The Bank of Canada released its latest decision on monetary policy a week ago on April 13, 2016 and left its target rate at 1/2% again. According to the Bank of Canada (BoC), the government’s fiscal policy saved the day for the Canadian economy. Global growth is slowing. The strength in the Canadian dollar (FXC) promises to erode the benefits from past depreciation. The U.S. economy is not quite delivering as the BoC had hoped. Investment cuts by Canadian oil businesses will be even worse than projected in January even with the recent recovery in oil prices. Yet, the positives of an accommodating fiscal policy promise to outweigh the negatives of the macroeconomic headwinds. From the Monetary Policy Report:

“While the Bank’s foreign activity measure, an indicator of demand for Canadian exports, is expected to grow strongly over the forecast horizon, it has been revised down. This change reflects the revised outlook for US residential investment and investment in the US oil and gas sector, which are key sources of demand for Canadian exports…

The projection for economic activity through 2016 and 2017 has been revised up. Slower foreign demand growth, the higher Canadian dollar and a downward revision to business investment all have negative impacts on the outlook but are more than offset by the positive effects of the fiscal measures announced in the federal budget in March. The net effects of the upward revision to real GDP and the downward revision to potential output growth is that, in the Bank’s base-case projection, the output gap is likely to close sometime in the second half of 2017, somewhat earlier than anticipated in January.”

BoC Governor Stephen S. Poloz was even more direct and clear in the press release announcing the decision on monetary policy (emphasis mine):

“The combined effect of all of these global and domestic developments would have been a modest downgrade of the Bank’s outlook. However, the fiscal measures announced in the March federal budget will have a notable positive impact on GDP. The Bank now projects real GDP growth of 1.7 per cent in 2016, 2.3 per cent in 2017 and 2.0 per cent in 2018. This new growth profile, combined with the revised estimate for potential, suggests the output gap could close somewhat earlier than the Bank had anticipated in January, likely in the second half of 2017.”

That fiscal stimulus must pack a serious punch to overcome all those negatives AND push projections upward! Here is how the BoC summarized the fiscal gifts:

“The fiscal measures included in the March 2016 federal budget amount to roughly $25 billion of additional spending over the next two years. Specifically, the federal government will spend about $11 billion over this period on infrastructure investments and $12 billion on measures for households, including the new Canada Child Benefit. Several other spending measures, such as environmental projects, programs to improve the socio-economic conditions of indigenous peoples, and the construction and renovation of affordable housing, are also notable for their likely impact on GDP.”

So this statement on monetary policy was an intriguing mix of good and bad news. The good news of fiscal stimulus allowed the BoC to improve forecasts for the Canadian economy. The worsened outlook on so many other key factors forced the BoC to be circumspect and cautious. The BoC has no excuse for sounding dovish, but it is also far from being hawkish. In other words, the BoC is “non-dovish.” For example, instead of celebrating the relatively strong economic numbers from Q1, Poloz instead cautioned that the performance was a bit of an aberration:

“First-quarter GDP growth appears to have been unexpectedly strong, but some of that strength is due to temporary factors and is likely to reverse in the second quarter.”

In the press conference, Poloz added that some of the Q1 strength was merely “catch-up” from weakness in the fourth quarter. He also later noted that the global economy still has the “capacity to disappoint.”

Even more importantly, the Canadian dollar has become a weight on the economy again:

“Non-resource exports are expected to strengthen, but their profile is weaker than previously projected, in part because of slower foreign demand growth and the higher Canadian dollar.”

The negative backdrop has added more uncertainty than usual to the BoC’s forecasts.

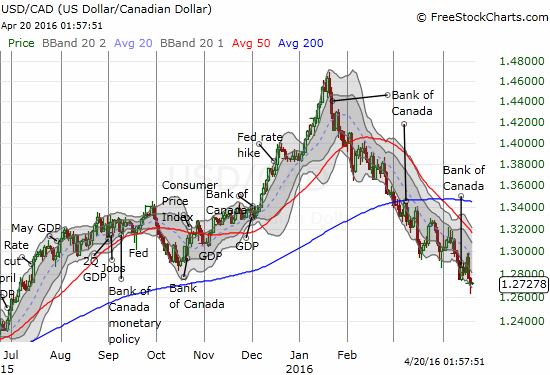

During the press conference, Poloz reiterated that the BoC has no target for the Canadian dollar, but he made it clear that the currency is now a headwind. Without a stronger statement or the promise/threat of further policy action, the Canadian dollar is likely to continue trending higher, lower for USD/CAD…

Source: FreeStockCharts.com

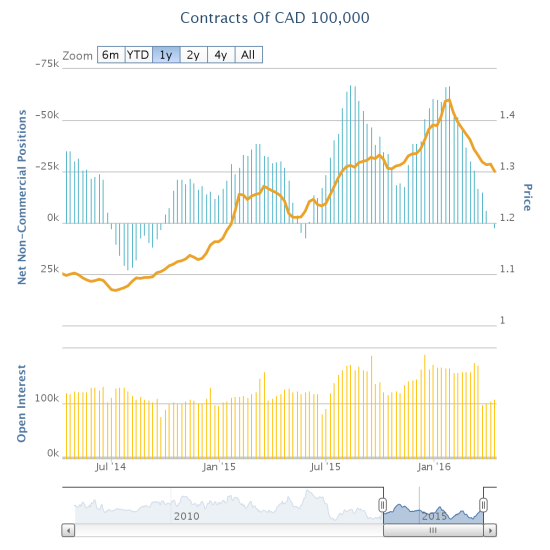

Speculators also continue to back off bearish positions against the Canadian dollar. In fact, over the last two weeks, speculators finally switched from bearish to bullish. They were last net bullish on the Canadian dollar way back in May, 2015…and that period lasted all of two weeks.

Source: Oanda’s CFTC’s Commitments of Traders

As long as speculators are trending away from bearishness and into deeper bullishness, I have every reason to expect the Canadian dollar to continue to strengthen.

Be careful out there!

Full disclosure: long FXC, short USD/CAD