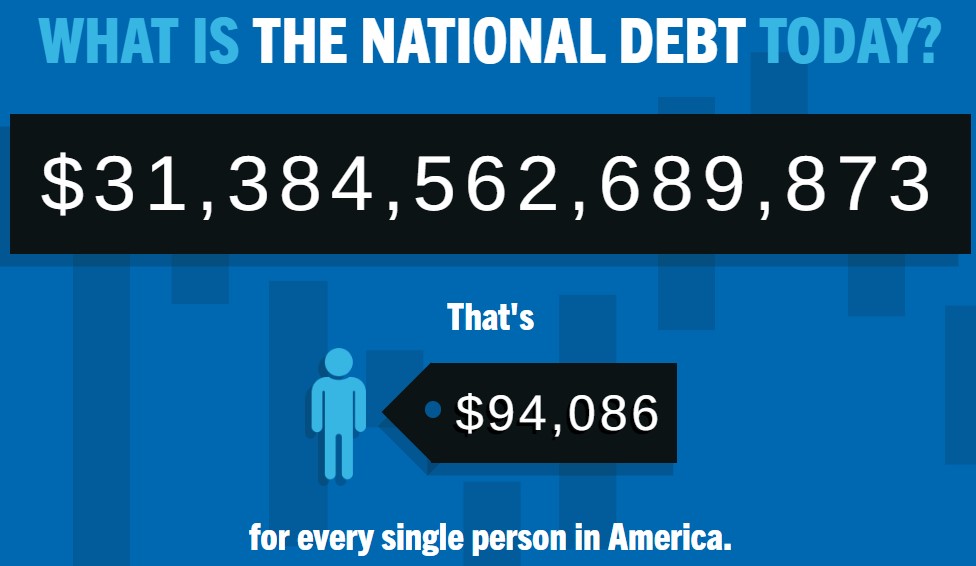

With the power change in the U.S. House of Representatives, 2023 will be another year of drama over the U.S.’s debt ceiling. Treasury Secretary Janet Yellen recently brought the looming debt drama to the forefront of economic headlines by delivering the obligatory warning about the risk of default if Congress does not increase the debt ceiling by June.

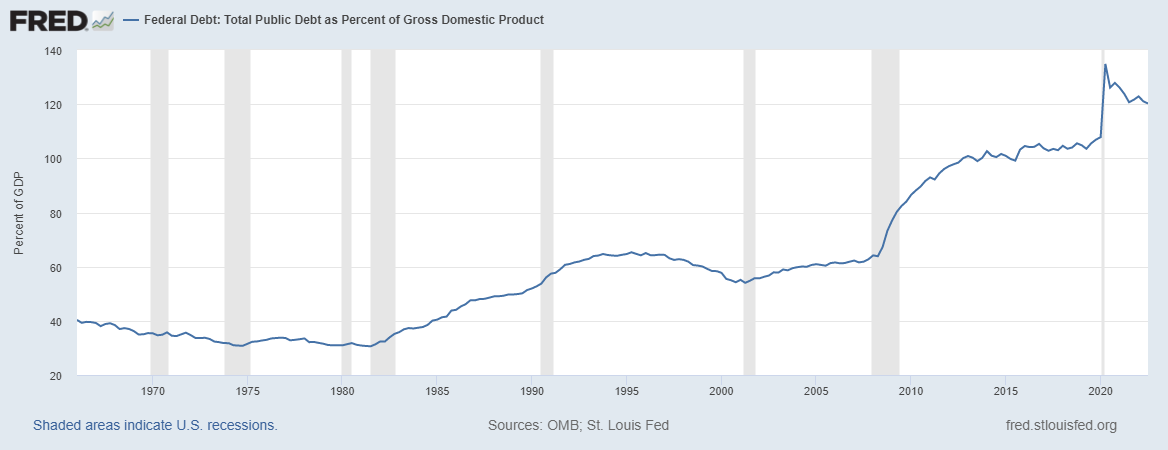

The ever-growing size of the debt relative to GDP provides on-going fodder for consternation and debate. This year’s debt drama will be further tinted by a) rising interest rates which make debt service more expensive for the Federal government and b) high inflation which we hope has peaked and is on its way to much lower levels. The higher profile for the U.S. debt should make SPDR Gold Shares (GLD) a winner this year. I also suspect the current parabolic moves in cryptocurrencies may represent trader efforts to front-run the debt drama.

The Debt Drama

To some, the public debt looks like America’s most alarming economic problem. To others, the public debt is just the cost of getting the government’s job done; a growing economy will take care of everything. (My opinions about the debt were shaped by watching the and reviewing the movie I.O.U.S.A. and reading “Empire of Debt: The Rise of An Epic Financial Crisis” which basically advised buying gold.) The rising debt to GDP ratio increasingly hands the advantage to those who care about the debt. In recent years, the debt to GDP ratio has had three important eras of growth:

- The go-go 1980s when government spent heavily to build-up the military.

- The wake of the Great Financial crisis when economic growth dropped from historical norms, and the government spent heavily to reconstruct the economy.

- The COVID-19 pandemic when government spent heavily to fill massive chasms in the economy.

Representing debt relative to GDP puts the debt into proper context. An economy with debt growing at the same rate as the economy is balanced. Economists argue about the acceptable ranges for the ratio. Generally, a ratio above 100% raises concerns and above 150% raises alarm bells. Over the above timeframe, the U.S. first went over the 100% level in Q4 of 2012. The pandemic-induced spike is being “paid down” by the current economic recovery. However, if the U.S. goes into recession, the ratio could surge again as the economy slows or even contracts. The current political environment may tightly constrain any growth in anti-recessionary spending.

The Gold

Gold went parabolic last March ahead of the first rate hike by the Federal Reserve. Markets have not seen a Federal Reserve serious about fighting inflation in over 40 years, so skepticism abounded. As the realities of aggressive monetary tightening unfolded, gold sold off. The sell-off did not end until around the time of the last peak in the yield of 10-year Treasuries. As markets increasingly anticipate the end of the Fed’s rate hikes, gold’s momentum has also increased. Now, gold is nearly parabolic again. The graph of SPDR Gold Shares (GLD) shows the price action around these bookends.

I strongly suspect gold will pull back from this move gone overdrive. However, I am eager to buy that dip given GLD is in breakout mode above its 200-day moving average (DMA) (the blue line above). Assuming my debt-related thesis for financial markets holds true, then GLD soaring 2.4% on the day of U.S. elections (November 8, 2022) makes a lot of sense. GLD in turn confirmed a 50DMA (red line above) breakout at that time.

The Bitcoin

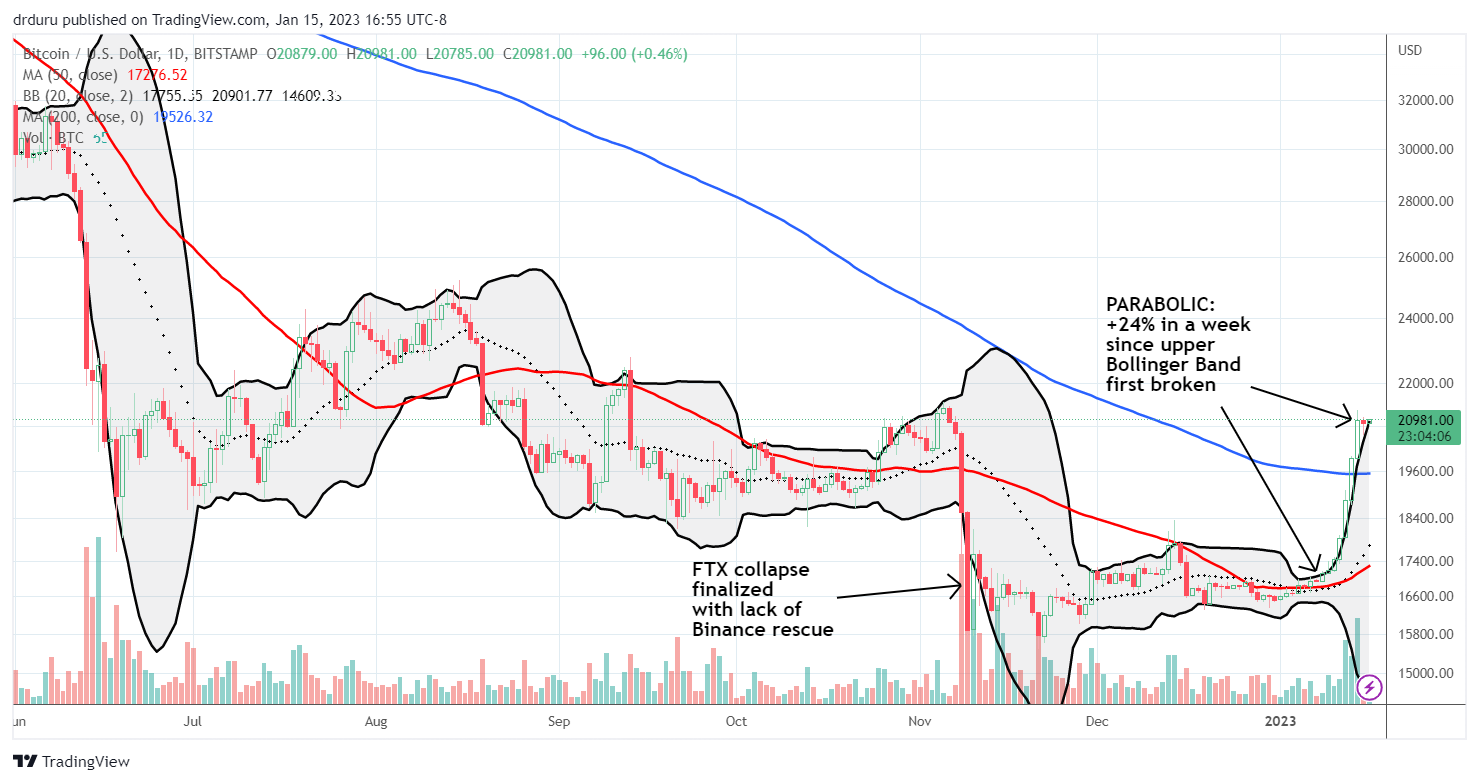

Cryptocurrency missed the early debt signals because of the historic collapse of crypto-exchange FTX in early November. The concurrent collapse in cryptocurrencies was at its most intense on the day of the election and the next day. The healing finally got moving over the past week. The make-up for lost time has been so intense that cryptocurrencies like Bitcoin (BTC/USD) have gone parabolic. BTC/USD even confirmed a 200DMA breakout over the weekend.

Now that Bitcoin has recovered its post FTX losses, resistance to the overheated move should appear. If not, BTC/USD could quickly move to $24,000. Otherwise, after a fresh period of cooling off, I will look to see whether crypto prices move with growing debt drama…and of course monetary policy drama.

Be careful out there!

Full disclosure: long GLD, long PHYS, long BTCUSD, long GBTC, long BITO, long BITI

Because of pushback from Congress in 2009 and thereafter, fiscal stimulus in response to the Great Recession (though large) was insufficient, resulting in a long slow recovery. The Fed initially was primarily focused on keeping the crumbling banking system functioning, and did not get around to QE until years late. Wave after wave of QE was required to finally get the economy growing again.

History doesn’t repeat, but it rhymes. I believe Congress will again refuse to countenance an adequate fiscal response if a recession begins this year, in fact it will do the opposite and insist on reductions to the currently planned spending, thus worsening what would otherwise be a mild recession. This will leave the Fed again as the only soldier standing. Fortunately, it will have some scope to cut rates. However, I suspect by mid-2024 economists will be agreeing the Fed raised them too high back in the halcyon days of early 2023 :-}.

Sounds like even more of a reason for gold and crypto to surge – front run the Fed’s next easing cycle.