(T2108 measures the percentage of stocks trading above their respective 40-day moving averages [DMAs]. It helps to identify extremes in market sentiment that are likely to reverse. To learn more about it, see my T2108 Resource Page. You can follow real-time T2108 commentary on twitter using the #T2108 hashtag. T2108-related trades and other trades are sometimes posted on twitter using the #120trade hashtag. T2107 measures the percentage of stocks trading above their respective 200DMAs)

T2108 Status: 37.4% (almost an 11 percentage point gain!)

T2107 Status: 43.0%

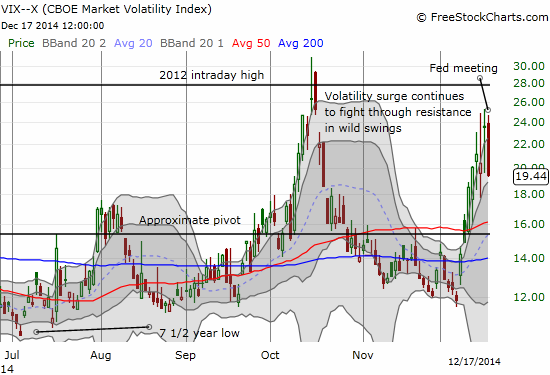

VIX Status: 19.4

General (Short-term) Trading Call: With S&P 500 closing above 50DMA, ALL bullish trades are OK with tight stops. More caveats below.

Active T2108 periods: Day #42 over 20%, Day #1 above 30% (overperiod ending 2 days under 30%), Day #4 under 40%, Day #6 under 50%, Day #10 under 60%, Day #112 under 70%

Reference Charts (click for view of last 6 months from Stockcharts.com):

S&P 500 or SPY

SDS (ProShares UltraShort S&P500)

U.S. Dollar Index (volatility index)

EEM (iShares MSCI Emerging Markets)

VIX (volatility index)

VXX (iPath S&P 500 VIX Short-Term Futures ETN)

EWG (iShares MSCI Germany Index Fund)

CAT (Caterpillar).

Commentary

“Relief from fear” is the best way I can describe the trading on Wednesday, December 17th. If you have been following along these past several days and weeks, hopefully you profited from the golden setup that the December Federal Reserve meeting provided.

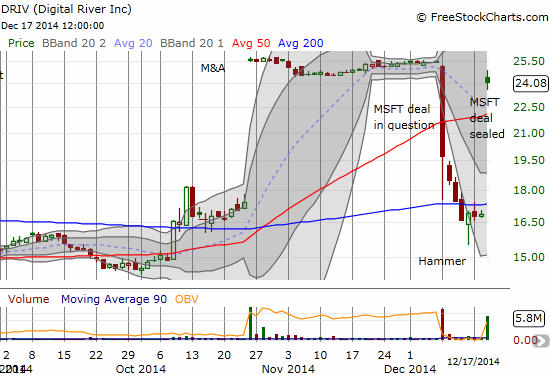

I could not have asked for a better open to the day. I practically jumped out my seat when I saw the best news possible coming from Digital River (DRIV):

“On December 16, 2014, Digital River, Inc. (“Digital River”) and Microsoft Corporation (“Microsoft”) entered into the Seventh Omnibus Amendment to the Microsoft Operations Digital Distribution Agreement dated September 1, 2006 (the “Seventh Omnibus Amendment”). The Seventh Omnibus Amendment extends the term of Microsoft Operations Digital Distribution Agreement to March 31, 2017 (the “Expiration Date”). Additionally, Microsoft may extend the Expiration Date for up to four (4) separate six (6) month renewal terms.”

The reaction in the stock was immediate and left no time for those who bailed on DRIV to get back in at a good price. DRIV closed the day with a 43% gain that took it back to within 2 points of the $26 being offered for the company. I am hoping at least a few of my readers took the plunge with me on what I thought was a VERY rare example of an exceptionally good risk/reward trade. You can see more details in the December 14th T2108 Update.

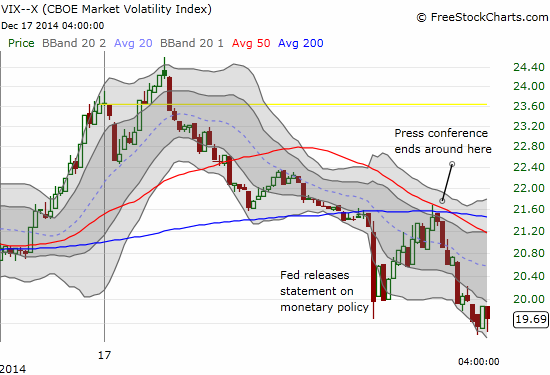

Next up was the Federal Reserve. I will just summarize to say that the release of the statement contained just the soft-pedaling on higher rates that I was anticipating and targeting for trading. Relief from fear started there but did not get into full gear until the subsequent press conference ended. At that point, there were no more surprises possible, nothing left to fear, and every reason for volatility to come tumbling down.

I took this opportunity to close out my put options on ProShares Ultra VIX Short-Term Futures (UVXY) that expire next week. The put options that expire Friday are still a bit underwater (I bought the first tranche too early!), and I want to see whether they can benefit from further declines in volatility in the wake of the Fed. The best trades ended up coming from my multiple roundtrips in and out of ProShares Short VIX Short-Term Futures (SVXY). THIS time, I decided to just hold SVXY through the entire day. Depending on how events unfold, I strongly suspect I can hold it for many more days to come as volatility continues to ebb through the holiday period. The BIG caveat is that the market often attempts to fade the immediate post-Fed reaction. If I even see a hint of such a reversal, like the S&P 500 trading below its 50DMA again, I will likely lock in my remaining profits on SVXY and look to buy yet again at lower prices. Currency markets also present an on-going wildcard as fresh extreme moves in various currencies could trigger bad reactions in the stock market.

My biggest lesson going forward is that SVXY shares are likely the BEST way to play my “relief from fear” strategy (let’s call it RFF going forward).

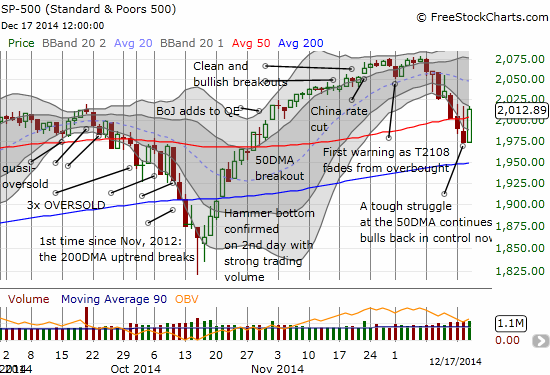

The end result for T2108 was a tremendous surge of almost 11 percentage points to 37.5%. This move indicates a large number of stocks likely flipped from breakdowns to breakouts. Indeed, the S&P 500 (SPY) managed to close above its 50DMA even after sellers faded an earlier breakout.

This bullish close above the 50DMA AND the 2000 level clears the pathway for bullish trades again. Certainly, large surges of T2108 from these low levels are very encouraging as they can signal sustainable bottoms. On the S&P 500, this means trades are a green light with a tight stop below the low of the recent churn (around 1972). Assuming the index opens firmly on Thursday, I will make my first tentative trades in ProShares Ultra S&P500 (SSO) call options. I will hold off on shares until/unless T2108 hits oversold conditions. If the S&P 500 manages to disappoint despite the encouraging signals, more aggressive bulls should feel free to wait to see what happens at 200DMA support.

Bears should have already locked in some profits. Aggressive bears can wait to see whether the S&P 500 can continue through the definitive downward channel defined by the two lower-Bollinger Bands.

I am personally firmly bullish, HOWEVER I fully recognize the fresh technical damage done in the market. For now, I am assuming the recent top will continue to hold through this seasonally strong period in the second half of December. Overall, I am still trading as if the market has gone from topping to chopping.

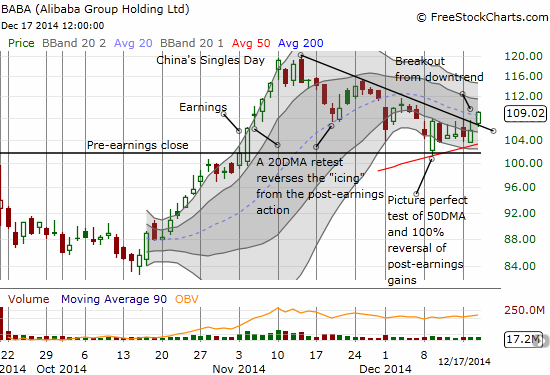

One breakout I somehow managed to miss in all the excitement was from Alibaba (BABA). I have periodically checked on the stock for trading signals. My latest was a play on a bounce from “close enough” to the support at the nascent 50DMA. This support has held up very well, making the breakout from the short-term downtrend from all-time highs all the more important and bullish.

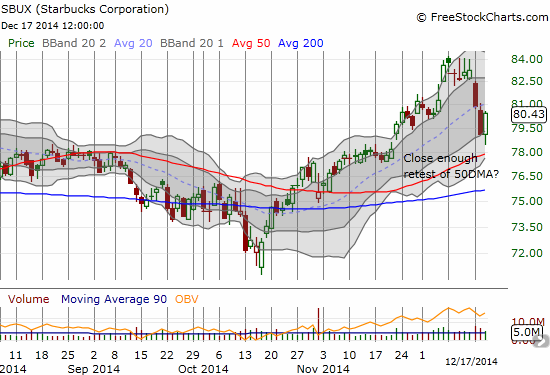

I randomly saw news about Starbucks (SBUX) and decided to check the chart. I saw a stock on its way to testing its 50DMA support. Given my bullish bias for the day, I did not hesitate to load up on some call options. I was well-rewarded. I am guessing SBUX should at least retest recent highs in short order.

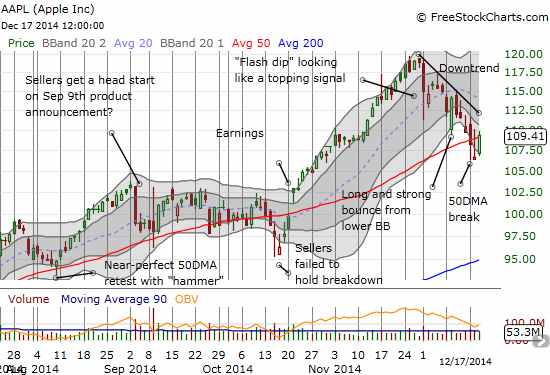

Finally, Apple (AAPL) has provided a multitude of trading opportunities. My Apple Trading Model (ATM) has remained stubbornly bullish so I have continued to buy call options on dips and sell them on any subsequent rally. Tuesday’s swoon was an excellent opportunity to reload. I sold those call options near the close. The ATM is even MORE bullish for Thursday with a 100% historic frequency for upside based on the current setup. The odds for a positive gain from the open are even high at over 80%. As usual, I will load up if the market is kind enough to offer a discount on this projection.

Daily T2108 vs the S&P 500

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Red line: T2108 Overbought (70%); Blue line: T2108 Oversold (20%)

Weekly T2108

*All charts created using freestockcharts.com unless otherwise stated

The T2108 Resource Page

Expanded daily chart of T2108 versus the S&P 500

Expanded weekly chart of T2108

Be careful out there!

Full disclosure: long UVXY put options, long AAPL call options, long SVXY shares, long GOOG call options, long AMZN put options