Stock Market Commentary:

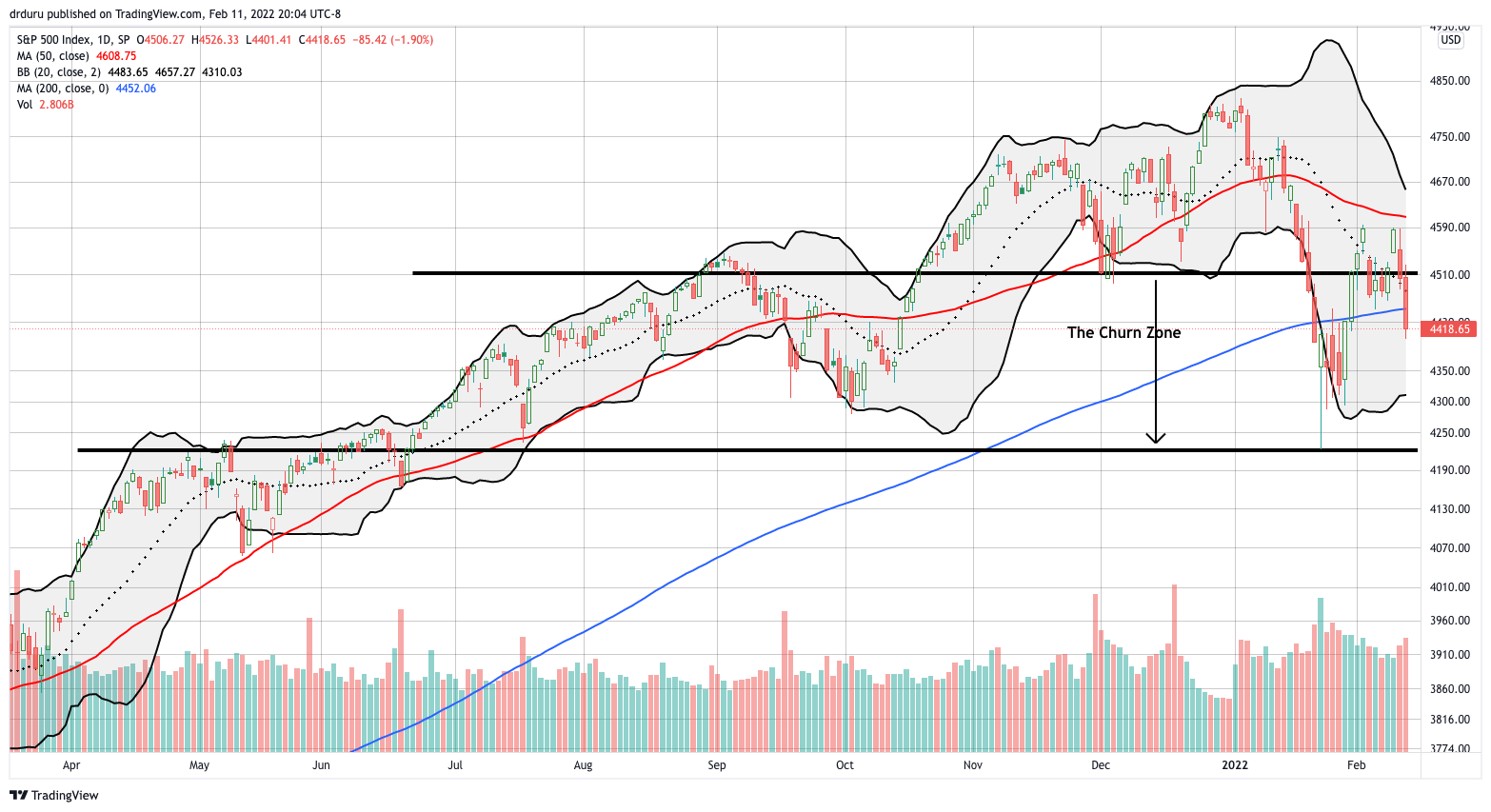

At mid-week, the stock market looked poised to put on a defiant display of buying power. However, multiple negative headlines proved too much to bear. Hawkish Fed-speak greased the skids on Thursday. Another hot inflation report and escalating tensions at the Ukrainian border sealed the deal for angst to rule the day. The stock market spent another week essentially locked into what I have called the “churn zone.”

All things considered, I am actually surprised the stock market did not fare a lot worse from all these tensions. The action has the feel of a market that “wants” to go higher. Accordingly, I assume that the stock market is well underway in a process of first absorbing and then pricing in the worst case scenarios.

Federal Reserve board member James Bullard made his face the symbol of “worst case” scenarios for monetary policy. Bullard is typically on the hawkish end of policy. He really ramped up the rhetoric on Thursday calling for a “supersized” rate hike process. Bullard was so hawkish that rumor-mongers were able to spook the market on Friday about a surprise, emergency rate hike in response to the lates inflation numbers. Bullard’s commentary essentially tested the boundaries of believability as far as traditional Fed behavior goes.

Lost in the angst was a series of Fed-speak that directly pushed back against Bullard’s hawkishness. With the next Fed meeting still a month away, think of the journey as one where someone like Bullard boosts the market’s resilience against the tightening of monetary policy. Others on the Fed provide the counterpoint to prevent a complete panic attack in financial markets. The resulting churn in the markets could frustrate bears and bulls alike. By the time of the March Fed meeting, the stock market could breathe a huge sigh of relief no matter what the Fed says and does.

The Stock Market Indices

The S&P 500 (SPY) lost 1.8% for the week thanks to Friday’s selling. On Wednesday, the index closed right at the highs of the current rally from oversold conditions. The S&P 500 looked poised for a real test of overhead resistance from its 50-day moving average (DMA) (the red line below). Subsequent selling first took the index back into the churn zone. The 1.9% loss on Friday sliced the index through its 200DMA support (the blue line below).

I got the hint early enough on Thursday to take profits on my weekly calendar call $452/$447 spread on an intraday rebound. Although the index sliced through support, I still jumped right back into a fresh SPY position. With volatility soaring, the call spread was extremely expensive at over 40% of the value of the spread. So I decided to sell short a higher call spread to reduce costs. I ended up with a long $445/$455 call spread and short a $455/$460 call spread, both expiring on February 25th. I gave the index a little runway to recover from the current angst.

The NASDAQ (COMPQX) only enjoyed 1 day above the churn zone. Indeed, Friday’s 2.8% plunge was deep enough to put the tech-laden index at risk of retesting the bottom of the churn zone in short order. Still, I am in the mood of looking at selling and angst as buying opportunities within the churn zone.

With my $350/$360 call spread expiring on Friday, I took profits on Monday. I left in place my short $360/$365 call spread expiring the following week with the intention to open a fresh long QQQ position against it. With Wednesday’s pop, I decided to move into a fresh long position: a $370/$380 call spread expiring February 25. That trade ended up being premature. On Thursday’s fade back to the NASDAQ’s churn zone, I shaved the short call spread to end up with a long QQQ $365 call. On Friday’s plunge, I felt compelled to take advantage of the surge in volatility. Accordingly, I jumped into one more (and my last for this cycle) QQQ position: a March 02/18 $365/$360 calendar call spread. This last position was quite expensive. I configured it to reduce the cost of the March 18 call and will be looking to take whatever profits I can get on the March 2nd call once volatility implodes again.

The iShares Russell 2000 ETF (IWM) managed to outperform with a 1.5% gain for the week. The ETF of small caps even held support at its 20DMA (the dotted line below). I was tempted to take profits on at least one of my two IWM call spreads on Wednesday and then Thursday’s surge toward 50DMA resistance. I ended up holding still. Upon review of my thinking, I should have taken profits on my call spread expiring on the 18th. That move would have also been consistent with my current assumption that overhead resistance from 50DMAs will hold tight for the indices for this period of churn.

Stock Market Volatility

The convergence of big tensions pushed the volatility index (VIX) higher the last two days of the week. Given the volatility gains, I am surprised the stock market did not sell off a lot more. Faders even managed to knock the VIX well off its high point of the day on Friday. The bears can take some satisfaction out of seeing the VIX hold the critical 20 level as support. Seeing the picture-perfect bounce makes me think I need to treat near-term tests of that level as signaling high odds of an end to whatever rally is underway at the time. For now, the clock is ticking on the sellers with the VIX already in fade mode.

The Short-Term Trading Call with Converging Tensions

- AT50 (MMFI) = 35.6% of stocks are trading above their respective 50-day moving averages

- AT200 (MMTH) = 34.3% of stocks are trading above their respective 200-day moving averages

- Short-term Trading Call: bullish

AT50 (MMFI), the percentage of stocks trading above their respective 50DMAs, did not fall as much as I would have expected given the tensions converging upon markets. I am assuming the outperformance of IWM helped my favorite technical indicator hold a 5.5 point gain for the week. So while AT50 failed to print a new breakout, its uptrend from oversold levels remains intact. My short-term trading call remains at bullish with overall bounce from oversold conditions still in play. In fact, there is no need to change until/unless AT50 reaches overbought status or the S&P 500 tests 50DMA resistance – whichever milestone comes first.

Having said all that, I fully recognize all the risks in the market given the toxic mix of tensions about monetary policy, inflation, and geo-political issues. If the stock market breaks down to fresh lows, I will hit the reset button on my trading strategy. At that point, at least one of the major indices will print important technical milestones whether it is the S&P 500 and/or NASDAQ violating the bottom of their respective churn zones and/or IWM descending into bear market territory. Assuming AT50 will be back to oversold conditions at that point, I will take whatever profits I have in my various hedges (IGV, ARKF, and ARKK puts and put spreads) as a way to fuel more confidence in sticking to the oversold trading strategy. As always, one step at a time…

Be careful out there!

Footnotes

“Above the 50” (AT50) uses the percentage of stocks trading above their respective 50-day moving averages (DMAs) to measure breadth in the stock market. Breadth defines the distribution of participation in a rally or sell-off. As a result, AT50 identifies extremes in market sentiment that are likely to reverse. Above the 50 is my alternative name for “MMFI” which is a symbol TradingView.com and other chart vendors use for this breadth indicator. Learn more about AT50 on my Market Breadth Resource Page. AT200, or MMTH, measures the percentage of stocks trading above their respective 200DMAs.

Active AT50 (MMFI) periods: Day #460 over 20%, Day #6 over 30% (overperiod), Day #2 under 40% (underperiod), Day #27 under 50%, Day #60 under 60%, Day #240 under 70%

Source for charts unless otherwise noted: TradingView.com

Full disclosure: long QQQ call and spreads, short QQQ call spread, long IWM call spreads, long SPY call spread

FOLLOW Dr. Duru’s commentary on financial markets via StockTwits, Twitter, and even Instagram!

*Charting notes: Stock prices are not adjusted for dividends. Candlestick charts use hollow bodies: open candles indicate a close higher than the open, filled candles indicate an open higher than the close.

I agree with the take of the CNBC analyst; in fact I think he missed a chance to point out that the markets were thoroughly wrong to listen to Bullard, whose perma-hawkishness has not historically influenced Fed policy. CNBC did a nice job of quoting three different FOMC members who are relatively dovish and (tactfully) repudiated Bullard’s bombast; also of pointing out that headline inflation was and continues to be expected to remain high until mid-year.

I’m bearish until this market finishes rolling back its over-valuations, but absent a worsening of the Ukraine situation before Monday’s open, I expect a near-complete rollback of the Bullard reaction.

I wish I could quickly draw up a history of the market’s over-reaction and the reversal of Bullardism. I suspect it could be even more dramatic than the post-Fed gyrations!

My anticipation was decrease at beginning of week, followed by up moves end of the week. That also gives time for a MMFI move down closer to the 20 (as it appears to be rolling over). I am assuming that is your thoughts as well with QQQ Short and Long at basically the same strike?

I don’t think there will be enough selling this week to get to oversold. This Friday is the expiration of monthly options. With the latest VIX surge, I am guessing traders got enough protection through that expiration. However that’s just an observation from the outside looking in. The QQQ position is net long. The short call spread is in place to lower the cost of being net long.

meaning they were selling call options against their long positions when vix was up?

Buying puts.

Selling calls (against existing positions) would make most sense when expectations for future price moves are *lower*.

If you expect price ranges to increase, you want to go long volatility.