This is an excerpt from an article I originally published on Seeking Alpha on December 28, 2011. Click here to read the entire piece.)

The Federal Reserve’s second phase of quantitative easing (QE2) is slowly becoming a distant memory…{snip}

The stark contrast between winning and losing stocks (S&P 500 index versus many commodity stocks) leaves the rules for profiting from a crash in commodity-related stocks at a crossroads. The anticipated crash did not occur in 2011 and increasingly it appears a crash will not occur in 2012 either (for example, see “From Destocking To Restocking, Joy Global Weakens Case For A Commodities Crash“). This is not to say commodities will not experience periodic sell-offs again. {snip} If some catalyst forces a major bullish re-evaluation on commodities, I will be grateful to have a handful of stocks already in play (Jeremey Grantham’s “no regret” positioning).

The simple rule triggering buys once QE2-inspired gains evaporated delivered very attractive entry points in 2011. {snip} The upshot is that these trades left me with profits and powder ready to apply to whatever opportunities are coming in 2012.

As the year changes, there exist a fresh slate of commodity-related stocks that have lost their QE2 gains; some are even struggling to regain any traction. I have created below a list of the stocks that caught my attention and grouped them by the commodity. {snip}

{snip}

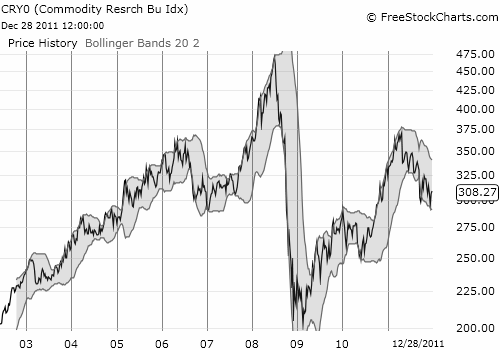

I end with a chart of the Commodity Research Bureau index (CRY0). It is a stark reminder of both the promise and the peril of investing and trading in commodity-related stocks. The collapse from 2008 to 2009 erased about six years of a bull run in a mere seventh months. In two more years, the index almost doubled off its lows. In 2011, the index has spent most of its time swinging widely in an overall downtrend, offering great trading opportunities along the way.

Source: FreeStockCharts.com

Be careful out there!

This is an excerpt from an article I originally published on Seeking Alpha on December 28, 2011. Click here to read the entire piece.)

Full disclosure: long GG, GLD, SLV, PAAS, ANR, VALE, and the FIDELITY GLOBAL COMMODITY STOCK FUND (FFGCX)