Walsh that reiterated his sober near-term expectations for iron ore:

{snip}

The Bloomberg article included a reminder of the collective bearish expectations of analysts:

{snip}

It is one thing to be bearish while prices are in freefall but it is REALLY bearish when market participants do not take the bait of rising prices to end their bearish growling. {snip}

Increasing financialization is one reason iron ore should continue to be more volatile than real business and market conditions. {snip}

Finally, the next big test of the BHP/RIO pairs trade should occur this week. {snip}

Be careful out there!

Full disclosure: short BHP shares, long BHP call options, short AUD/JPY, short USO put and call options, long USO call options

(This is an excerpt from an article I originally published on Seeking Alpha on April 18, 2016. Click here to read the entire piece.)

Here are other analyst expectations from a recent article in the Sydney Morning Herald:

McKinsey & Co said last week iron ore would trade between $US45 and $US50 a tonne this year.

Goldman Sachs was even more bearish, forecasting iron ore to end the year about $US35 a tonne.

Citi forecast an average price of $US38 for 2016 and $US35 for 2017 and 2018.

Read more: http://www.smh.com.au/business/mining/chinas-sudden-steel-boom-could-be-bad-news-for-miners-20160417-go883s.html#ixzz46CJ504bR

Follow us: @smh on Twitter | sydneymorningherald on Facebook