During its earnings call, LGI Homes (LGIH) projected strong performance ahead. The company’s December home closings report delivered. LGI Homes closed 748 homes last month. The 49.6% year-over-year growth contributed to an 18.0% year-over-year overall growth rate in home closings for the first eleven months of 2019.

The stock market responded positively by sending LGIH up 3.0%. The close exactly matched LGIH’s post-earnings high. More importantly, the stock broke out from a near 1-month consolidation period around and near its 200-day moving average (DMA).

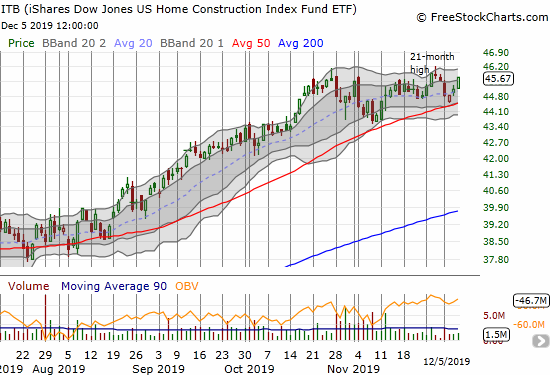

The strong report from LGI Homes no doubt helped boost sentiment across the board in home builders. The iShares US Home Construction Index Fund ETF (ITB) was able to gain 1.2% on a day when interest rates jumped, and the S&P 500 (SPY) barely closed above flatline (0.2%).

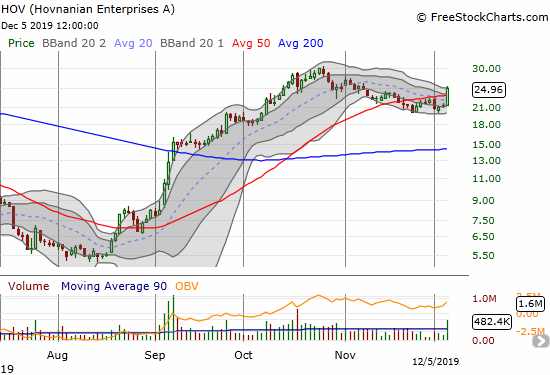

Another sign of revival came on the speculative/momentum side. Hovnanian Enterprises (HOV) recovered from its earlier 50DMA breakdown with high-volume buying and a 16.4% gain. HOV closed at a 1-month high and now looks ready to challenge its October high. HOV was the only major home builder I follow that out-performed LGIH.

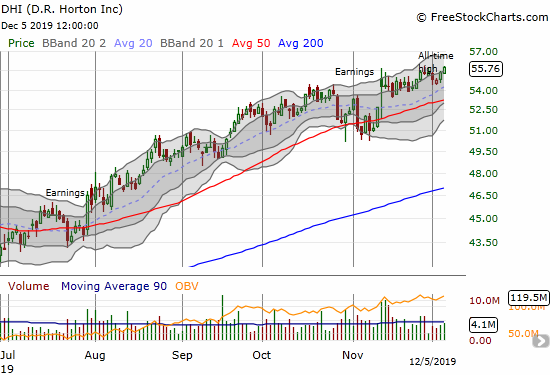

Finally, D.R. Horton (DHI) printed a fresh all-time high. This milestone is something no other home builder has achieved in almost two years.

Source for charts: FreeStockCharts

All this revival and upward momentum seems to confirm that home builders are overcoming their moment of truth. LGIH will be the first home builder stock I buy as a part of the seasonally strong period for home builders.

Be careful out there!

Full disclosure: long ITB call spread