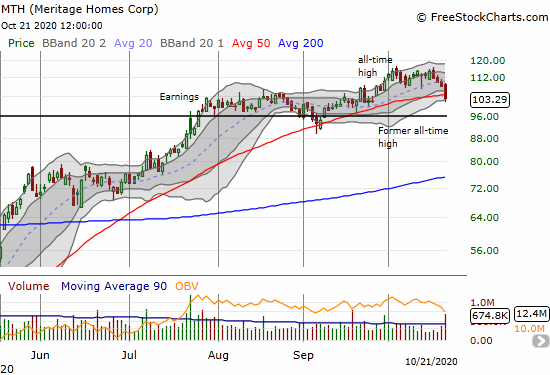

This week’s housing data were impressive. The Housing Market Index (HMI) for October reported another all-time for home builder sentiment. Subsequently, starts for single-family homes hit a fresh 13-year high. Yet, the stock market yawned. Housing-related stocks demonstrated rare signs of weakness not seen in a long time. Several stocks suffered breakdowns below their respective 50-day moving averages (DMAs). One of my favorite builders, Meritage Homes Corp (MTH), closed below its 50DMA for the first time since April.

MTH reversed the gains from its last breakout and closed at a 1-month low. Trading volume was higher than normal which suggests an exit from the stock may be just beginning.

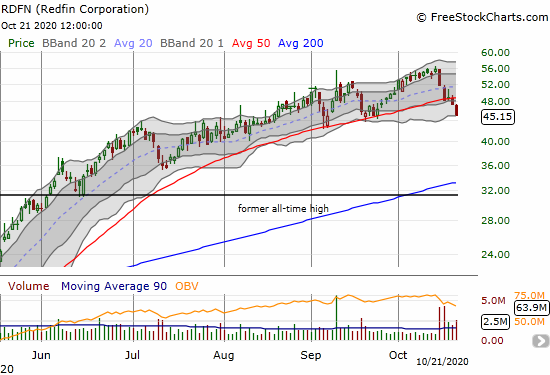

Home buying and selling services company Redfin (RDFN) looks more alarming. While RDFN also trades at a 1-month low, today’s 4.7% loss confirmed a 50DMA breakdown. RDFN is already down 18.9% from its all-time high set just one week ago. RDFN last closed below its 50DMA in April.

RDFN will officially enter bearish territory if it breaks below the lows from September.

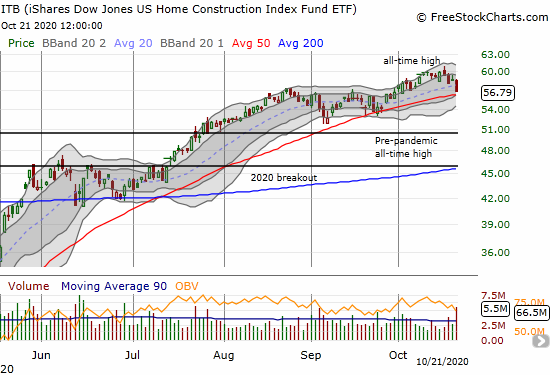

For now, enough of the components of the iShares Dow Jones US Home Construction Index Fund ETF (ITB) trade above key support at 50DMAs. ITB lost 3.0% but closed above its 50DMA. ITB also still has a ways to go before it can test the lows from September.

Overall and collectively, the charts of housing-related stocks concern me. However, this pullback may be quite timely as it launches the seasonal trade in housing-related stocks.

The Seasonal Trade

Despite its precarious nature, the growing sell-off in housing-related stocks is “right on time” for my seasonal trade in home builders. The typical season to buy these stocks starts in October or November. In past years, I stuck by the trade rules and bought into sell-offs no matter the drivers. Invariably, by season end, the stock market delivered opportunities to profit.

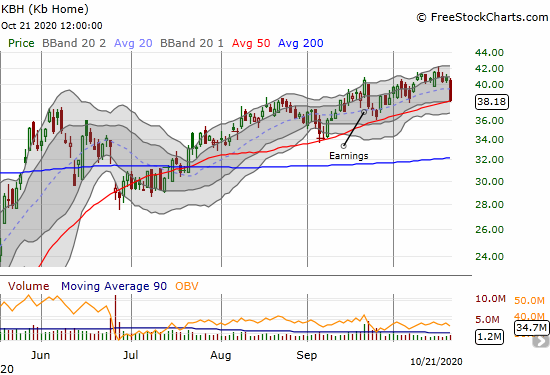

In deference to the potential (short-term) bearish nature of this sell-off, I kicked off the seasonal buying period with a relatively conservative trade in buying shares in KB Home (KBH) and selling a November $40 call against the position. Although KBH sold off a bit in the wake of September earnings, I was satisfied with the company’s results. I treated today’s 5.6% plunge as an opportunity to make a belated purchase. KBH is one of the housing-related plays clinging to 50DMA support.

While I stick to the discipline of the seasonal trading rules, my eyes are open to the risks. Interest rates are the biggest present danger on my radar right now. The seasonal trade in housing-related stocks launches right into rising rates.

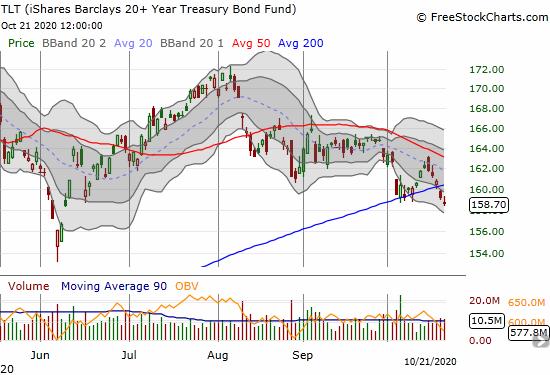

The rush to buy homes is fueled by historically low interest rates. In recent years, home buyers have demonstrated extreme sensitivity to rising rates: home affordability remains a stubborn problem in the U.S. Interests have slowly but surely crept up in recent months. The increase in yields on Treasury bonds filters into mortgage rates. The trend was presumably confirmed by a 200DMA breakdown in the iShares Barclays 20+ Year Treasury Bond Fund (TLT). TLT trades lower when rates increase.

As a result of the risks, I am taking my time and picking spots. By the next Housing Market Review, I hope to have enough information to generate a more comprehensive seasonal trading plan.

Be careful out there!

Full disclosure: long KBH shares and short call, long TLT calls