Stock Market Commentary:

I started last week’s trading with a call for discipline over precision. That post turned out to be timely as the bears and bulls took the stock market on a wild ride through the Fed’s latest monetary policy decision (more on that in a future post). The indices plunged deeply on Monday but set the tone for the week with a spirited comeback. Subsequently, the market traveled similar distances every day in what became a distinct churn zone. The stakes are high for this churn zone. A bear market awaits financial markets if selling breaks the trading action to lower levels.

The Stock Market Indices

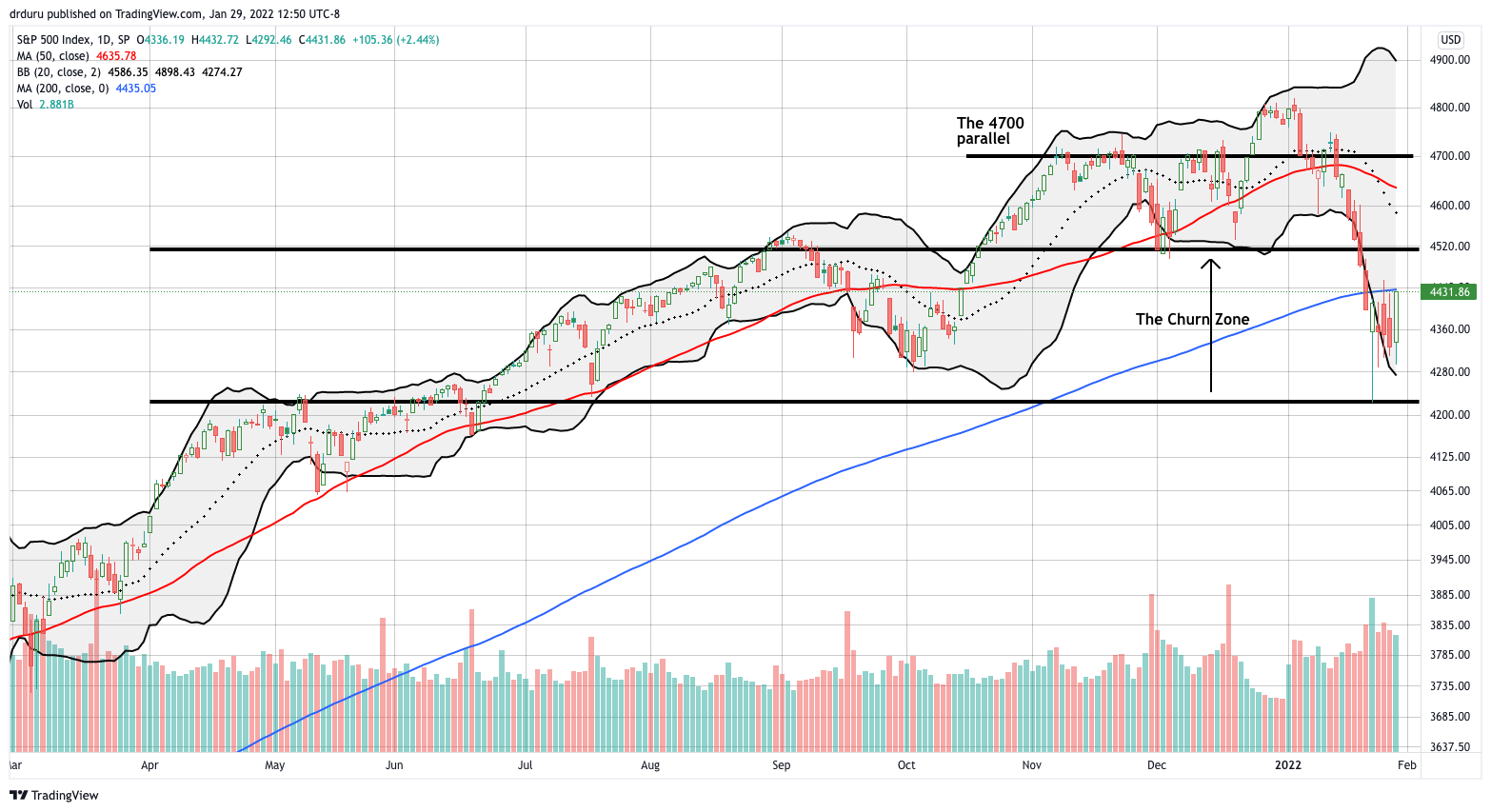

The S&P 500 (SPY) fought through the churn zone (shown below) to end the week with a hard-earned 0.8% gain. As expected, the index jammed itself against overhead resistance from its 200-day moving average (DMA) (the blue line). I took profits on my calendar call spread and held my hopeful 450/460 call spread expiring this Friday. I call this spread “hopeful” because the top of the spread targets a breakout above the churn zone for a test of 50DMA resistance (the red line).

The churn zone describes the current conditions for support and resistance. The lower part of the churn zone markets the intraday low from Monday, a 12% decline from the all-time high. I fear that a breakdown below this bottom sets up the index for a steady decline that will feel like a bear market where rallies get sold. A technical bear market comes from a 20% decline from the all-time high. That level is around 3837. The S&P 500 last visited that level in March, 2021. The top of the churn zone loosely coincides with the December closing low and the October breakout.

The NASDAQ (COMPQX) already delivered a bear market scare. The tech-laden index lost 18% at its intraday low last week. Even Friday’s intraday low almost tested that level. Given my bullish short-term trading call, I refreshed a call spread on the Invesco QQQ Trust (QQQ) near that low. Interestingly, call options were a LOT more expensive put positions. The $350/$360 call spread expiring February 11th cost 40% of the point spread (20-25% is more normal). I reduced the cost by selling short a $360/$365 call spread expiring February 18th (200DMA resistance is at $365).

In the last Market Breadth post I asked: “Could a bellwether like Apple (AAPL) deliver results awful enough to cast a pall on corporate profits for the next quarter or two? Certainly, such a thing is possible, but I am not willing to bet on it.” Indeed, AAPL pulled off an amazing post-earnings rebound with a 7.0% gain. AAPL even closed above its 50DMA.

Even with AAPL back in a bullish zone, the NASDAQ remains in a precarious technical position. A breakdown below the churn zone will essentially mark the beginning of a bear market for technology stocks. The top of the churn zone closely coincides with the October low and the June breakout point. A breakout above this point still leaves the NASDAQ to contend with declining 200DMA resistance.

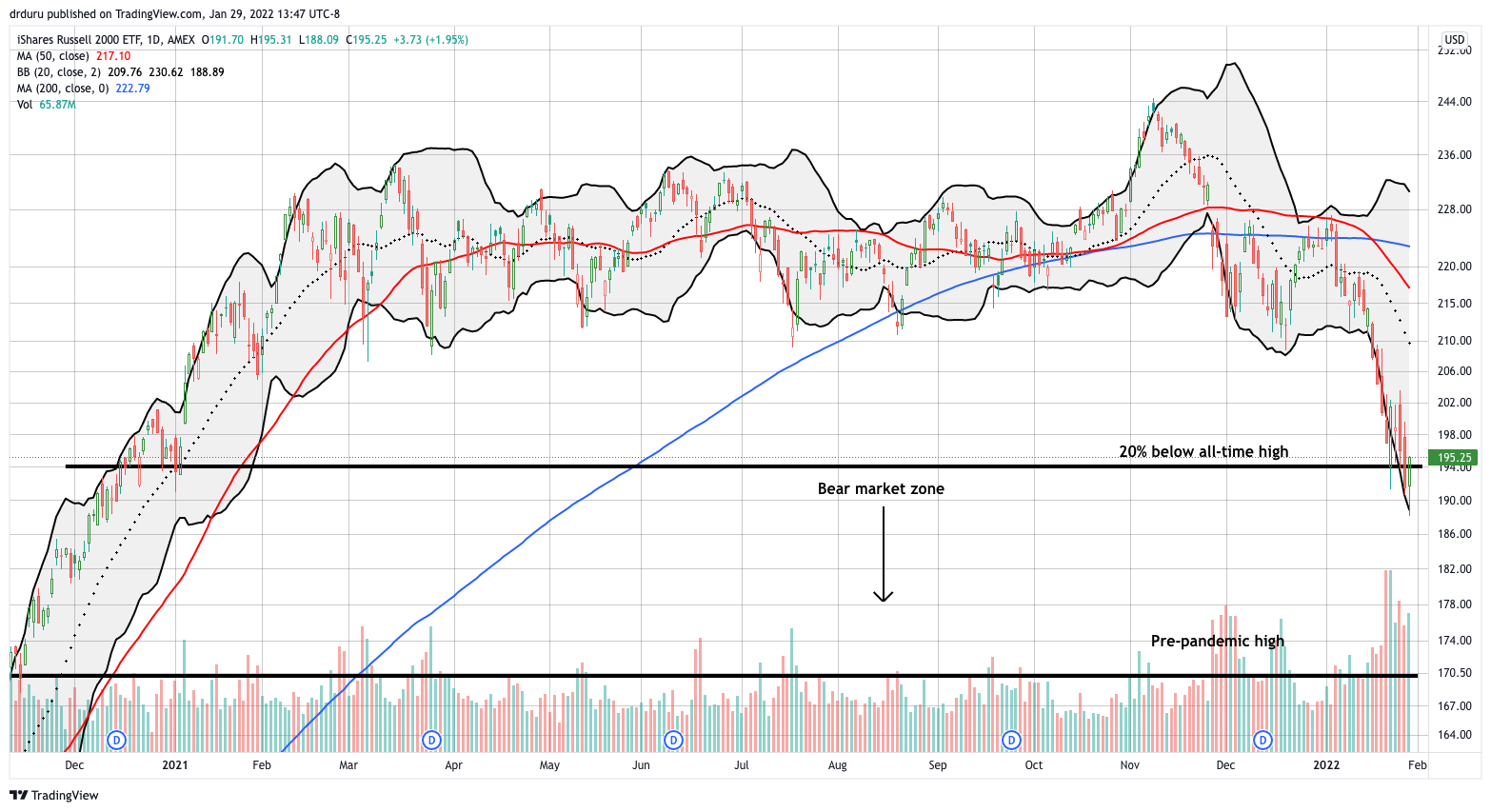

The iShares Russell 2000 ETF (IWM) started last week piercing into bear market territory. On Thursday, IWM actually closed in bear market territory. Friday’s 2.0% gain barely saved IWM from ending the week in bear market territory. This slippery trading action did not create the buffer of a churn zone that the S&P 500 and the NASDAQ secured. Accordingly, IWM still looks like it is in danger of erasing all its pandemic era gains before this selling cycle ends. Still, my short-term trading rules drew me into two separate call spreads on IWM with expirations on February 11th and the 18th.

Stock Market Volatility

The volatility index (VIX) printed a small loss for the week after tremendous churn. The massive fade on Monday from a 38.9 intraday high to a 29.9 close signaled a major win for the faders. For example, I successfully flipped shares in ProShares Short VIX Short-Term Futures ETF (SVXY). The short volatility play never got low enough again for me to dare take a second risk. SVXY remains my first go-to on the next extreme surge in the VIX.

The Short-Term Trading Call in A Churn Zone

- AT50 (MMFI) = 22.9% of stocks are trading above their respective 50-day moving averages (fell as low as 15.5% during the week)

- AT200 (MMTH) = 31.3% of stocks are trading above their respective 200-day moving averages (fell as low as 25.8% during the week)

- Short-term Trading Call: bullish

After AT50 (MMFI), the percentage of stocks trading above their respective 50DMAs, dropped below the 20% oversold threshold, I flipped the short-term trading call to bullish. The selling going into the week was already so extreme that I felt an intraday visit to oversold was a sufficient signal for an upgrade. While I notched a few successful bullish trades, a look back on the carnage revealed a surprise. My trading success for the month has been dominated by put options that I used as hedges. At the time I was nibbling on “pre-oversold” bullish positions. That tilt toward bearish wins says a lot about the extreme selling so far in January.

The market now sits at a critical juncture. Accordingly, the major indices I track are in cascading conditions of health. IWM is in the worst shape. The ETF of small caps already visited bear market territory and is staring down the prospects of giving up all its pandemic era gains. The NASDAQ is a breakdown away from a bear market. The S&P 500 is in the best shape with a churn zone well above bear market territory. The index is already testing overhead resistance at the 200DMA. The S&P 500 could quickly flip the script on the bears and sellers.

I still contend that last week’s extremes created a sustainable bottom. However, IWM’s slide forces me to consider the prospects for a bear market. The longer the stock market sits in or “near” oversold conditions, the more likely a churn zone will give way to a bear market. The trading rules still apply but tight trading windows just go lower and lower. At that point I downgrade to cautiously bullish in deference to the selling momentum. Fortunately, the moving averages provide strong signals to assist in calling the end of a bear market.

Be careful out there!

Footnotes

“Above the 50” (AT50) uses the percentage of stocks trading above their respective 50-day moving averages (DMAs) to measure breadth in the stock market. Breadth defines the distribution of participation in a rally or sell-off. As a result, AT50 identifies extremes in market sentiment that are likely to reverse. Above the 50 is my alternative name for “MMFI” which is a symbol TradingView.com and other chart vendors use for this breadth indicator. Learn more about AT50 on my Market Breadth Resource Page. AT200, or MMTH, measures the percentage of stocks trading above their respective 200DMAs.

Active AT50 (MMFI) periods: Day #450 over 20%, Day #7 under 30% (underperiod), Day #9 under 40%, Day #17 under 50%, Day #50 under 60%, Day #230 under 70%

Source for charts unless otherwise noted: TradingView.com

Full disclosure: long QQQ call spread and short QQQ call spread, long IWM call spread, long SPY call spread

FOLLOW Dr. Duru’s commentary on financial markets via StockTwits, Twitter, and even Instagram!

*Charting notes: Stock prices are not adjusted for dividends. Candlestick charts use hollow bodies: open candles indicate a close higher than the open, filled candles indicate an open higher than the close.

Obviously a good part of this decline is due to the expectation that the FED will raise rates. And they will. In the past, while short term that has resulted in market declines, it doesn’t always kill a bull market.

A good example is the ending of QE2, which took place back in June of 2011. The market initially went down, and then churned around for a while. But nearly 4 years later, the market had advanced about 60%!

While I don’t think we’ll see a gain of that magnitude this time, I also don’t think we’re entering a bear market phase. Statistics for previous market outcomes during FED increases would also tend to support this expectation. (Unless, of course, the FED gets too aggressive, and puts the country in a recession. We can’t completely rule that out.)

Having said that, I don’t think the decline is over yet. Friday was nice, and there may be some follow through on Monday. But I’m guessing it’s a head fake, and we’ll see further declines for a while. Maybe even a big selloff and another VIX spike, which would scare a lot of people, and really set the stage for a sustainable rally, if not a resumption of the uptrend. An event like that would be a good buying opportunity, at least for we long term investors.

Even so, I can’t imagine we’ll see significant gains this year, since higher interest rates and smaller S&P earnings increase projections will probably make any gains relatively modest, certainly compared to last year. Just getting back (or almost back!) to last year’s high would be a major accomplishment, all things considered.

In the meantime, you’re buying calls on IWM?? You’re a braver man than I am, Duru…..

QE is such a black box that I can understand how the market could get over its angst in due time. It’s also interesting to consider the experience from 2016 to 2018 where the Fed steadily raised rates. The stock market overall did fine until things finally started coming apart in 2018. The Fed backed off and started talking about mid-cycle adjustments. But both the end of QE and the last rate hike cycle are very different than this one where inflation is considered a clear and present danger. It is much easier for the market to anticipate a recession or stagflation from a Fed struggling to tame inflationary forces.

Fortunately for those of us who follow the technicals, the tea leaves are pretty clear for now. I drew the ranges on the charts as guides to divide between clinging to the bull market and a bear market (different for each index).

IWM is a very speculative play. Investors and algos can be very reflexive at key moments like a 20% decline. There will be people betting that all the bad news is finally priced in. So I want to ride that wave. If it fails to materialize, then I suspect IWM will continue on a path to wiping out the pandemic era gains.

I should have added that the longer IWM stays in a bear market, the more likely sentiment will sour across the market. Sellers will come out again trying to get ahead of the other indices tumbling into their own bear markets.

But in the meantime, earnings season has been decent enough (especially with Apple!) to keep the S&P 500 and even the NASDAQ stabilized in/around the churn zones…or at least that is my current expectation!

I love your optimism. It’s good for us pessimist. Ha! Great comments and perspectives on the technicals. I learn a lot from Your posts, especially about thinking from the “algos” perspective.

I did not have a lot of confidence about market being bullish this week but I Mimicked your 350/360 spread and did a TQQQ covered call with a strike 15% in the money (trade debit below the strike price so any close in the money would make money, and if not I’d be a long buyer at 80 percent of current price). Anyways closed both for small profits once they got in the green as Mondays initial sell off gave me paper hands.

Question… do you ever consider the “slope” of the moving average line in your technical analysis. Looking at most charts all the tech stocks had positives slopes which flattened and turned negative fast… a pattern the major indices seem to be moving towards.

Well, call it conditional optimism. 🙂

Good stuff on the call option trades! Nothing wrong with that with the precarious state of the stock market.

I do consider the slope of moving averages for trending purposes. For example, I am closely watching the 200DMA for the S&P 500.

Doc,

Your churn Zone looking Prophetic.

Thoughts on PayPal…what do you think a good price for Long term investment?

Also Haven’t seen any Crypto articles lately. I am not a big fan of crypto. I just couldn’t fathom how something with no underlying value (though I realize you could argue ETH and BTC have some) could go up like crazy. Then I realized they do have a powerful force…human greed! ha! Anyways, looking at the BTC and ETH charts, today looking like they will bounce of the median BB to head back down if trend continues. Lows in June ’21 on horizon. I think most Alt Coins doomed. A bounce of June 21 lows on BTC and ETH might make me a buyer. How you playing?

Last thought, you ever thought of starting your own discord or trading room?

Hi Philip,

I think PYPL is an excellent long-term investment. My timing was off as I got started ahead of earnings. D’oh! I bought a small number of shares when the stock looked like it finally stabilized in December. I will add more, but I am in no rush. I need to see the stock stabilize again. This mini-disaster is a great lesson in heeding in the technicals. A more patient approach would have been to wait to see what PYPL did at 50DMA resistance as the stabilization process unfolded. Notice how PYPL never even tagged resistance before earnings!

On crypto: my articles on crypto are some of my least read/popular. I just assumed there was little need to write a lot. And honestly, crypto trading remains mostly a technical story…with a huge industry of people backing into catchy narratives to explain this wiggle and that wiggle. lol. I have followed a very simple trading (not investing) approach: buy the plunges, sell the rips. This latest cycle has gone on a lot longer than I anticipated. But I remain patient. As long as crypto maintains a large base of adherents and diehard followers, the secular trend is up….

Finally, I thought briefly of floating the idea of a paid subscription. Ultimately, I enjoy the ability to publish when and what I want. I do not feel the pressure to deliver enough content to make an $X dollar subscription worthwhile. I just hope readers are getting some valuable nuggets from here that are helping them learn and win. Oh yeah – and hopefully people are seeing engaging and useful ads (I get no report on the content readers see in the dynamic ads).

I just looked at the chart and noticed that PYPL has now given up ALL its pandemic era gains. I decided to go ahead and add more shares now. I will buy one more time if the stock goes into a very deep discount from here.