Stock Market Commentary:

The churn zones continued to hold sway over the market last week. Buyers effectively fought off a descent into a bear market by rallying the major indices up and out of the churn zone. Still, the narrative of churn stands thanks to a refresh of fear from Facebook’s post-earnings blow-up. Meta Platforms, Inc (FB) slammed the market with the largest ever one day loss in market cap. Next, Amazon.com (AMZN) followed that performance with history’s largest ever one day gain in market cap. On balance, wild price swings were the rule in a week that produced net gains for the indices. It was actually a week that delivered for bullish trades on a bounce away from oversold trading conditions. Still, churn rules everything around market stocks (CREAMS) thanks to hawkish monetary policy in the midst of heightened uncertainty.

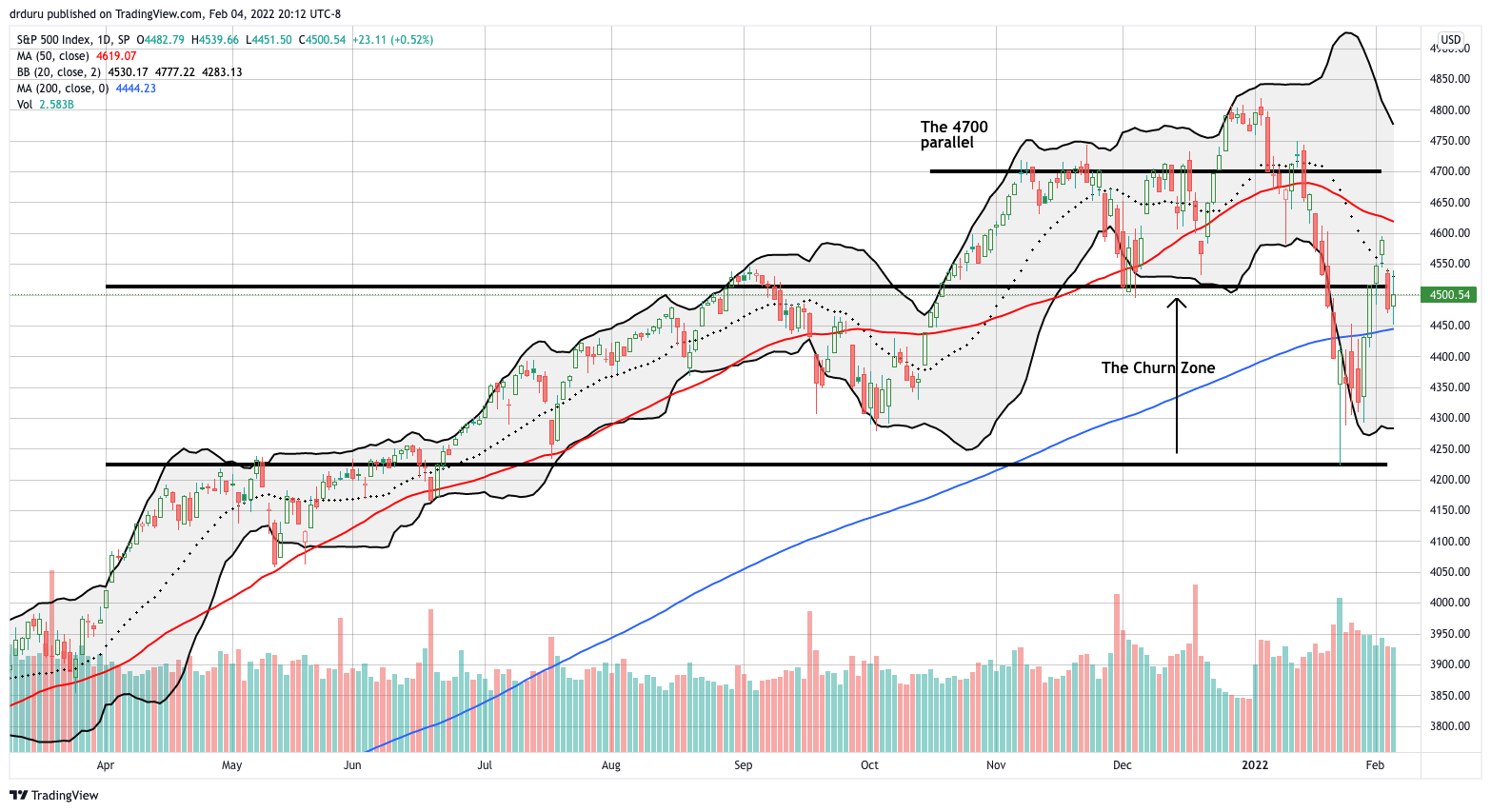

The Stock Market Indices

The S&P 500 (SPY) gained 1.6% for the week. The continued buying off the oversold lows validated (once again) the principles of staying disciplined with the AT50 trading rules. If not for the historic plunge in the shares of Meta Platforms, Inc (FB), the S&P 500 might have even tested resistance at its 50-day moving average (DMA) (the red line below). Instead, the breakout above the churn zone turned into a fresh test of support at the 200DMA (the blue line). You guessed it. I bought a fresh SPY calendar call spread right at the 200DMA. I continue to choose spreads where options premiums are high. My $452/$447 weekly configuration assumes that the index at best will churn along its 200DMA in the coming week.

I took profits on my previous SPY $450/$460 after the S&P 500 broke out above its 20DMA (the dotted line).

Like the S&P 500, the NASDAQ (COMPQX) popped above the churn zone for two days. The tech laden index suffered even more from FB’s earnings disaster. The NASDAQ ended the week with a brief challenge of the top of the churn zone. The index gained 2.4% for the week. I never took profits on my QQQ call spread position, but I will need to act this week.

The iShares Russell 2000 ETF (IWM) gained 1.6% for the week. IWM started the week with an impressive 3.1% surge where I took profits on my IWM call spread. You guessed it again. I bought a fresh IWM call spread when IWM dropped to the 20% line (see below) on Friday. I really stretched on this position with a March 04/18 $215/$210 calendar call spread configuration. This position gives IWM room to rally. If IWM drops further and tests the recent lows, I will reload on a fresh IWM call spread position.

Stock Market Volatility

The volatility index (VIX) provided the best visual of the week’s wild prince swings. The VIX dropped 10.5% and 11.4% the first two days of the week. It held steady on Wednesday and of course popped again on Thursday. The VIX ended the week with a 16.1% drop, but it never broke through the critical 20 level. I fully expect the VIX to remain elevated in the coming week. I am also bracing for the next VIX surge; once a month seems about right given the current patterns and the current upside bias. Timing these surges is not attractive with the stock market close to oversold. Instead, I will embrace the next surge as a fresh opportunity to fade the VIX.

The Short-Term Trading Call with Wild Price Swings

- AT50 (MMFI) = 30.0% of stocks are trading above their respective 50-day moving averages

- AT200 (MMTH) = 32.3% of stocks are trading above their respective 200-day moving averages

- Short-term Trading Call: bullish

AT50 (MMFI), the percentage of stocks trading above their respective 50DMAs, surged to start the week. My favorite technical indicator closed that first day at 29.4%. AT50 made slight progress from there with a 30.0% close for the week. At these levels, AT50 remains “close enough” to oversold. Accordingly, my short-term trading call remains bullish. I want to buy dips in the major indices in this zone. Buying individual stocks remains quite hazardous given the wild price swings following earnings reports.

The week’s trading action validated my claim that the earlier extremes “created a sustainable bottom.” However, beyond the brief breakout above the churn zones, I have little confidence the indices can pop above stiffer resistance levels. The S&P 500 and IWM must contend with a downtrending 50DMAs. The NASDAQ must contend with even more ominous converging 50 and 200DMAs. As these moving averages decline, I will likely need to revisit my short-term trading call. Until the big tests come, I expect the stock market to churn away: churn rules everything around market stocks (CREAMS).

Be careful out there!

Footnotes

“Above the 50” (AT50) uses the percentage of stocks trading above their respective 50-day moving averages (DMAs) to measure breadth in the stock market. Breadth defines the distribution of participation in a rally or sell-off. As a result, AT50 identifies extremes in market sentiment that are likely to reverse. Above the 50 is my alternative name for “MMFI” which is a symbol TradingView.com and other chart vendors use for this breadth indicator. Learn more about AT50 on my Market Breadth Resource Page. AT200, or MMTH, measures the percentage of stocks trading above their respective 200DMAs.

Active AT50 (MMFI) periods: Day #455 over 20%, Day #1 over 30% (overperiod), Day #14 under 40%, Day #22 under 50%, Day #55 under 60%, Day #235 under 70%

Source for charts unless otherwise noted: TradingView.com

Full disclosure: long QQQ call spread and short QQQ call spread, long IWM call spreads, long SPY call spread

FOLLOW Dr. Duru’s commentary on financial markets via StockTwits, Twitter, and even Instagram!

*Charting notes: Stock prices are not adjusted for dividends. Candlestick charts use hollow bodies: open candles indicate a close higher than the open, filled candles indicate an open higher than the close.

doc,

Several questions….

1. On your call debit spreads, why do you buy both options OTM? cheaper price? Seems if you bought ATM (or just OTM), you would get both delta increase and “inherent value”? I am still learning how things move so just curious.

2. How do you set up your calendar spreads. I assume your buying the 452 and selling the 447. What time frames do you use? Is the play here that the short call loses time value much quicker. I know some folks will sell that long call and sell short positions multiple weeks against it (which I guess works well as long as the short call stays OTM) but it seems like your playing more the short term movement and possibly volatility crush (which would be less on an ITM call I think?)

3.”Still, churn rules everything around market stocks (CREAMS) thanks to hawkish monetary policy in the midst of heightened uncertainty.’….explain this to me

sorry question one should have said why do you buy the call OTM (not both as your obviously selling one)

Philip – thanks for reaching out for clarity! I am sure these questions are helping other readers.

1. For my call debit spreads, I am typically choosing strike prices according to technicals. The cheaper price of OTM is indeed attractive, especially when I am relatively confident in the direction. Buying at-the-money, or even in-the-money, implies a LOT of confidence in both direction and timing since there is more money at risk.

2 . For calendar spreads, I am almost always picking the higher strike price as the short side and the earlier expiration. For the short side, I pick a strike I think can be attained by the time the long side expires but NOT by the time the short side expires. I only started trying these configurations in the past year or two so I am still learning on this one. I use the calendar spreads to reduce the price of the long side that I believe in.

3. “CREAM” is a reference to a 90s rap song. I included the video for reference. 🙂 The reference is not really relevant. What’s more important is that I am claiming the stock market will be stuck churning for a while longer. For more details on how the hawkish Fed is increasing market uncertainty, you should read my related post.

hi from italy. For first many compliments your posts are great. Can I ask to you what are “churn zones”? Are there many posts about this?? (Got U links?)? Thanks in advance. Happy times

Thanks for checking in all the way from Italy!

The churn zones are marked in the charts. I first defined them here: https://drduru.com/onetwentytwo/2022/01/29/churn-zone-stands-against-bear-market-the-market-breadth/

Note that these churn zones are temporary. At *some* point, the market will break out above or below them and establish a new pattern.

Doc,

Let me guess…

…You closed all your Spy and IWM call spreads mid week for a profit (just before the huge sell off Thursday) and your neutral for this week (because MMFI turned and looks to be heading south)

THAT would have been a great crystal ball! So not quite. I will write more in the next post. The headline is I take a rolling approach. I make sure to take profits on some positions when the market offers them. I hold other positions looking for continuation of the rally. Since I think the market is going to be in a “churn zone”, I am focused on playing the indices from the presumed bottom to the top of the zones.

I remain bullish, especially given MMFI is in the 30s.