(This is an excerpt from an article I originally published on Seeking Alpha on December 17, 2014. Click here to read the entire piece.)

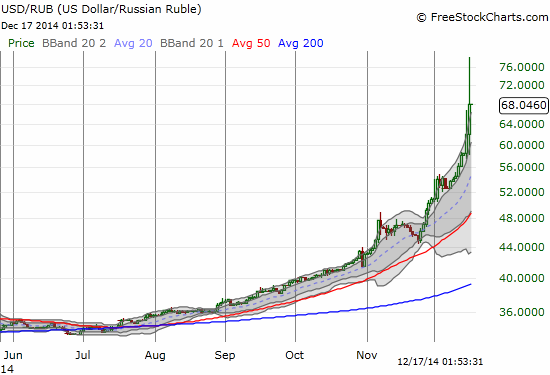

Currency markets have been rocked with increasingly extreme moves in risk-bearing currencies like the Russian ruble (USD/RUB). Last week, the Russian central bank hiked interest rates from 9.5% to 10.5%. This move proved insufficient to protect the currency and control inflation, forcing the Russian central bank to send rates surging to 17%. Despite this rate hike, the ruble STILL lost about 25% against the U.S. dollar before finally reversing from the extremes of what is an extremely parabolic move.

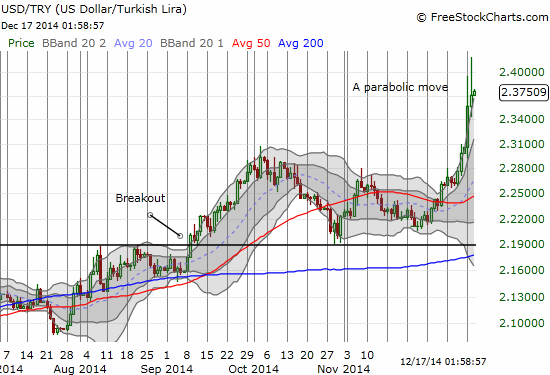

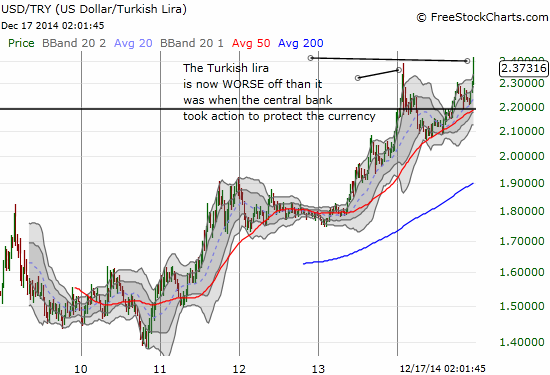

{snip} A parabolic move that started on December 1st and accelerated in recent days has punished the Turkish lira. Now the USD/TRY exchange rate is higher than the crisis levels back in January. The Turkish lira is now back to what looks like record lows against the U.S. dollar.

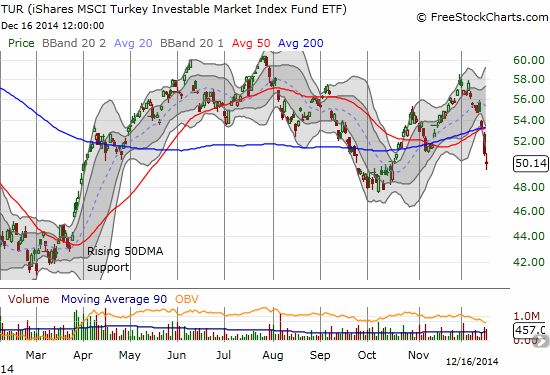

Interestingly, the fresh plunge in the Turkish lira has not accompanied the kind of collapse seen in Russian stock indices. For example, here is a chart of iShares MSCI Turkey (TUR).

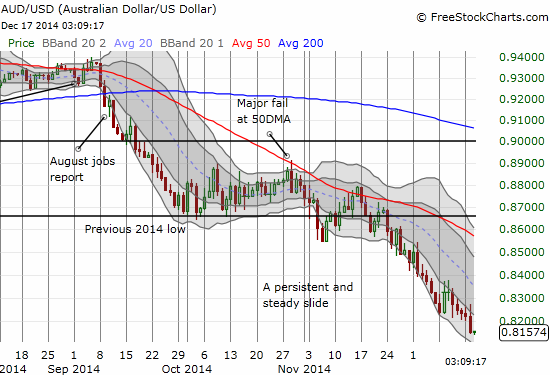

These extreme and parabolic moves in risk currencies bring the Australian dollar immediately to mind. The Reserve Bank of Australia (RBA) has repeatedly warned traders that the Australian dollar could essentially plunge at just about any time without warning given the currency remains very over-valued. {snip}

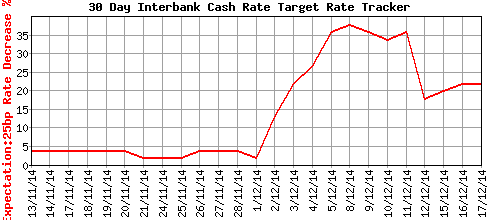

{snip} Over the past week, expectations for a rate cut in Australia have taken a sharp turn downward. Yet, the pacing of the slide in the Australian dollar has not changed.

Source: ASX RBA Rate Indicator – February 2015

This relative independence suggests to me that the weakness in the Australian dollar has taken on its own self-reinforcing momentum. {snip}

{snip} If so, it will be important to watch whether the U.S. dollar’s (UUP) rise takes a pause in response…or continues to power higher on its own momentum…and in turn taking risk currencies down another few notches.

Source for currency and stock charts: FreeStockCharts.com

Be careful out there!

Full disclosure: net short the Australian dollar

(This is an excerpt from an article I originally published on Seeking Alpha on December 17, 2014. Click here to read the entire piece.)