Stock Market Commentary

Stocks quickly invalidated the latest topping signals and recorded a statement week. This regular routine was further boosted by a Federal Reserve that dished out stronger forecasts for the economy and inflation and yet, much to my bemusement, “promised” the stock market three rate cuts are still likely ahead for the year. Fed Chair Jerome Powell even reassured markets that a rate cut need not wait for weakness in labor markets. The path forward looks relatively clear until another earnings season starts in about a month. Given six Fed meetings remain for the year, (at least?) half of the meetings will deliver rate cut goodies for the stock market; this distribution offers the prospect of constant statements of the Fed’s “support” for the rally. The Fed’s next pronouncement on monetary policy comes on May 1st.

The Stock Market Indices

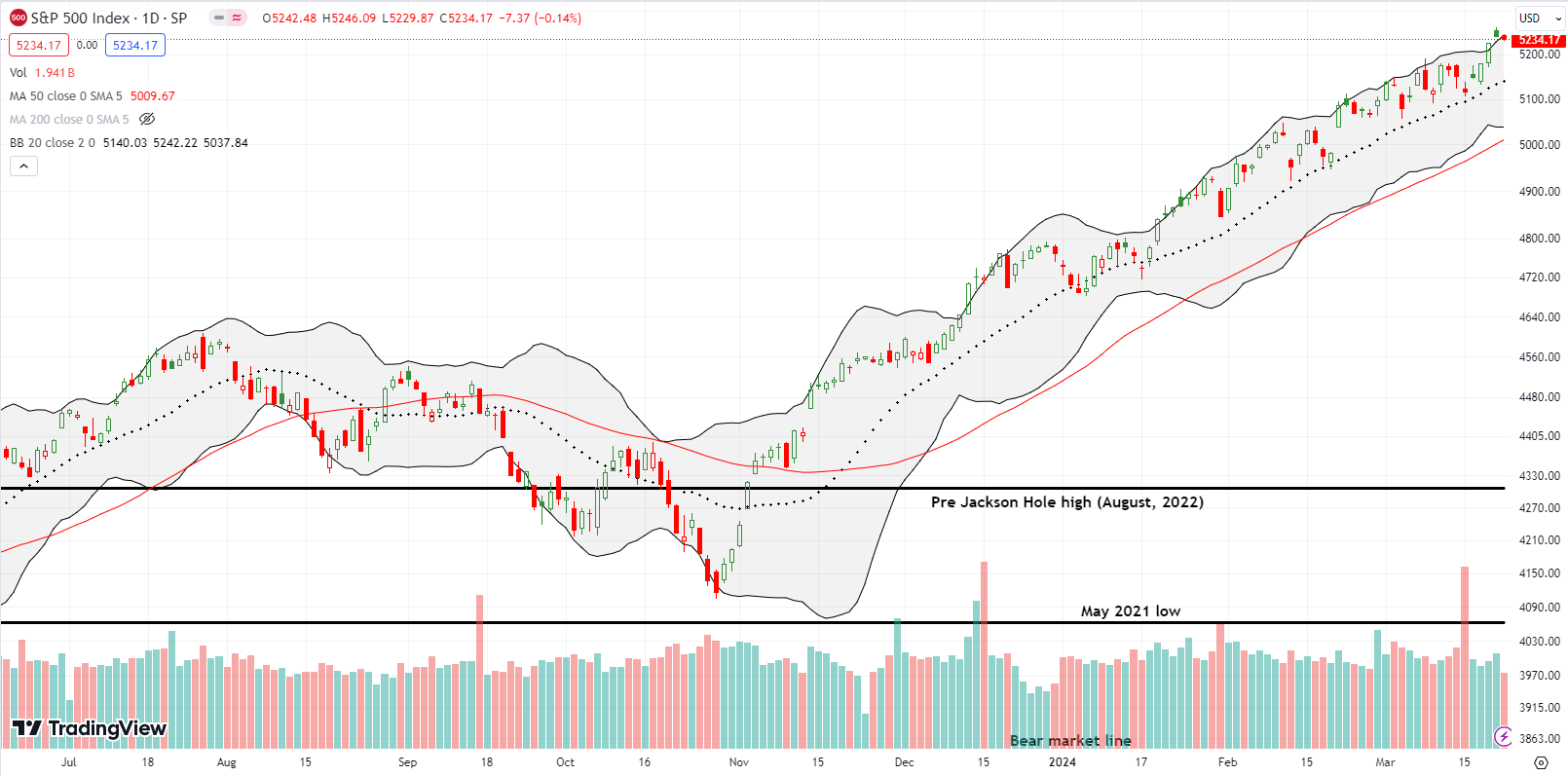

The S&P 500 (SPY) had a statement week starting with a ride on the Fed’s doves to a 0.9% gain on Wednesday and an all-time high. The next day, buyers gapped and stretched the index above its upper Bollinger Band (BB). A small fade from there barely nicked the upper BB on the way down for the week’s close.

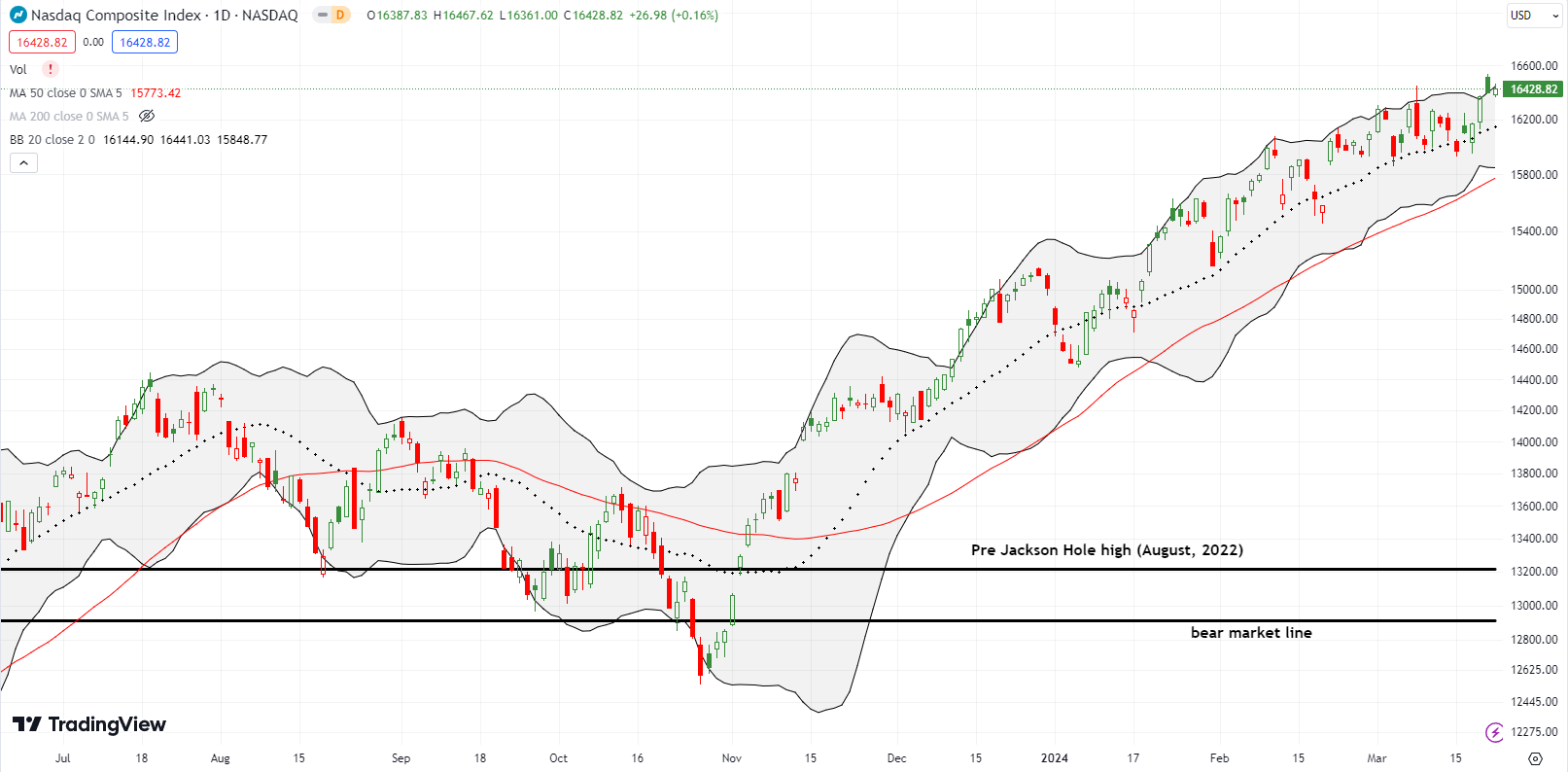

The NASDAQ (COMPQ) gained 1.3% riding the Fed’s doves. A follow-up gap up was almost closed by faders. Still, the tech-laden index looks ready to build upon its statement week. Note that sellers were only able to close the index below its 20DMA (the dashed line) for one day. The NASDAQ is holding its own despite a major drag from Apple (AAPL) which is now fighting an anti-trust lawsuit from the U.S. Department of Justice. AAPL lost 4.1% on the news Thursday. The sudden move all but assured a loss on my calendar call.

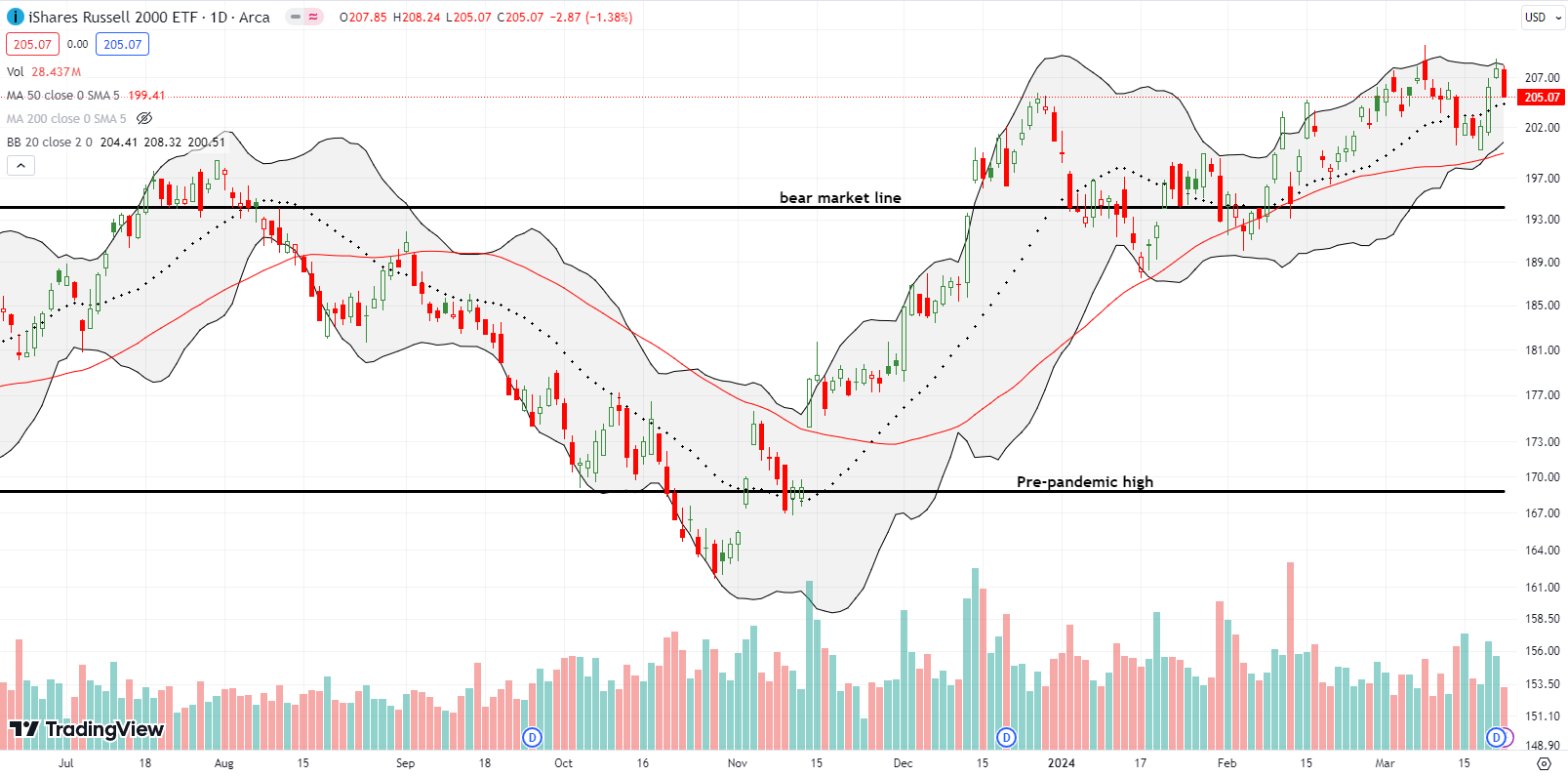

The iShares Russell 2000 ETF (IWM) lagged the other major indices with a failure to make a clean breakout for the year. The ETF of small caps gained 1.3% for the week, but a 2.0% post-Fed celebration was partially spoiled by Friday’s 1.4% pullback. I bought an IWM call for a potential rebound off 20DMA support.

The Short-Term Trading Call With A Statement Week

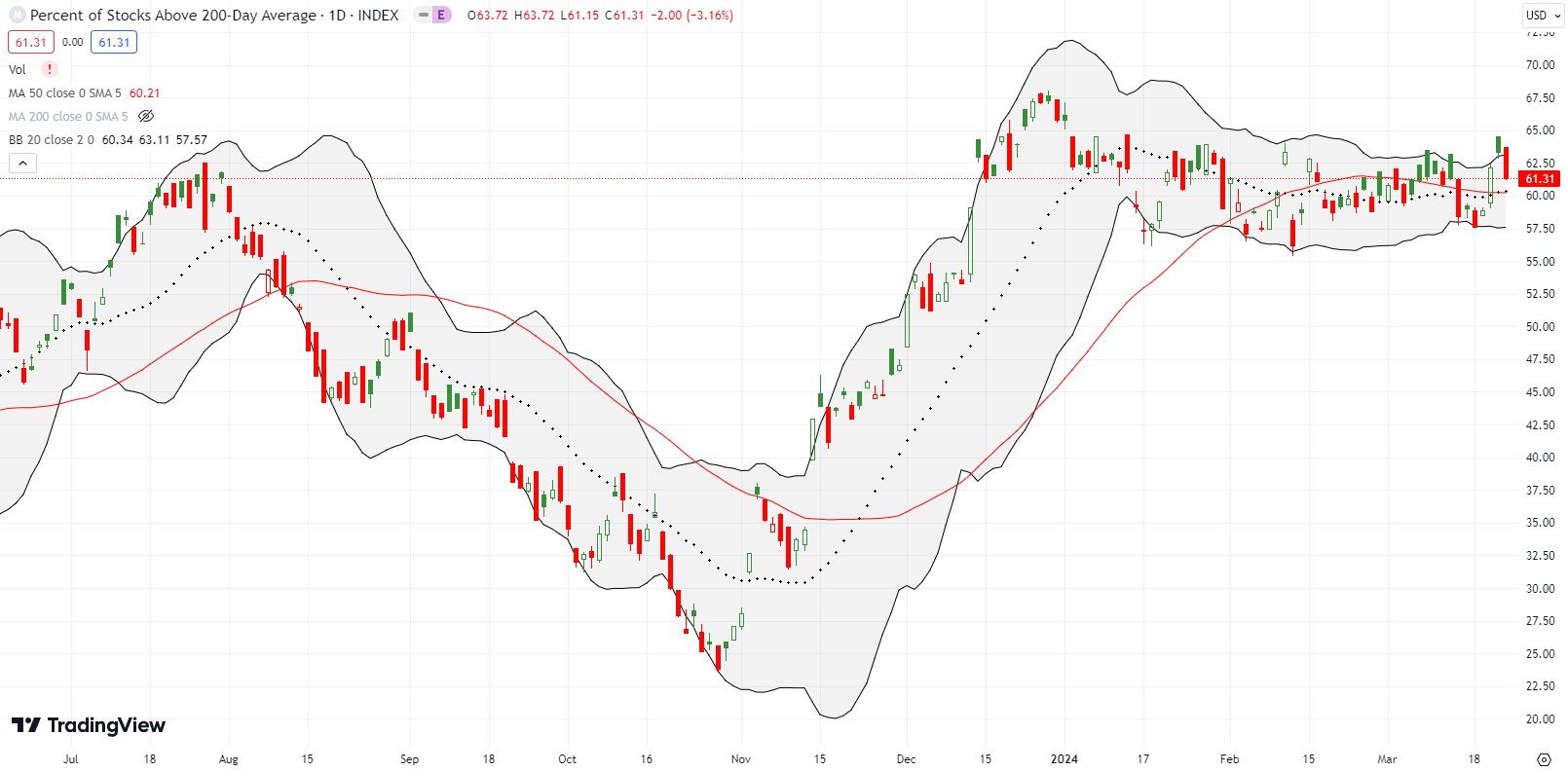

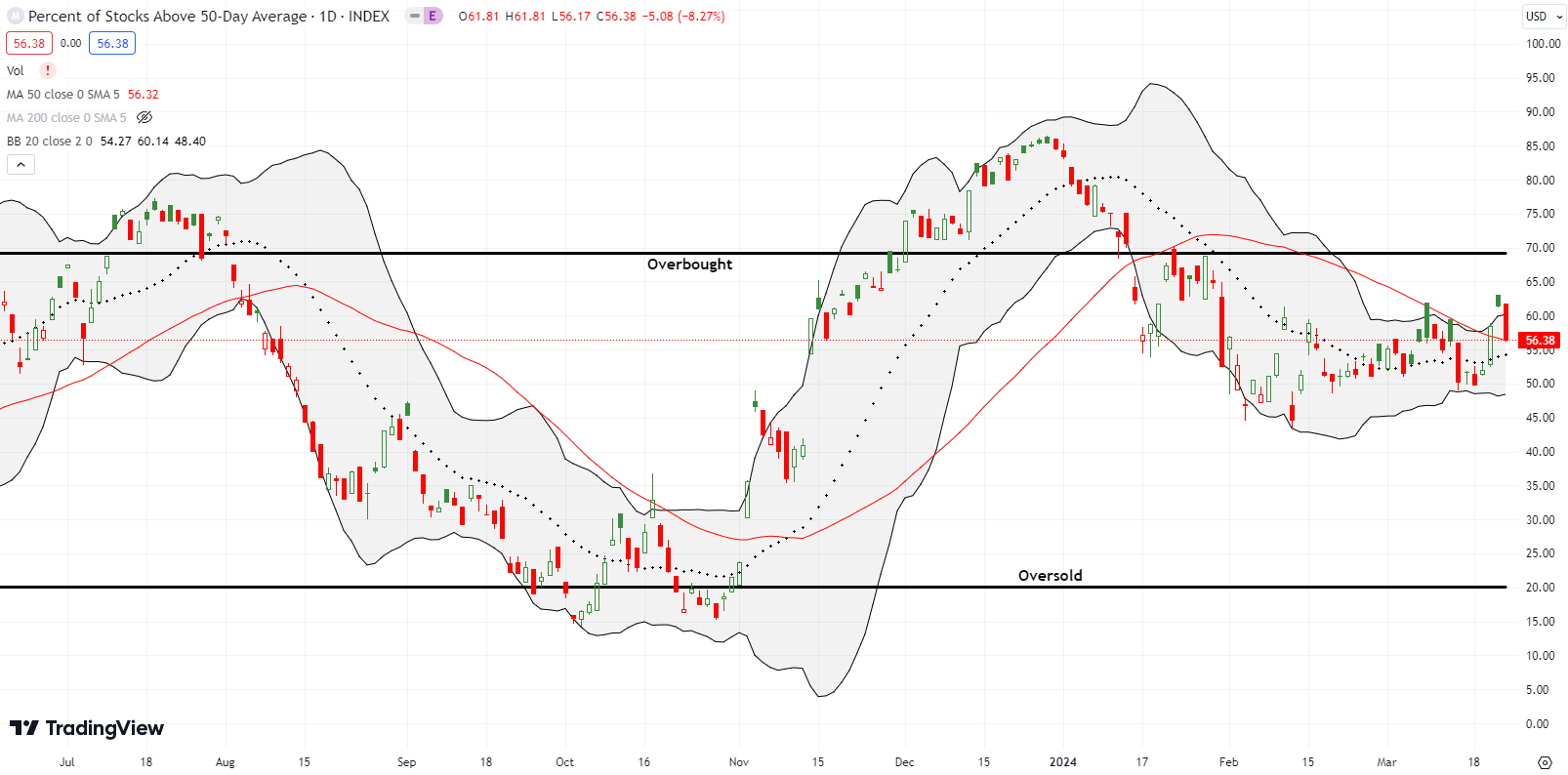

- AT50 (MMFI) = 56.4% of stocks are trading above their respective 50-day moving averages

- AT200 (MMTH) = 61.3% of stocks are trading above their respective 200-day moving averages

- Short-term Trading Call: skeptical

AT50 (MMFI), the percentage of stocks trading above their respective 50DMAs, closed at 56.4%. The statement week for stocks was tarnished by my favorite technical indicator fading from a breakout to a 2-month high. Once again, AT50 stepped back from a “threat” to challenge the overbought threshold (70%). Small caps were the major drag, yet the on-going widening divergence between the S&P 500 and the AT50 deepens my skepticism about the rally. The pragmatic approach to my skepticism remains to follow the trend while I stay ready so I don’t have to get ready for the next real pullback.

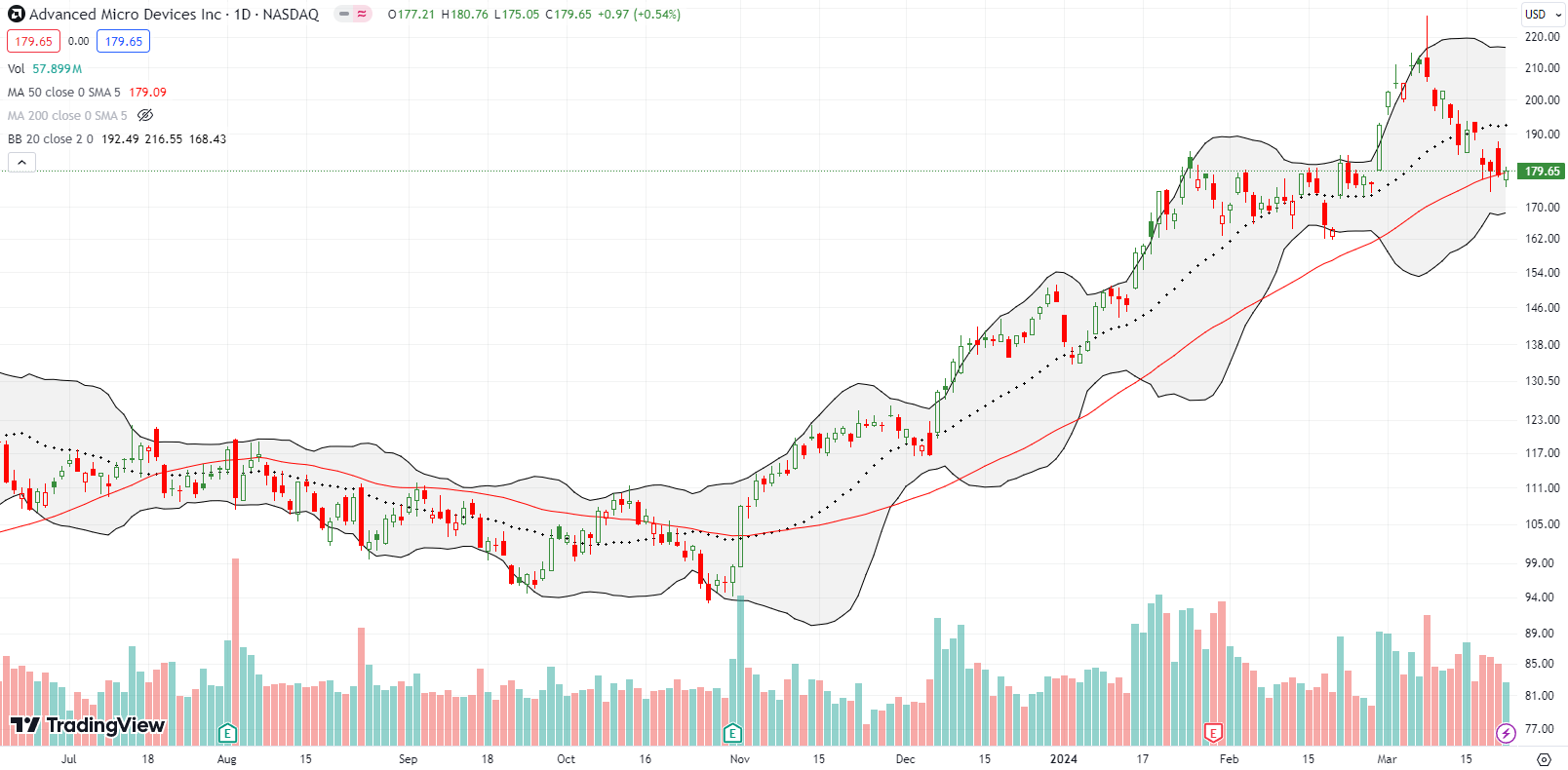

NVIDIA Corporation (NVDA) is on the verge of invalidating its major topping signal. The rebound following the GTC on AI advances left behind Advanced Micro Devices (AMD). AMD quickly confirmed its topping pattern and is now struggling to hold 50DMA support (the red line below). My aggressive trade on AMD as a generative AI play failed at the 20DMA. I now have a fresh call spread with AMD struggling to hold 50DMA support. I also accumulated shares down to this support. If AMD suffers a 50DMA breakdown, I will not add more shares until a fresh support level like the 2024 breakout point around $151.

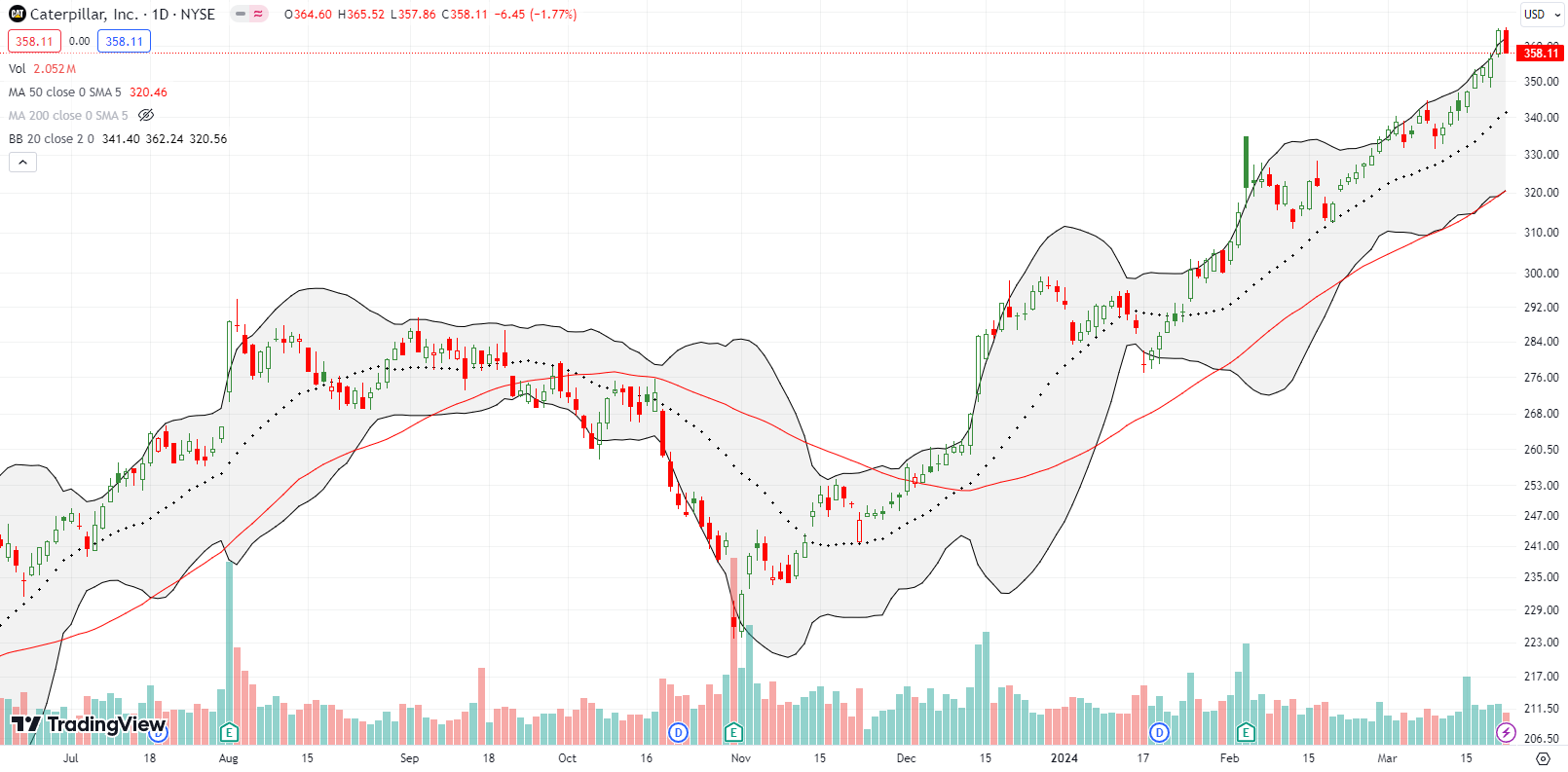

Caterpillar, Inc (CAT) is supposed to be my hedge against bullishness. However, CAT’s recent preference for persistent strength has dissuaded me from bothering with puts as frequently as normal. Friday’s near complete reversal of CAT”s latest breakout to an all-time high has me sitting up again. I am poised to buy a put spread on continued selling.

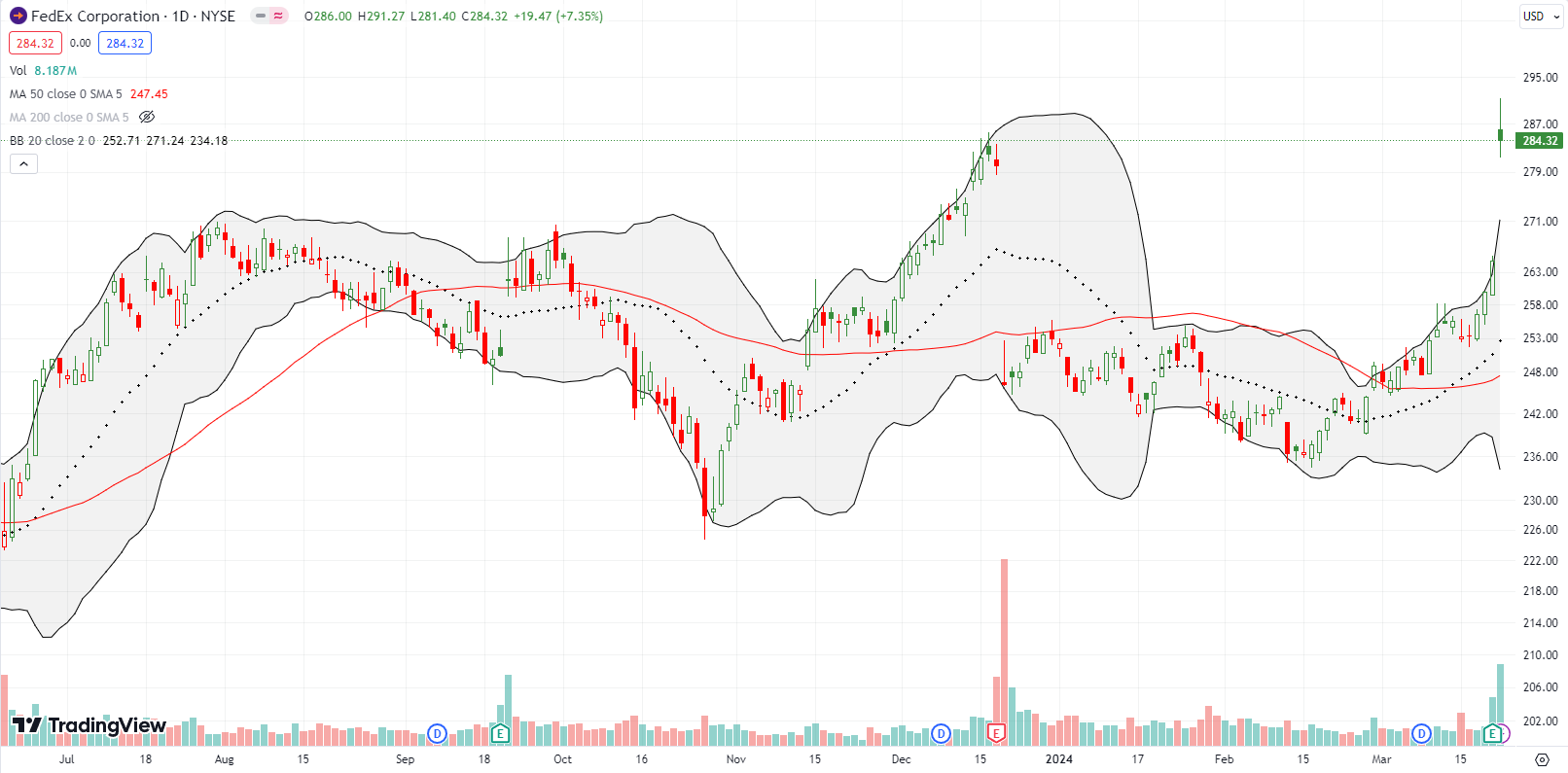

FedEx Corporation (FDX) soared 7.4% post-earnings and created one of the loudest statements of a statement week for stocks. FDX closed the week at a 32-month high. The market clearly has no idea what to think about FDX given December earnings featured a 12.1% drop.

In the prior week, I was dismayed to see I missed Logitech International S.A. (LOGI) completely recovering from January’s post-earnings gap down. Along comes an announcement about an executive departure, and I received a new opportunity. This time I did not hesitate. LOGI looks like it is already back into recovery mode.

Be careful out there!

Footnotes

Subscribe for free to get email notifications of future posts!

“Above the 50” (AT50) uses the percentage of stocks trading above their respective 50-day moving averages (DMAs) to measure breadth in the stock market. Breadth defines the distribution of participation in a rally or sell-off. As a result, AT50 identifies extremes in market sentiment that are likely to reverse. Above the 50 is my alternative name for “MMFI” which is a symbol TradingView.com and other chart vendors use for this breadth indicator. Learn more about AT50 on my Market Breadth Resource Page. AT200, or MMTH, measures the percentage of stocks trading above their respective 200DMAs.

Active AT50 (MMFI) periods: Day #83 over 20%, Day #81 over 30%, Day #79 over 40%, Day #27 over 50% (overperiod), Day #1 under 60% (underperiod), Day #50 under 70%

Source for charts unless otherwise noted: TradingView.com

Full disclosure: long IWM call, long AMD, long LOGI

FOLLOW Dr. Duru’s commentary on financial markets via StockTwits, Twitter, and even Instagram!

*Charting notes: Stock prices are not adjusted for dividends. Candlestick charts use hollow bodies: open candles indicate a close higher than the open, filled candles indicate an open higher than the close.

At 7:30 in the video, regarding the balance sheet Powell says “… it will be appropriate to slow the pace of runoff fairly soon, consistent with the plans we have previously issued”.

My memory is fallible, but other than handwaving about intentions (as done again here) and I don’t usually read the Minutes, but I don’t recall specific plans in the Statement or Implementation Note documents. Powell goes on to say that the (current) pace will be reduced to foster a smooth transition, but the reduction won’t imply a change in the ultimate target.

This is an important signal. Both the runoff pace and target are critical to mortgage rates, which are critical to the housing market, which is critical to inflation measures. Each step in this chain has lags.

My _guess_ is that on the day of the first rate cut, a reduction in the runoff pace will also be announced.

There are several remarkably insightful questions about this starting at 31:15, and detailed answers from Powell that I found helpful – first noting that non-treasury holdings (MBSs etc bought 10-15 years ago) have independent liquidity, and second recognizing that in 2019 attempts to shrink the balance sheet did not go smoothly. Powell went further at this point, saying he hopes that a slower pace could enable a smaller ultimate target, while keeping a significant buffer to deal with unexpected volatility.

I am pretty sure Powell has consistently communicated intentions about the balance sheet. Members of the press often ask about it as well. This plan to reduce the pace added to the dovish flavor of latest announcement on monetary policy and supports higher asset prices.

Seems like nothing but up until we see a real increase in Inflation, which is the only thing that would make the fed pivot. Fear of any deflation keeps fed supporting asset prices….seems like potentially forever…

The stock market is in that magical goldilocks universe at this point!