(This is an excerpt from an article I originally published on Seeking Alpha on November 26, 2012. Click here to read the entire piece.)

{snip} It is hard to be bearish on the U.S. economy when housing is working. Homebuilders are also the ultimate play on the U.S. economy given the minimal (direct) linkage to global macro-economics. For a good summary on how housing can drive recessions and recoveries see an EconTalk podcast interviewing Ed Leamer from UCLA: “Leamer on Macroeconomic Patterns and Stories“. {snip}

So, as the housing recovery continues to unfold, 2013 should prove to be a pivot year for the economy. Next year should also be a time to get picky about trading homebuilders as full participants in the recovery. While the recovery is in its early stages, the rally in homebuilders is quite advanced. {snip}

Key for ticker symbols used in the rest of this piece:

Beazer Homes USA Inc. (BZH), DR Horton Inc. (DHI), Hovnanian Enterprises Inc. (HOV), KB Home (KBH), Lennar Corp. (LEN), MDC Holdings Inc. (MDC), Meritage Homes Corporation (MTH), PulteGroup, Inc. (PHM), Ryland Group Inc. (RYL), Toll Brothers Inc. (TOL)

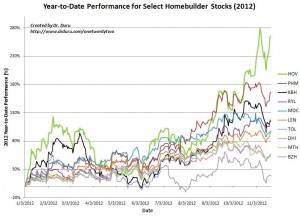

Click image for a larger view….

Source: Prices from Y!Finance

*To help follow the spaghetti in the chart, the legend is ordered to follow year-to-date performance in descending order.

{snip}

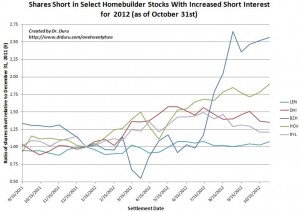

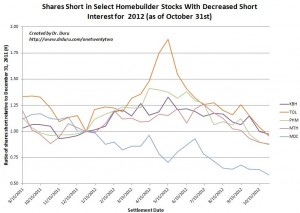

For some clues, I looked for the hot spots that have the focus of the housing bears. It turns out there is a mild relationship between the change in short interest this year (measured as a ratio in shares short) and year-to-date stock price performance. {snip}

{snip}

Click image for a larger view….

Source: NASDAQ.com Short Interest

{snip}

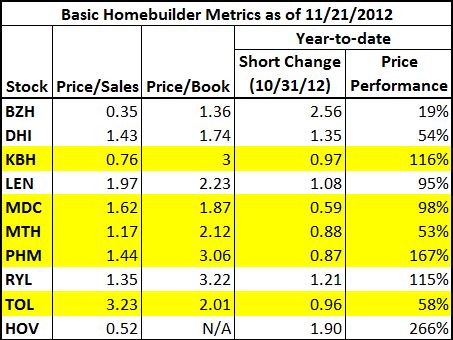

I used valuation to place a final ordering on my picks. {snip} The table below combines valuation with the short interest and price performance metrics. Stocks highlighted in yellow are my picks for 2013.

Source for valuations: Y!Finance

{snip}

Source: FreeStockCharts.com

MTH’s #1 ranking, pushes MDC to #2. TOL gets a #3 ranking mostly by virtue of the recent sharp decline in short interest. I consider its valuation a bit high but not surprising given it serves the higher-end segment of the housing market. KBH gets a #4 ranking based on the low P/S valuation. Finally, PHM gets a #5 ranking as the remaining homebuilder stock with decreased short interest on the year. Like KBH, its P/B ratio is very high, but unlike KBH its P/S ratio is in the middle of the pack.

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on November 26, 2012. Click here to read the entire piece.)

Full disclosure: no positions