Price Failures

The furious rally in Bitcoin (BTC/USD) from the March lows helped take my mind off the on-going downtrend in price. Since the last major peak in price at $13,880 on June 26, 2019, BTC/USD has made a series of lower highs and lower lows. The last peak in price was on May 7th and 8th when excitement over the Bitcoin halving sent the cryptocurrency hurtling into $10,000 and a subsequent failure at that resistance.

This kind of price action is the very definition of a downtrend. This downtrend looks more ominous with the three failed challenges at the $10K level. The next price test will come at support from the converging 50 and 200-day moving averages (DMAs).

Source: TradingView.com

The negative effects of the halving that I anticipated back in February, 2020 seem to be playing out.

“The prospect of higher mining costs sets up the tension. Optimistic miners anticipating that higher costs will result in higher selling prices could build up inventory in anticipation of those higher prices. This kind of hoarding could cause scarcity in supply ahead of the halving and help to drive up price like now. However, if prices do not approach theoretical costs as the halving approaches, miners may feel compelled to sell to make sure they can continue to fund operations when profits go negative (negative profits could even force many miners into shutdowns). In such a case, Bitcoin could suffer a swift sell-off as lower prices motivate yet more selling. I find it telling that Bitcoin is not already trading at the halving’s theoretical mining cost. Either the cost model is wrong or this market is very inefficient (or some combination of both!).”

From a recent post in News BTC:

“Miners operating with tight margins due to high electricity costs and older mining machines have been forced to turn off their machines in the wake of this halving.

As a result, Bitcoin’s hash rate — the amount of computational power securing the network — has fallen, dipping over 20% from the all-time highs…

The Hash Ribbons crossing over to the downside, analysts say, indicates the existence of “miner capitulation.” The analysts say that during said capitulation, some Bitcoin miners are unprofitable, and are thus forced to sell their BTC to keep their operations online or out of debt.”

When I laid out my trading plan for Bitcoin in anticipation of the challenge of $10K, I had the “moment of truth” for halving in the back of my head. In that post, I noted my stop price of $8700. In a strange twist of events, BTC/USD hit that level on the charts several times, but I failed to sell because I never received a price alert. I next watched BTC/USD run up to $10K. The move looked like the classic “shake and bake” where weak hands are left behind. I continued to sit awaiting the $10K breakout.

Instead, Bitcoin fell back, and I finally decided to lock in my profits around the $8650 price level. I flipped BTC/USD one more time for a small profit. I have now decided to “close shop” and watch from the sidelines. Bitcoin is in a no-man’s land of price action. I want to either get a major discount on my next purchase – like a drop back to around $7000 where BTC/USD consolidated in April – or buy on a convincing breakout above $10K which confirms the strong hand of buyers are backing the price action.

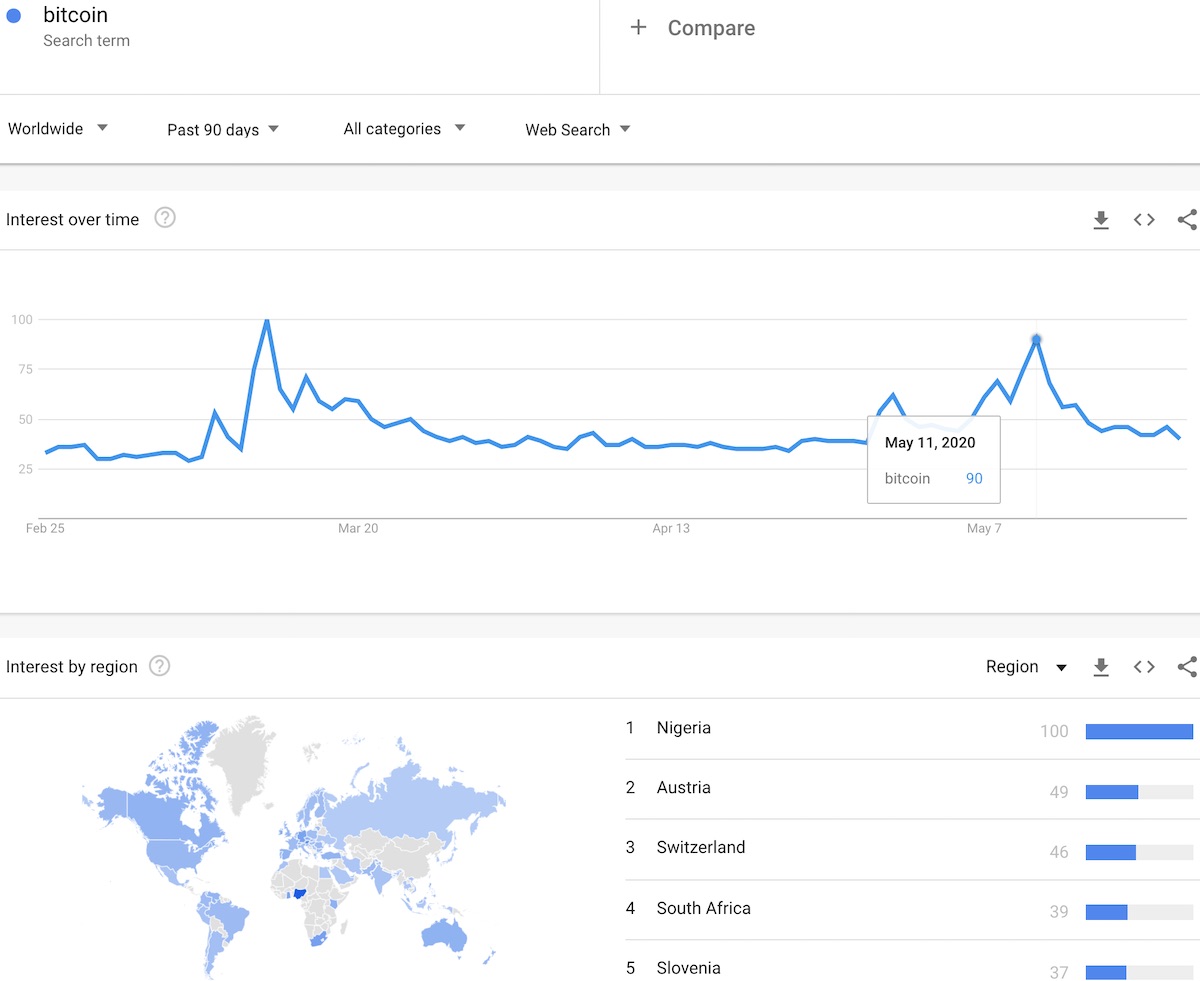

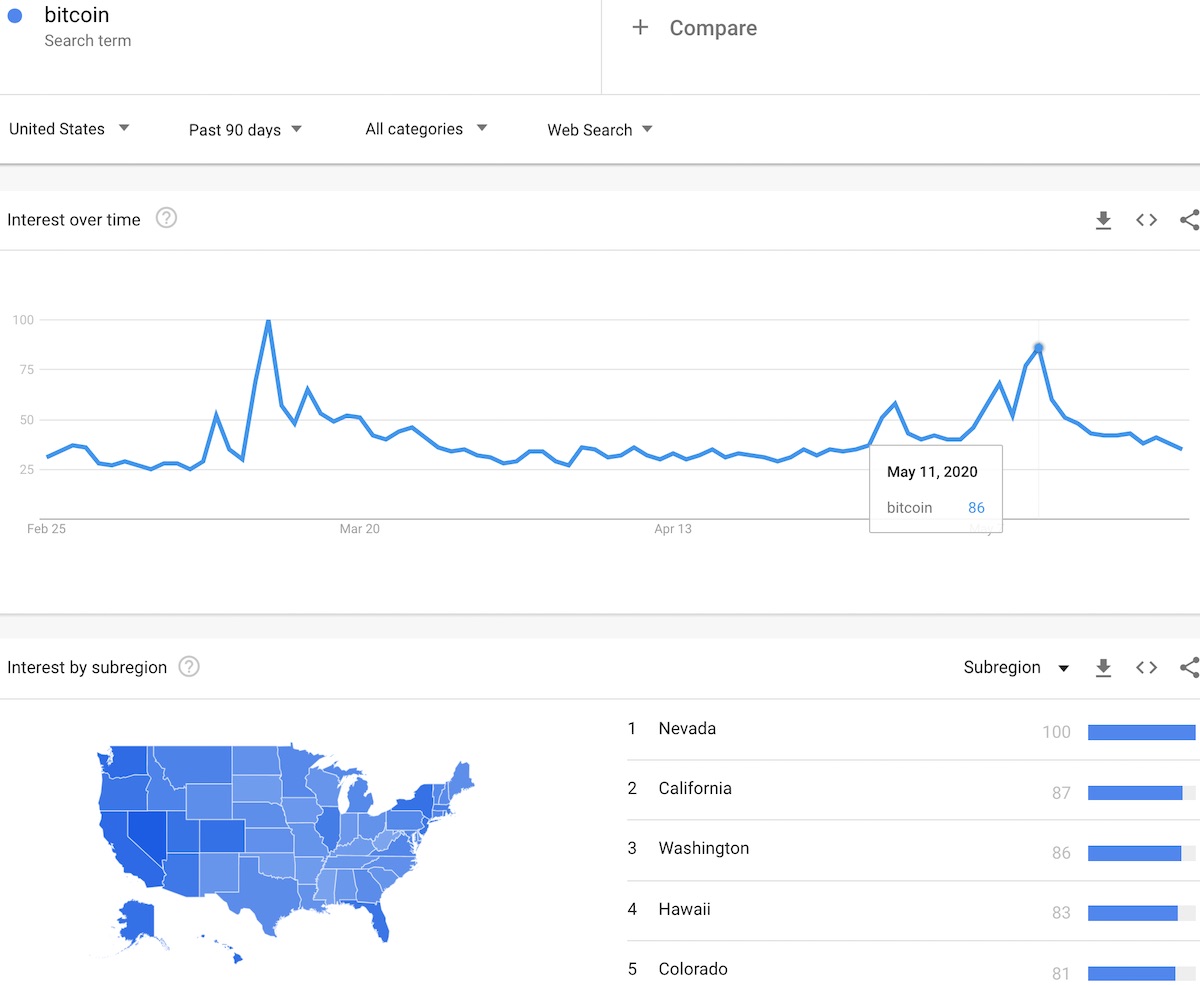

Google Trends Momentum Check

The Google trends for the search “Bitcoin” has calmed back down from the spike on May 11th. The steep price drop on May 11th was apparently at least partially driven by fears that Bitcoin’s mysterious founder Satoshi Nakamoto was starting to unload the 1.1 million bitcoins that s/he owns. Nakamoto sure has one serious problem: the market is still not liquid enough to convert those riches into fiat currency, and Bitcoin has yet to achieve the mainstream adoption that would allow for spending those riches on material well-being. Anyway, the potential for a major liquidation event one day never occurred to me until now. I take this prospect very seriously!

Anyway, the Google Trends Momentum Check (GTMC) worked once again to signal an end to an extreme price move. The subsequent fresh pullback is not generating any news excitement yet, so I am assuming that even lower prices are around the corner.

Source: Google Trends

Source: Google Trends

Be careful out there!

Full disclosure: no positions