(This is an excerpt from an article I originally published on Seeking Alpha on January 19, 2015. Click here to read the entire piece.)

{April 8, 2015 addendum: negative feedback loop is not the accurate term. I should have left it at feedback loops or even destructive feedback loops}

{snip}

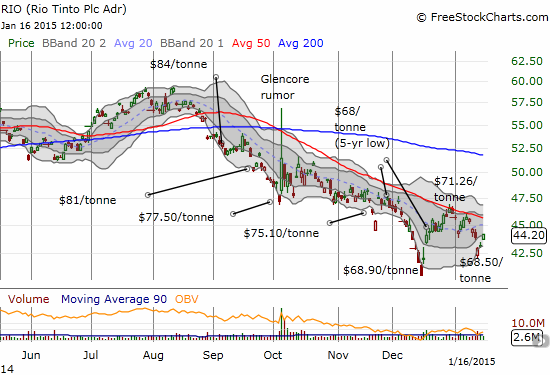

{snip} There is every reason to believe that prices will continue converging upon the marginal cost of production of the three biggest players that are driving the market into severe conditions of over-supply: Rio Tinto (RIO), BHP Billiton Limited (BHP), and Vale S.A. (VALE).

Here is a summary of the key pillars that keep on the bearish side of the fence (albeit hedged):

Oil prices

Oil prices (USO) have fallen off a cliff and have reached lows last seen during the financial crisis.

Source: St. Louis Federal Reserve

{snip}

Government intervention

Unemployment makes for bad politics. Governments in resource-rich areas have few options to keep voters happy and protect lost tax revenues than to do what they can to help prop up their local producers. {snip}

China

It goes without saying that the Chinese government is helping to keep its iron ore miners in business. {snip}

Canada

The investment arm of the Canadian province of Quebec is reportedly talking to Cliffs Natural Resources Inc. (CLF) to reopen its high cost Bloom Lake iron ore mine. {snip}

Speculators

Hellenic Shipping News recently ran a story called “Chinese funds aggressively shorting commodities linked to copper dive.” {snip}

Insufficient retrenchment by Chinese producers

The big hope for almost a year now is that the Chinese will shut down high-cost mines as prices drop below their costs of production. In June, 2014, a Citigroup analyst was bullish on iron ore given his observation of “daily mine closings” in China. {snip}

Incentive to continue producing regardless of current market conditions

All the major producers have insisted that the long-term outlook for Chinese demand is very bullish. I believe they have generally stayed bullish on prices every year since the 2011 peak. Only BHP seems to have finally cracked a bit recently. {snip}

The commodities crash playbook

Using the revised playbook on commodities, I have to assume that the current downtrend will persist. I maintain no predictions for when a bottom may occur or where prices might be this year or the next. {snip}

Source for stock charts: FreeStockCharts.com

Be careful out there!

Full disclosure: short RIO, long VALE, long CLF

(This is an excerpt from an article I originally published on Seeking Alpha on January 19, 2015. Click here to read the entire piece.)