This is an excerpt from an article I originally published on Seeking Alpha on December 29, 2011. Click here to read the entire piece.)

In early November, I wrote that a turnaround finally seems to be materializing for Lender Processing Services (LPS). Regulatory and legal issues have long been a severe overhang for LPS, so when the Nevada Attorney General announced on December 16 that it will sue LPS for consumer fraud, it seemed the entire story fell apart again in one fell swoop. LPS responded quickly to the suit:

{snip}

The stock market also responded quickly to the suit: the stock dropped 17% that day. LPS did not make new 52-week (and all-time) lows, but the stock has also barely made any progress in the subsequent two weeks.

Source: FreeStockCharts.com

Since the big plunge, some large trader (or traders) may have decided that now is the time to BUY LPS. On December 19th, 6,476 call options traded on the June $21 strike versus an open interest of just 10 call options. Open interest increased the next day to 6,416 call options. Open interest surged again on December 23 to 11,930 call options. {snip}

What makes this call option activity all the more interesting is that in the past year or more large blocks of put buying have signaled trouble ahead for LPS (for example, see “Rethinking Lender Processing Services Amidst New Allegations and Surging Put Activity“). {snip}

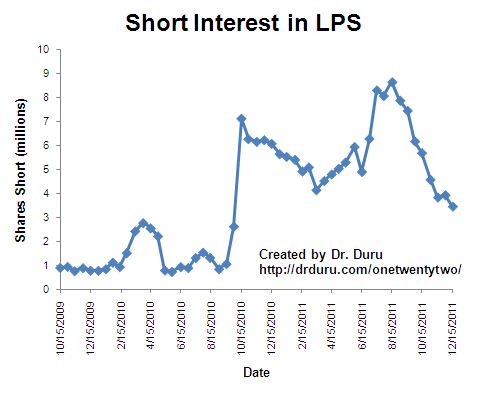

Finally, note that short interest in LPS continues to decline. {snip}

Source: NASDAQ.com short interest

Be careful out there!

This is an excerpt from an article I originally published on Seeking Alpha on December 29, 2011. Click here to read the entire piece.)

Full disclosure: long LPS