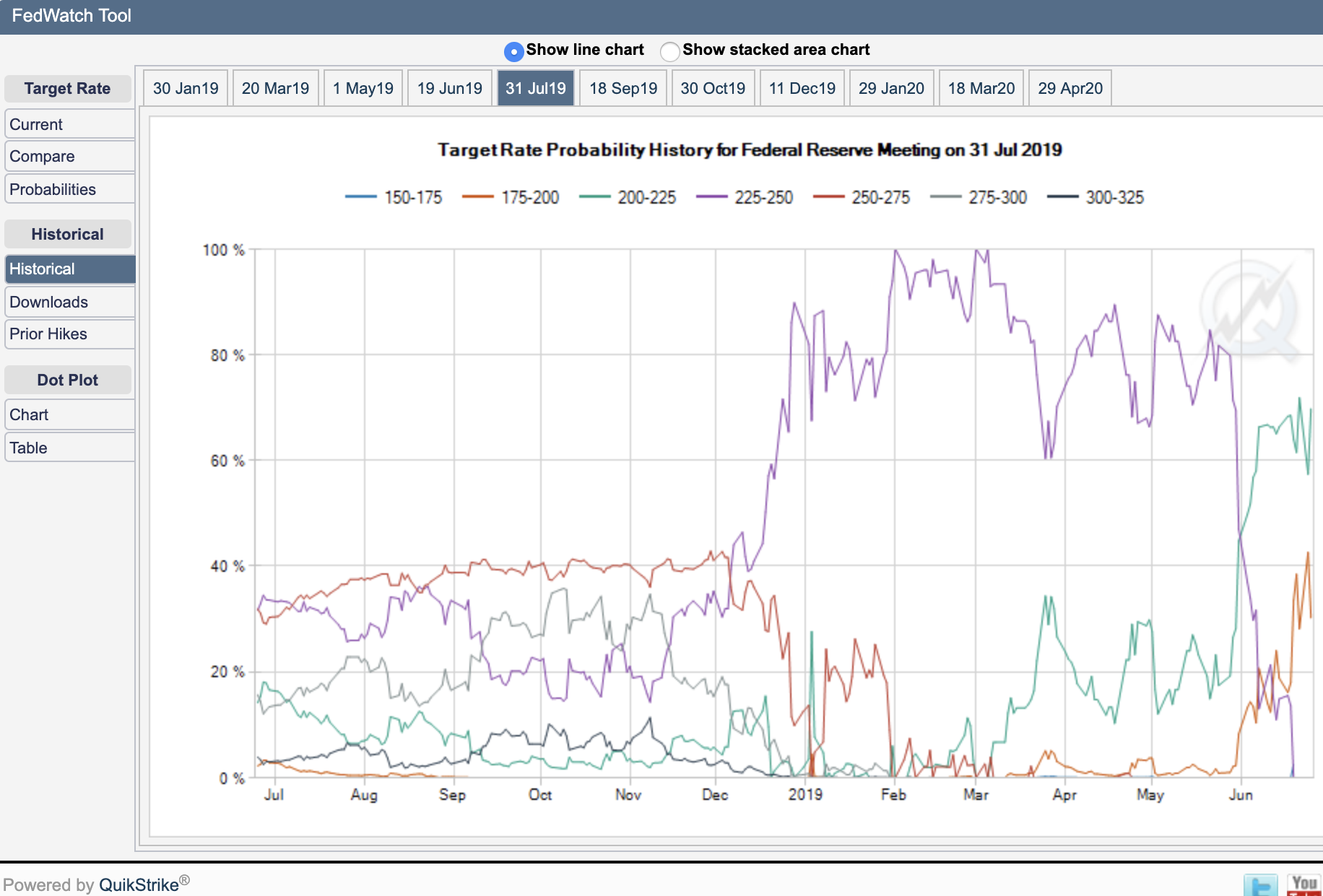

In recent days, market pundits have excitedly talked about the prospects of the Federal Reserve getting so dovish that it would be willing to make a bold statement with a rate cut of 50 basis points for the July 31st announcement on monetary policy. Such a move would be quite dramatic given the Fed has trained the market to expect moves in increments of 25 basis points.

After the Federal Reserve announced its decision on monetary policy on June 19th, the Fed Futures priced in the odds of a cut of 50 basis points at 33.5%. In just three more trading days, the odds rushed upward as high as 42.5% on June 24th. These levels proved so premature that St. Louis Federal Reserve Bank President James Bullard, the very man who dissented with the Fed decision not to cut at all last week, burst the myth of the double-barreled rate cut for July. In a Bloomberg TV interview, Bullard reaffirmed that he thinks the Fed should cut rates by 25 basis points, but he did not see the need for 50.

Bullard pointed out that U.S. unemployment is at 50-year lows. Also, inflation is a bit low, but it is not too far off from the 2% inflation target. The Fed just needs to make an “insurance” rate cut. The odds for 50 basis points deflated quickly and ended the day at 30.2%, the lowest odds yet since last week’s Fed decision.

Source: CME Fed Watch Tool

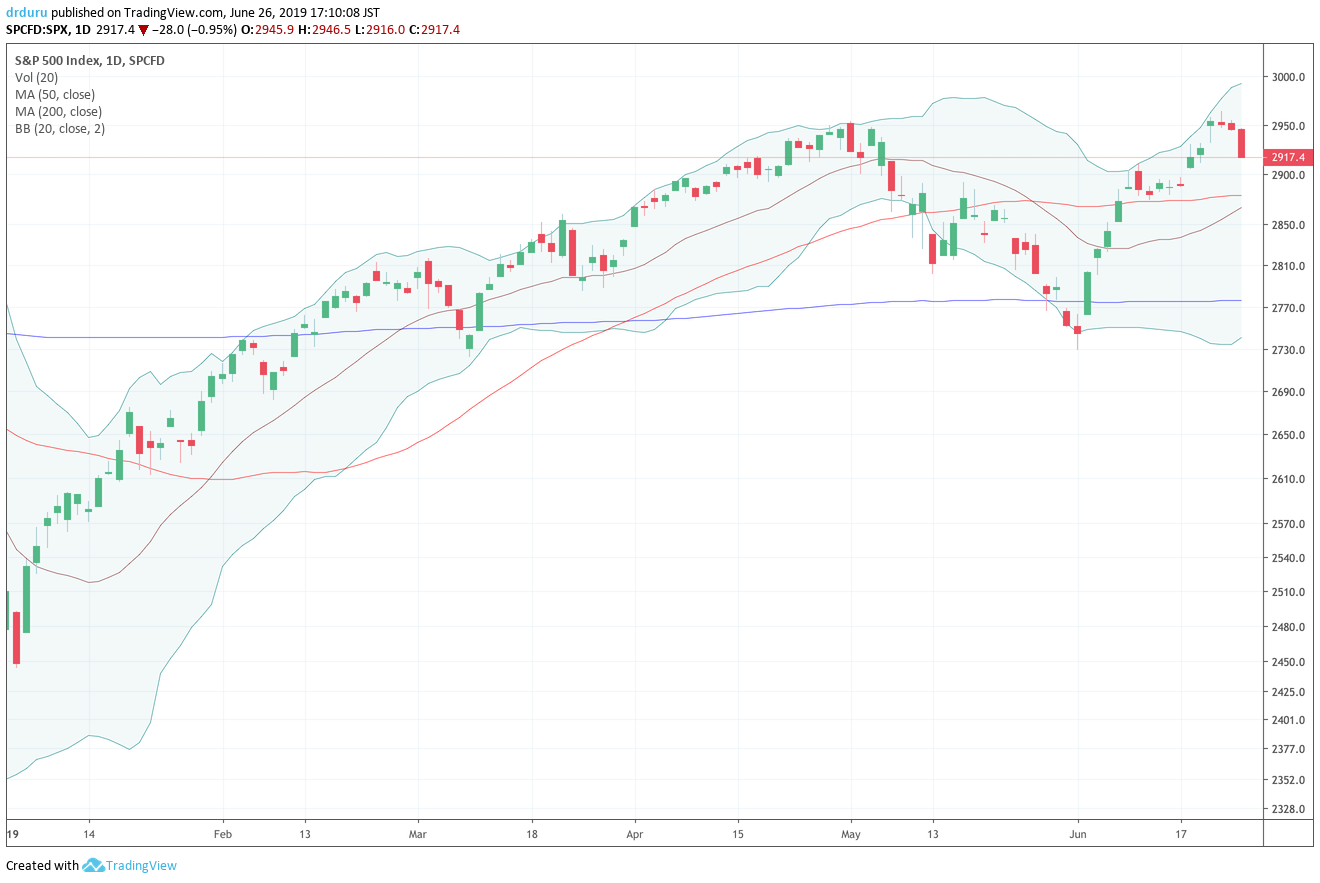

The reaction in the market was a lot more dramatic than I would have expected; I certainly did not appreciate just how much the market’s latest euphoria depended on a super easy Fed. Selling was broad-based. The S&P 500 (SPY) lost 1.0% and created what now looks like a double-top off the all-time high as it gave up all of its post-Fed gains (a very familiar sight!).

Source: TradingView.com

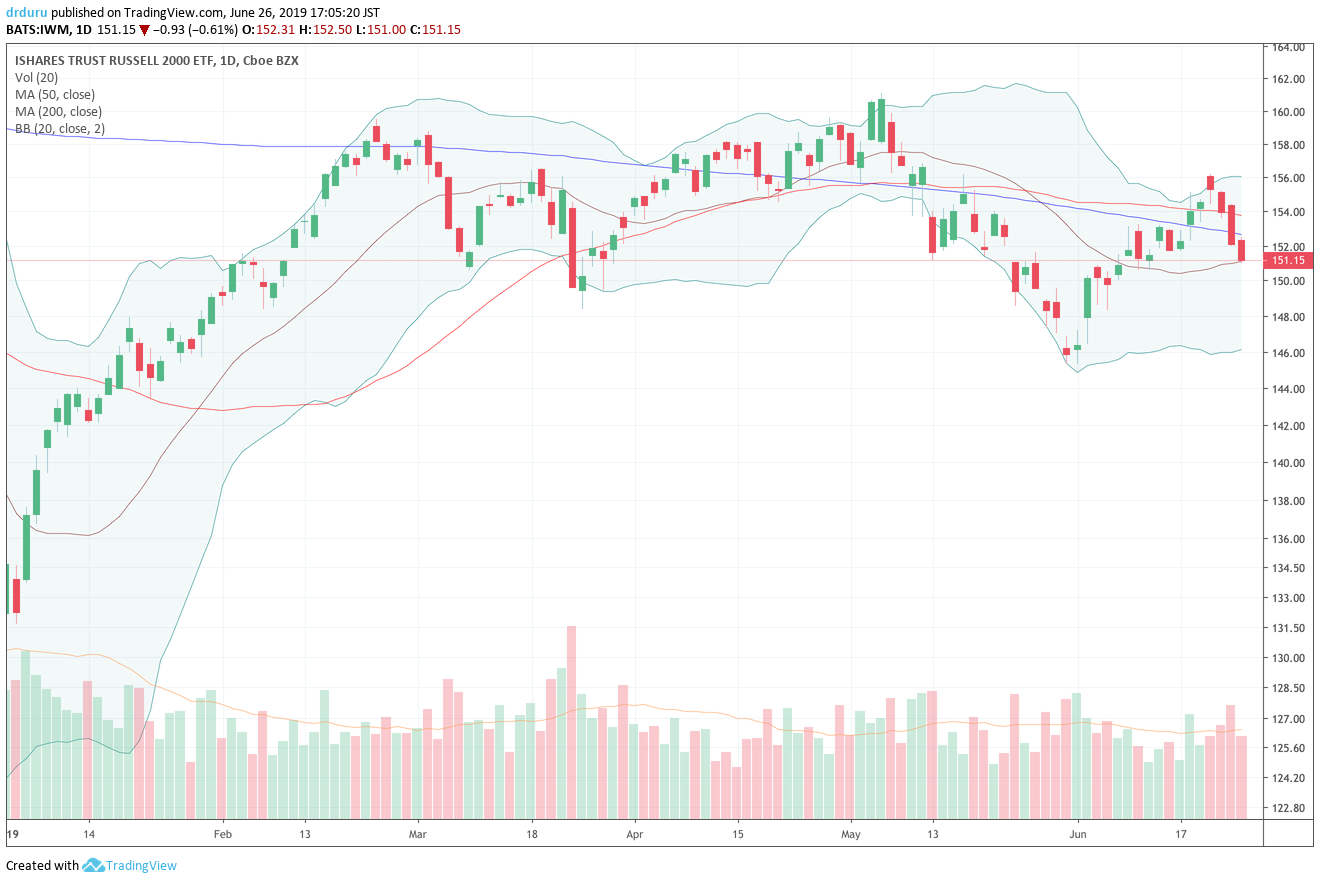

The story of course is not finished as a G20 meeting is coming up where the tables could flip all over again with euphoria over some press release or leaks from sources in the know. However, I find it quite telling that ahead of Tuesday’s sell-off, small caps in the form of the iShares Russell 2000 ETF (IWM) were already failing to keep pace. On Monday, IWM sliced right through both its 50 and 200-day moving average (DMA) support levels. The index has failed to gather fresh momentum since it first topped out in February.

Source: TradingView.com

If stocks rev up a fresh sell-off, Bullard’s (misplaced) claim that the Fed does not capitulate to market pressures could be severely tested.

Be careful out there!

Full disclosure: no positions