That sigh of disappointment was Wall Street looking for signs of a weakening labor market in the June jobs report. Instead, that report showed job creation remains robust in the economy. Not only did the unemployment rate remain steady at a low 3.6% with the economy adding 372,000 jobs (far more than “consensus” expectations), the number of people working part-time involuntarily plunged in June and fell to levels last seen in 2001. Thus, the Federal Reserve has every reason to proceed as planned with its normalization of monetary policy.

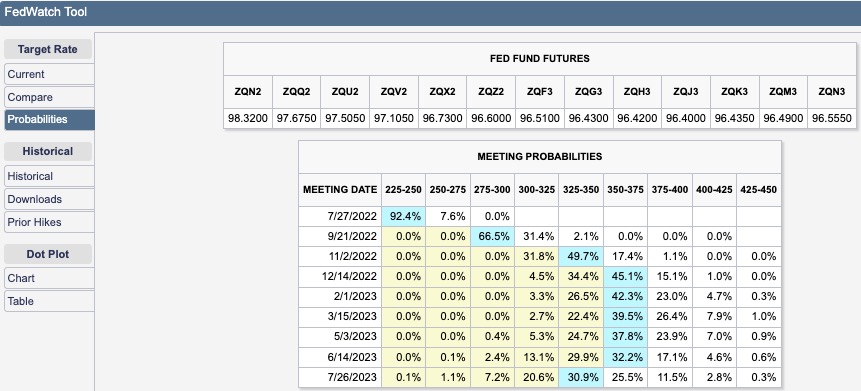

This tightening of monetary policy has helped send the stock market into a bear market. Getting out of this rut will largely depend on when the stock market thinks the Fed will get to the end of normalization and perhaps even the timing of the next rate-cut cycle. In recent times, economic troubles have pushed the Fed to cut rates. Wall Street wants a recession as one of the quickest ways to convince the Fed to end normalization earlier than scheduled. A recession could end the inflation threat and make the Fed comfortable returning to easy money policies. Currently, the Fed Fund Futures have priced in an end to the tightening cycle in June, 2023 with a subsequent rate cut.

Wall Street does not want a recession for the pain it inflicts on the real economy. Instead, Wall Street wants a recession for the benefits that accrue to the financial economy. As the Fed responds to a recession with easier money policies, bond yields fall and money gets cheaper, both are conducive to higher stock prices (absent other negative shocks). Just as the stock market has crumbled in anticipation of economic turmoil, the stock market will bottom and turn around well ahead of actual improvements in the economy. Eventually, stocks may even benefit from a real economy made more efficient and more profitable by difficult business choices made during a recession.

Cathie Wood Looks Forward to A Recession

Cathie Wood is technically not part of Wall Street. In fact, she speaks like she leans against the pervailing Wall Street ethos. Even so, her introductory remarks in her last ARK Invest update summarized why Wall Street wants a recession (emphasis mine):

“The bad news is that the Fed has become extremely aggressive and hawkish. The good news is that we’re beginning to get data that is confirming that…the U.S. economy is in recession. And if you’ve tuned in before, you know we believe that Europe and China have effectively been in recession as well. So now a global recession. We’re also getting a lot of indicators that prices are coming down…”

The implication of the first two sentences is that a recession will force the Fed to stand down. Wood goes on to explain the connection as she has done in previous economic discussions. A recession would also further validate her firm conviction that the economy is in a longer-term deflationary trend.

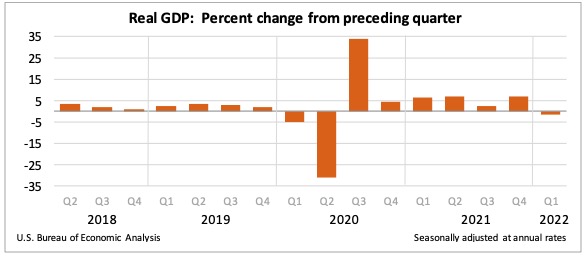

The strong jobs data throw a wrench into the claims of the recessionistas. However, it is easy to dismiss the jobs numbers as lagging indicators; Wood has done so in the past. Wood prefers the shorthand rule of thumb: two straight quarters of negative, sequential GDP growth equals a recession. First quarter GDP growth was -1.6% which followed a robust +6.9% for Q4. Given the Q4 GDP growth in 2018 and 2019 was the lowest quarter of their respective years, I am surprised I did not read theories that Q4’s strength included pull forward from Q1 demand.

What Is A Recession?

Nonetheless, the official arbiter of recessions, the National Bureau of Economic Research (NBER), insists that a recession cannot be simply defined by two straight quarters of negative growth. From the NBER (emphasis mine):

“Because a recession must influence the economy broadly and not be confined to one sector, the committee emphasizes economy-wide measures of economic activity. The determination of the months of peaks and troughs is based on a range of monthly measures of aggregate real economic activity published by the federal statistical agencies. These include real personal income less transfers, nonfarm payroll employment, employment as measured by the household survey, real personal consumption expenditures, wholesale-retail sales adjusted for price changes, and industrial production. There is no fixed rule about what measures contribute information to the process or how they are weighted in our decisions. In recent decades, the two measures we have put the most weight on are real personal income less transfers and nonfarm payroll employment.”

Note well that both personal income less transfers and nonfarm payroll employment remain quite strong despite the GDP declines. Accordingly, two straight quarters of negative GDP changes may be insufficient catalysts to convince the Fed to stand down. Those looking forward to a negative Q2 GDP print may get an even bigger disappointment than the strong June employment report.

Andrew Hunter, senior U.S. economist at Capital Economics reacted to the June jobs report by calling it a “mockery” of the notion that we are already in a recession. Based on the NBER’s definition, Hunter may very well be correct.

So why the GDP shorthand? First of all, traders and investors do not want to wait the time it takes for the NBER to collect all its data to make a confident recession call. By the time the NBER officially declares a recession, recovery could already be underway.

More importantly, consecutive quarters of negative GDP growth are rare. Thus, a mere occurrence looks quite significant and impactful, recession-worthy. I counted just 11 episodes of consecutive negative growth quarters since 1947. Of these, only one occurred (in 1947) outside of an official recession. Moreover, the NBER has identified just two other recessions where no two quarters satisfied the GDP shorthand: 1960-04-01 to 1961-02-01 and 2001-03-01 to 2001-11-01. So no wonder the shorthand!

![U.S. Bureau of Economic Analysis, Quarterly Change in Real Gross Domestic Product [GDPC1], retrieved from FRED, Federal Reserve Bank of St. Louis, July 7, 2022.](https://drduru.com/onetwentytwo/wp-content/uploads/2022/07/220710_GDP-quarterly-growth.png)

Gold Not There Yet

If the market is getting ready for the Federal Reserve to back down, gold has yet to receive the memo. The SPDR Gold Shares (GLD) made a parabolic peak in March a week ahead of the Fed’s first rate hike in March. At that point, the gold market made a good call on the Fed’s seriousness. GLD has not been the same since. Last week delivered a fresh breakdown. GLD closed the week at a 9+ month low. (The recent declines in commodities and related inflation-related hedges also demonstrate that the Fed’s hawkishness has been working as intended.)

Whenever the Fed even so much as drops a hint that monetary policy is taking a less aggressive course, GLD will be the first thing I buy/trade….recession or no recession.

Be careful out there!

Full disclosure: long GLD

2 thoughts on “Why Wall Street Wants A Recession”