(This is an excerpt from an article I originally published on Seeking Alpha on April 11, 2016. Click here to read the entire piece.)

The Japanese yen (FXY) rang in the new year with loud alarm bells. At the time, I wrote about the implications for the surge of strength in “The Japanese Yen Flashes Red for 2016.” The S&P 500 (SPY) continued a steep sell-off from there that did not end until the last oversold period bottomed out in mid-February. The whole episode was another reminder of the inverse relationship between the yen and the stock market. However, the yen is now even stronger than it was to start the year while the S&P 500 has managed an impressive rally off its February lows. {snip}

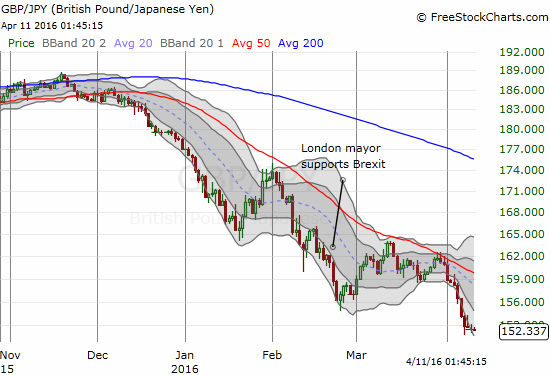

Source: FreeStockCharts.com

Yet, even with the presumed inverse correlation failing over a longer timeframe, Bloomberg was able to note a significant inverse relationship in a recent one-paragraph article:

{snip}

So what gives?

Well, basically both the timeframe and the cross-section of data matter when understanding the yen’s relationship with U.S. stocks.

Bloomberg’s observation definitely holds in the data (uploaded here for those who want to review for themselves). {snip}

Given the rarity of big FXY up days, one can imagine how the S&P 500 can still manage to rally enough over time to work off the otherwise inverse relationship. {snip}

With the Japanese yen capturing so much attention, I expected speculators to accumulate larger and larger bullish positions in favor of the yen. {snip}

Source: Oanda’s CFTC’s Commitments of Traders

{snip}

While speculators are not scooping up ever-increasing bullish positions, Japanese citizens are apparently hoarding cash. {snip}

Source: FreeStockCharts.com

Be careful out there!

Full disclosure: long USD/JPY, short AUD/JPY, short GBP/JPY

(This is an excerpt from an article I originally published on Seeking Alpha on April 11, 2016. Click here to read the entire piece.)