(This is an excerpt from an article I originally published on Seeking Alpha on February 20, 2015. Click here to read the entire piece.)

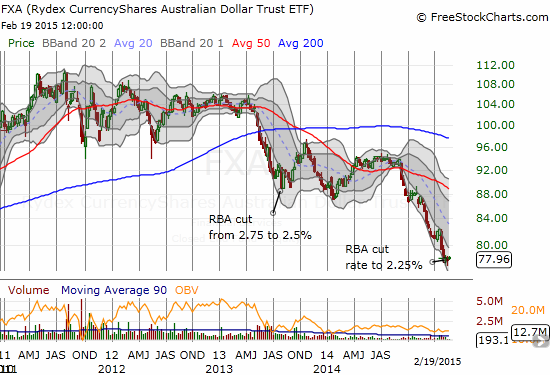

I extend a hat tip to the Sydney Morning Herald for alerting me to the incendiary comments made by Lourenco Goncalves, the Chairman and Chief Executive Officer of Cliffs Natural Resources (CLF), during his company’s earnings conference call on February 3, 2015. Goncalves had some choice words for monetary policy in Australia. He essentially accused the Reserve Bank of Australia of manipulating the Australian dollar (FXA) to lower levels. {snip}

This was a curious accusation: the RBA’s rate cut that same day was the first in about 18 months. {snip}

The Australian dollar would likely be a lot weaker except that monetary policy across much of the rest of the developed world has remained highly accommodative, leaving Australia’s rates relatively attractive. {snip}

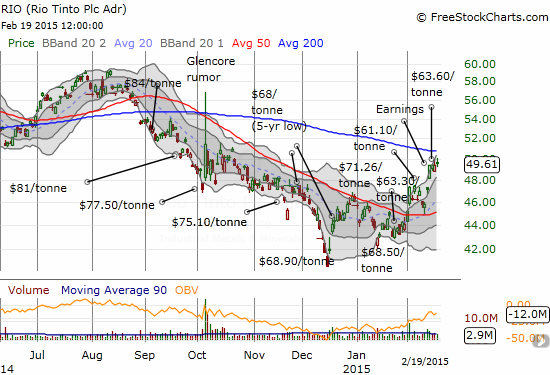

Goncalves predicted major doom for the major iron ore miners (or is he trying to put a curse on them?). This quote is a direct accusation of supply dumping. However, the majors are not technically dumping given iron ore is still selling for well above the cost of production. {snip}

And there is plenty of room yet to fall for iron ore prices without some abrupt surge in demand. Here is Walsh describing the comfortably large margins RIO still earns on iron ore even with prices at 5-year lows:

{snip}

Fortunately for CLF, its sole Australian mine also has extremely low costs. {snip}

After reading through the transcript of RIO’s last conference call, I think CLF is under-estimating the staying power of its competitors in Australia.

{snip}

Source for charts: FreeStockCharts.com

RIO is of course well aware of the sustained challenging operating environment:

{snip}

The company also has little sympathy for those companies desperately trying to hang on long enough to survive the downturn (emphasis mine):

{snip}

Suffice it to say that there is less profit and more pain ahead in 2015.

Be careful out there!

Full disclosure: long RIO put options

(This is an excerpt from an article I originally published on Seeking Alpha on February 20, 2015. Click here to read the entire piece.)