(T2108 measures the percentage of stocks trading above their respective 40-day moving averages [DMAs]. It helps to identify extremes in market sentiment that are likely to reverse. To learn more about it, see my T2108 Resource Page. You can follow real-time T2108 commentary on twitter using the #T2108 hashtag. T2108-related trades and other trades are occasionally posted on twitter using the #120trade hashtag. T2107 measures the percentage of stocks trading above their respective 200DMAs)

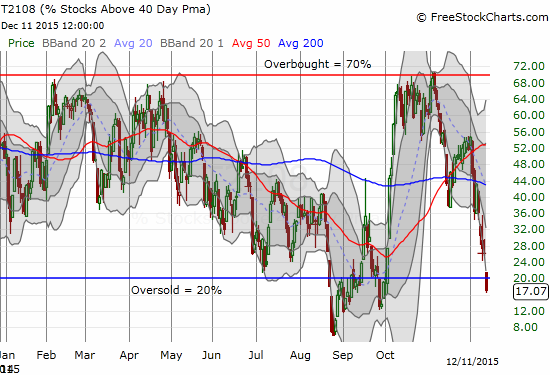

T2108 Status: 17.1% (first day at oversold)

T2107 Status: 23.1%

VIX Status: 24.4

General (Short-term) Trading Call: bullish

Active T2108 periods: Day #1 under 20% (ending 48 days above 20%) (first day of the oversold period), Day #2 under 30% (underperiod), Day #5 under 40%, Day #7 below 50%, Day #22 under 60%, Day #363 under 70%

Reference Charts (click for view of last 6 months from Stockcharts.com):

S&P 500 or SPY

SDS (ProShares UltraShort S&P500)

U.S. Dollar Index (volatility index)

EEM (iShares MSCI Emerging Markets)

VIX (volatility index)

VXX (iPath S&P 500 VIX Short-Term Futures ETN)

EWG (iShares MSCI Germany Index Fund)

CAT (Caterpillar).

IBB (iShares Nasdaq Biotechnology).

Commentary

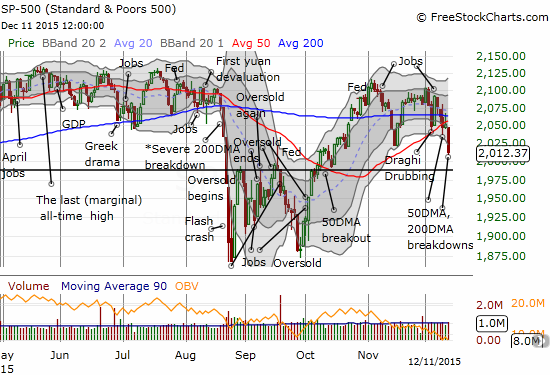

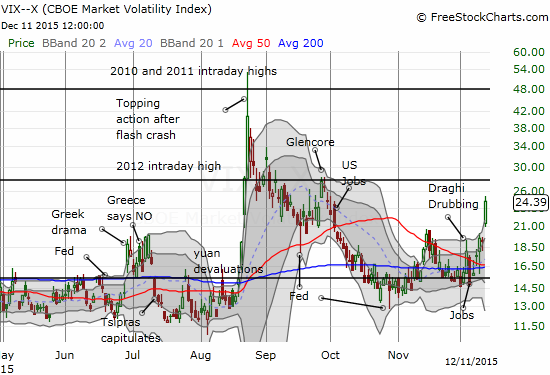

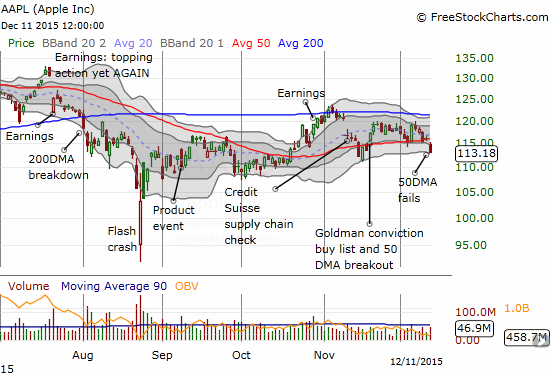

T2108, the percentage of stocks trading above their respective 40-day moving averages (DMAs), triggers an oversold trading condition when it falls below 20%. Oversold signifies that odds favor a bounce (upside) because sellers have exhausted themselves for the time-being. T2108 last closed in oversold territory on October 1, 2015. The lift-off from there was nearly breathtaking: October ended with a historic gain. By the end of October, the S&P 500 was up 8.1% from that last oversold close. I do not think a similar rush awaits the resolution of this latest run at oversold trading conditions. Given the deteriorating technicals going into this oversold period – chronicled over and over again in previous days and weeks – I think trading conditions are actually even more dangerous than they were during the August Angst. At that time, I confidently proclaimed an epic buying opportunity. For recent examples of the warnings, see December 2nd’s “A Notable Market Setback” and/or December 8th’s “A Mild Down Day Hides Expanded Market Weakness.”

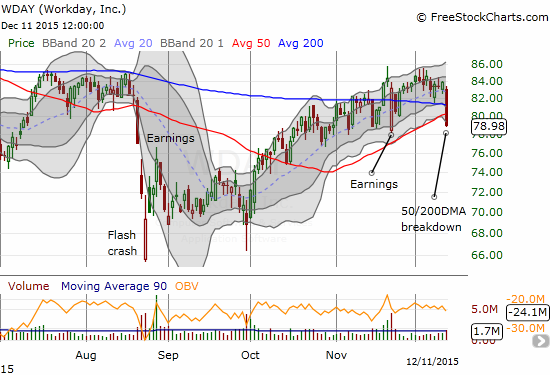

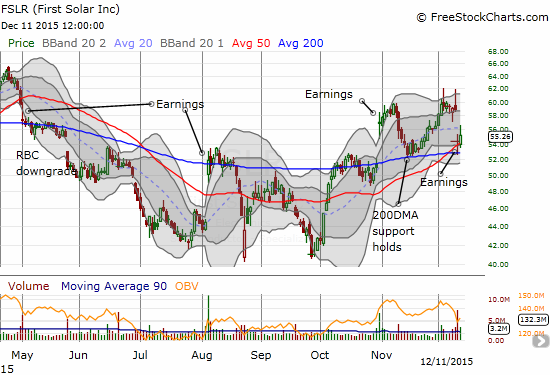

T2108 closed the week at 17.1%. The August Angst first closed in oversold territory on Friday, August 21 at 18.1%. The S&P 500 (SPY) fell that day by 3.2% to 1970.89 as it delivered a follow-through to the previous day’s violent breakdown from 200DMA support. With angst building up over the weekend, the next trading day delivered up a flash crash. This time around, the S&P 500 fell 1.9% to 2012.37 to confirm a breakdown from 50DMA support that followed right on the heels of a 200DMA breakdown. We can only brace for what Monday brings THIS time!

Astute traders will notice a particularly dangerous pattern that has developed in the S&P 500: a potential double-top. The double-top is messy but it is reinforced by the index’s stubborn insistence on trading just below the last all-time closing high set in May for three months until all heck broke loose in the August Angst. The rally off the subsequent W-bottom and oversold trading conditions decisively ended just short of the all-time high…twice, both times in November. So, the stock market is oversold but dangerous: sure it should bounce from round current levels, but the upside prospects are limited. I even doubt the S&P 500 will break what is now resistance at the 50 and 200DMAs anytime soon.

At this point, traders should assume the current selling and breakdown below critical support signals a confirmation of a top until buyers prove otherwise. In other words, the market is guilty until proven innocent because of all the tremendous resistance that has built up since the all-time high in May on top of multiple convincing failures of 50 and 200DMA support. A retest of that W-bottom seems a near lock in the coming weeks or months. Again, because December is typically a mild month when it comes to maximum drawdowns, I am assuming a massive plunge is not in the cards for this month, even with the Federal Reserve’s huge decision on monetary policy coming on December 16th.

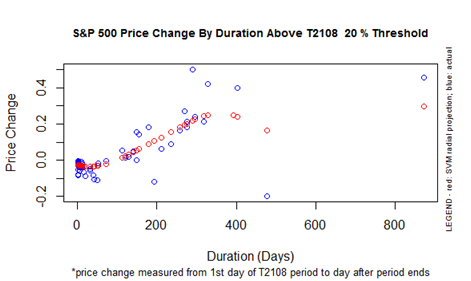

T2108 spent 48 trading days above 20%. During this roundtrip back to oversold conditions, the S&P 500 gained a decent 3.1%. The chart below shows this performance is well above expectations compared to similar runs since 1986.

This is surprisingly strong performance and is one sliver of light for the market. Traders following the conservative T2108 trading strategy have thus achieved modest success. The conservative T2108 trading strategy triggers a buy only after the oversold period ends. The 3.1% gain does not take into account previous trades and still pales in comparison to the gains from aggressively trading the last oversold periods.

Given my assessment of increasing danger in the market, I will not trade the current oversold period as aggressively as I typically would do. The current selling is not deep enough with overhead resistance looming. I will still be looking to fade any large spikes in volatility. I am particularly getting ready to fade volatility going into or immediately after the Fed announcement on monetary policy. Going into this assessment, I did automatically execute my oversold trading rules. As a result I find myself sitting on two tranches of shares in ProShares Short VIX Short-Term Futures (SVXY). A low-ball bid on ProShares Ultra S&P500 (SSO) call options even executed.

T2107, the percentage of stocks trading above their respective 200DMAs, is adding to the sense of danger. When T2108 first went oversold during the August Angst, T2107 closed at 25.5%. This time around oversold starts with T2107 at 23.1% – a slight, yet, notable slippage in technical health for the market. Moreover, T2107 never quite reversed all the losses incurred during the August Angst. In other words, the longer term outlook for the market remains questionable.

On the bearish side, I DID change things up a bit. Soon after the open, I went after Splunk (SPLK) with put options. The gap down looked like a confirmed 50DMA breakdown. As selling picked up on the day, I was able to lock in more than a double on this position.

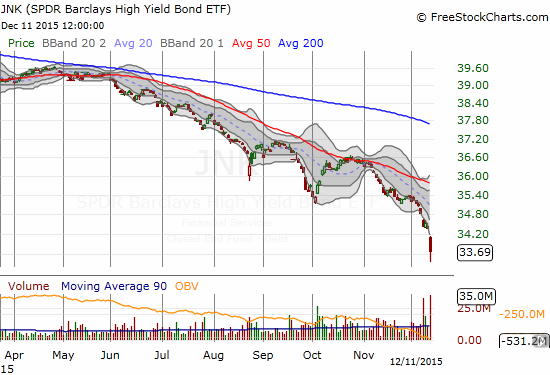

Next up was SPDR Barclays High Yield Bond ETF (JNK).

On "junk" watch. $JNK has been barreling lower since Spring. So I know I am late. But today's move/news looks like start of something big.

— Dr. Duru (@DrDuru) December 11, 2015

In case you somehow missed the news, here is a summary from Reuters in “Third Avenue to liquidate junk bond fund that bet big on illiquid assets“:

“New York-based Third Avenue Management is blocking investors from withdrawing their money from a near $1 billion junk bond fund as it tries to liquidate the fund in the biggest failure in the U.S. mutual fund industry since the Primary Reserve Fund “broke the buck” during the 2008 financial crisis

The demise of the fund is sure to renew fears that less liquidity in the corporate bond market will cause more volatility, especially as the Federal Reserve leans toward raising interest rates next week for the first time in a decade.”

Liquidity is the life blood of the market. A rush to get out the market when the Fed is moving to get incrementally less accommodative to financial markets adds yet more danger to trading conditions. That danger gets amplified when sellers cannot find buyers. Despite being late to the decline in JNK, put options here look like one of the better market hedges around right now. At least one other trader though like me as volume surged on the fistful of January $32 put options that I bought.

I drew the parallel on the monthly chart because I suspect that a decline in liquidity in the junk bond market is connected to the accelerated collapse in commodity prices. The appetite and capacity for risk must be dropping. Yet more danger for the market even as the market first faces the prospects for an oversold bounce.

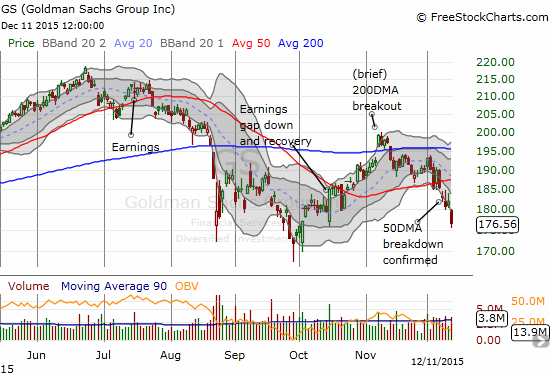

My JNK put options effectively replace my short on Goldman Sachs (GS). I covered this position according to my T2108 oversold trading rules that requires scaling back on bearish positions. GS is also now well below its lower-Bollinger Band and likely itching to bounce back. Depending on market conditions, I may consider shorting GS again on a retest of 50DMA resistance.

The woes for GS are important because market conventional wisdom has insisted that financial firms like GS will benefit from higher rates from the Fed.

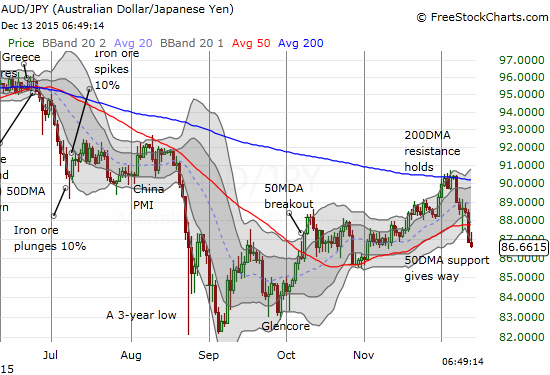

The currency markets provide a final confirmation of the increasing danger.

Could be entering new phase of selling as both euro and yen gain favor: aka more carry trades closing. $EURUSD $USDJPY #forex $SPY

— Dr. Duru (@DrDuru) December 9, 2015

The Australian dollar (FXA) versus the Japanese yen (FXY), AUD/JPY, is my favorite proxy for the market’s appetite for risk. At the time of writing, AUD/JPY confirmed Friday’s critical breakdown from 50DMA support. ‘Nuff said.

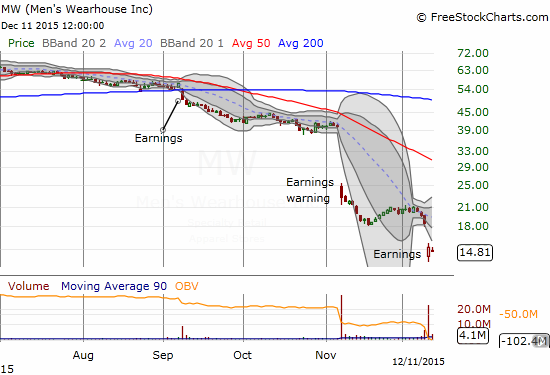

I offer this final set of charts for consideration with commentary in the captions…

Daily T2108 vs the S&P 500

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Red line: T2108 Overbought (70%); Blue line: T2108 Oversold (20%)

Weekly T2108

*All charts created using freestockcharts.com unless otherwise stated

The charts above are the my LATEST updates independent of the date of this given T2108 post. For my latest T2108 post click here.

Related links:

The T2108 Resource Page

Expanded daily chart of T2108 versus the S&P 500

Expanded weekly chart of T2108

Be careful out there!

Full disclosure: long SVXY shares, long SSO call options, net short of the Australian dollar, net long the Japanese yen, long JNK put options