AT40 = 61.6% of stocks are trading above their respective 40-day moving averages (DMAs)

AT200 = 53.9% of stocks are trading above their respective 200DMAs

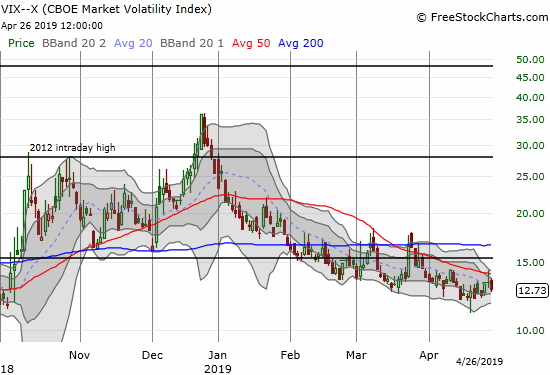

VIX = 12.7

Short-term Trading Call: neutral (change from bearish)

Stock Market Commentary

The week ended with a U.S. GDP report for Q1 2019 that represents well the state of the stock market: on the surface, strong headline numbers, but underneath nagging reasons for doubt. Despite the surprisingly strong headline growth number of 3.2% annualized, growth in both consumer spending and business investment were weak. The GDP was boosted by a sharp decline in imports and a strong build in inventories. Downward revisions and weaker growth could be ahead for the rest of the year.

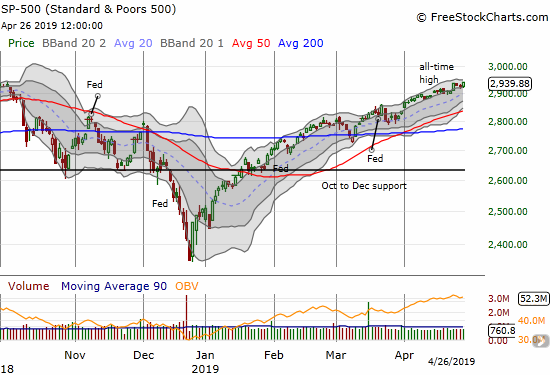

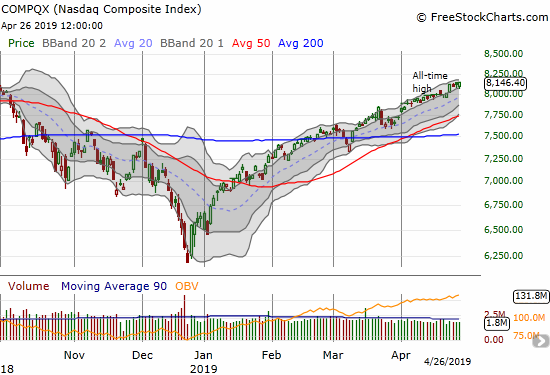

Similarly, the headline results on the stock market continue to look good. Now both the S&P 500 (SPY) and the NASDAQ (NDX) are making new all-time highs. At the same time, underlying breadth is narrowing ever so slightly. AT40 (T2108), the percentage of stocks trading above their respective 40-day moving averages (DMAs) has churned underneath the overbought threshold (70%) for 3 weeks. AT200 (T2107), the percentage of stocks trading above their respective 200DMAs, has failed to make a new high in two weeks. The all-time highs are cradling these nagging signs of bearish divergence…lulling them into a harmless slumber for now.

The volatility index, the VIX, sprang to life mid-week until faders swarmed at the VIX’s 50DMA. I made a tactical error in failing to take profits on my latest tranche of call options on the Ultra VIX Short-Term Futures ETF (UVXY). I assumed over-optimistically that I would get Friday to decide whether to exit.

Bearish Divergence

The bearish divergence I described in the last Above the 40 post is still confirmed by the Australian dollar versus the Japanese yen (AUD/JPY). Predictably, AUD/JPY stopped falling right at support from the bottom of its multi-month trading range. The bounce was mild so the sustainability of this support is far from certain in the coming days and weeks.

Stock Chart Reviews – Bullish

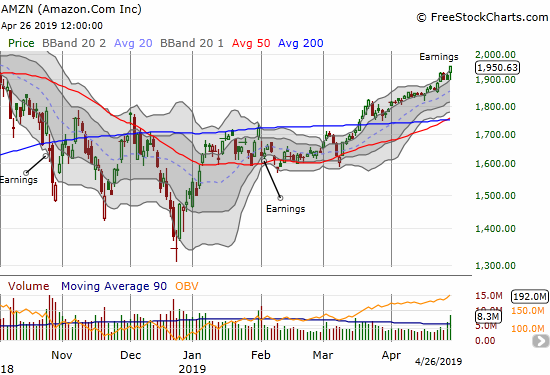

Amazon.com (AMZN)

Amazon.com (AMZN) posted earnings and received an initial lukewarm response. At one point the stock traded down to the bottom of its narrow upper Bollinger Band (BB) channel before rebounding to a 2.5% gain on the day. Along the way, I bought a calendar call spread consistent with my AMZN post-earnings rule to buy the open no matter what. The setup (short April 26 $1920 call vs long May 3 $1920 call) turned out correct only intraday (I was taken out at my target profit) as the strong close would have created a small loss. I will be looking to do another calendar call spread next week if AMZN pushes even higher than its Friday close.

Caterpillar (CAT)

After Caterpillar (CAT) gapped down post-earnings, my bearish bias on the stock drove me immediately to buy put options. I sold quickly the next day as the stock tested its 200DMA. Friday’s rebound puts the stock in position to fill its post-earnings gap down. A BB squeeze is also forming.

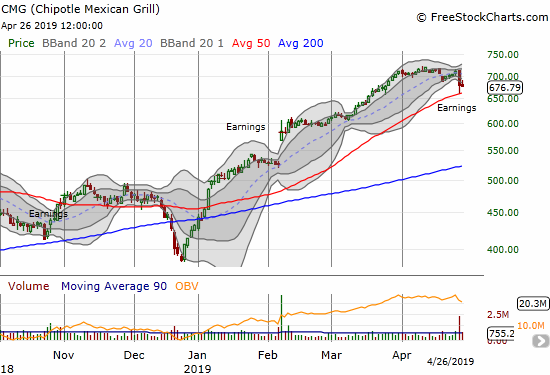

Chipotle Mexican Grill (CMG)

I do not know what to think about trading Chipotle Mexican Grill (CMG) after its big post-earnings drop. CMG conveniently bounced off 50DMA support so it is still in a bullish position, however tenuous. Sellers stepped in again on Friday making this position even more tenuous. A new post-earnings low will be bearish for the stock. I cannot consider going long until CMG reverses its post-earnings loss.

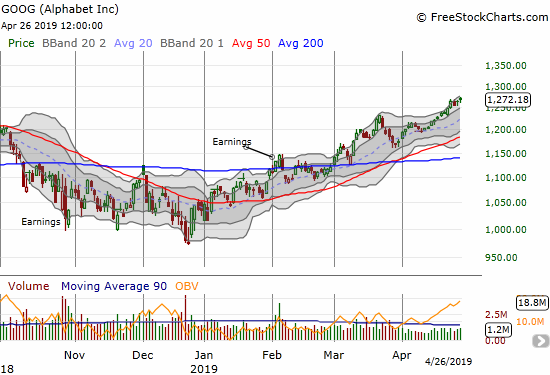

Alphabet (GOOG)

Alphabet (GOOG) has melted higher almost in a straight line for over two weeks. The path higher has been smoother than the wide swings in March. Presumably, investors are anticipating strong earnings results…

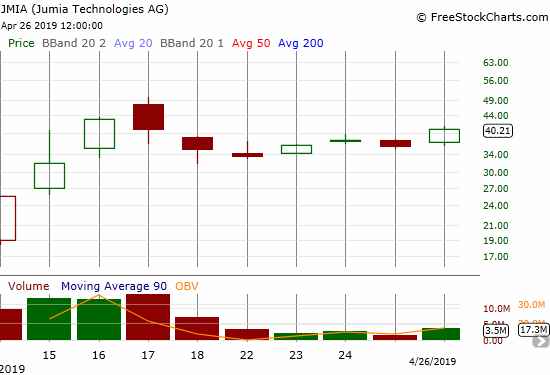

Jumia (JMIA)

I talked about my trading plans for Jumia (JMIA) shortly after its IPO. The purchase turned out to be fortuitous as JMIA rallied nicely last week. With my position up 20%, I decided to close it out and wait for the next dip to buy. The stock is very expensive and the stock looks like a trader’s plaything, so I am assuming a dip from current levels is inevitable.

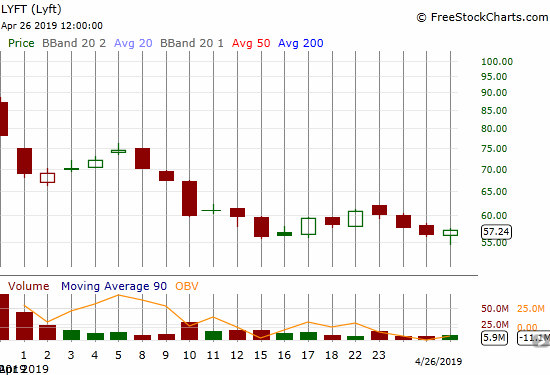

Lyft (LYFT)

Lyft (LYFT) looks like it is trying to stabilize ahead of the IPO for Uber. The stock hit a new intraday all-time low on Friday, but the buying force from there created a bottoming hammer pattern. If buyers follow through in the coming week, the stock could be in a good position to withstand the “dilutive” impact of Uber’s massive IPO.

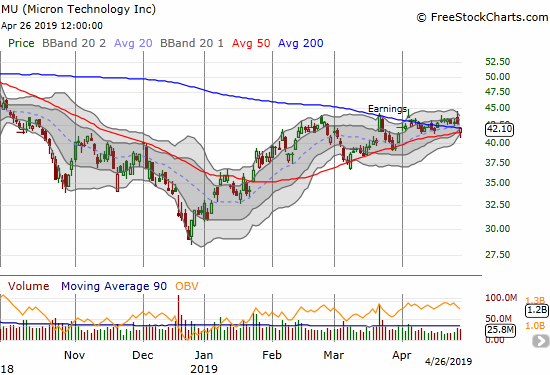

Micron (MU)

Micron (MU) looked like it was drifting its way higher on the residues of a modest 200DMa breakout until Intel (INTC) earnings. The stock gapped down on Friday but found decent support at its 50DMA. With a converging 200DMA, I am expecting a big move up or down soon. I will follow the stock in that direction.

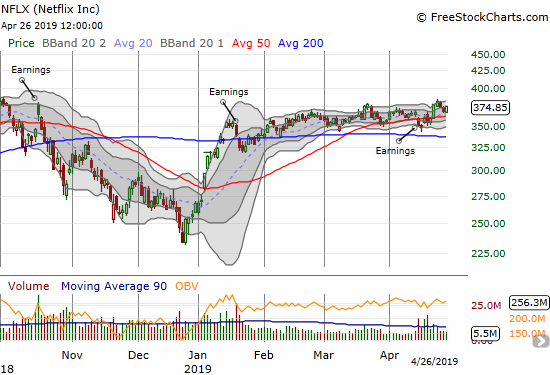

Netflix (NFLX)

Netflix (NFLX) turned back from a fresh (marginal) breakout. I decided to jump on a put spread at that point. My downside target is the post-earnings closing low, but the buying on Friday greatly reduced the odds of hitting that target by expiration.

Impinj (PI)

I have yet to return to Impinj (PI) after last year’s trades. Yet last week’s breakout is very impressive. The stock is a buy here with a stop below support either at the 200DMA or 50DMA.

Snap (SNAP)

Snap (SNAP) printed a post-earnings bearish engulfing. The selling was not enough to salvage some pre-earnings puts I bought. I flipped new put options post-earnings. I was anticipating a 50DMA breakdown, but a bit of buying at support on Friday gives the stock a greater chance of going higher before it goes lower in coming days.

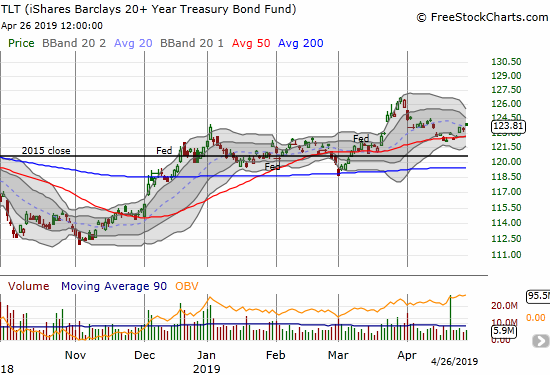

iShares 20+ Year Treasury Bond ETF (TLT)

I explained the bullish setup in iShares 20+ Year Treasury Bond ETF (TLT) a week ago. After a brief stumble, TLT got moving. The big move came on Wednesday even as the U.S. dollar soared (mainly against the euro). It is telling that rates still dropped (bonds increased) with the GDP report; that is, bond players are still not convinced of the economy’s strength. I went ahead and took profits on my TLT call options given I failed to take profits on my UVXY calls when I had them.

Xilinx (XLNX)

Xilinx (XLNX) suffered a large 50DMA breakdown post-earnings. The 17% drop caught my attention because XLNX increased revenue guidance for the current quarter and raised its dividend by a penny. A slew of analysts downgraded the stock anyway. For example Needham raised concerns with gross margin guidance coming under street expectations. They moved to the sidelines to wait out “multiple compression” – another way of saying they fear a larger sell-off. XLNX was up an amazing 64% for the year, so I am not surprised this sentiment shift caused such a steep sell-off.

I bought into the sell-off anyway with an upside target of 50DMA resistance. I was thinking about where I would buy a second tranche as the sell-off resumed on Friday, but buyers showed up along with other tech buyers before I could act. Suddenly, the stock looks like it has bottomed. If XLNX closes above its 50DMA, the rush upward from there could be fast given the price action would likely force analysts and momentum players right back into the stock.

Stock Chart Reviews – Bearish

Dominos Pizza (DPZ)

Dominos Pizza (DPZ) suffered an ugly post-earnings gap and crap that should be very difficult to recover. I am watching closely for the action around 200DMA support which also marks near the pre-earnings close. While the stock looks toppy, the stock would not be a good risk/reward short until/unless it broke down below the March or December lows.

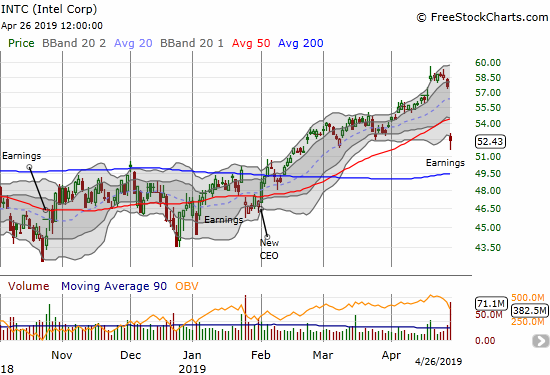

Intel (INTC)

The poor post-earnings response to Intel (INTC) suddenly made my hindsight feel fine with taking profits a tad early on my between earnings call options on INTC. While the stock is clearly in a bearish position now, I went ahead and bought two calls to relaunch my between earnings play just in case the weekend gives time to the market to realize that the breakdown was overdone. Otherwise, I will be looking to get aggressive around 200DMA support which also happens to mark a complete reversal of the February breakout. Below that (say mid to low 40s), I would back the truck up on shares to hold for a longer time period.

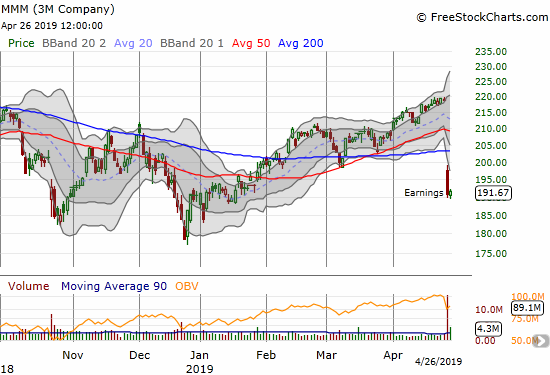

3M Company (MMM)

The post-earnings collapse in 3M Company (MMM) was apparently its worst one-day drop since 1987. I believe this one earnings report helped the volatility index zip higher temporarily. Here are some key quotes from MMM’s earnings report (from Seeking Alpha transcripts):

“…throughout the quarter we continued to see soft end market trends in China, Automotive and Electronics, along with channel inventory adjustments. These trends primarily impacted our Industrial, Safety and Graphics, and Electronics and Energy businesses…

Our earnings and margin shortfall was due to a combination of two things.

First negative organic growth in the quarter and the second weak productivity, especially in our Industrial related businesses within Asia Pacific and the United States. As the actions we took were not sufficient to offset the broad-based softening we faced in those markets as the quarter progressed…We are moving quickly to strengthen our performance and address the challenges we face and the actions on this slide are underway. First, we are reducing approximately 2,000 positions, through both voluntary and involuntary actions. Reductions will span all business groups, functions and geographies with emphasis on corporate structure and underperforming areas of the portfolio.”

An analyst questioned MMM about reducing the workforce given general expectations for a rebound in growth in the second half of the year. Management’s answer was a clear hedge on their implicit assessment that those growth expectations may be misguided.

This is NOT a stock I want to play for a rebound to overhead resistance just yet. Given the nature and context of the decline, I think MMM is a fade on a rally for an eventual retest of the December low…back when markets were trying to get ahead of a feared slowdown rather than reacting to an actual worsening in earnings numbers.

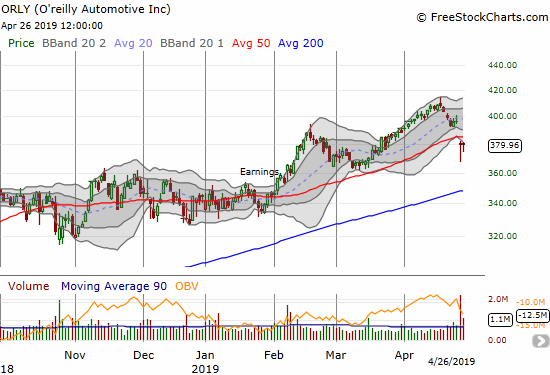

O’reilly Automotive (ORLY)

O’reilly Automotive (ORLY) disappointed me with a post-earnings 50DMA breakdown. The poor earnings reaction forced me to take my remaining profits in my position as a risk management measure. I will return on a close above 50DMA resistance. Even with the buying off the intraday lows two days in a row, I think ORLY is more of a risk for a test of 200DMA support with the February breakout fully reversing.

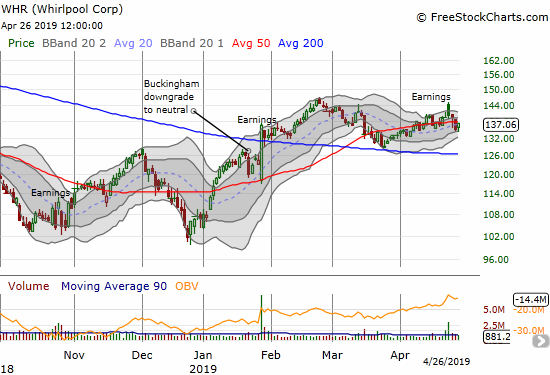

Whirlpool (WHR)

Selling continued in WHR. I neglected to buy puts after seeing the gap and crap that reversed all the initial post-earnings gains. Buyers showed up on Friday, so I suspect the stock is about to go into an extended period of churn.

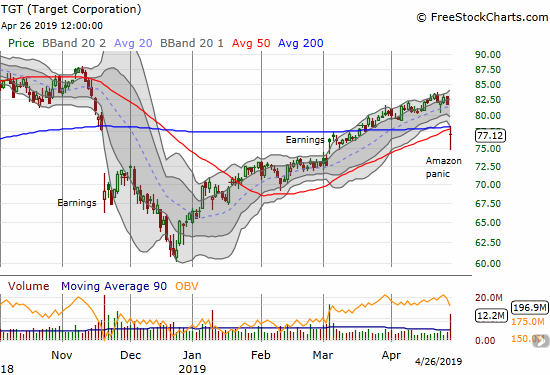

Target (TGT)

Target (TGT) suffered another bout of Amazon panic. This time the selling launched off Amazon’s announcement of 1-day shipping for Amazon Prime members. Amazon’s offer is a serious threat to retailers and promises to compress margins across the industry as competition heats up further. Thus unlike most other Amazon panics, I am not in a rush to buy against the stampede. Converged 50/200DMA support is supposed to be tough to break and now it is positioned as resistance…

Tesla (TSLA)

In early March, I covered short-term trading strategies for Tesla (TSLA). I included a case for shareholders to get protection for their shares. The calendar put spread I described from Fast Money turned into a major winner with uncanny timing. The April $250 put expired worthless and left the June $250 put standing as of now around $28 and a near triple in value of the position. I took on shorter-term positions that mostly failed and on Friday took on a weekly calendar put spread with a $230 strike.

On a happier note, I have another Tesla friend connection to mention. I met someone who create a useful app called SenseEV for Tesla departure schedules. With SenseEV you can control the climate of your Tesla remotely. Try it out!

— – —

FOLLOW Dr. Duru’s commentary on financial markets via email, StockTwits, Twitter, and even Instagram!

“Above the 40” uses the percentage of stocks trading above their respective 40-day moving averages (DMAs) to assess the technical health of the stock market and to identify extremes in market sentiment that are likely to reverse. Abbreviated as AT40, Above the 40 is an alternative label for “T2108” which was created by Worden. Learn more about T2108 on my T2108 Resource Page. AT200, or T2107, measures the percentage of stocks trading above their respective 200DMAs.

Active AT40 (T2108) periods: Day #78 over 20%, Day #76 over 30%, Day #75 over 40%, Day #20 over 50%, Day #1 over 60% (overperiod ending 1 day under 50%), Day #37 under 70%

Daily AT40 (T2108)

Black line: AT40 (T2108) (% measured on the right)

Red line: Overbought threshold (70%); Blue line: Oversold threshold (20%)

Weekly AT40 (T2108)

*All charts created using FreeStockCharts unless otherwise stated

The T2108 charts above are my LATEST updates independent of the date of this given AT40 post. For my latest AT40 post click here.

Related links:

The AT40 (T2108) Resource Page

You can follow real-time T2108 commentary on twitter using the #T2108 or #AT40 hashtags. T2108-related trades and other trades are occasionally posted on twitter using the #120trade hashtag.

Be careful out there!

Full disclosure: long UVXY calls, short LYFT puts and long calls, long NFLX put spread, long TSLA calendar put spread, long XLNX shares and call spread

*Charting notes: FreeStockCharts stock prices are not adjusted for dividends. TradingView.com charts for currencies use Tokyo time as the start of the forex trading day. FreeStockCharts currency charts are based on Eastern U.S. time to define the trading day.