Stock Market Commentary:

The market feels heavy and bearish. Yet, the major indices continue to bounce between the edges of their “churn zones.” Last week’s churn delivered a surprising ray of light tantalizing the dour sentiment. While the S&P 500 and the NASDAQ closed with a second straight week of losses, the major breadth indicators closed flat for the week. Moreover, the volatility index barely eked out a gain for the week. These signs point to promising green shoots trying push through the growing angst and anxiety engulfing financial markets. The unanswerable question remains what will markets actually do if the worst fears become reality?

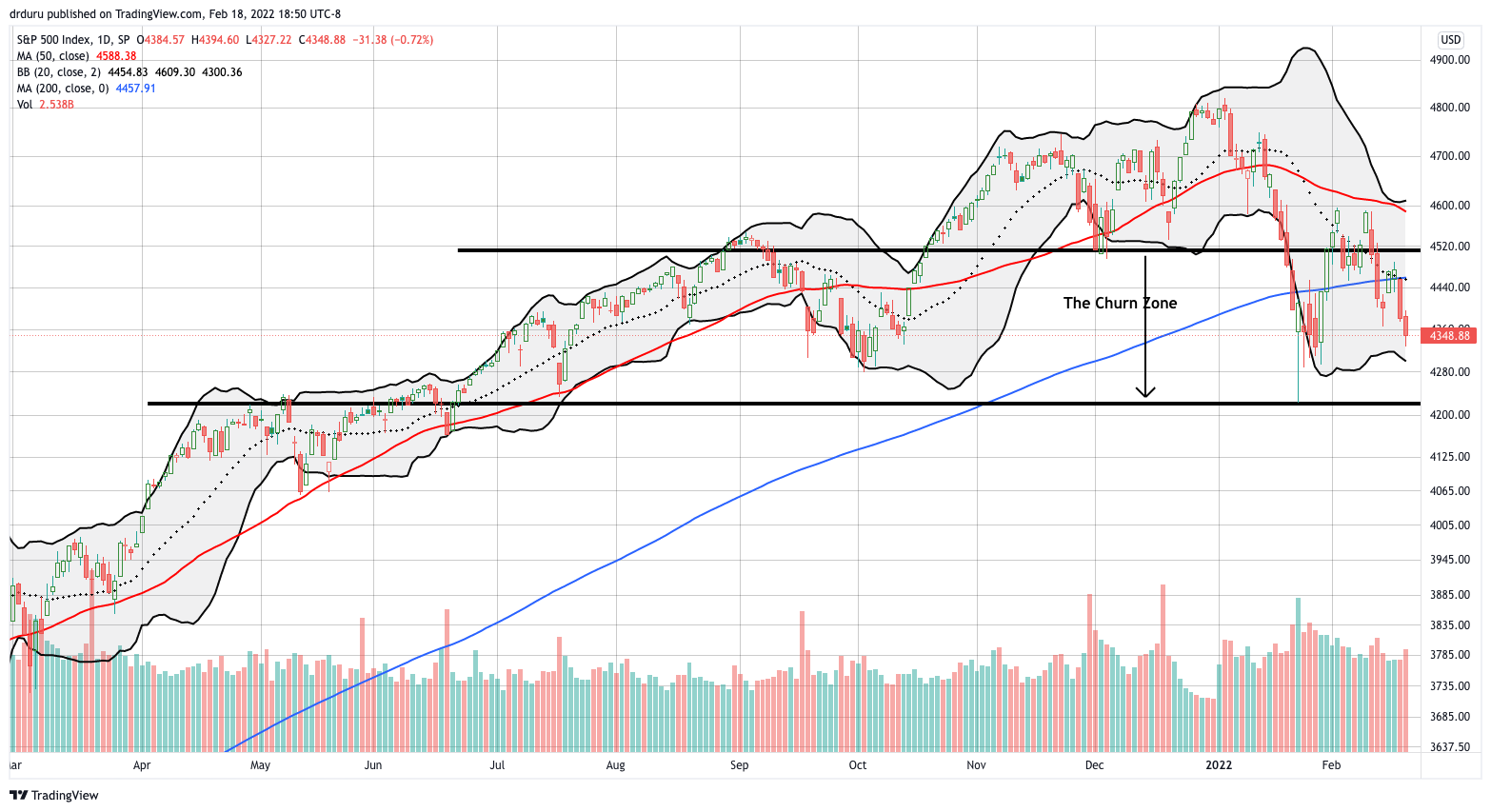

The Stock Market Indices

The S&P 500 (SPY) lost 0.7% for the day and 1.6% for the week. The intraday low missed the closing low of the year by a mere point. The sellers maintained control of the narrative by confirming overhead resistance at the converged 20 and 200-day moving averages (DMAs). Still, sellers have yet to score a bearish breakdown below the churn zone. Every moment spent inside the churn zone is a promising step in the direction of exhaustion of anxiety and angst.

The NASDAQ (COMPQX) is worse off than the S&P 500 relative to overhead resistance levels. However, the tech-laden index sits higher above support from the bottom of the churn zone. That achievement is about as promising as one can hope for under the circumstances.

The iShares Russell 2000 ETF (IWM) is pulling off the promising feat of staying out of the bear market zone. The ETF of small caps just barely closed below its 20DMA support and looks close to setting up a churn zone above the bear market zone. IWM lost 1.0% for the week and 0.9% on the day. A 2.6% setback on the previous day locked in the slide into a negative week.

Stock Market Volatility

In the previous week, I was surprised that the stock market did not sell off more given the surge in the volatility index (VIX). Last week surprised me with the VIX’s inability to gain more ground given the heavy selling that closed the week in the major indices. On balance, this development looks promising for financial markets. Still, the VIX should remain elevated (above 20) until the churn zone gives way to a breakout.

The Short-Term Trading Call with A Promising Divergence

- AT50 (MMFI) = 35.5% of stocks are trading above their respective 50-day moving averages

- AT200 (MMTH) = 34.3% of stocks are trading above their respective 200-day moving averages

- Short-term Trading Call: bullish

AT50 (MMFI), the percentage of stocks trading above their respective 50DMAs, ended the week exactly flat with the close of the previous week. AT50’s cousin AT200 (MMTH), the percentage of stocks trading above their respective 200DMAs, did the exact same thing. As a result, I am less concerned about the fade from the highs of the week and more intrigued by the promising divergence from the S&P 500 and the NASDAQ. These indices stretched toward the lows from January’s oversold period while the breadth indicators are remain well above their January lows. This promising divergence keeps my short-term trading call firmly planted in the bullish camp.

I fully recognize the incongruence of bullishness with clear and obvious risks abounding. Indeed, the main feature of the churn zone is that both bulls and bears can be right. I have just chosen to focus on the bullish possibilities created by selling pressure in the middle of a recovery from oversold trading conditions. Surprisingly, my March QQQ calendar call spread closed out at my initial profit target (recall I was Apple wary). I reflexively opened a new spread near the close of the NASDAQ’s selling. On the downside, I stubbornly passed up an opportunity to come out even on my expiring IWM call spread. Perhaps the most telling trade was my first failed hedge in many weeks. I resigned myself to nabbing residuals in my IGV put. Finally, I rolled profits from my latest ARKK put calendar spread into a new one.

Speaking of the ARK funds. All but one is now close to finishing complete reversals of the pandemic breakout. All the gains from riding easy money and zero regard for (near-term) valuations are just about gone. The new lows in these funds symbolize the heaviest weights dragging down the stock market. I will discuss the technicals in my next stock chart reviews.

Be careful out there!

Footnotes

“Above the 50” (AT50) uses the percentage of stocks trading above their respective 50-day moving averages (DMAs) to measure breadth in the stock market. Breadth defines the distribution of participation in a rally or sell-off. As a result, AT50 identifies extremes in market sentiment that are likely to reverse. Above the 50 is my alternative name for “MMFI” which is a symbol TradingView.com and other chart vendors use for this breadth indicator. Learn more about AT50 on my Market Breadth Resource Page. AT200, or MMTH, measures the percentage of stocks trading above their respective 200DMAs.

Active AT50 (MMFI) periods: Day #465 over 20%, Day #11 over 30% (overperiod), Day #2 under 40% (underperiod), Day #32 under 50%, Day #65 under 60%, Day #245 under 70%

Source for charts unless otherwise noted: TradingView.com

Full disclosure: long QQQ call spreads, long IWM call spread, long SPY call spread, long ARKF puts, long ARKK calendar put spread

FOLLOW Dr. Duru’s commentary on financial markets via StockTwits, Twitter, and even Instagram!

*Charting notes: Stock prices are not adjusted for dividends. Candlestick charts use hollow bodies: open candles indicate a close higher than the open, filled candles indicate an open higher than the close.

hi. greatly appreciate your commentary.

can you please explain how you derive the churn zones?

Thanks for reading! I explained the churn zones here: https://drduru.com/onetwentytwo/2022/01/29/churn-zone-stands-against-bear-market-the-market-breadth/

The short version is I started with the presumed low point marked by the lows of the January oversold period. Next, I looked for likely resistance for the top of the churn zone. I pinned the October, 2021 as a point where selling would resume. It’s not precise, but I like it as a guideline to prevent me from being too aggressive below the more standard overhead resistance levels from the 50 and/or 200DMAs. The premise here is that the high level of uncertainty means that the market is biased for churn until some of these points of anxiety get resolved.

I hope that makes things clearer.

The churn zone prediction looks pretty spot on for last couple of weeks, but you mention you used the oct ’21 as top of zone…. looks more like there was a top/price resistance in sept 21′ and early nov ’21 the MMFI peaked……sorry if I am being annoyingly precise but trying to see if I am missing something?

Support and resistance is in the eye of the beholder. 🙂

Recall that I made up the churn zone ahead of knowing exactly where the market would stop. So it was my best guess. I feel comfortable sticking to it given the breakouts above the churn zone were brief. Moreover, the churn zone continues to define the majority of the trading action.