(This is an excerpt from an article I originally published on Seeking Alpha on October 5, 2014. Click here to read the entire piece.)

{snip}

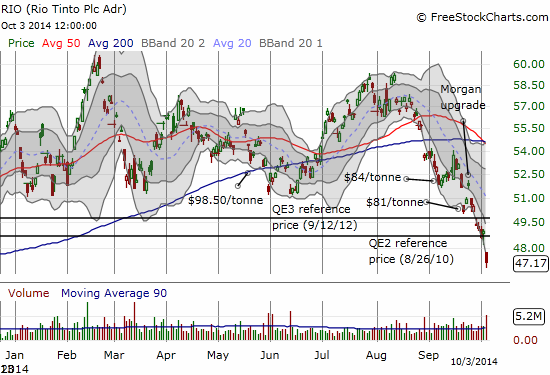

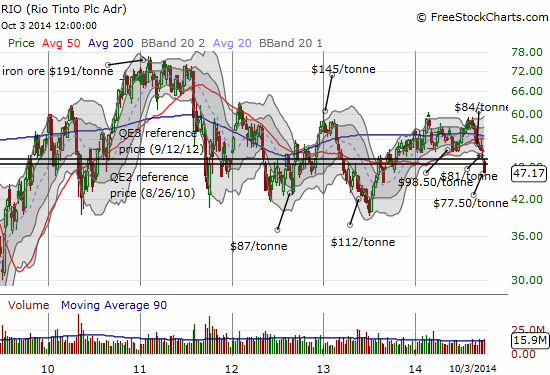

Almost any piece these days discussing the price of iron ore refers to the growing supply gut caused by major iron ore miners who continue to produce and ship as much of the commodity as they can despite falling prices. Rio Tinto (RIO) and BHP Billiton Limited (BHP) are the main culprits as they take advantage of their low cost structure to push higher-cost competitors over the edge and out of the iron ore business. {snip}

I have yet to see anyone wonder about scenarios other than the carefully planned and executed destruction of most of RIO and BHP’s competition. What if instead of RIO and BHP managing the market into a near duopoly (Vale SA of Brazil should also be a major survivor of the iron ore carnage), what if the spiraling downward of the industry is actually a path to mutually assured destruction? {snip}

In other words, I think enough real risks exist in this iron ore game of brinkmanship to justify extreme caution. I feel well-justified in remaining short Rio Tinto as I recommended in “The Australian Dollar Finally Breaks Down Amid Signs Warranting Increased Caution.” {snip}

Source of charts: FreeStockCharts.com

{snip} I juxtaposed the quotes from Citigroup CEO Chuck Price in 2007 and RIO CEO Walsh in 2014 to call attention to these parallels.

{snip} His unbridled confidence was on full display in a speech he gave in Tokyo, Japan on November 18, 2013 at a joint event by the Australia and New Zealand Chamber of Commerce. In this speech, Walsh spoke of bravely facing the need to innovate even when others are hesitant, timid, and conservative:

{snip}

Be careful out there!

Full disclosure: long put options in RIO

(This is an excerpt from an article I originally published on Seeking Alpha on October 5, 2014. Click here to read the entire piece.)